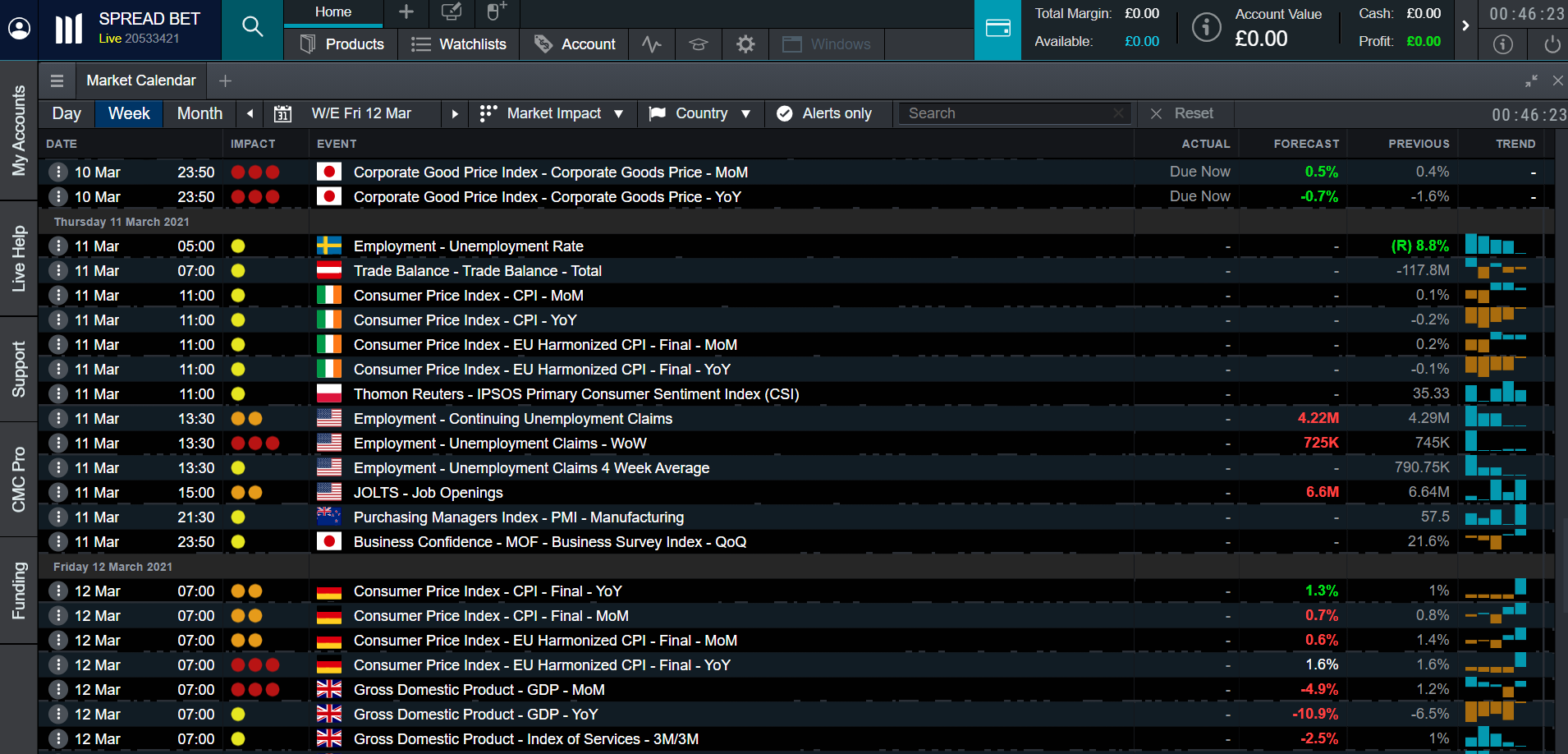

As with other asset classes, forex trading news can become particularly active before and following major economic events. However, there are significant differences between the type of news that sets apart currencies from other financial markets.

Forex markets tend to respond the most to macroeconomic news – the kind of developments that reflect or impact broad economies. Generally speaking, forex traders can look at economic news to assess its impact on interest rates and monetary policy. News that suggests a more hawkish (aggressive) central bank tends to push forex pairs up in value relative to other currencies, while dovish (peaceful) news can cause a currency to depreciate.

Currencies of countries that are major exporters of raw materials or commodities can be impacted by news forex trading news, as this affects the prices of the main commodities that they produce. These currencies are often referred to as resource currencies. Prices of commodities that affect these currencies can be influenced by issues affecting supply and demand.

On the supply side, news that suggests a lower supply can push up prices, while news that suggests higher supply can depress prices, which can then impact related currencies. News that could reflect changes in supply may cover political tensions, wars, terrorism, weather, economic sanctions, labour relations (strikes) and more. Speculation and pricing related to demand is mainly influenced by many of the same major news releases noted above, plus commodity inventory reports and outlooks.