The first step is to identify the support and resistance that bound the current and recently observed price action. Once this is done, the theory is to pitch the buy and sell orders appropriately, near and above the support and near and just under resistance levels. After this is done, it is prudent practice to apply stop losses (exit orders for example) to the buy (or sell) orders.

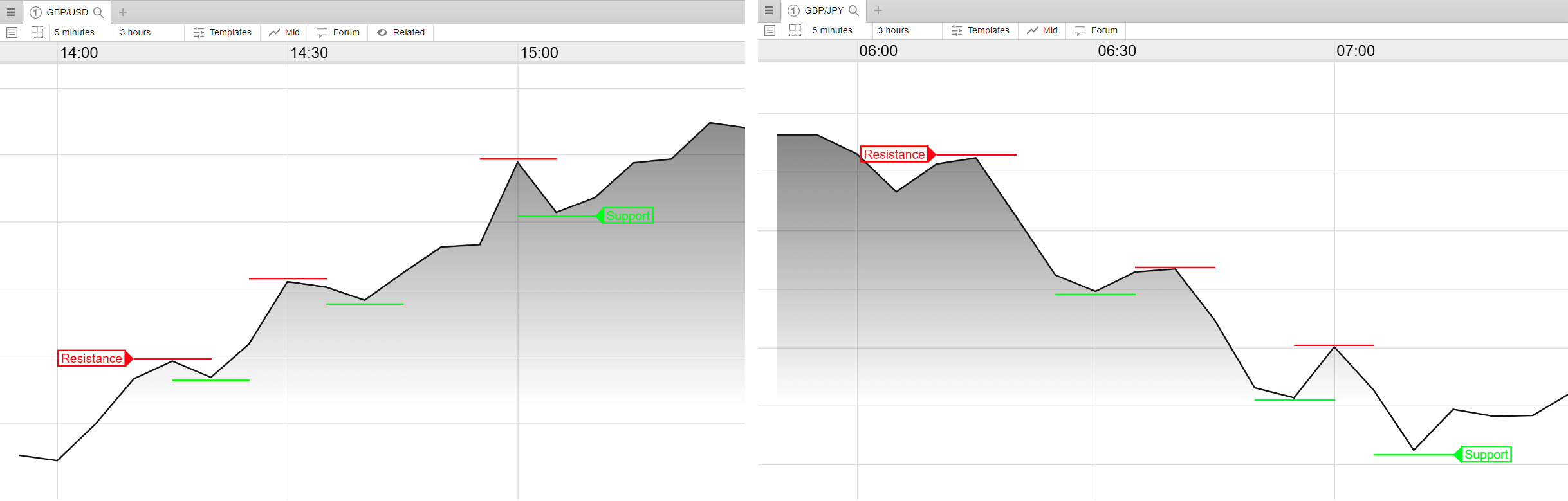

Example:

Below is a basic example of a trade plan with a planned limited risk (for example, the difference between our orders and the exit), for a hoped for return. If a trading plan is used and a sell position is entered into, one of two events will occur. They are outlined in the two figures below.

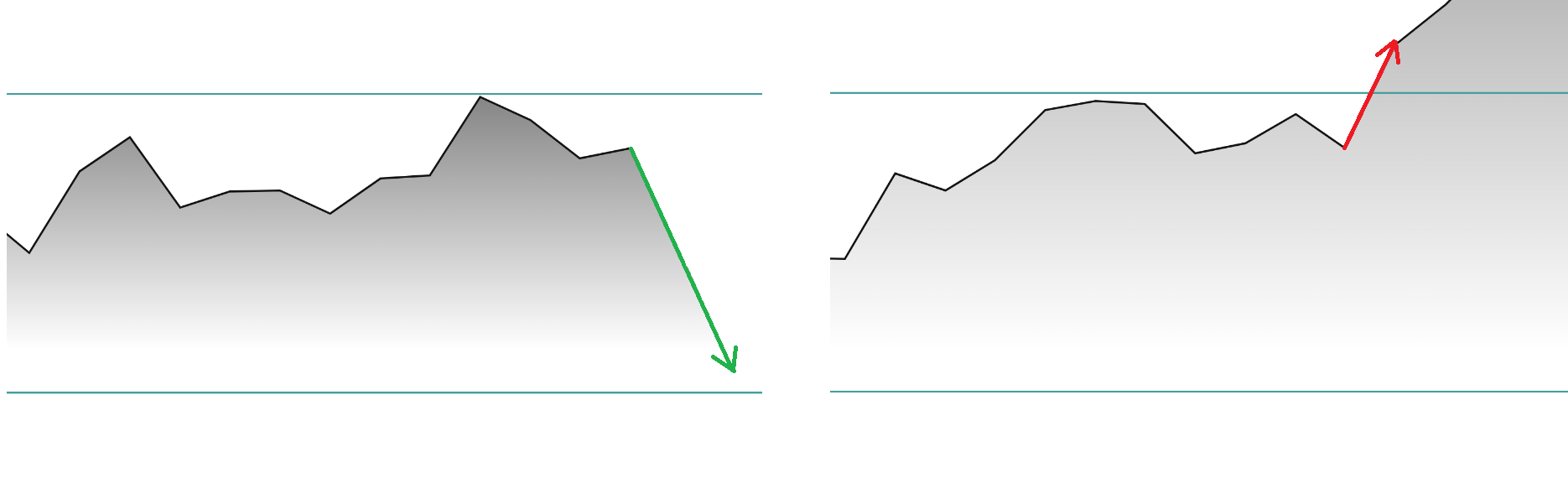

The first figure shows the ideal scenario. A short (sell) position was entered into at the top of the range, near the high and resistance level, with a stop loss on the other side of resistance. From the selling point, the price falls back to the lower end of the range and the take profit order (near support) is triggered and the position is exited with a profit.

The second figure shows the scenario to avoid, but that you must be prepared for. A short (sell) position was entered at the top of the range, near the high and resistance level, with a stop loss on the other side of resistance. From the selling point, the price rises back to, and through, the upper end of the range, instead of falling. In doing so, it hits and triggers the stop loss. This position is therefore exited with a loss.