Market sentiment refers to the overall attitude of investors and traders towards the financial markets at a certain time. This is in relation to anticipated price developments for a particular instrument or market. Market sentiment can vary due to many external factors, such as economic reports, seasonal changes, national and global political events.

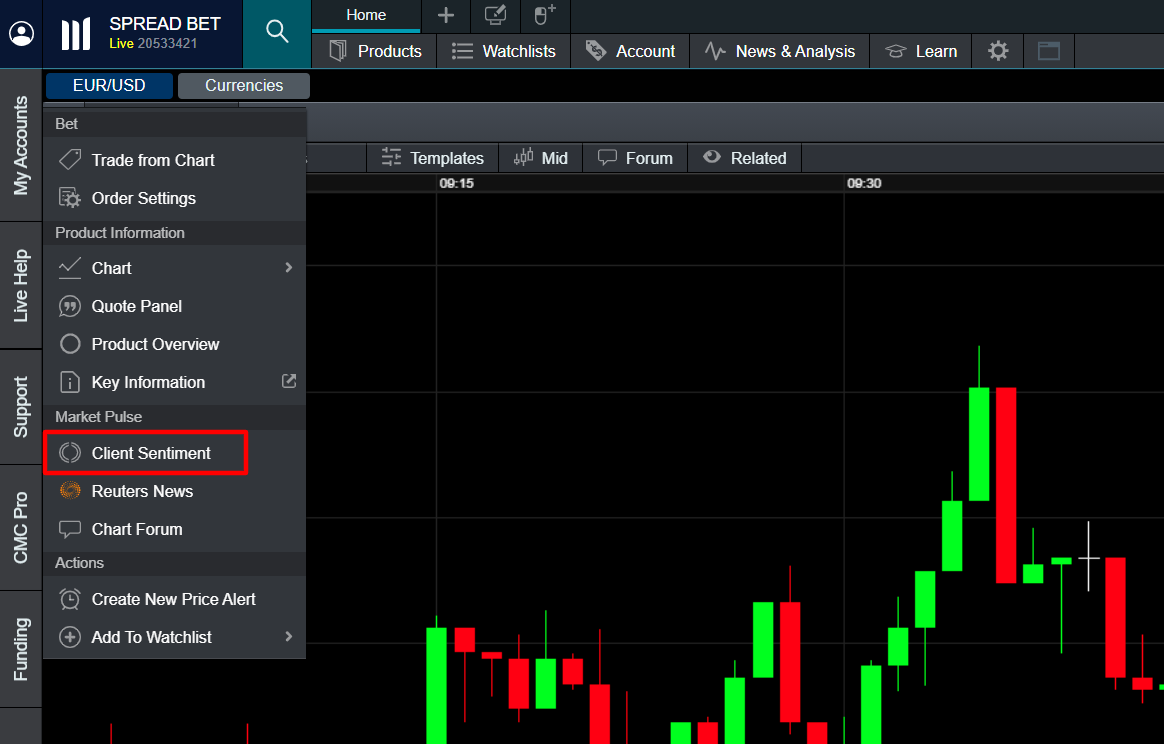

Some traders look for market sentiment when opening a position for a financial instrument, as this can be a good indication of where the market is heading. Market sentiment can vary due to many external factors, such as economic reports, seasonal changes, national and global political events.

As an example, if 80% of clients are going long on the FTSE 100 stock index and only 20% short, this signals a strong uptrend in the market. Other traders may then join the trade if they expect profits to follow.

If this statistic decreases to 60% long positions and 40% short positions within a short timeframe, this signals a change in trader sentiment, and there may possibly be volatility in the market, causing a shift in the asset’s price action. Traders will then start to decide whether they need to short sell the asset if they are in a falling long position, or buy the asset if they expect the price to start an uptrend.