As global populations age, a labour gap is looming, which could be especially acute in the very sectors tasked with caring for this growing senior cohort. Investment firms, tech companies and research institutions see autonomous mobile robots (AMRs) as a potential solution to this approaching crisis, as well as to addressing human loneliness more generally.

- VanEck suggests that robots could be key to labour crunch caused by ageing populations — especially in elderly care.

- Toyota research team is using ‘large behaviour models’ to crack tasks requiring dexterity.

- Tesla’s share price nearly doubles year-to-date, with hype growing around its Optimus bot.

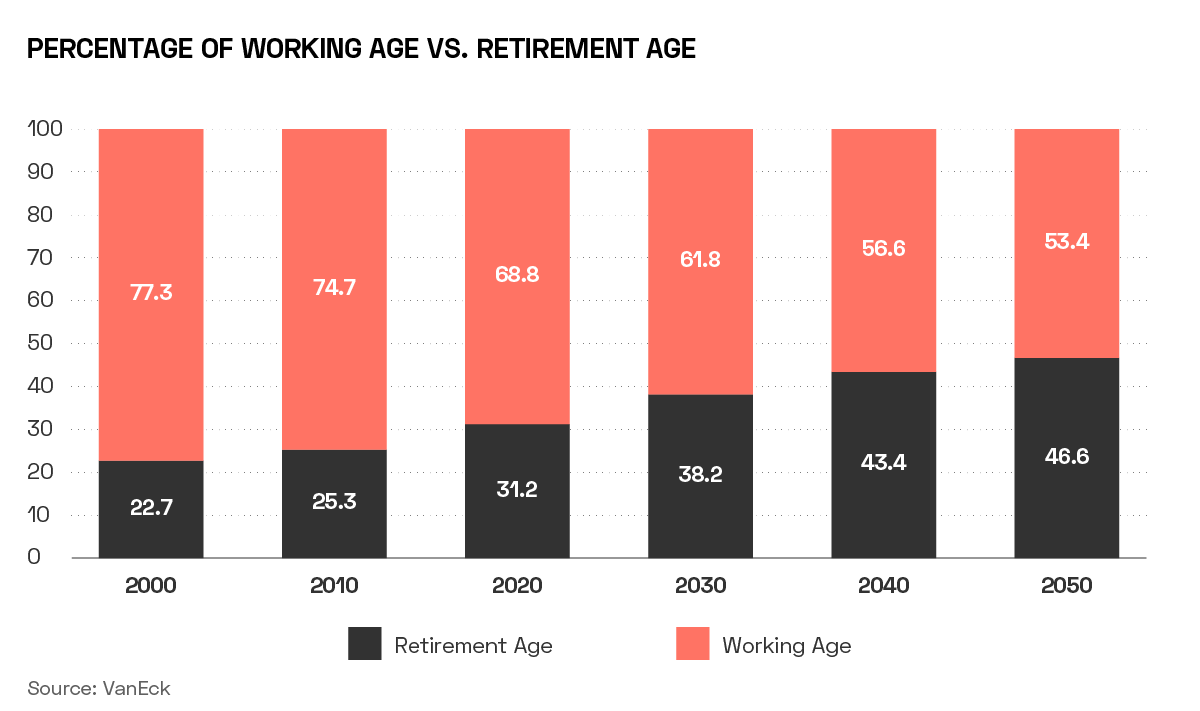

Western populations are getting older, thematic investing firm VanEck points out in a report titled ‘The Aging Population: Robotics as the Long-Term Play’.

According to VanEck, over 40% of the population of high-income countries could be above 65 by 2040.

This poses significant challenges to their economies. At a macro level, the shrinking proportion of working-age people could create labour shortages. VanEck highlights countries such as China and Japan, whose populations aren’t just ageing but also shrinking.

Such shortages could also be felt in the social care industries that will look after an increasingly large cohort of retirees. Care workers are already severely undersupplied in countries such as the US and UK, and these demographic trends will only exacerbate the issue.

VanEck believes, however, that robotics is the solution to this brewing labour crisis. “The ability of robots to automate tasks currently carried out by humans can alleviate labour shortages, boost productivity and reduce operational costs,” writes Drew Anderson, Product Analyst at VanEck and author of the report.

Various aspects of healthcare have already benefited from automation, according to Intel’s [INTC] review of the interplay between the two themes, ‘Robotics in Healthcare: The Future of Robots in Medicine’. Intel lists high-quality patient care, including social engagement for elderly patients, as one potential application. The report goes into more detail on the notion of ‘social robots’ — a type of AMR — which can offer social engagement and monitoring in long-term care environments.

“In general, social robots help reduce caregiver workloads and improve patients’ emotional well-being,” says the report.

BUDDY Systems

Research and governmental institutions at various levels are taking the looming labour crisis, and the potential of robotics to solve the problem, seriously.

Developments in this field will, according to the University of Bristol, “help older people live better, more independent lives and reduce the need for in-hospital care”. Jonathan Rossiter, Professor of Robotics at the university, is developing a system of robotic muscles that can be implanted in the body in order to “effectively turn back the body clock”. Slowing the process of muscle wastage that can affect the elderly could reduce the rate of falls, disability, admission to hospital and the need for long-term care, as well as easing the burden on already-overstretched healthcare systems as populations age.

The ACCRA project a collaboration between the EU and Japan, was established to research robotic interventions to facilitate healthy ageing.

“In 20 to 30 years’ time there’s not going to be enough people to take care of the ageing population,” Estibaliz Arzoz-Fernandez, Project Manager and Deputy Coordinator of ACCRA, told Horizon, a research and innovation magazine from the EU Commission, in March of last year. To that end, ACCRA has developed BUDDY, an ‘emotional robot’ roughly the size of a dog, with an expressive face, that was designed with the input of elderly people and their carers.

Arzoz-Fernandez believes that robots like BUDDY will significantly improve elderly patients’ wellbeing, telling Horizon that its elderly contributors “really felt they had a presence and didn’t feel alone”.

The market for eldercare assistive robots such as these could, according to Future Market Insights, grow to $8.1bn globally by 2033, from $2.5bn in 2023, registering a 12.4% CAGR over the course of 10 years.

Breaking Some Eggs

With the world’s largest proportion of those over 65 (besides Monaco) and a leading position in the global robotics industry, it is unsurprising that Japan is at the forefront of innovation in robotics for longevity. One of the country’s industrial giants, Toyota [TM], is making significant strides.

The division responsible is the Toyota Research Institute (TRI), whose Senior Vice President of Robotics, Max Bajracharya, told TechCrunch in February that cracking the use case of robots in the home is the institute’s driving goal. At the time, TRI had temporarily pivoted away from this challenge in order to master more structured environments, such as grocery stores, where robots could still usefully perform tasks for elderly patients.

However, in September, The Verge reported that TRI had taught robotic arms how to whisk eggs and perform other complex tasks, like manipulating ‘deformable objects’ (such as bags, cables and fabric), by equipping the robots with pressure sensors and using generative AI to supply the robots with understanding of the tasks.

This approach ultimately aims to create ‘large behaviour models’ that enable robots to learn to perform behavioural tasks — the steps it takes to make breakfast, for example — via observation, similarly to how a large language model (such as GPT-4) enables an AI application (such as ChatGPT) to learn how to respond to text prompts.

Robots: Not Just for Christmas

China is another nation with huge demand for ‘companion robots’, according to Interesting Engineering. In China, some 92 million adults — 6% of the population — live alone. Despite this sizeable potential market, the high cost, questionable safety and low accessibility of companion robots remain as major barriers to their widespread adoption.

On that front, hype is gathering around Tesla’s [TSLA] Optimus robot. In September, CEO Elon Musk shared a video of the humanoid robot practising yoga and sorting blocks based on their colour. “Perhaps in less than a decade, people will be able to buy a robot for their parents as a birthday gift,” Musk told the Substack Beijing Channel last year.

How to Invest in Longevity and Robots

While they are, fundamentally, automakers, Toyota and Tesla are among the companies making the greatest strides in humanoid robots — which Musk himself has previously said could be “more valuable than the car” in the long term. Toyota’s share price has gained 37.6% year-to-date as of 6 December, while Tesla’s has gained 93.8%.

Few investment products directly target the intersection of longevity and robotics, but both themes are well-served by ETFs that seek to capture each individually.

The Global X Aging Population ETF [AGNG] tracks an index of companies that serve the expanding senior population via health care, pharmaceuticals, senior living facilities and other sectors that contribute to increasing lifespans and extending quality of life in advanced age. As of 30 November, healthcare companies account for 93% of the fund’s sector exposure, while 7% go to real estate. Eli Lilly [LLY] is the fund’s top holding. AGNG has gained 3.1% in 2023 through 6 December.

The VanEck Robotics ETF [IBOT] tracks an index of companies involved in the robotics industry, with Nvidia [NVDA] being the top holding. The fund has gained 8.8% since launching in April.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy