Commodity trading

Spread bet and trade CFDs with leverage on Gold, Silver, Brent and West Texas Crude Oil plus commodity indices, on our award-winning platform. With tight spreads, lightning-fast execution* and the highest customer satisfaction in the industry.**

FCA regulated

Segregated funds

LSE listed

Search instruments:

More than a commodity trading platform

Over 100 cash and forward commodities

Including all the favourites as well as lesser-traded instruments like Palladium.

Trade out of hours

Favourites like Brent and West Texas oil trade up to 23 hours a day, so you don't have to stop when the markets do.

No partial fills

And never any dealer intervention, regardless of your trading size.

'Cash' markets

Tighter spreads, no rollovers and charting back as far as 1992 to help your analysis.

Dedicated customer service

UK based, award-winning service online 24/5, whenever you’re trading.

Trade the whole sector

Take a view across a whole commodity sector from a single position, with our bespoke commodity indices.

Over 100 cash and forward commodities

Get exposure to volatility across cash and forward commodities including favourites like Gold, Silver, crude oils and Natural Gas, with spreads from as low as 0.3 points.

Other popular commodities

Pricing is indicative. Past performance is not a reliable indicator of future results.

Our commodity trading costs

Whatever you trade, costs matter. We’re committed to keeping our costs as competitive and transparent as possible, whether you spread bet on trade CFDs on metals, energies or agriculture.

Increase your exposure to the commodity market

EXCLUSIVE TO CMC

Expecting big things in energy? Diversify your portfolio and spread risk with our unique commodity indices, which allow you to take a view on a commodity sector as a whole with a single position.

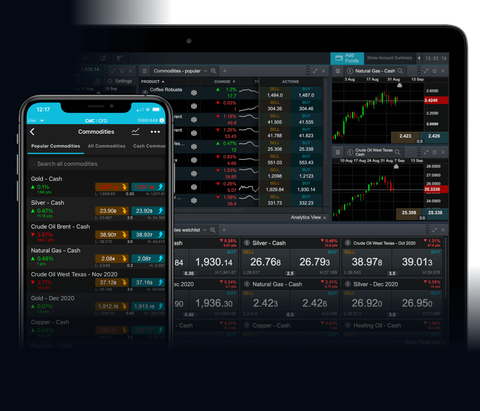

The platform built for commodity trading

Fast execution, exclusive insights and accurate signals are vital to your success as a commodities trader. Our award-winning commodity trading platform was built with the successful trader in mind.

Industry-leading charting

Our charting package ranked highest for charting in the 2019 Investment Trends survey**. Choose from over 115 technical indicators and drawing tools, more than 70 patterns and 12 in-built chart types.

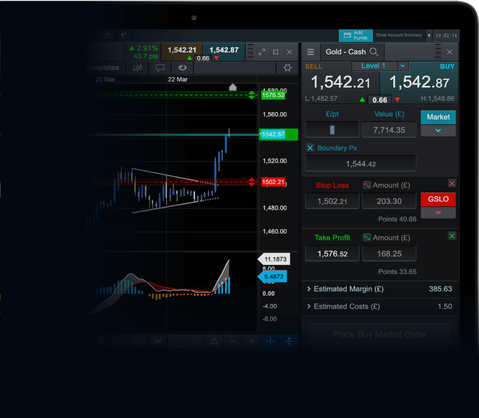

Advanced order execution

We offer a range of advanced order types, including trailing and guaranteed stop losses, partial closure, market orders and boundary orders on every trade, so you have the flexibility to trade your way.

Reuters news and analysis

Award-winning app**

Highest Overall Customer Satisfaction

Investment Trends 2013-2019 UK Leverage Trading Report

Best Platform Features

Investment Trends 2013-2019 UK Leverage Trading Report

Best Mobile/Tablet App

Investment Trends UK Leverage Trading Report

News

Opto Sessions: Jack Schwager’s market misconceptions

PODCAST

Jack Schwager, renowned author of the Market Wizards book series, reveals a major misconception in investing.

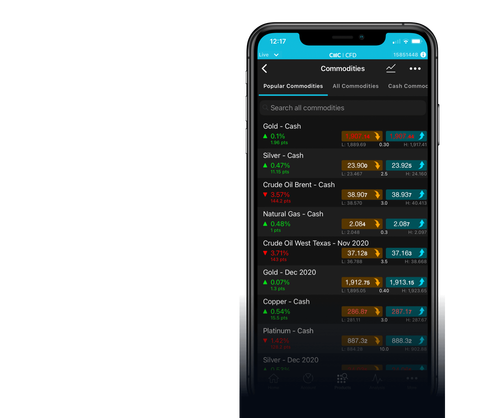

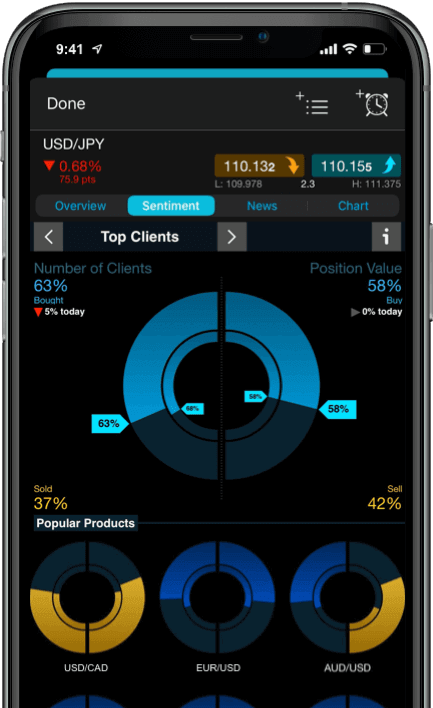

Powerful trading wherever you are

Trade like you’re on a desktop, from your mobile. Our award-winning mobile trading app allows you to seamlessly open and close trades, track your positions, set up notifications and analyse mobile-optimised charts.

FAQs

New to trading?

Is it free to open an account?

There's no cost when opening a live spread betting or CFD trading account. You can also view prices and use tools such as charts, Reuters news or Morningstar quantitative equity reports, free of charge. However, you will need to deposit funds in your account to place a trade.

What are the costs of spread betting and CFD trading?

There are a number of costs to consider when spread betting, including spread costs, holding costs (for trades held overnight which is essentially a fee for the funds you borrow to cover the leveraged portion of the trade), rollover costs on expiring forward trades, and guaranteed stop-loss order charges (if you use this risk-management tool). Find out more about our costs

Is CMC Markets regulated by the FCA?

Yes, CMC Markets UK plc (registration number 173730) and CMC Spreadbet plc (registration number 170627) are fully authorised and regulated by the Financial Conduct Authority (FCA) in the UK. Retail client money is held in segregated client bank accounts and money held on behalf of clients is distributed across a range of major banks, which are regularly assessed against our risk criteria.

Is CMC Markets covered by the FSCS?

Yes, your eligible deposits with CMC Markets are protected up to a total of £85,000 by the Financial Services Compensations Scheme (FSCS), the UK's deposit guarantee scheme. If CMC Markets ever went into liquidation, retail clients would have their share of segregated money returned, minus the administrator's costs in handling and distributing these funds. Any shortfall of funds up to £85,000 may be compensated under the FSCS.

How does CMC Markets protect my money?

As a CMC client, your money is held separately from CMC Markets' own funds, so that under property, trust and insolvency law, your money is protected. Therefore your money is unavailable to general creditors of the firm, if the firm fails.

How does CMC Markets make money?

Our income primarily comes from our spreads, while other fees, such as overnight holding costs, make a minor contribution to overall revenue.

We never aim to profit from our clients' losses. Our aim is to build long-term relationships by providing the best possible trading experience through our technology and customer service.

New to commodity trading?

What is a commodity?

A commodity is a physical good that can be bought or sold on the various commodity markets. Commodities can be categorised into either hard or soft varieties. Hard commodities are natural resources like oil, gold and rubber and are often mined or extracted. Soft commodities are agricultural products such as coffee, wheat or corn.

Find out more

How do you trade commodities?

The commodity markets are traded in a similar way to other types of financial instruments, but there are some points to be aware of in order to avoid any shocks or surprises when dipping your toe into commodities trading.

Find out more

What is leveraged trading?

One of the features of spread betting and CFD trading is that you only need to deposit a percentage of the full value of your position to open a trade, known as trading on leverage. Remember, trading on leverage can also amplify losses, so it’s important to manage your risk.

Why spread bet?

Spread betting allows you to trade tax-free on a wide range of financial markets 24 hours a day, from Sunday night through to Friday night. Trade on your phone, tablet, PC or Mac on a wide range of instruments using leverage. Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.