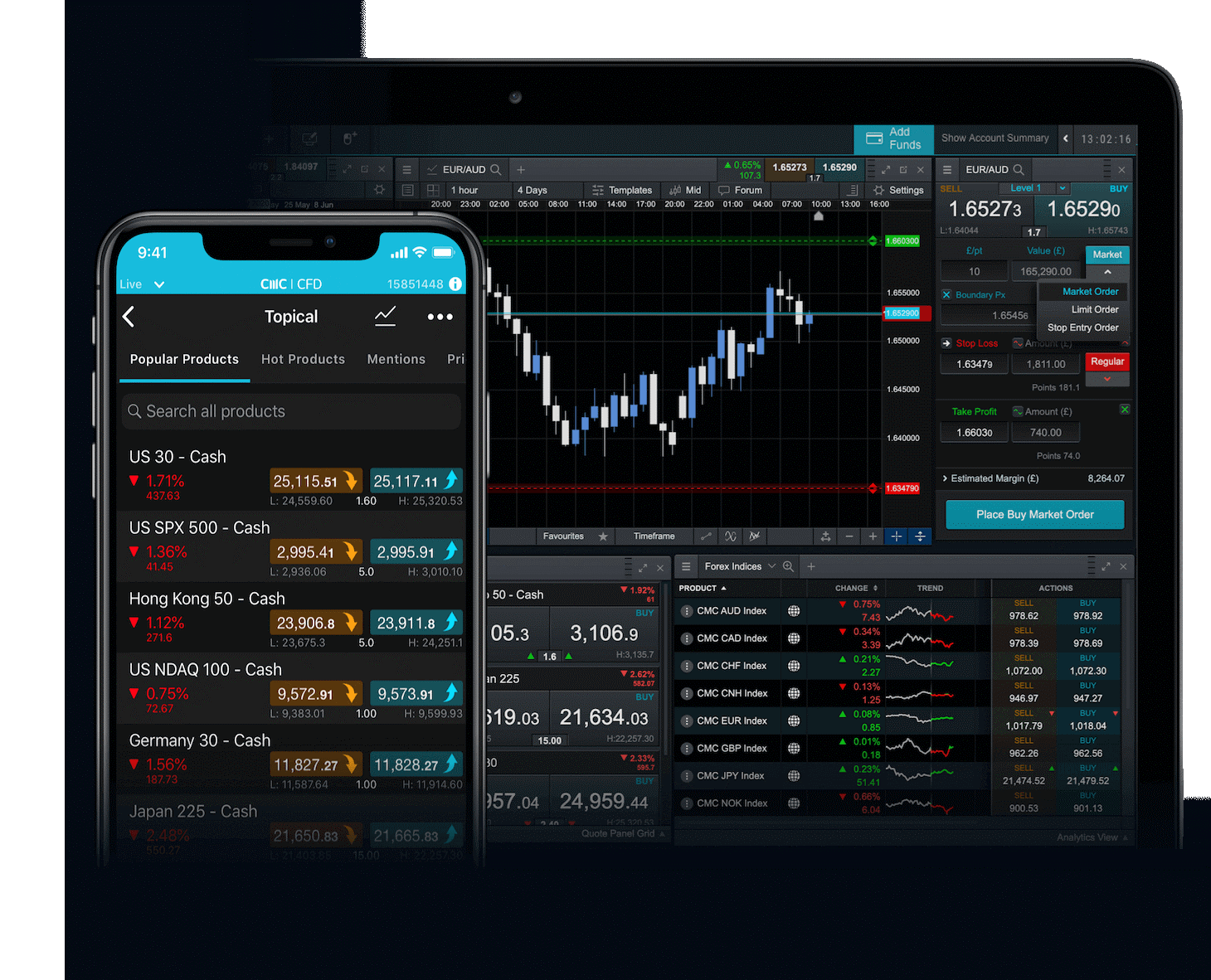

Identifying which ARK ETF is the ‘best’ to trade would not be an accurate task. However, by reviewing the ETFs’ performances in 2020 & Q1 2021, we can gain an understanding of which are the top performing ETFs for that period, and maybe of interest for traders to keep an eye on.

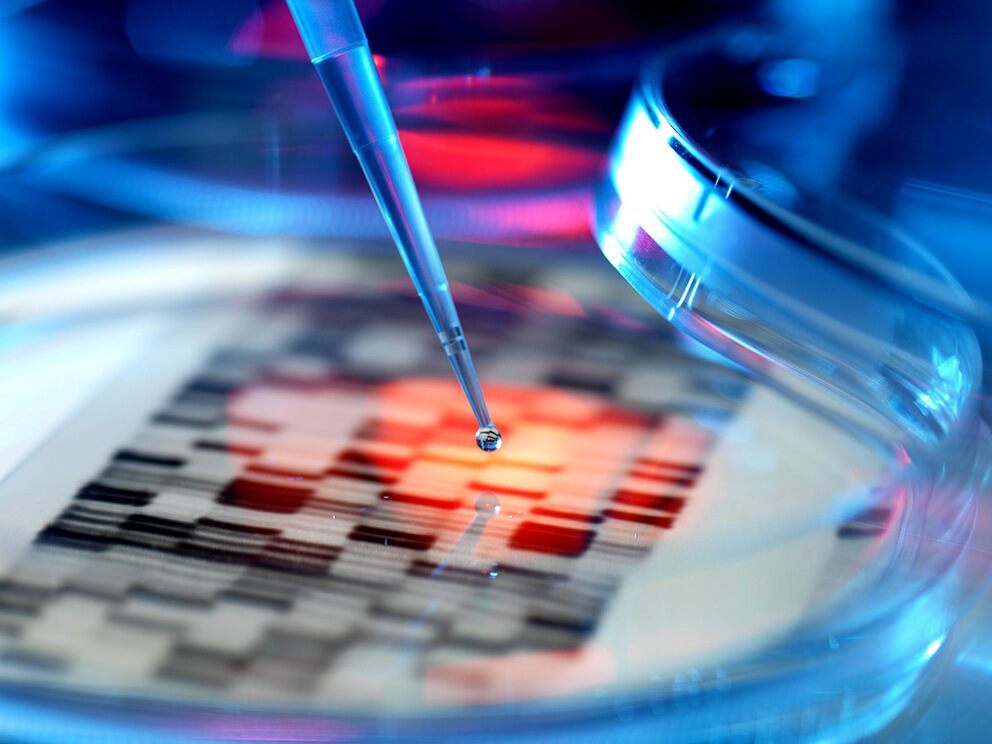

ARK Genomic Revolution ETF (ARKG) led the pack in 2020 as it generated gains of 180%. Some of the other top performing ETFs in 2020 were the ARK Innovation ETF (ARKK), the ARK Next Generation Internet ETF (AKRW), and the ARK Fintech Innovation ETF (AKRF).

After experiencing a difficult time in the 2020 bear market, the 3D Printing ETF (PRNT) has since gained just under 200% in the space of 10 months, resulting in it being one that is being closely watched by many traders in 2021.