Top 10 silver mining stocks to watch

Silver miners discover and extract silver. The precious metal is in high demand as it is used in many products. The value of silver exploration and mining stocks is based on both the price of silver and how much of it these silver mining companies produce. In this article, we look at how the silver market works, and some of the top players in the industry.

What factors affect the price of silver mining stocks?

Demand for silver is driven by industries that use the precious metal as well as general market speculation on the price of the metal. If demand is high from these participants, the price of silver rises. If demand is low, the price will fall.

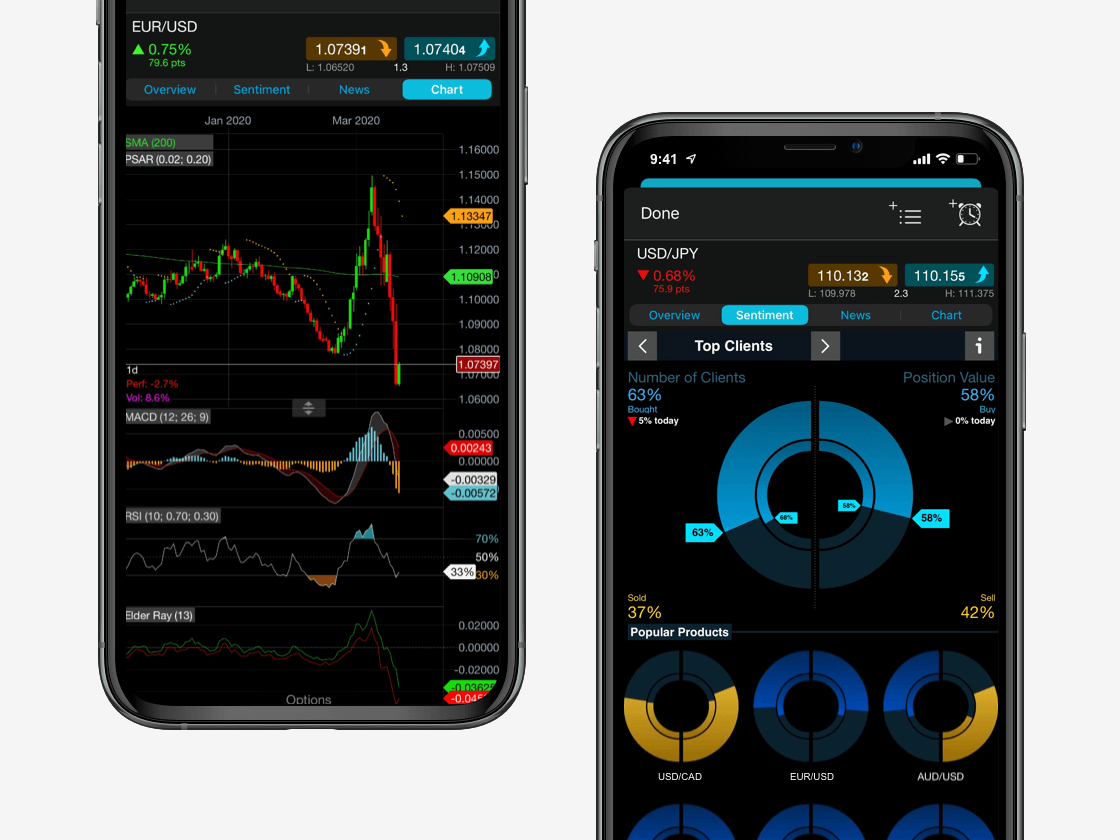

Our Next Generation trading platform allows investors and traders to monitor the price of silver by simply typing in “Silver” into the product library search box. The term “Silver – Cash” shows our current price of silver, which fluctuates constantly on the open market.

Silver miners are affected by the price of silver since the open market price determines how much they can sell their silver for. As silver prices fall, most silver miner stocks may also fall since profits are likely to drop. If silver prices are rising, this will generally help push silver miner stocks higher. A stock’s market cap also rises and falls with these swings, as each share outstanding is worth more or less.

Individual companies are also affected by how much silver is expected to be produced and how much is actually made. If a company can extract more silver than expected, or a new mine could potentially produce more silver than published estimates (from the company or based on stock market analyst’s research), this could drive up the price of the stock, since the company will be able to extract and sell more silver, thus increasing its profits.

Similarly, if a company produces less silver than expected, or silver production is below published estimates, this may drag down the price of the stock.

The gold/silver ratio may also affect the price of silver mining stocks. The ratio is the price of silver in relation to the price of gold and may help determine which metal will be more favourable to sell in the future. For example, if the ratio is high (compared to historic values), then silver may be more in demand over the coming months and years until the ratio moves back to more average levels.

Top silver stocks to watch

Included in this list of silver stocks are some companies that produce the most silver in the world. All of these stocks are tradable on our Next Generation trading platform via spread bets or CFDs, so open an account to get started. Please note that statistics included in this section are taken from annual company financial reports and are up to date as of July 2021.

Fresnillo [FRES]

This stock is listed on exchanges in London, Mexico, France and the US on the over-the-counter (OTC) market. It was the world’s largest silver producer in 2020 and is said to be Mexico’s largest producer of gold. In 2020, it produced 53.1m ounces (moz) of silver and 796.6k ounces (koz) of gold. As a by-product, the company also produces lead and zinc. The company has been in operation since 1887.

KGHM Polska Miedź [KGH]

This company is listed on exchanges in France and the US OTC market. The Polish company is one of the largest silver producers in the world, as well as being a major copper producer. The company also sells mining and construction equipment. It was formed in 1961.

Newmont Corporation [NEM]

Newmont is listed on the New York and Toronto stock exchanges. It produced 27.8 moz of silver in 2020, and more than five moz of gold. It also produces and sells zinc, lead, copper and other forms of bullion. The company has operated since 1916.

Vedanta Limited [VEDL]

This stock is listed in multiple exchanges around the world, including the New York Stock Exchange. Silver production totalled 23.7 moz in 2020. In addition to iron, copper, silver, gold, zinc and other metals, the company also produces power via thermal coal mines. The company has operated since 1965.

Southern Copper Corporation [SCCO]

This stock is listed on multiple global exchanges, including the New York Stock Exchange. It produced 21.5 moz of silver in 2020. It also produces zinc, copper, gold, and lead. The company was founded in 1952.

Polymetal International [POLY]

Polymetal is listed on the London Stock Exchange and the US OTC market. Silver production totalled 18.8 moz in 2020. It also produces gold, zinc, copper, as well platinum. It was founded in 1998.

Pan American Silver Corp [PAAS]

This company is listed on the New York and Toronto stock exchanges. Producing 17.3 moz of silver in 2020 puts it inside the top 10 largest silver producers. It also produces zinc, copper, lead and gold. The company was founded in 1979.

Hecla Mining [HL]

This stock is listed on the New York Stock Exchange. The company was founded in 1891 and produced 13.5 moz silver in 2020. It also deals in lead and zinc.

Wheaton Precious Metals Corp [WPM]

Wheaton is listed on the New York and Toronto stock exchanges. The company sells precious metals such as gold and silver for others in what is known as “streaming”. It was founded in 2004 and had more than $1bn in revenue in 2020.

First Majestic Silver [FR]

This company is listed in the US and Canada, and is one of Canada’s largest silver producers. It produced more than 20 moz of silver in 2020. It also mines gold.

Trade on silver stocks and ETFs

Silver ETFs to watch

There are two primary ways to utilise ETFs (exchange-traded funds) to gain exposure to the silver market:

- Trade ETFs that hold physical silver. These ETFs typically move in lockstep with the price of silver as each tracks the buying and holding of silver. The value of the ETF depends solely on the price of silver.

- Trade ETFs that hold silver mining companies. The value of these ETFs is determined by the price moves of the stocks they own. Since the stocks of silver mining companies historically tend to make much bigger price moves than the price of silver itself, trading a silver mining ETF can sometimes result in much bigger profits and losses than trading physical silver or a silver ETF.

iShares Silver Trust [SLV]

This physical silver ETF had circa 576m ounces in trust as of June 2021. It holds silver and nothing else. Most other silver ETFs are small in comparison to this one. It is one of the most heavily traded silver ETFs in the world.

Global X Silver Miners ETF (SIL)

This silver mining ETF has approximately $1.4bn in net assets and will often hold around 40 silver mining stocks in its portfolio. Traders can trade the ETF, but also use it to gauge the strength of the silver exploration and production industry. If the ETF is falling, this indicates most silver mining companies’ stocks will be in decline, and vice versa if the ETF is rising.

Learn more about trading ETFs.

How can I short silver stocks?

Silver stocks, like most stocks, can be shorted. Short selling means that you may profit if the stock price drops by selling first at what is hopefully a high price, and buying the shares back at a lower price. Here’s how to short stocks.

To short a silver stock or even physical silver using spread bets or CFDs, open our Next Generation trading platform and search for the name of the stock you want to short. You will see a bid and ask price. Click on the price to bring up an order window. Select the ‘Sell’ price if it isn’t already selected. Input how much you wish to sell at. Place a stop-loss and profit target if desired, which are often used by traders to control risk. The order ticket shows how much the trade will cost to make as well as the profit and loss potential (if you inputted a stop-loss and profit target).

FAQ

Silver stocks vs physical silver: which should I trade?

Both options are viable. Stocks and ETFs are easy to buy and sell, and trades can be kept for minutes or years. Buying and selling physical silver is more difficult because you need to physically meet and buy or sell the silver with someone else. This is more typical for long-term investors who buy, hold and store physical metals. See our silver price chart for more details.

Which companies produce the most silver?

Some of the top silver stocks mentioned earlier produce the most silver in the world combined, including Newmont, Fresnillo and Pan American Silver Corp. While these are major players, smaller companies could strike it big on a new mine and become major players themselves. Learn how to trade on company stocks.

What other precious metals companies are there?

There are numerous gold producers to choose from on the market. Some leading companies of gold production include Barrick Gold, AngloGold Ashanti, and Kinross Gold. Read our article on the top gold stocks and ETFs to watch right now.

Can silver stocks help hedge against inflation?

Sometimes precious metals, including silver, act as a hedge to inflation, and other times they don’t. There have been examples on both sides of this debate throughout history. In theory, silver could act as a hedge against inflation, but because its price is driven by human demand and speculation, it doesn’t always work out that way. Inflation is not the only input into the price of silver and silver stocks. As discussed, silver production amounts and expectations, as well as supply and demand of silver and silver stocks, also play a major role.

Trade silver stocks on the go

Seamlessly open and close trades, track your progress and set up alerts

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.