Fund manager VanEck recently published a report outlining the resurgence of nuclear energy and the factors behind it. The increasing demand for nuclear power is putting upward pressure on uranium prices. Innovative players are leveraging government incentives to boost capacity, while a recent breakthrough could see uranium washing up on the beach.

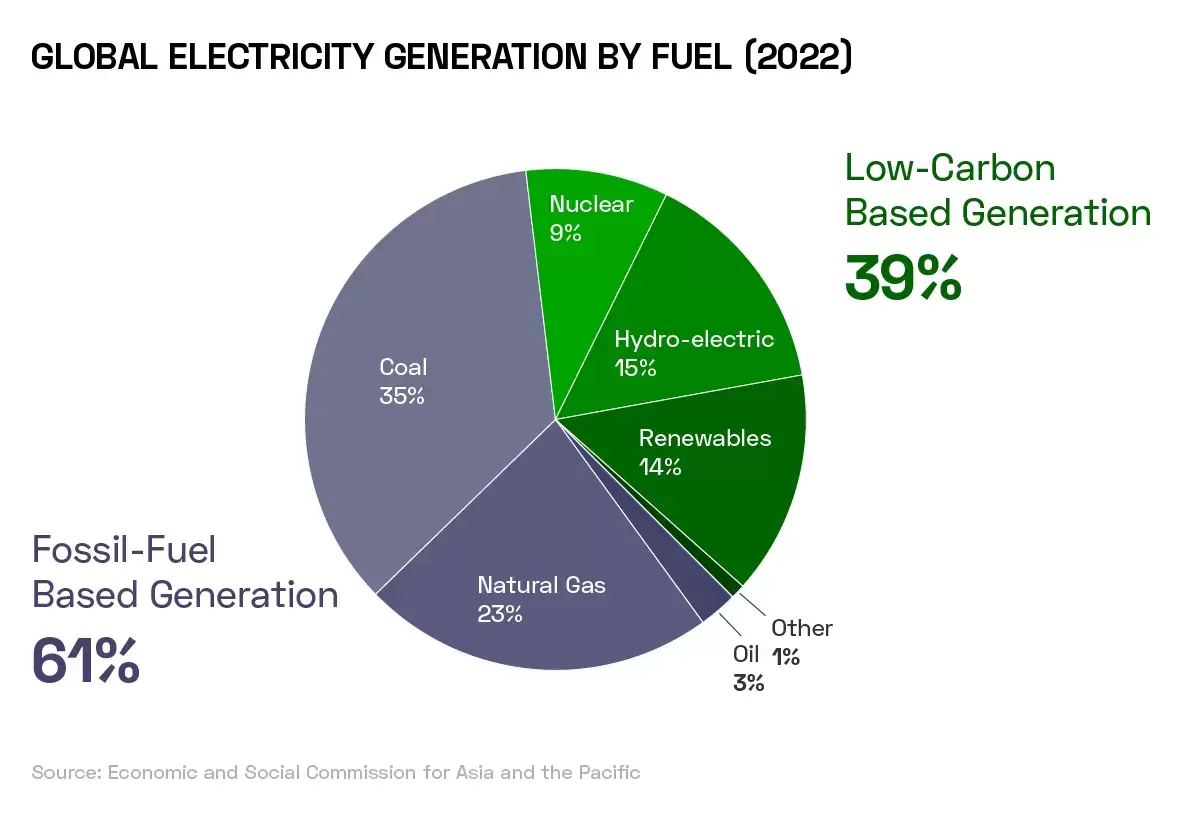

- Nuclear energy accounted for 9% of global electricity generation in 2022.

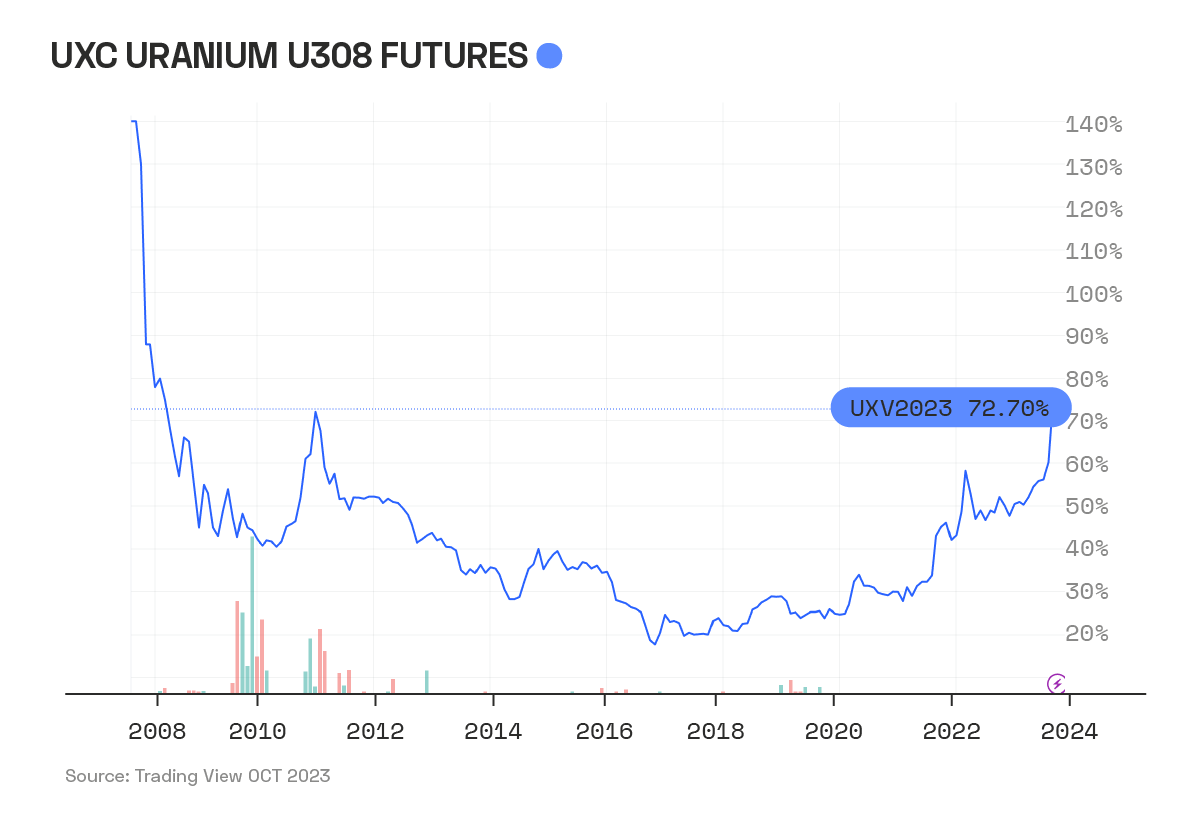

- Uranium futures have hit their highest level since the 2011 Fukushima disaster.

- Constellation Energy is leveraging $1bn US government incentive to boost domestic supply.

VanEck published a report on 13 October entitled ‘A Resurgence of Nuclear Energy?’ Citing data from the International Energy Agency (IEA), VanEck notes that 9% of the world’s electricity was generated via nuclear power in 2022. Over the last 50 years, nuclear power has displaced 60 gigatonnes of CO2 emissions, equivalent to two years’ worth of global energy-related emissions.

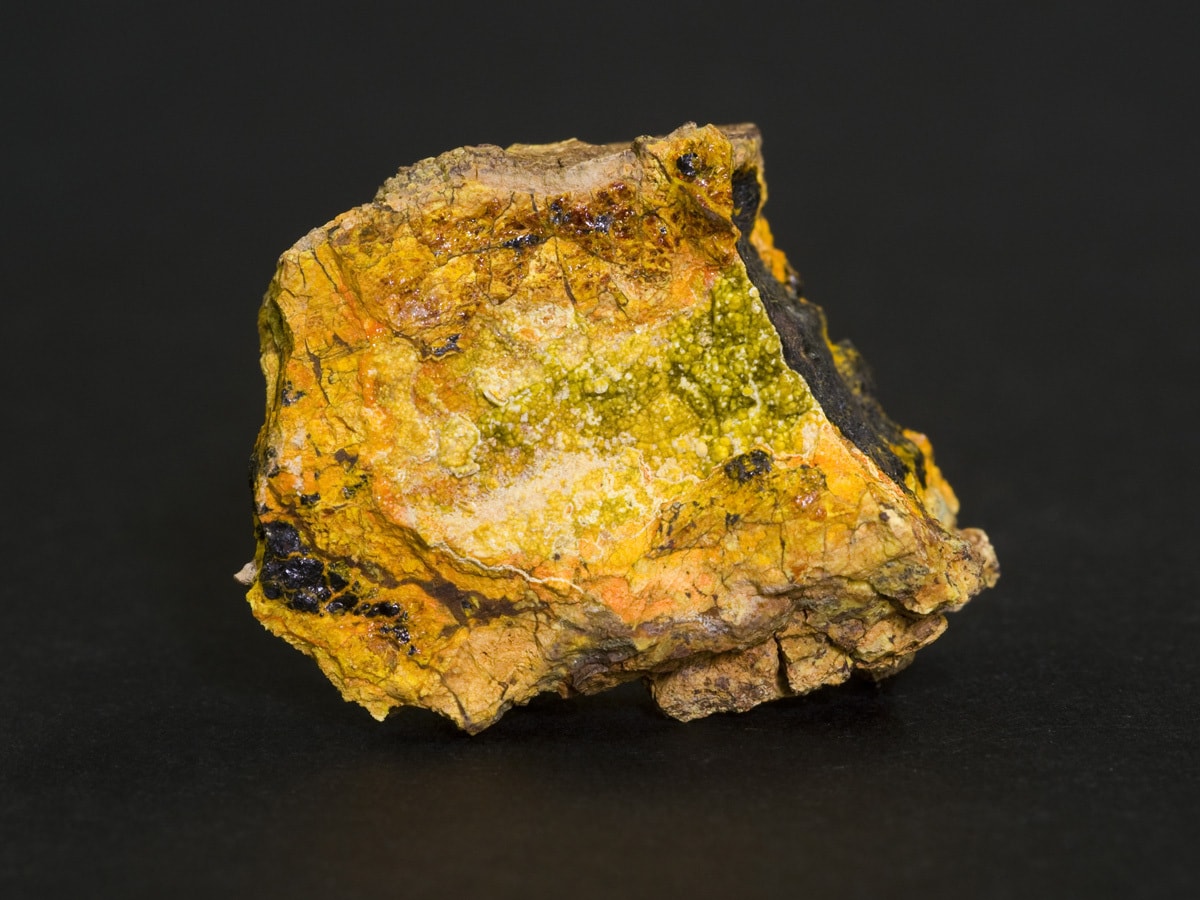

Uranium has been experiencing considerable price volatility. According to VanEck, this is thanks to factors including long lead times for mining projects, supply shortages, geopolitical tensions (especially in Europe) and reduced capital spend on exploration for new sources. While exploration budgets bottomed in 2020, data from S&P Global Market Intelligence suggests that these likely recovered to their highest level since 2017 in 2022.

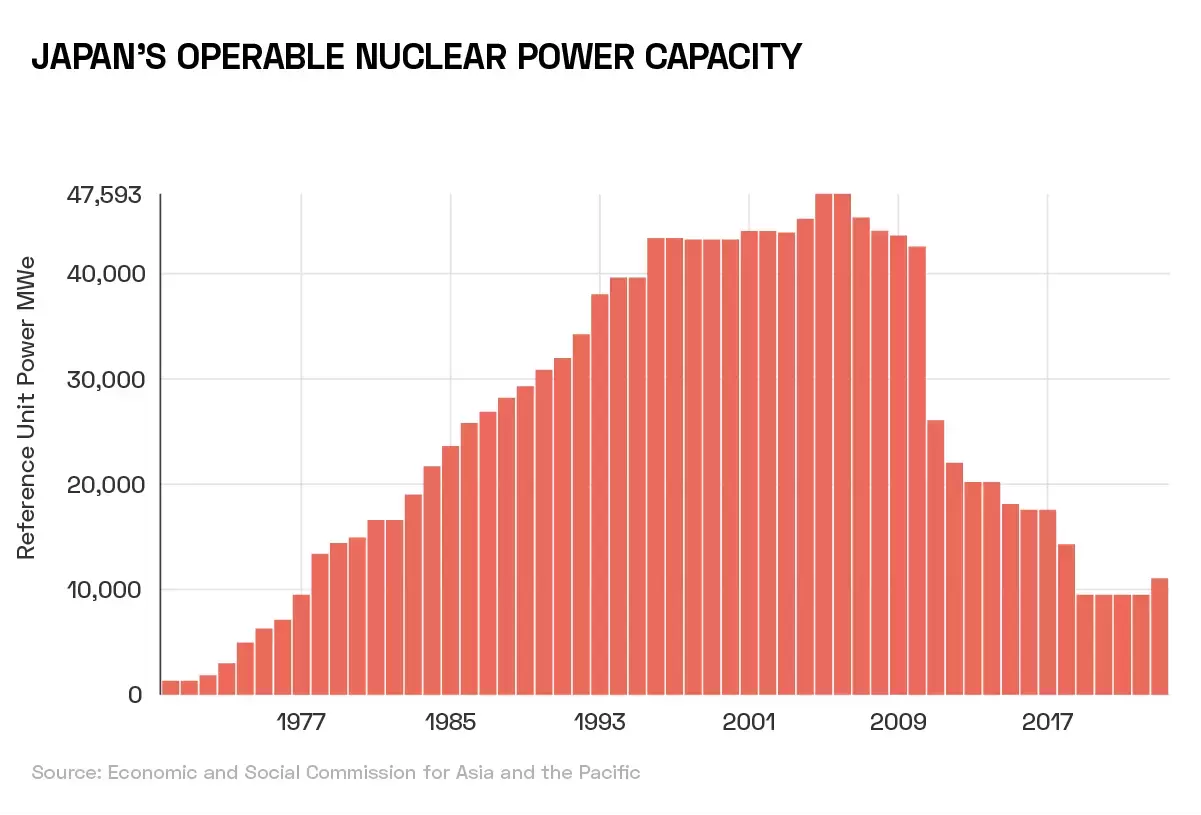

Nations such as Japan are, according to VanEck, a blueprint for the global picture as far as nuclear energy is concerned. Following the Fukushima disaster, the country scaled back its reliance on nuclear power However, it is currently rebuilding it. Data from the World Nuclear Association shows that Japan’s nuclear capacity fell off sharply in 2011, the year of the disaster, and fell (or flatlined) every subsequent year until 2023, when it ticked up from 9,486MWe to 11,046MWe.

VanEck’s report points out that Germany, Belgium and India are also reassessing their nuclear strategies. According to analysts in a September report by Reuters, the resurgent popularity of nuclear energy is a result of Russia’s invasion of Ukraine in 2022, and the consequent push for energy security on the part of global governments.

This newfound popularity is a boon for uranium miners who, according to VanEck, “are poised to gain, attracting increased investor interest”.

Nuclear Supply Reacts to Demand

According to the IEA, “8GW of new nuclear capacity was brought online in 2022,” but reaching global net-zero goals will require more than four times this level per year by 2030. The agency says that the further innovations, such as small modular reactors (SMRs) among others, will be key to delivering these targets.

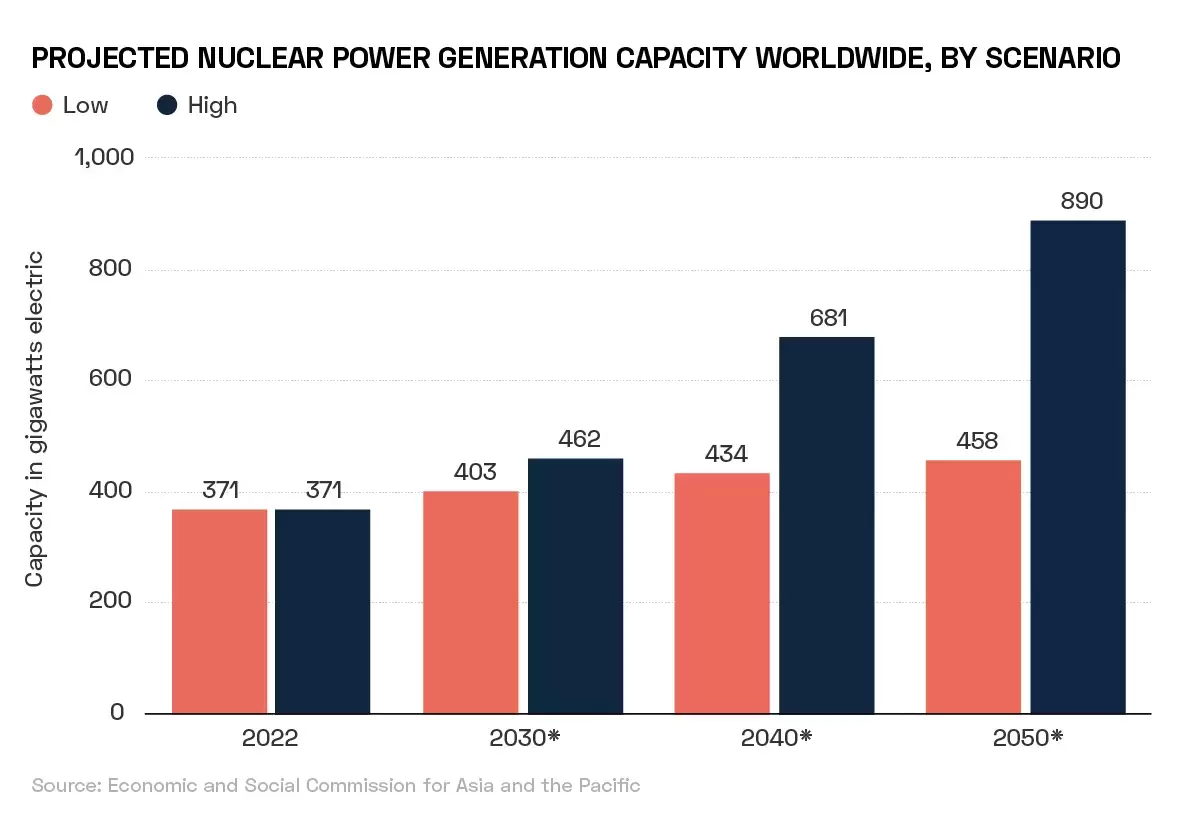

Data from Statista reinforces the view that the world is set to experience two decades of increasing nuclear power capacity. While Statista’s ‘low’ scenario envisages just 87GW being installed between 2022 and 2050 (an increase of 23.5%), Statista’s ‘high’ scenario envisages global capacity increasing by nearly 140% to 890GW over the same period.

Uranium prices have risen sharply in light of the increasing global demand for nuclear energy. This surge has taken uranium futures prices to their highest level since Fukushima.

According to John Meyer, Mining Analyst at SP Angel, the price increases could continue well into the future. In September, Meyer told Reuters that he expects uranium prices to continue rising “year-on-year for [the] next 10–20 years or till the world finds another source for large scale un-interruptible base load power with a low carbon footprint".

Industrial Scale

Not being dependent on sunshine or wind, nuclear is a more reliable source of energy than most renewable sources. Another advantage is that it can potentially help to power hard-to-abate sectors of the economy.

The production of hydrogen — a key fuel source for the energy transition — is part of this. Hydrogen has, until recently, been primarily produced using fossil fuels. However, Constellation Energy [CEG] is set to leverage a $1bn award from the US Department of Energy to produce 33,450 tonnes of clean hydrogen annually at its nuclear plant in Marseilles, Illinois.

In a similar vein, steel producer Nucor [NUE] is collaborating with private nuclear power company Helion to develop a 500MW fusion power plant, which will power its steelmaking facility with zero-carbon electricity. According to a September press release, the collaboration is “the first fusion energy agreement of this scale in the world and will pave the way for decarbonising the entire industrial sector”.

The Next Wave of Uranium Innovation

Doomberg a popular financial Substack run by former scientists with a keen eye on energy markets, said on an episode of Opto Sessions earlier this month that they are “most excited about nuclear energy in general”. This is, in large part, thanks to the range of innovations that are taking the sector forward. Doomberg cited the increased safety of nuclear reactors on this front.

Innovative technology could also solve the issues facing uranium supply over time. The ocean holds approximately 4.5 billion tonnes of uranium, and a team of researchers in Australia published research in June claiming that materials known as layered double hydroxide (LDH) could be used to absorb this uranium directly from seawater. There are several hurdles that would need clearing before the technology could be deployed at scale, but it offers a glimpse of what the next wave of uranium production could look like.

How to Invest in Uranium

Major uranium players include the likes of Constellation Energy. Constellation’s share price has gained 33.9% year-to-date.

Cameco [CCJ] is the world’s largest uranium producer by market cap, as of 25 October. Its shares are up 69% year-to-date. Uranium Energy [UEC], another leading player, is up 48.7% over the same period.

All three stocks are held by the VanEck Uranium+Nuclear Energy ETF [NLR] as of 24 October. The fund is up 26.6% year-to-date.

Indirect exposure can be gained by investing in innovative users of nuclear energy, such as Nucor. Nucor’s shares are up 12.8% year-to-date.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy