A group of stocks known as the ‘magnificent seven’ accounted for approximately 73% of all stock market gains in 2023. These mega-cap technology stocks offered superior earnings growth and profit margins to the broader market. However, Wall Street observers have tipped them for a pullback early in 2024.

- Magnificent seven stocks accounted for approximately 73% of all stock market gains in 2023.

- Some Wall Street analysts believe that the stocks may now be overvalued.

- Tesla posts its worst start to a year since going public, but Nvidia is still going strong.

As of 5 December 2023, the ‘Magnificent Seven’ stocks — Alphabet [GOOGL], Amazon [AMZN], Apple [AAPL], Meta [META], Microsoft [MSFT], Nvidia [NVDA] and Tesla [TSLA] — accounted for approximately 73% of all stock market gains last year.

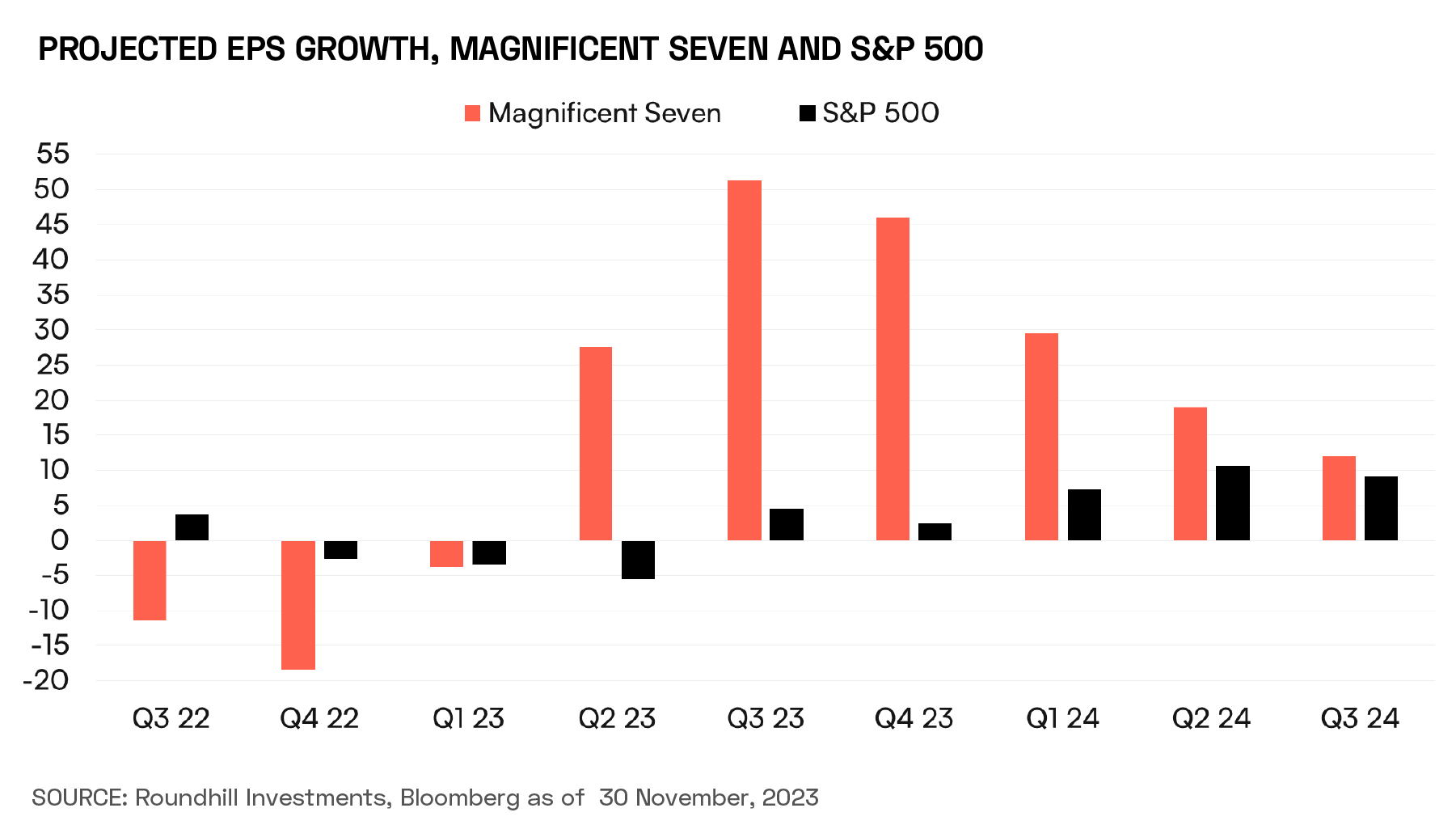

Dave Mazza, Chief Strategy Officer at Roundhill Investments, detailed the underlying factors behind this group’s “magnificence”. Firstly, all seven stocks experienced significant earnings growth. While their detractors highlighted the elevated P/E multiples at which the stocks traded last year, Mazza observed their P/E-to-growth ratio (PEG, a stock’s P/E ratio divided by the growth rate of its EPS) actually fell significantly during the year, even as their share prices rose, off the back of stronger-than-expected forward earnings growth.

Anticipated EPS growth for the magnificent seven was also superior to that of the S&P 500, even without excluding these high-growth stocks from the index. This divergence is expected to fall during 2024, but will persist into Q3 according to projections from Bloomberg.

The magnificent seven also boasted higher average operating margins compared to the S&P 500: 19.9%% as opposed to 13.6%. These margins have grown across a variety of market conditions in recent years, including the pandemic, implying strong resilience.

In a December report, Alliance Bernstein highlighted the distorting impact of this outperformance on indices and portfolios: “Actively managed portfolios that didn’t own some of these stocks were saddled with big underweight positions, making it almost impossible to beat the benchmark — especially since the rest of the market underperformed.”

Their overweighting has also skewed indices in favour of growth stocks, and, according to the investment firm, this overconcentration poses risks to investors. “Passive investors enjoyed the Mag 7 rally but are also exposed to a potential turn in sentiment because of a lack of diversification in the index and the increasingly correlated trading patterns of these names,” it wrote.

Could the Tide Turn on the Magnificent Seven?

Nevertheless, the risks of a pullback should not be underestimated.

Writing for Seeking Alpha, Raheel Siddiqui, Global Macro Strategist at Neuberger Berman, believes that “the tide could turn in 2024” following the overperformance of these stocks the previous year. Siddiqui observes that the group’s valuations are “precarious”, being 40% more expensive than the rest of the S&P 500, “even after adjusting for their higher returns on equity”.

Their current valuations price in projected earnings growth of 33% through 2025, make them vulnerable to even “minor hiccups”, according to Siddiqui.

Siddiqui also believes that the group is more cyclical and volatile than it appears, with a price beta of 1.4 — 50% higher than the rest of the S&P 500 over the last three years. Finally, Siddiqui argues that the group’s price movements are “highly correlated”, and that “owning them as a group could invite additional risk rather than diversification”.

Early in January, Bank of America’s equity team flagged that the Wall Street consensus was these stocks would see a rout through the remainder of the month. “Crowding risk in the leaders of 2023 has been cited by many (including ourselves) as a key risk in 2024,” Managing Director Savita Subramanian wrote in a note seen by Seeking Alpha.

Halfway through the month, this prediction has yet to bear out, although there has been notable divergence between the seven stocks.

At the top end of January performance, Nvidia gained 13.9% in the year to 17 January. At the low end, Tesla shares fell 11.5%. Apple has dropped 4.6% and Meta has gained 3.8%. The Roundhill Magnificent Seven ETF [MAGS], which holds the seven stocks exclusively, has gained 1% year-to-date.

Tesla and Nvidia: Contrasting Fortunes

Tesla is in the middle of its worst January since listing, according to Bloomberg, with slowing growth and shrinking profit margins wiping $94bn off its market value.

Against this backdrop, the company’s visionary but divisive CEO Elon Musk is complicating matters by insisting on having 25% voting control over Tesla if he is to develop artificial intelligence (AI) products there, rather than at another company.

By contrast, Nvidia’s shares have picked up in 2024 where they left off in 2023, with double digit gains adding $128bn to the company’s market cap, according to Markets Insider. It is now the fifth most-valuable company in the US, behind only Microsoft, Apple, Alphabet and Amazon.

Read the stories of Tesla and Nvidia’s leaders — Elon Musk and Jensen Huang — in OPTO’s Visionaries series.

2024 Outlook

In short, the outlook for the magnificent seven is mixed, and will depend to a certain extent on how the macroeconomic situation unfolds this year. As the contrasting starts of Tesla and Nvidia show, the seven are not necessarily as tightly correlated as they have been in the past.

“The magnificent seven stocks do not have the same attractive valuations they did a year ago, as investors bid up their share prices,” Mazza told OPTO. “However, these stocks offer considerably greater forecasted earnings growth than the broader market.”

While rates remain elevated, and recessionary fears linger, Mazza believes that the magnificent seven will continue to outperform — until, that is, “we see a material change in the economic environment that would see the global central banks embarking on a rate-cutting cycle”.

How to Invest in the Magnificent Seven

One approach to investing in the magnificent seven is to buy the individual stocks. In the 12 months to 17 January, the stocks posted the following gains: Nvidia gained 218.7%, Meta gained 171.5%, Tesla gained 67.2%, Microsoft gained 63.8%, Amazon gained 59.5%, Alphabet gained 56.1%, and Apple gained 35.8%.

Roundhill’s MAGS ETF offers highly focused exposure to all seven stocks. In a blogpost entitled ‘How to (and How Not to) Gain Exposure to the Magnificent Seven’, Mazza explains the advantages of the MAGS ETF to investors who are seeking exposure to the group.

Compared to tech-focused indices such as the Nasdaq-100 or the NYSE FANG+ index, MAGS offers comprehensive and undiluted exposure to the magnificent seven.

Furthermore, because the fund is rebalanced to equal weight on a quarterly basis, holding this ETF automatically balances the relative distributions of the seven stocks themselves for investors, “forcing one to sell high and buy low”.

Since its inception in April 2023, MAGS has gained 36.5%.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy