Uranium stocks and ETFs to watch

Uranium is a natural, non-renewable resource that is used as an alternative energy source to typical fossil fuels such as coal and natural gas. It is a highly unstable element used in nuclear power plants across the world. Although it is a commodity, uranium cannot be traded directly due to its radioactive nature. Instead, investors can gain exposure to uranium through stocks and exchange-traded funds (ETFs) that represent companies involved in the mining and production of uranium. Join us as we count down some top uranium companies to watch right now, based on market capitalisation, growth potential and investor interest.

What is uranium?

Uranium is a radioactive material that can be located and extracted in many countries throughout the world. It is part of the process of powering nuclear fission, which accounts for over 10% of the world’s electricity. Uranium is a relatively clean burning source, as a tiny amount can produce the same amount of power as coal, without the same harmful emissions that coal releases into environment.

Properties of uranium

- Has a very high density – highest atomic mass of any naturally occurring element

- When refined, it appears as a silver-white metal

- It is malleable and ductile

- When finely divided, it can react with cold water and break into flames

- Relatively poor conductor of electricity

- Forms compounds that are of a yellow or green colour

What is uranium used for?

Historically, uranium compounds were used as a colouring agent for household items, such as glassware, ceramics and glazes, and as mordants for electric conductors such as lightbulbs. However, these uses are slightly outdated and not practised as much anymore.

These days, uranium is primarily used within nuclear reactors and power plants in order to generate electricity. It is also used for military purposes such as powering submarines and nuclear weapons. The nuclear fuel cycle shows how uranium differs in each stage, from when it is mined, milled and enriched at the start, to when the fuel is fabricated, stored and reprocessed towards the end of the cycle.

Where is uranium found?

Low and non-harmful concentrates of uranium are present in rocks, soil and water worldwide. Unlike other non-renewable energy sources such as coal and natural gas, specialists believe that there is a much larger global supply of uranium that has yet to be discovered. This means that uranium may be an effective energy source in the long-term.

Largest producers of uranium in the world

The top uranium producing countries are as follows, according to the World Nuclear Association:

| Country | Uranium production in 2019 (tonnes) | % of world total |

|---|---|---|

| Kazakhstan | 22,808 | 42% |

| Canada | 6,938 | 13% |

| Australia | 6,613 | 12% |

| Namibia | 5,476 | 10% |

| Uzbekistan | 3,500 | 6% |

| Niger | 2,983 | 5% |

| Russia | 2,911 | 5% |

It is interesting to note that, while Australia is the third-largest producer of uranium, and it also has the largest amount of uranium resources in the world, nuclear power is banned in the country. This may be due to the concerns surrounding the potential risks that nuclear stations and power plants present to the environment and the health of Australian citizens, which was triggered by the 2011 Fukushima disaster.

How has the Fukushima nuclear disaster had an effect on uranium production?

In 2011, Japan’s Fukushima power plant was hit by a severe earthquake and tsunami in the region, causing the most severe nuclear accident since the Chernobyl disaster. This resulted in the meltdown of its reactors and discharge of radioactive water, forcing residents to evacuate their homes.

Following this disaster, Japan’s nuclear power production dropped from 30% to just 2%. All nuclear plants in the country were either closed down or operations were suspended, and other countries became wary of nuclear power generation also, cutting down on their own operations. Because of this, the price of uranium has halved since 2011 and is struggling to regain its peak.

Nevertheless, as you can see from the table above, the decline in nuclear production from developed countries such as Japan has paved the way for emerging economies such as Kazakhstan and Namibia to take charge of the uranium market. Although many power plants are not in use anymore, each country that is part of the Paris Agreement must adhere to the rules of producing at least 20-22% of its energy portfolio in nuclear power, which will raise the demand for uranium once again.

As the world’s largest uranium consumer, US president Biden describes nuclear power as “critical clean energy technologies” and the country is striving to reclaim domestic uranium mining as one of its goals, rather than solely relying on imports from the biggest producers above.

Can you invest in uranium?

Unlike other commodities and raw materials such as gold, silver and crude oil, it is not possible to invest in or trade on physical uranium, due to its radioactive nature. Instead, an alternative way of gaining exposure to this commodity is via the stock market.

To start trading on the price of uranium through shares and exchange-traded funds, follow the steps below.

- Open a live account. We offer over 9,000 shares and ETFs to trade, including those involved in the extraction, mining and dispersal of uranium.

- Choose your product between spread bets and CFDs. Both allow you to speculate on the underlying price movements of popular instruments, and spread betting is tax-free* in the UK.

- Follow news regarding the price of uranium and developments within the nuclear industry. Natural disasters, climate change and new regulations against non-renewable types of energy will all have an impact on uranium-focused stocks.

- Learn about the share market. These types of assets can be unpredictable, so you should learn how to trade stocks by using effective strategies and brushing up on your technical analysis skills.

- Use risk-management controls when opening positions. Stop-loss orders can help to minimise losses when there is an unexpected price change or volatile movement on a trading chart.

Uranium stocks to watch

Cameco (TSX:CCO)

Cameco is the world’s largest publicly traded uranium company that has headquarters in Saskatoon, Canada. Founded in 1988, it is one of the largest global uranium producers, accounting for around 18% of uranium production. On average, the company has the capacity to produce more than 53m pounds of uranium concentrates annually. The company operates uranium mines in a number of countries, including Canada, the US, Kyrgyzstan, Mongolia and Australia, spanning over 1.7m acres of land. The company vows to safely and reliably produce uranium and nuclear fuel products to generate electricity at worldwide nuclear reactors.

Uranium Energy Corp (NYSE:UEC)

Uranium Energy is an American uranium mining and exploration company. Founded in 2003, the company has headquarters in Texas and focuses its projects mainly throughout the southwestern US, in the states of Texas, Wyoming, Arizona, Colorado and New Mexico. It also has operations in Paraguay, which is one of the highest-grade Ferro-Titanium deposits in the word. Uranium Energy has one of the largest databases of historic uranium exploration in the US. The company is dedicated to providing low-cost fuel for emission-free electricity in order to contribute towards a cleaner environment overall.

Rio Tinto (LSE:RIO)

Rio Tinto is an Anglo-Australian mining company with headquarters in London. As well as being one of the largest global producers of uranium, it is also one of the largest companies in the UK by market capitalisation and is considered to be of blue-chip status. The company was founded in 1873. As well as uranium, Rio Tinto explores, mines and refines other precious metals and commodities such as gold, diamonds, copper, aluminium and iron. In 2020, the company’s destruction of the Juukan Gorge sacred caves in Australia caused public backlash and Rio Tinto’s CEO decided to step down.

Fission Uranium Corp (TSX:FCU)

Fission Uranium is a Canadian mineral exploration company that focuses on the exploration and development of uranium assets. Its core concentration is developing the high-grade Triple R uranium deposit, which is part of the Patterson Lake South (PLS) project located in the Athabasca Basic. Triple R is the only existing major high-grade deposit in the region found at such a shallow depth. Since Fission Uranium was founded in 2013, the company has made a number of significant discoveries and has won awards for Mining Persons of the Year and Exploration of the Year.

Energy Resources of Australia (ASX:ERA)

Energy Resources is an Australian mining company and a subsidiary of Rio Tinto, which owns roughly 70% of the company. It is one of the largest uranium producers in the world and owns part of the Ranger Mine along with its parent company. Although mining stopped in 2012, it is still producing material from stockpiled uranium ore, and the Ranger Mine produced 3.8m of uranium throughout 2019. ERA sells its product to electric utility companies across Asia, North America and Europe. The company has previously come under fire for over 200 environmental incidents that have occurred at the Ranger Mine.

BHP (LSE:BHP)

BHP is another leader in the global mining industry. Founded in 1885, it is an Anglo-Australian metals and petroleum producer that has headquarters in Melbourne. The company has one of the largest market capitalisations in the UK. Aside from uranium, BHP also focuses on the extraction and production of commodities such as iron ore, copper, coal, petroleum and nickel. It owns the Olympic Dam mine in Australia, which is one of the largest uranium deposits in the world. This mine produced 6% of total global supply in 2019 with estimates of 347,000 tonnes of contained uranium oxide.

Uranium Participation Corp (TSX:U)

Uranium Participation is a Canadian holding company that invests the majority of its assets into uranium, both in the form of uranium oxide in concentrates (U3O8) and uranium hexafluoride (UF6). The company has the investment objective of capital appreciation, with the hope that as the price of uranium increases, so will the value of its holdings. Uranium Participation’s strategy is to invest in uranium holdings rather than entering into short-term derivative contracts, and it also earns income through lending portions of its uranium holdings to third parties on occasion. The company was founded in 2005 and is based in Toronto.

Yellow Cake (LSE:YCA)

Yellow Cake is a British uranium company that founded in 2018 and has headquarters in Jersey. It offers direct exposure to the spot uranium price without any associated risks of mining, exploration or processing that comes with an operating company. The company purchases mainly uranium oxide (U3O8). It exploits a range of opportunities such as commodity streaming, synthetic production and royalties, offering shareholders exposure to the price of physical uranium through its own purchase and storage of the commodity. Yellow Cake primarily buys uranium on the spot market from the world’s largest seller, Kazakhstan-based company Kazatomprom.

Uranium ETFs to watch

An effective way to diversify your portfolio can be through ETF trading. Exchange-traded funds track the performance of major global indices in order to provide investors exposure to companies that are involved in uranium production and nuclear generation. Learn about two significant ETFs that we offer on our platform in order to take advantage of this growing investment theme.

Global X Uranium ETF (URA)

The Global X Uranium ETF tracks the Solactive Global Uranium & Nuclear Total Retire Index, which contains a broad range of companies involved in the mining of uranium and the production of nuclear components. This includes the manufacturing of equipment, as well as extraction and refining of the element. Top holdings within the ETF include Kazatomprom, Cameco, NexGen Energy, Denison Mines, Uranium Energy Corp and Sibanye Stillwater. In the first quarter of 2021, the Global X Uranium ETF saw returns of 46% and was trading at an all-time high, signalling promising potential for the uranium market.

North Shore Global Uranium Mining ETF (URNM)

The North Shore Global Uranium Mining ETF is made up of a basket of companies that are involved in the mining, exploration, development and production of uranium. It also holds companies that hold physical uranium at spot price, as well as uranium royalties or other non-mining assets. The fund is designed to track the North Shore Global Uranium Mining Index, which is a market-cap-weighted index for the uranium industry. Its two biggest holdings are Kazatomprom and Cameco, as well as Yellow Cake and Uranium Participation Corp, representing a mixture of uranium-based shares. In the first quarter of 2021, the North Shore Global Uranium Mining ETF saw returns of almost 42%.

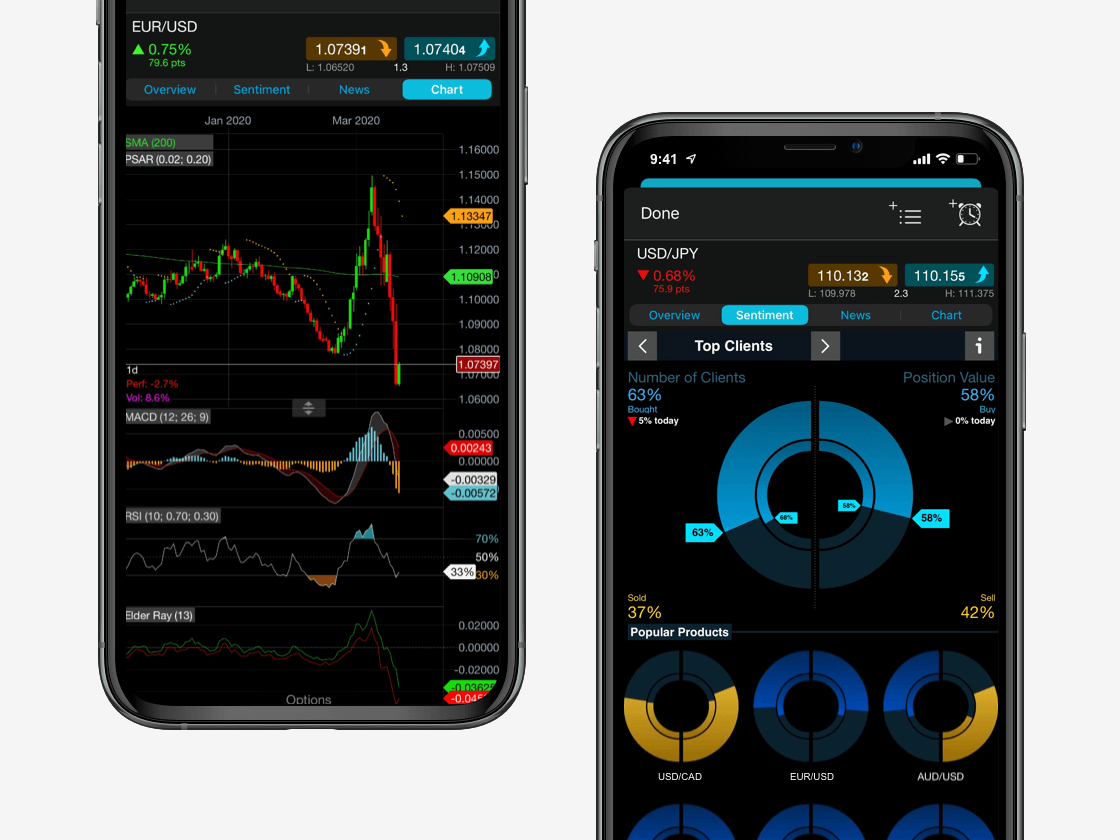

Seamlessly open and close trades, track your progress and set up alerts

What influences the price of uranium stocks?

- Environment: nuclear power generation is generally seen as cleaner and more eco-friendly than fossil fuels. Therefore, uranium stocks may make an attractive investment for those that are interested in making more environmentally conscious decisions.

- Natural disasters: natural disasters or accidents involving uranium or nuclear production, such as the Fukushima disaster, will most likely have a negative impact on the price of uranium, due to negative market sentiment.

- Politics: each political leader may have a different stance on fossil fuels, nuclear power and renewable energy. For example, if Biden is promoting the production of nuclear power, then uranium stocks are more likely to increase in price.

- Price of other energy sources: if the price of uranium or share prices for uranium-based companies are lower than its fossil fuels counterparts, such as coal and natural gas, this may make a more attractive investment, and vice-versa.

- Government stimulus: governments across the world often pledge to invest a certain amount of money and resources into nuclear research, raising interest and demand for higher uranium production.

How to buy uranium stocks

Long-term investors can buy uranium stocks through the process of share dealing. This involves paying the full value of the asset upfront to take on a ‘buy-and-hold’ approach. When share dealing, you take full ownership of the stock and cannot trade on both sides of the market. This means that if the price of your stock drops due to factors mentioned above, such as company earnings reports or a natural disaster that has affected the supply of uranium, this may result in losses. An alternative way of investing is to take a position on a stock using derivative products, such as spread bets and CFDs.

How to trade on the price of uranium

With derivatives, you can trade on the underlying price of uranium through stocks and ETFs that are involved in the uranium market. Learn about the difference between spread betting and CFD trading to find out which product is more suitable for your trading personality, strategies and overall goals.

Stay up to date with uranium news

As the world moves away from fossil fuels, there will be a greater dependency on nuclear power and renewable sources to meet the world’s energy demands. You should keep on top of market news to monitor the price of uranium and react appropriately to news events that may have an impact on your open positions. With a live account, you will have access to our news and analysis section, which is updated by our expert market analysts on a daily basis, as well as exclusive fundamental Morningstar reports and our Reuters news feed. It is even possible to set trading alerts for this type of news via desktop, mobile or tablet device.

FAQ

What is the spot price of uranium?

In 2021, the spot price of uranium stands at around $30 per pound. This has risen considerably since the start of 2020 but doesn’t compare to its original price of over $70 before the Fukushima disaster struck. Learn about how investor sentiment can affect the financial markets.

Will uranium stocks go up?

It appears that uranium stocks are on the rise since countries around the world have begun investing more money and resources into uranium mining. Prominent companies such as Cameco, NexGen Energy and Yellow Cake have seen strong gains between 2020 and 2021.

What is the demand for uranium?

The demand for uranium is expected to increase by around 40% by 2025, according to Morningstar Research. This may even bring its spot price back up to its original, pre-2011 level. Read about economic indicators that may have an effect on the supply and demand for uranium.

Can you invest in uranium as a commodity?

Given its radioactive nature, uranium cannot be invested in as a physical commodity. This is dissimilar to other raw materials such as gold, silver or crude oil, which traders can purchase and store. Learn about alternative commodities that you can take a position on.

What are uranium ETFs?

Uranium ETFs are exchange-traded funds that provide exposure to multiple companies within an underlying global index, such as the Solactive Global Uranium & Nuclear Total Retire Index or North Shore Global Uranium Mining Index. Read more about how to trade ETFs.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.