Gold stocks to watch

Gold stocks can be an effective way of gaining exposure to the precious metal. Traders that don’t want to invest in physical gold directly can choose to trade on the price movements of stocks that are involved in the mining, extraction and production of gold bullion or coins. In this article, we will discuss how to trade on gold stocks using derivative products, and we run through some of the top gold stocks to watch in 2022.

An overview of gold in the stock market

The gold market offers a number of investment opportunities, such as spot gold, futures contracts, shares, exchange-traded funds and even gold-based indices. However, an effective way for gold traders to gain exposure to the underlying asset without physically owning bullion is through gold companies, which come in two separate forms:

- Companies that are involved in the mining and production of the precious metal.

- Gold streaming and royalty companies. This is when businesses pay a fee to a gold miner in exchange for a fraction of the mine’s revenue.

Both types of stock can provide profits when the gold market is strong, although some may be more successful than others.

Some may choose to trade on gold stocks in order to avoid certain risks and costs that come with investing in physical gold. These include commissions (due to a less liquid market), insurance and transportation costs, and finding somewhere to store the commodity. When you spread bet or trade CFDs on gold shares, you are only speculating on the price movements of the asset, rather than taking ownership. This means that you can trade both sides of the market, depending on which direction you think the gold stock will move in.

How do gold stocks perform during a recession?

As gold has a negative correlation with the stock market, when stock prices fall during a recession, the price of gold tends to increase in value. In turn, this magnifies the value of gold stocks, even in spite of a stock market crash. As gold is often seen as a safe haven asset that investors turn to in times of financial crisis, gold stocks often work in the same way within the stock market.

Remember that this isn’t always the case, as gold stocks that are already in a bull market tend to outperform those that are displaying a more bearish outlook. Therefore, trading on gold stocks is still a risky process during a recession. If the price of gold were to drop suddenly, then this could most likely be reflected in the share market.

How to trade gold through the stock market

- Open an account. With a live spread betting or CFD trading account, you can speculate on the price movements of 9,000+ shares, including those mentioned below.

- Research the share market. Whereas gold prices are often relatively stable, stocks can be volatile at times and this may have an effect on your positions. Learn how to analyse company fundamentals such as earnings reports and P/E ratios.

- Decide whether you want to buy (go long) or sell (go short). Your trading strategy depends on whether you think the price of the instrument will rise or fall.

- Consider risk-management controls. Traders may utilise stop-loss orders to minimise the chance of capital loss when the market heads in an unfavourable direction.

- Keep up to date with economic news and announcements. The price of gold could jump or fall at any point due to external economic factors, so keep an eye on our Gold price chart for any upcoming changes.

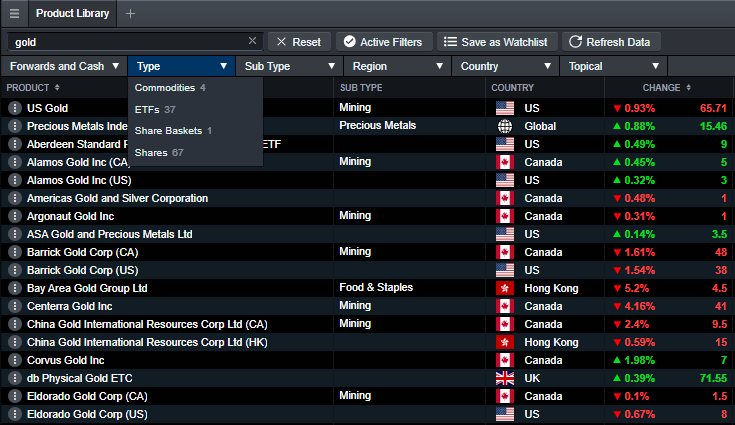

You can filter gold stocks and ETFs by simply searching for ‘gold’ in our Product Library

Gold mining stocks to watch

Barrick Gold (ABX)

Barrick Gold, a Canadian company that has headquarters in Toronto, is one of the largest gold mining companies in the world, previously sitting at the top spot before 2018. It is estimated to produce approximately 141 tonnes of gold each year. The company has 16 operating sites across 13 countries, including Argentina, Côte d'Ivoire, Saudi Arabia, Tanzania and the US. Barrick Gold has a number of subsidiary companies, such as Acacia Mining and Nevada Gold Mines, which is a joint venture between Barrick and Newmont Corporation. It is listed on both the Toronto Stock Exchange and New York Stock Exchange.

Franco-Nevada (FNV)

Franco-Nevada is also based in Toronto, Canada, and is a leader in precious metals streaming and royalty. The company holds a diverse portfolio of gold, silver and other precious metals, as well as oil and gas, although around 80% of its revenue comes from gold-equivalent ounces. Unlike the other companies on this list, Franco-Nevada does not carry out exploration, develop its own projects, or operate mines, instead investing in others located across the US, Canada and Australia. The company pays a healthy dividend and has reported debt-free balance sheets in 2021, which is uncommon for the gold mining industry. Franco-Nevada is listed on the TSX.

Newmont Corporation (NEM)

This Colorado-based company currently ranks first in the world as a gold producer and supplier. In 2019, Newmont Mining acquired Canadian company Goldcorp, which was one of the world’s largest producers of gold at the time, merging the two companies together to become a leader. It has mining operations across five continents, amounting to approximately 180 tonnes each year. In 2020, Newmont produced over 5.9m attributable ounces of gold and over 1m more from the sale of by-products. Its mines are located in Nevada, Colorado, Mexico, Canada, Ghana, Peru and Suriname, to name a few. Newmont Corporation is listed on the NYSE and is also one of our silver stocks to watch.

Eldorado Gold (ELD)

Eldorado Gold is a Canadian gold mining company that engages in the mining, development and exploration of gold and other base metals. It operates in countries such as Brazil, Canada, Greece, Romania and Turkey. Out of its total of five mines, operations in Turkey provide the majority of annual revenue for the company. Eldorado aims to produce around 430,000-460,000 ounces of gold each year, having jumped 34% in production in 2020 to 528,874 ounces. Eldorado is listed on the TSX and NYSE.

Petropavlovsk (POG)

One of Russia’s major gold mining companies, Petropavlovsk is headquartered in London and operates across Russia’s Far East. The company has advancements in gold production, reserves and resources, with the aim of offering a responsible and low-cost output of gold. Its principal assets include four hard-rock gold mines in the Amur region, which have collectively produced over 7.8m ounces of gold. In 2020, Petropavlovsk increased gold production by 6%, when compared with the previous year. It also engages in silver production. The company is listed on the London Stock Exchange and is a constituent of the FTSE 250 stock index.

Newcrest Mining (NCM)

Newcrest Mining is an Australian company that reportedly has the largest group gold ore reserves in the world. The mining company focuses on the exploration, development and sale of gold and gold-copper concentrate across a number of countries, including Australia, Canada, Indonesia and Papua New Guinea. In 2010, Newcrest merged with Lihir Gold to become the world’s fifth-largest gold producer, with a combined production of 2.8m ounces. Newcrest’s cash and operating costs are consistently kept below the industry average, leaving more room for the company to profit. It is listed on the Australian Securities Exchange.

Kinross Gold (K)

Toronto-based Kinross Gold operates eight active gold mines across the Americas, West Africa and Russia. The company produced around 2.4m gold-equivalent ounces in 2020 and holds over 30m ounces of gold reserves in total, as well as 59m ounces of silver. Historically, the company has used acquisitions to drive expansion and growth in more regions, with a number of subsidiaries such as Red Back Mining, Fairbanks Gold Mining and EastWest Gold Corporation. Kinross’ gold production is expected to grow by 20% before 2023, and annual revenue also increased by 20% between 2019 and 2020. Kinross is listed on the NYSE.

Centamin PLC (CEY)

Centamin is a multinational mineral exploration, development and mining company with headquarters in Jersey. It focuses on the Arabian-Nubian Shield in particular, which is an exposure of crystalline rocks on each side of the Red Sea. Centamin operates mines in Egypt, Jordan, Israel, Saudi Arabia and Somalia, its most famous being the Sukari Gold Mine. It also owns exploration and development assets in Burkina Faso and Côte d'Ivoire. The company has a number of subsidiaries within the surrounding regions. Centamin’s revenue increased by 27% in 2020 when compared to the previous year. It is listed on the LSE.

Sibanye-Stillwater (SSW)

Sibanye-Stillwater is a multinational precious metals company that operates in South Africa and the US. It is the world’s third-largest producer of gold, as well as the largest producer of platinum and second-largest producer of palladium. The company owns and operates five underground and surface gold operations in South Africa, where gold doré is produced. It is then refined and sold on international markets by global gold refiner, Rand Refinery, in which Sibanye holds a 44% interest. The company is listed on the Johannesburg Stock Exchange and the NYSE.

Spread bet or trade CFDs on gold stocks

What affects the price of gold stocks?

- Supply and demand of gold. Gold is often seen as a safe haven asset that is sought after by investors all over the world. Supply and demand push up the price of gold and gold stocks, making them more valuable.

- Cost of gold production. As gold becomes more expensive to mine (as the most accessible gold deposits have already been reached), this subsequently impacts gold stocks’ profit margins.

- Interest rates and inflation. Both the gold and stock markets tend to decrease in value when interest rates set by central banks are increased, while increasing inflation expectations can have a positive impact on the price of gold if interest rates remain stable.

- Company fundamentals. It is important to analyse the financial performance of gold companies, as one may have higher extraction and cash costs than the other. Other factors that can affect investor sentiment are dividend yields, balance sheets, and the economic health of the country in which the company operates.

Diversify your portfolio with our US Gold share basket

Another way to gain exposure to the gold market is through our new US Gold share basket. This product allows you to speculate on the price movements of 15 US-based shares by opening one single position, some of which are among the largest gold mining companies in the world. Our share baskets also come with zero commission fees and lower holding costs, which gives you an edge over trading on individual gold stocks. Top holdings include Franco-Nevada, Barrick Gold, Newmont, Kinross and Eldorado.

Read about constituent weightings, margin rates and further trading details on the dedicated page for our US Gold share basket.

Trade gold stocks on the go

Seamlessly open and close trades, track your progress and set up alerts

Are gold stocks a good investment?

In theory, gold stocks should offer a high return potential when the gold market is performing well. This is because when the price of gold is high, it is usually mirrored in the value of the share. If a company is displaying strong financials, such as a stable cash flow, balance sheets and growth potential, this should eventually be reflected in its share price. For this reason, some investors may assume that trading on gold streaming or royalty stocks may provide better returns on average, in comparison with mining stocks, as they hold physical gold from the commodities market.

However, this is not always the case, and any trader that is looking to spread bet or trade CFDs on gold stocks should conduct thorough research beforehand on the risks of leverage in stock trading. Read our risk-management guide for further details on how to monitor profit and loss.

FAQ

Which countries produce the most gold?

The countries that produce the most gold are China, Russia, the US, Canada and Australia. However, the majority of large-cap gold mining and streaming companies are Canadian, such as Barrick Gold, Franco-Nevada and Kinross, contributing to its status as one of the world’s largest economies.

Is it better to buy physical gold or gold stocks?

There are benefits and risks for both when it comes to investing in physical gold and gold stocks. When you buy physical gold at spot price, you will pay for transportation and storage, as well as extra commissions. You do not need to store gold stocks, but it may be an expensive purchase at the upfront value without the use of leverage. Read our article on ‘is gold a good investment?’.

Which gold stocks pay dividends?

Currently, a number of gold stocks are paying healthy dividends to their shareholders, including Franco-Nevada, Newmont Corporation and Kirkland Lake Gold. Learn more about high-yielding dividend stocks.

What is the forecast for gold stocks?

The price of gold has been steadily increasing within recent years, as investors often use it as a safe haven asset in times of economic crisis. Therefore, we could assume that gold stocks will also increase in value; however, this depends on a wide range of economic indicators and external factors, which may have an adverse effect on share prices.

Can I trade on the price of gold?

As well as trading within the stock market, you can also spread bet and trade CFDs on the price movements of physical gold. Read our extensive guide on gold trading for more information on possible methods.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.