At the historic COP28 summit in December, global governments for the first time pledged to cut consumption of fossil fuels. While global macroeconomic conditions have been a headwind for renewable stocks — particularly those in the wind sector — during the past year, 2024 could be brighter, especially for solar power.

- While wind stocks have struggled during 2023, solar stocks have benefitted from the Inflation Reduction Act.

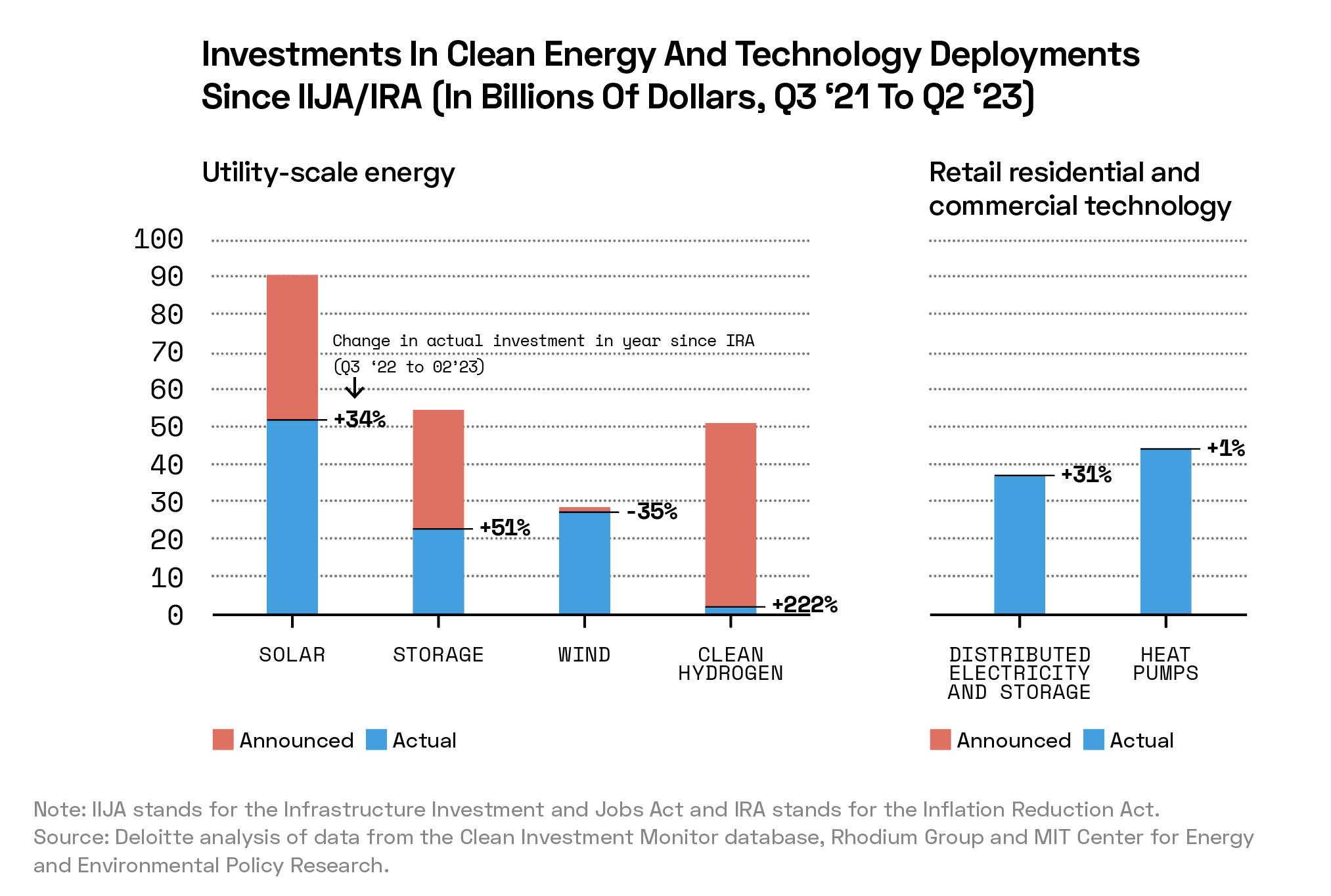

- Deloitte shows that US government legislation has prompted $92bn of announced investment and $52bn of actual investment into solar energy.

- Heliogen’s share price gained 187% during 2023.

“Stocks from renewable energy companies are out of favour”, wrote Arjan Palthe, Fund Manager at Triodos Investment Management, in November.

Palthe cites declines for the MSCI Global Alternative Energy Index since the start of 2023 and underperformance of clean energy stocks as evidence that markets are taking a pessimistic view of their prospects.

But this pessimism, argues Palthe, is unwarranted. These stocks “have strong impact narratives, are a clear fit to the renewable resources transition theme and have good long-term prospects”.

However, the theme is contending with significant headwinds. Among the most significant of these are: high interest rates, which are pushing up the cost of borrowing to fund new projects; inflation, which is pushing up the costs of these projects; and, more recently, falling energy prices, which are squeezing profit margins.

These factors have hit wind turbine manufacturers particularly hard, according to Palthe. Increasing project complexity and a backlog of projects, signed at unfavourable prices given the recent rise in costs, have led to companies such as Siemens Energy [SMNEY] requiring state guarantees from the German government.

However, solar power manufacturers have fared better, in part thanks to the incentives provided by the US Inflation Reduction Act (IRA) of 2022. Palthe reckons that the incentives and tax credits included in the IRA mean that First Solar [FSLR] “receives millions of US dollars for every gigawatt of solar panels produced in the US”.

With the headwinds predominantly company- or industry-specific, Triodos views the difficult year for the renewable energy sector merely as a temporary setback. Governments continue to back the energy transition, which still has far to go, and “this will surely support future profitability and performance”.

Solar’s Bright Spot

Research from Deloitte also highlights this bifurcation within the renewable energy sector.

In its ‘2024 Renewable Energy Industry Outlook’, the professional services firm observed that utility-scale solar capacity grew faster in the US than other renewable sources between January and August 2023, with 9 gigawatts (GW) installed during the period, compared to just 2.8GW of wind capacity. This represents a 36% year-over-year increase in the amount of utility-scale solar capacity added, compared to a 57% fall in the amount of new wind capacity coming online.

Overall, renewable energy capacity is expected to increase in 2024. According to Deloitte’s report, the Energy Information Administration predicts renewable deployment will grow by 17% to 42GW during the year. This would see renewable energy account for almost a quarter of US electricity generation.

Several trends are expected to impact the US renewable energy market this year. Foremost among these are historic levels of investment driven by regulatory boosts such as the IRA and the Infrastructure Investment and Jobs Act (IIJA). Only 10% of the funding from the IRA has yet been distributed, and Deloitte expects this figure to grow in 2024. So far, these legislative bills have encouraged $227bn of investment in utility-scale renewable energy projects, of which $100bn has been realised.

Solar has been the biggest beneficiary of these acts; according to Deloitte, $92bn of announced investment and $52bn of actual investment have been directed towards the sector.

Could Fossil Fuels Be History?

December’s COP28 climate summit in Dubai saw global governments agree on a slew of measures to combat climate change, among them a pledge to triple the output of renewable energy by 2030.

Anders Opedal, CEO of Equinor [EQNR], told Reuters that the plan “is realistic, but there are elements that need to be solved”, such as permitting, leases and grid connections. A tripling of renewable energy output implies 11,000GW of solar capacity by 2030, 20% more than BloombergNEF’s projected equivalent of 9,000GW.

An early draft of the COP28 agreement controversially omitted a commitment to phase out fossil fuels, prompting backlash from participants, who accused petrostates like Saudi Arabia of undermining the summit’s objectives, according to the Financial Times. However, the final resolution committed states to start reducing their consumption, in a deal that Reuters says is “meant to send a powerful message to investors and policymakers that the world is united in its desire to break with fossil fuels”.

Heliogen Lights the Way

While expanding solar power may be one route towards reducing global fossil fuel consumption, constant innovation is required to improve its efficiency and scope.

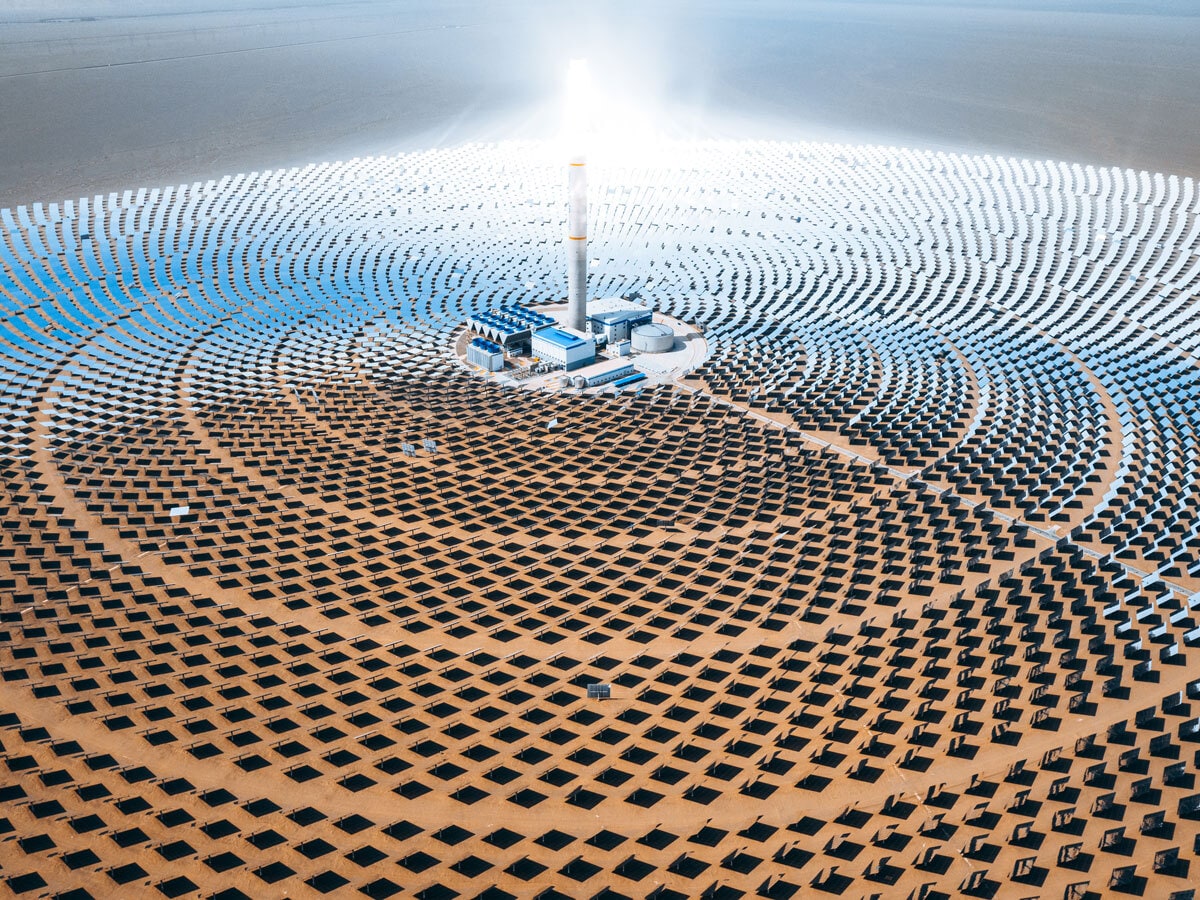

Heliogen [HLGN] is one company at the forefront of this. Unlike conventional solar photovoltaic power, Heliogen uses AI to direct giant mirrors, known as heliostats, in such a way that the sun’s energy is directed towards a receiver, generating large amounts of heat. This enables the energy to be stored or converted into steam or hydrogen, promising approaches to decarbonising hard-to-abate industrial sectors.

Other companies may soon be able to benefit from Heliogen’s unique closed-loop software, which optimises the positioning of heliostats. An experiment at Sandia National Laboratories’ National Solar Thermal Test Facility demonstrated that the software can reduce tracking error to 0.33 milliradians (mrad), significantly surpassing the project target of less than 1.0mrad.

“This development is pivotal in widening the scope of our proprietary technology, enabling its application across government, industry, and new or existing solar projects, thereby advancing the decarbonization of hard-to-abate sectors,” said Christie Obiyaya, CEO of Heliogen, in a press release.

How to Invest in Renewable Energy

The bifurcation in the renewable energy sector through 2023 is highlighted by the divergent performance of the relevant stocks: solar made (sometimes significant) gains, while more general or wind-specialised energy stocks have fallen or flatlined.

Heliogen’s share price gained 186.5% during 2023, while First Solar gained 15%. Conversely, Siemens Energy fell 29.7%. Equinor, which is principally an oil and gas company, albeit one that has made significant investments in offshore wind, fell 0.8%.

Investing in individual renewable energy stocks involves a relatively high degree of risk, given the variability of costs and the viability of individual projects. Investors who believe that the sector has a bright future but don’t want to pin their hopes on individual companies can select a thematic ETF instead.

For instance, the iShares Clean Energy ETF [ICLN] tracks an index which itself tracks the stocks of global companies in the clean energy sector. As of 29 December 2023, First Solar is ICLN’s top holding, with an 8.4% weighting. The fund fell 20.4% during 2023.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy