As 2023, a year defined in large part by the explosion of generative artificial intelligence (AI), draws to a close, there are reasons to believe that 2024 could be the year of quantum computing. Big tech companies and cloud providers are readying tools and products for the ascension of this potentially groundbreaking theme.

- Defiance ETFs believes that quantum computing could be a key theme to watch in 2024.

- Big tech companies such as Google and IBM are developing toolkits and products for the development of quantum applications.

- Defiance Quantum ETF gains 38% year-to-date.

Quantum computing — a form of computing that “harnesses the laws of quantum mechanics to solve problems too complex for classical computers”, in the words of IBM [IBM] — could make as big a splash in 2024 as artificial intelligence (AI) did in 2023, Jane Edmondson, Head of Thematic Strategy at VettaFi, wrote in a December blogpost.

According to Defiance ETFs, the race for supremacy in this emergent field is already underway among the big names in technology, such as Microsoft [MSFT], Alphabet’s [GOOGL] Google, Intel [INTC] and IBM.

Defiance notes that Sycamore, Google’s quantum computer, has achieved 70 operational qubits. Qubits are at the heart of quantum computing: they enable a bit, which is the basic unit of data in computing, and is conventionally equivalent to either 0 or 1, to be both 1 and 0 simultaneously, thereby unlocking a range of possible use cases. Sycamore this year completed a calculation in just over six seconds that would take Frontier, one of the most advanced traditional supercomputers, 47 years to complete.

In March, Microsoft’s Azure Quantum achieved a major breakthrough by demonstrating the feasibility of topological qubits, which Microsoft believes represent the best approach to creating a quantum supercomputer.

“With its ability to process complex calculations at an unprecedented speed, quantum computing has the potential to solve problems that are currently unsolvable with classical computers,” says Defiance. The potential of the technology is, it says, already attracting interest in a range of sectors, including finance, healthcare and logistics.

A Physical Market

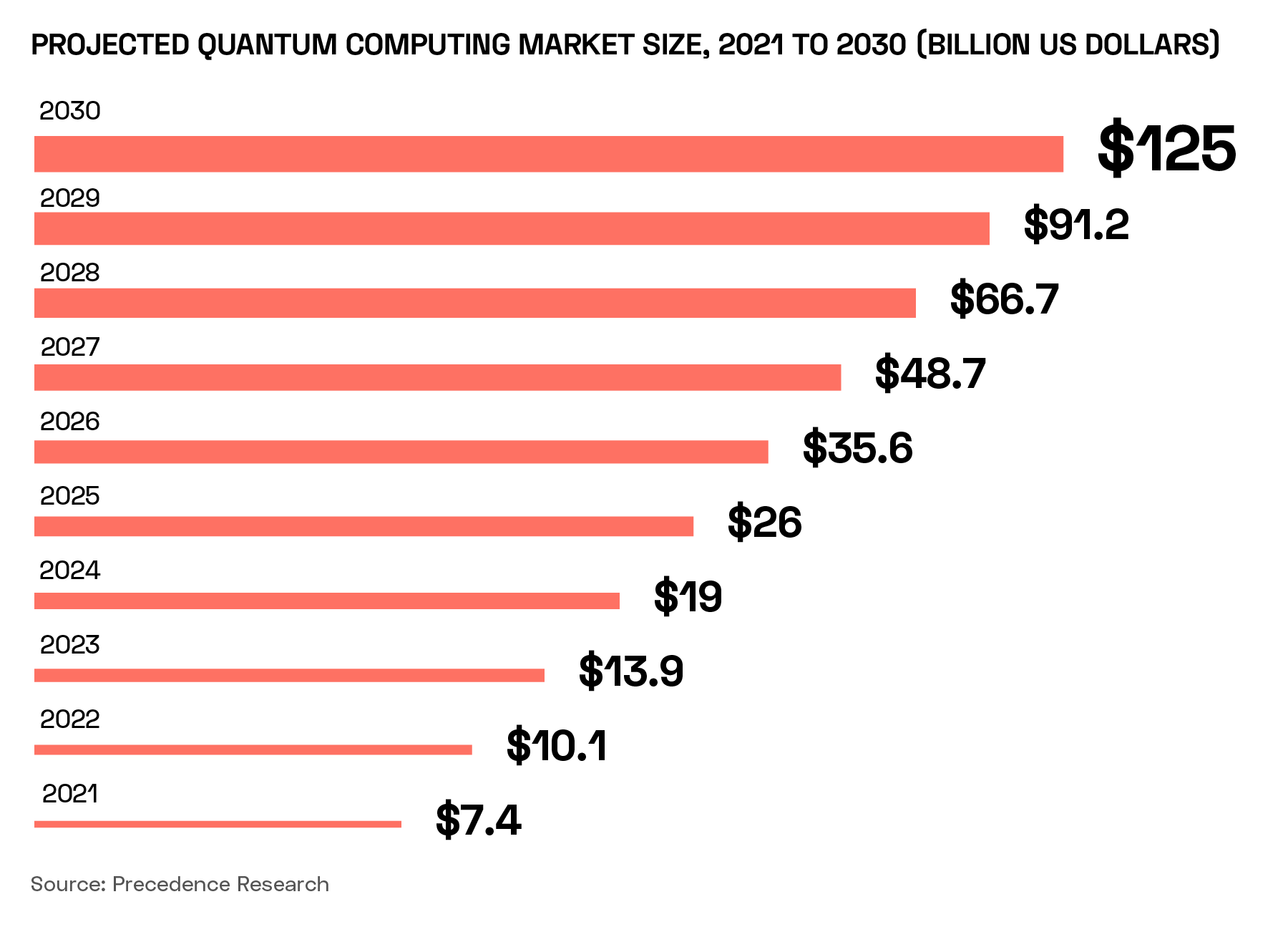

Defiance cites data from MarketsandMarkets that estimates global quantum computing market revenue at $866m in 2023, and projects it will increase to $4.4bn by 2028, implying a 38.3% CAGR.

But Precedence Research data implies that these total figures could be far too low. Precedence projects a $66.7bn market in 2028, growing to as much as $125bn in 2030. However, between 2022 and 2030, Precedence forecasts a similar CAGR of 36.9%, implying that the differences between these figures and those of MarketsandMarkets are principally due to the methodology deployed.

Strategy consultancy McKinsey cites an approximate figure of “$80bn by 2035 or 2040”. In its report, entitled ‘Potential and Challenges of Quantum Computing Hardware Technologies’, McKinsey identifies five key technologies that it says are currently at early stages of research, but which will be key to the future growth of quantum computing as a theme.

These five are: photonic networks, which offer high speed and the potential for massive quantum entanglement (a phenomenon in particle physics that involves changes to one particle affecting another); superconducting circuits, which offer improved processing speed and are also easy to manufacture; spin qubits; neutral atoms; and trapped ions. While some of these technologies are theoretical at present, McKinsey notes that any one of them — or a combination of several — could ultimately emerge as the key to creating a “fault-tolerant quantum computer”.

A Paradigm Shift

Forbes recently included quantum computing alongside space and AI as one of three tech areas to watch in 2024.

The rise of the technology will be, according to Chuck Brooks, President of Brooks Consulting International, “a paradigm shift in quantum research, learning, and prediction in society”. The article cites Robert Liscouski, CEO of Quantum Computing Inc, who predicts that “end users; business users, medical researchers, cybersecurity professionals, will change the conversation from ‘what can quantum computing do?’ to ‘look what I can achieve with quantum computing’”.

IBM is already looking ahead to the practicalities of developing software that can leverage the potential of quantum computing. At its 4 December quantum computing summit, the company unveiled Qiskit 1.0, which Forbes calls “a major upgrade to its open-source software development kit for quantum computing”. Google has similarly released a range of tools for quantum computing including Cirq, its open-source library for quantum computing using the Python programming language.

The Quantum Cloud

One clear sign that quantum computing is on the verge of feasibility is the energy that major cloud providers are expending on readying their products for its ascension. Microsoft, for example, offers quantum compatibility via its Azure cloud platform.

IonQ [IONQ], a quantum computing company founded in 2015, established partnerships with Amazon’s Web Services (AWS) [AMZN] and Microsoft in 2019 to make its quantum computers available via the cloud. On 5 December, IonQ announced that its most powerful quantum system, IonQ Forte, is now available via AWS’ fully managed quantum computing service Amazon Braket.

Peter Chapman, President and CEO of IonQ, said in a press release that “IonQ Forte’s inclusion on Braket Direct ensures more customers can take advantage of the most powerful commercially available quantum hardware available.”

How to Invest in Quantum Computing

As we have seen, big tech companies are investing in their quantum computing offerings and as such these offer exposure to the theme’s potential. Google, Microsoft and Amazon are members of the so-called “magnificent seven” stocks; their share prices have respectively gained 54.9%, 57%, and 83.1% year-to-date as of 20 December.

The AI boom played a significant part in the growth of these stocks through 2023, and should a quantum boom materialise in 2024, it could broaden this narrative out to other large technology companies that aren’t included in the magnificent seven. One of these is Intel, though with year-to-date gains of 80 6% it has outperformed some magnificent seven stocks. IBM, despite its longstanding association with AI via its Watson product suite, appears to have missed out on the AI boom, with gains of just 20.4%.

These are, however, large and diversified companies. For more concentrated exposure to quantum computing, investors can select a company solely focused on the technology, such as IonQ. IonQ’s stock is up a massive 315.1% year-to-date.

Finally, investors seeking concentrated but diverse exposure to the theme can select a thematic ETF such as the Defiance Quantum ETF [QTUM]. QTUM holds IonQ, Intel, Alphabet, IBM and Microsoft as of 20 December. The fund has gained 38.1% year-to-date.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy