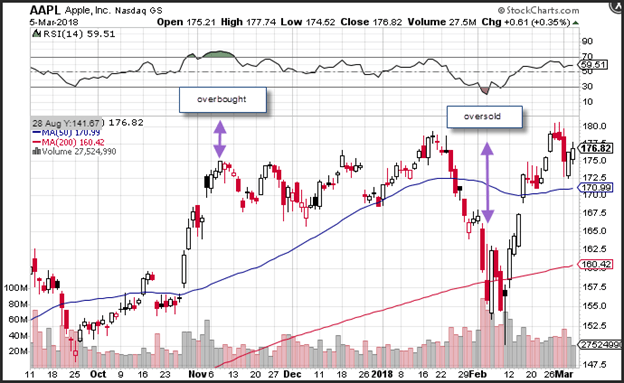

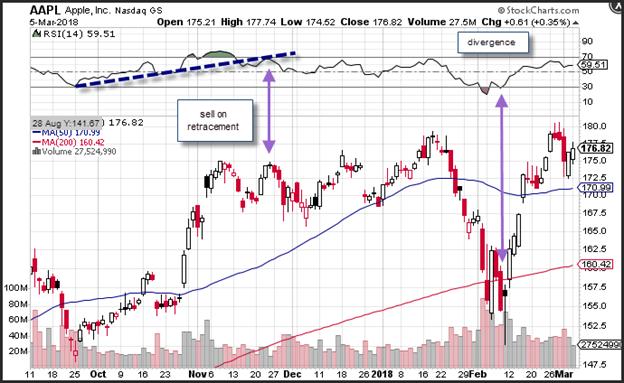

The RSI indicator generates a measurement between zero and 100. According to Wilder, the RSI is overbought when the index has a reading above 70, and it is oversold when it has a reading below 30. In addition to overbought and oversold levels, the RSI can also introduce signals by looking for divergence, failure swings and centreline crossovers.

The RSI can also be used to identify trends. Very overbought and very oversold periods are defined at 80 and 20 respectively. The rate of change of price action can indicate if momentum is accelerating or decelerating. This is important as it can help traders determine the current trading environment and define which strategy to adopt. For example, many traders buy on a dip when negative momentum is decelerating and sell on a rally when positive momentum is decelerating.

Alternatively, you may want to buy on a breakout when positive momentum is accelerating, and sell on a breakdown when negative momentum is accelerating. The RSI will provide enough information to determine if the price of an asset is experiencing negative or positive momentum and whether that momentum is accelerating or decelerating.