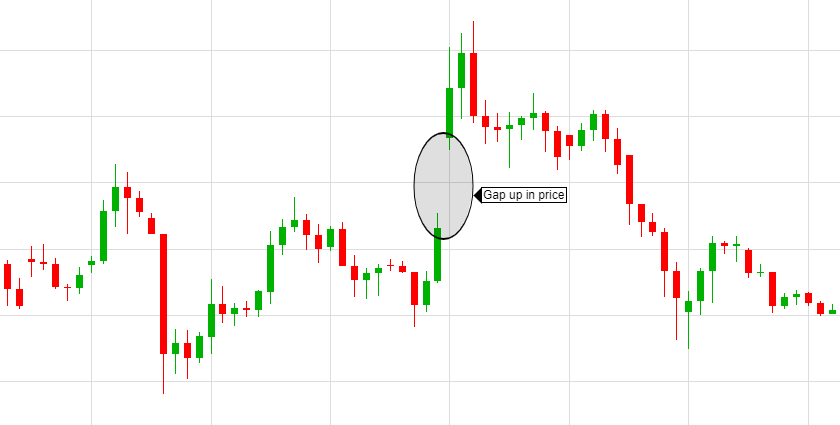

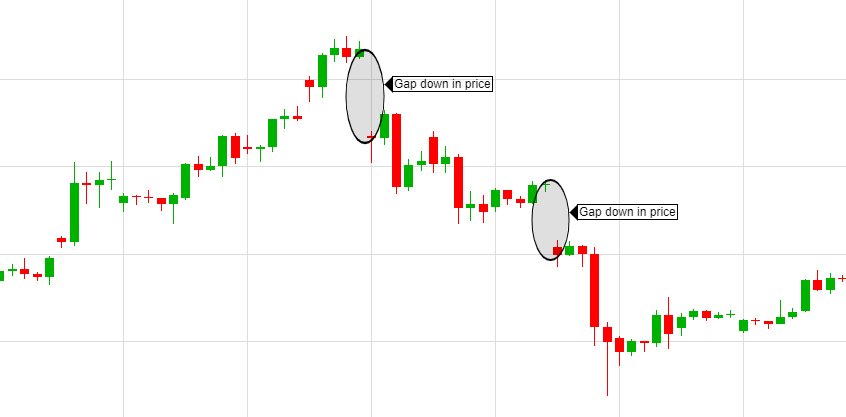

Considering the above information, what does ‘trading the gap’ mean? In simple terms, traders identify gaps between opening and closing prices on a trading chart where there has been volatile action, and can use this to devise an appropriate trading strategy. They will then need to calculate potential entry and exit points for their trades. Traders often use event-based strategies when there is a market gap, as they can predict but not guarantee what will happen next.

There are also different classifications of gaps, as they do not all represent the same price pattern or trend on a price chart. These can be split into the following: