The ascending triangle is a bullish ‘continuation’ chart pattern that signifies a breakout is likely where the triangle lines converge. To draw this pattern, you need to place a horizontal line (the resistance line) on the resistance points and draw an ascending line (the uptrend line) along the support points.

11 Most Essential Stock Chart Patterns

Stock chart patterns are an important trading tool that should be utilised as part of your technical analysis strategy. From beginners to professionals, chart patterns play an integral part when looking for market trends and predicting movements. They can be used to analyse all markets including forex, shares, commodities and more.

The following stock chart patterns are the most recognisable and common chart patterns to look out for when using technical analysis to trade the financial markets. Our guide to eleven of the most important stock chart trading patterns can be applied to most financial markets and this could be a good way to start your technical analysis.

1. Ascending triangle

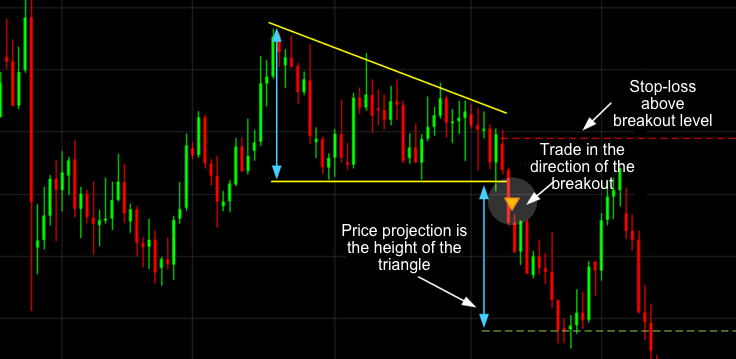

2. Descending triangle

Unlike ascending triangles, the descending triangle represents a bearish market downtrend. The support line is horizontal, and the resistance line is descending, signifying the possibility of a downward breakout.

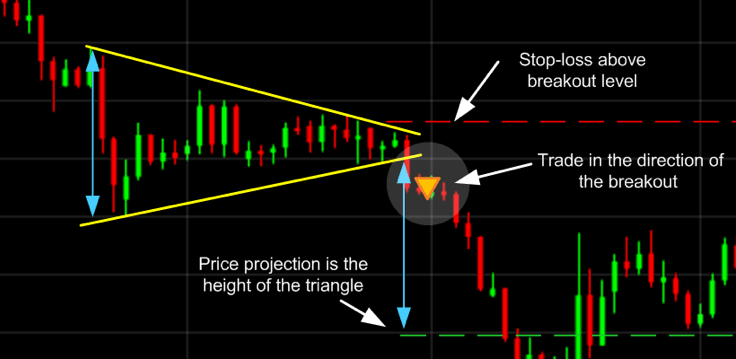

3. Symmetrical triangle

For symmetrical triangles, two trend lines start to meet which signifies a breakout in either direction. The support line is drawn with an upward trend, and the resistance line is drawn with a downward trend. Even though the breakout can happen in either direction, it often follows the general trend of the market.

4. Pennant

Pennants are represented by two lines that meet at a set point. They are often formed after strong upward or downward moves where traders pause and the price consolidates, before the trend continues in the same direction.

5. Flag

The flag stock chart pattern is shaped as a sloping rectangle, where the support and resistance lines run parallel until there is a breakout. The breakout is usually the opposite direction of the trendlines, meaning this is a reversal pattern. Learn more about breakout stock patterns.

6. Wedge

A wedge pattern represents a tightening price movement between the support and resistance lines, this can be either a rising wedge or a falling wedge. Unlike the triangle, the wedge doesn’t have a horizontal trend line and is characterised by either two upward trend lines or two downward trend lines.

For a downward wedge, it is thought that the price will break through the resistance and for an upward wedge, the price is hypothesised to break through the support. This means the wedge is a reversal pattern as the breakout is opposite to the general trend.

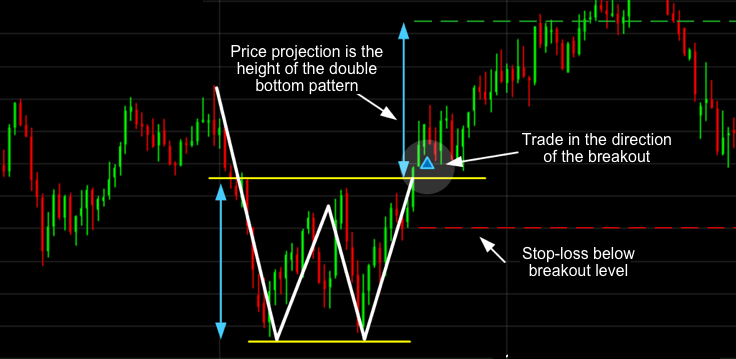

7. Double bottom

A double bottom looks similar to the letter W and indicates when the price has made two unsuccessful attempts at breaking through the support level. It is a reversal chart pattern as it highlights a trend reversal. After unsuccessfully breaking through the support twice, the market price shifts towards an uptrend.

8. Double top

Opposite to a double bottom, a double top looks much like the letter M. The trend enters a reversal phase after failing to break through the resistance level twice. The trend then follows back to the support threshold and starts a downward trend breaking through the support line.

Read more about trading with double top and bottom patterns.

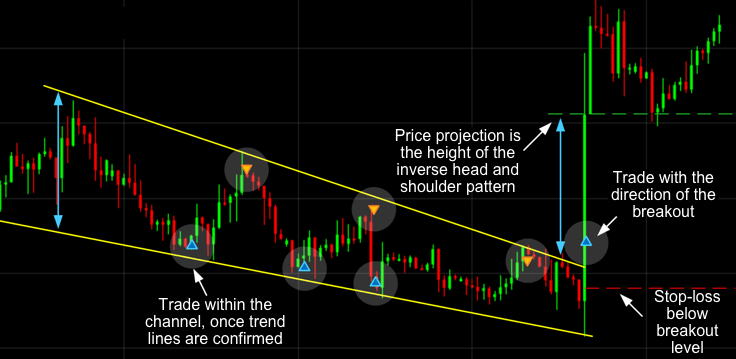

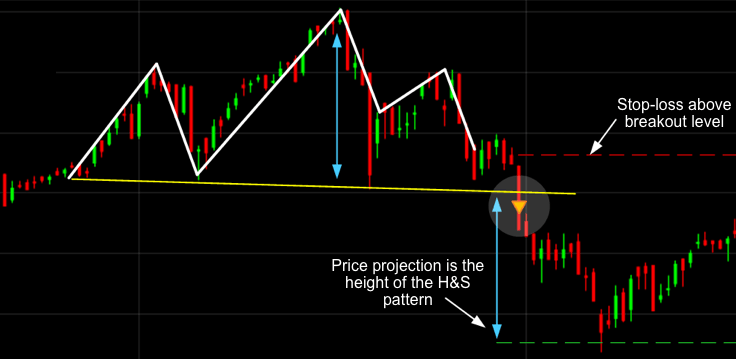

9. Head and shoulders

The head and shoulders pattern tries to predict a bull to bear market reversal. Characterised by a large peak with two smaller peaks either side, all three levels fall back to the same support level. The trend is then likely to breakout in a downward motion.

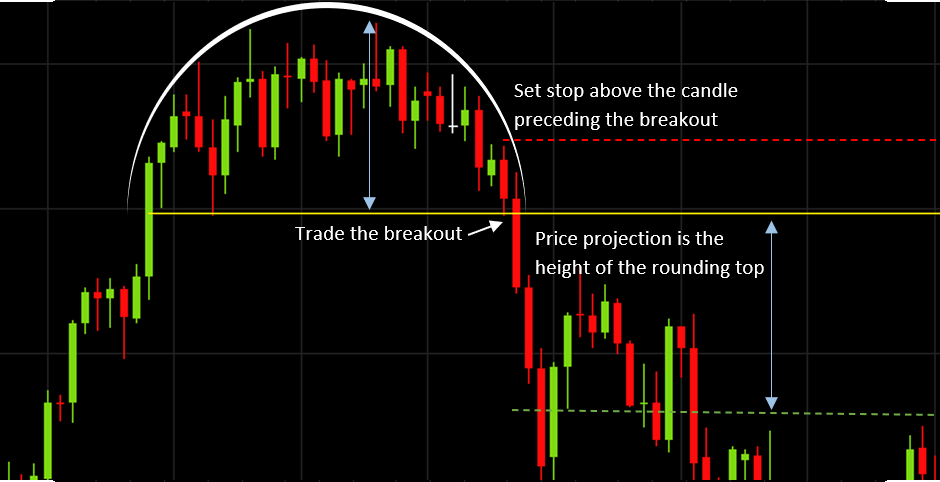

10. Rounding top or bottom

A rounding bottom or cup usually indicates a bullish upward trend, whereas a rounding top usually indicates a bearish downward trend. Traders can buy at the middle of the U shape, capitalising on the trend that follows as it breaks through the resistance levels.

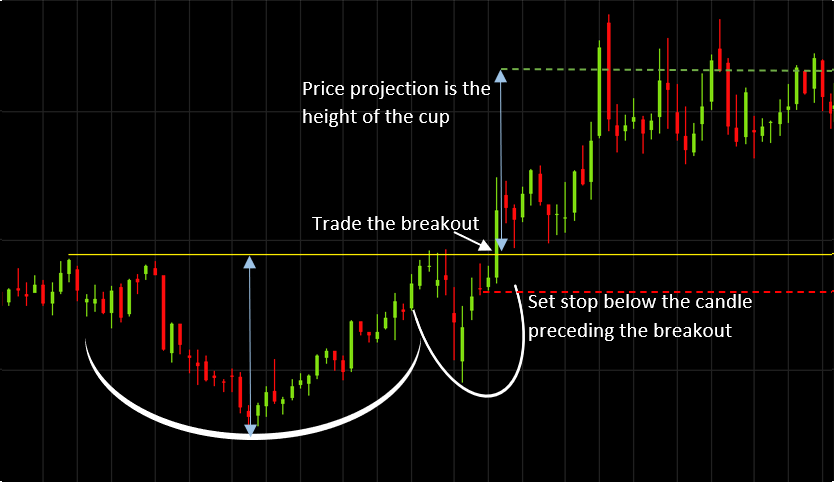

11. Cup and handle

The cup and handle is a well-known continuation stock chart pattern that signals a bullish market trend. It is the same as the above rounding bottom, but features a handle after the rounding bottom. The handle resembles a flag or pennant, and once completed, you can see the market breakout in a bullish upwards trend.

How to use this guide

- Learn these essential candlestick chart patterns.

- Open a demo account and practice identifying and trading chart patterns.

- Once confident in your chart pattern trading abilities, you may wish to upgrade to a fully funded live account to profit from your new trading edge.

How to easily recognise chart patterns

Chart patterns can sometimes be quite difficult to identify on trading charts when you’re a beginner and even when you’re a professional trader. Using popular patterns such as triangles, wedges and channels, coupled with our bespoke star rating system, we have a tool that updates every 15 minutes to continuously highlight potential emerging and completed technical trade set-ups. You can also apply stock chart patterns manually on your trading charts as part of our drawing tools collection.

Trading chart patterns often form shapes, which can help predetermine price action, such as stock breakouts and reversals. Recognising chart patterns will help you gain a competitive advantage in the market, and using them will increase the value of your future technical analyses. Before starting your chart pattern analysis, it is important to familiarise yourself with the different types of trading charts.

Stock pattern screener

Luckily, we have integrated our pattern recognition scanner as part of our innovative Next Generation trading platform. Our pattern recognition scanner helps identify chart patterns automatically, saving you time and effort. The pattern recognition software collates data from over 120 of our most popular products and alerts you to potential technical trading opportunities across multiple time intervals. Alternatively, see a list of well-known and effective stock screeners here.

Stock chart patterns app

Our online trading platform is also available on mobile and tablet devices, thanks to advancements in technology. Read more about our mobile trading applications and how you can browse stock chart patterns through our app when trading on-the-go. This is available for both Android and iOS software.

FAQS

What are stock chart patterns?

Stock chart patterns are lines and shapes drawn onto price charts in order to help predict forthcoming price actions, such as breakouts and reversals. They are a fundamental technical analysis technique that helps traders use past price actions as a guide for potential future market movements.

How many types of chart patterns are there?

There are three key chart patterns used by technical analysis experts. These are traditional chart patterns, harmonic patterns and candlestick patterns (which can only be identified on candlestick charts). See our list of essential trading patterns to get your technical analysis started.

What chart patterns are common in forex?

The head and shoulders chart pattern and the triangle chart pattern are two of the most common patterns for forex traders. They occur more regularly than other patterns and provide a simple base to direct further analysis and decision-making. Try a demo account to practise your chart pattern recognition.

How do stock chart patterns work?

Chart patterns work by representing the market’s supply and demand. This causes the trend to move in a certain way on a trading chart, forming a pattern. However, chart pattern movements are not guaranteed, and should be used alongside other methods of market analysis. Chart patterns can be identified on our chart pattern screener tool.

What are reversal and continuation patterns?

When a price signal changes direction, it is a reversal pattern. However, when a price trend continues in the same direction it is a continuation pattern. Technical analysts have long used chart patterns as a method for forecasting price movements and trend reversals. You can use our pattern recognition software to help inform your analysis.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.