Having struggled to reinvigorate economic activity following its post-Covid reopening, China’s economy faces a triple threat of debt, deflation and demographic headwinds. Conversely, research institutions and investment analysts believe that India, and particularly its fintech sector, could be set for outsized growth over coming years.

- Morgan Stanley discusses the debt, deflation and demographic challenges facing China’s economy.

- India is set for superior growth over the coming years, according to S&P Global.

- VanEck Digital India ETF leads the Global X MSCI China Information Technology ETF year-to-date.

A Tale of Two Superpowers

On Morgan Stanley’s Thoughts on the Market podcast on 12 December, Laura Wang, Chief China Equity Strategist, and Robin Xing, Chief China Economist, discussed the “triple challenge” that is currently facing China’s economy: debt, deflation and demographics.

The country risks falling into a debt deflation loop, according to Wang. Consumer activity has failed to recover following China’s post-Covid reopening. The Financial Times reported a 0.5% year-over-year fall in China’s November consumer price index (CPI) earlier this month, exceeding both the expectations of economists surveyed by Bloomberg and the equivalent figure for October, both of which were 0.2%.

The danger is that falling prices could make current debt levels unsustainable by reducing the value of the assets (such as houses) against which loans are secured. Several property developers have already defaulted this year, according to the Financial Times.

Xing added that “the reflationary journey remains gradual and bumpy. In particular, the downturn in the housing sector and its spillover to local government are still lingering.”

Compounding these pressures is China’s unfavourable demographic outlook — its population is one of the fastest-ageing in the world, according to the World Health Organisation.

“In our long-term growth forecast, labour quantity will lower overall GDP growth by 40 basis points every year between 2025 [and] 2030,” said Xing.

Conversely, the macroeconomic story around India is overwhelmingly positive.

“India is undergoing a cyclical upswing,” wrote Kristy Fong, Investment Director at abrdn in a November blog post. Whilst highlighting the “stark contrast” between India’s “buoyant property sector” and the challenges faced by China’s, abrdn also foregrounds strong banking balance sheets, committed government infrastructure spending, and improving consumer sentiment, with optimism rising among both urban and rural parts of India. Corporate profits during the July–September quarter also rose 41% year-over-year and are expected to increase 20% for the full fiscal year, wrote Fong.

India Set for Outsized Growth

A comparison of the two countries’ prospects published in September by the Brookings Institution reaches a “conservative conclusion” that, during the 2020–45 period, India’s rate of economic growth will be on average 3.5% faster than China’s.

The report by Surjit S Bhalla, Former Executive Director for India, Bangladesh, Sri Lanka and Bhutan at the International Monetary Fund, and Karan Bhasin, Graduate Assistant at University at Albany, SUNY, highlights the fact that, from 2010 to 2019, India’s economy grew at a faster rate than China’s (by 5.2% versus 4.5%) — the first decade it has done so since the 1960s.

Credit rating agency S&P Global similarly believes that India’s growth will outpace China’s in coming years. S&P expects China’s GDP growth to peak at 4.8% in 2025, while India’s is expected to increase from 6.4% in 2023 to 7.0% in 2026. This divergence will, according to S&P, shift the Asia-Pacific region’s growth engine from China to south and southeast Asia.

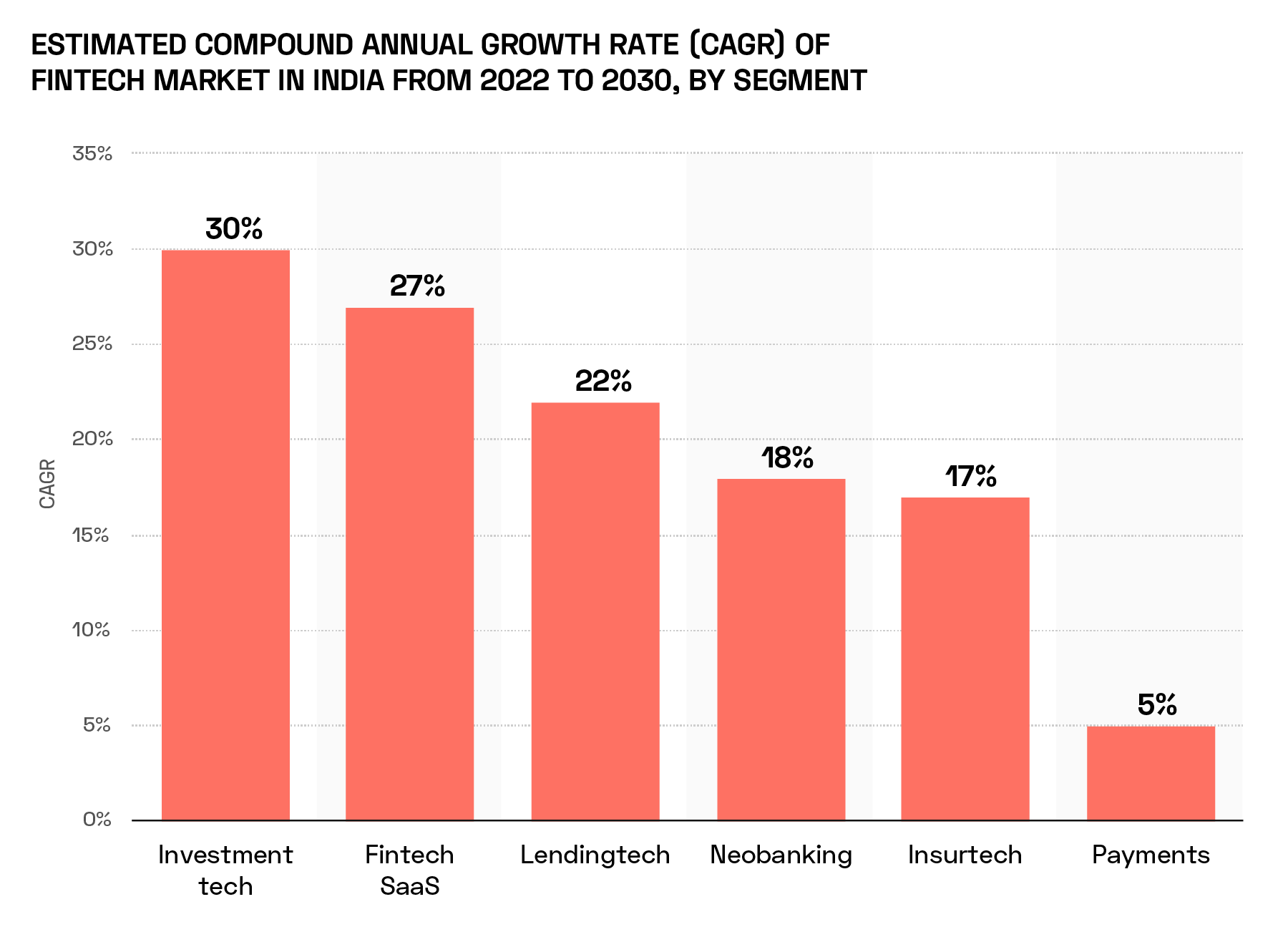

In May, consulting firm Boston Consulting Group (BCG) published its Global Fintech report for 2023, which predicts that the region will be the world’s largest fintech market by 2030, growing at a 27% CAGR during that period.

According to Statista, fintech is likely to be the fastest-growing market in India. The research firm forecasts a CAGR of as much as 30% for investment technology, which it predicts will be the fastest-growing segment of India’s fintech industry.

Exchange of Fortunes

India’s flourishing economy is manifesting in the increasing prominence of its major stock exchange, the National Stock Exchange of India (NSE), which is set to overtake the Stock Exchange of Hong Kong. The Financial Times cites October data from the World Federation of Exchanges which showed the NSE’s total capitalisation stood at $3.7trn compared to Hong Kong’s $3.9trn — with Indian share prices having increased and Chinese stocks struggled since then.

Major technology companies are also taking note. Foxconn [FXCOF] recently upped its investment in a manufacturing plant in Bengaluru by $1bn, on top of a pre-existing $1.6bn commitment. The site, which is emblematic of the broader shift away from China, is likely to become a major producer of Apple [AAPL] products, including the iPhone, according to Bloomberg.

However, one potential limit on India’s appeal to the world’s largest tech companies could be the question of how to ensure that sufficient workers are available locally.

Foxconn’s Chinese model was heavily reliant on migrant labour; Indian states such as Tamil Nadu are investing heavily into building sufficient accommodation to house the numbers of workers that will be required to run the new wave of technology production plants, some of which house up to 18,000 people, according to the Financial Times.

VanEck: India’s Digital and Demographic Tailwinds

Angus Shillington, Emerging Markets Deputy Portfolio Manager at VanEck, joined OPTO Sessions in September to discuss the demographic tailwinds that he believes will propel India’s economy over coming years, as well as the digital revolution that the country is undergoing.

“India is at this crazy intersection of the demographic story,” Shillington emphasised.

VanEck’s research highlights Tata Consultancy Services [TCS:NS] in particular as being poised to capitalise on the long-term digitalisation trend that is underway in India, particularly as it has already been able to bring its technological prowess to bear in the rapidly expanding payments industry.

How to Invest in Indian Tech

The contrasting fortunes of India and China’s technology sectors can be seen in the performance of two representative ETFs: the VanEck Digital India ETF [DGIN] and the Global X MSCI China Information Technology ETF [CHIK]. DGIN tracks an index of companies involved in supporting the digitalisation of the Indian economy, whereas CHIK holds large- and mid-cap information technology stocks from the MSCI China Index.

DGIN has gained 31.4% year-to-date as of 19 December. CHIK has fallen 11.3% over the same period.

Foxconn is one of the companies that best encapsulates the shift in manufacturing focus from China to India. Its Taiwan listing [2354:TW] is up 2.3% year-to-date. Apple has gained 51.6%, while Tata is up 21.1%.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy