What is leverage in forex?

Leverage in forex is a way for traders to borrow capital to gain a larger exposure to the FX market. With a limited amount of capital, they can control a larger trade size. This could lead to bigger profits and losses as they are based on the full value of the position.

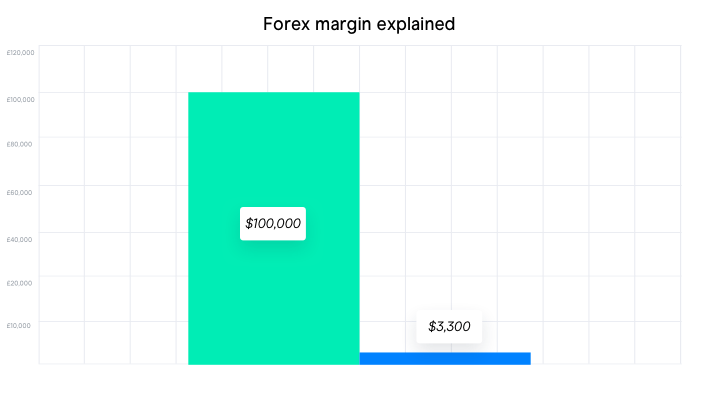

Trading with leverage in forex, which is also referred to as forex margin, means you can magnify profits if markets move in your favour; however you can also lose all of your capital should markets move against you. This is because profits and losses are based on the full value of the trade, and not just the deposit amount.

Forex trading comes with some of the lowest margin rates in the financial markets. The leverage difference between forex and stocks, for example, is much higher. Stock market leverage starts at around 5:1, which makes trading within the share market slightly less prone to capital risk.