After the November 2022 launch of ChatGPT, generative AI has taken the world by storm, particularly in the fields of investing and technology. Many observers expect 2024 to see a marked shift towards implementation. The use cases are far-reaching, but sales could be one of the first functions to be overhauled.

- Goldman Sachs anticipates a robust “hybrid AI ecosystem” in 2024.

- EY: 65% of tech CEOs fear falling behind on AI.

- Salesforce and UiPath unveil new generative AI products.

Artificial intelligence (AI) broke onto the world stage in late 2022 and shaped conversations throughout 2023; 2024 looks set to be the year in which businesses begin to truly harness its potential.

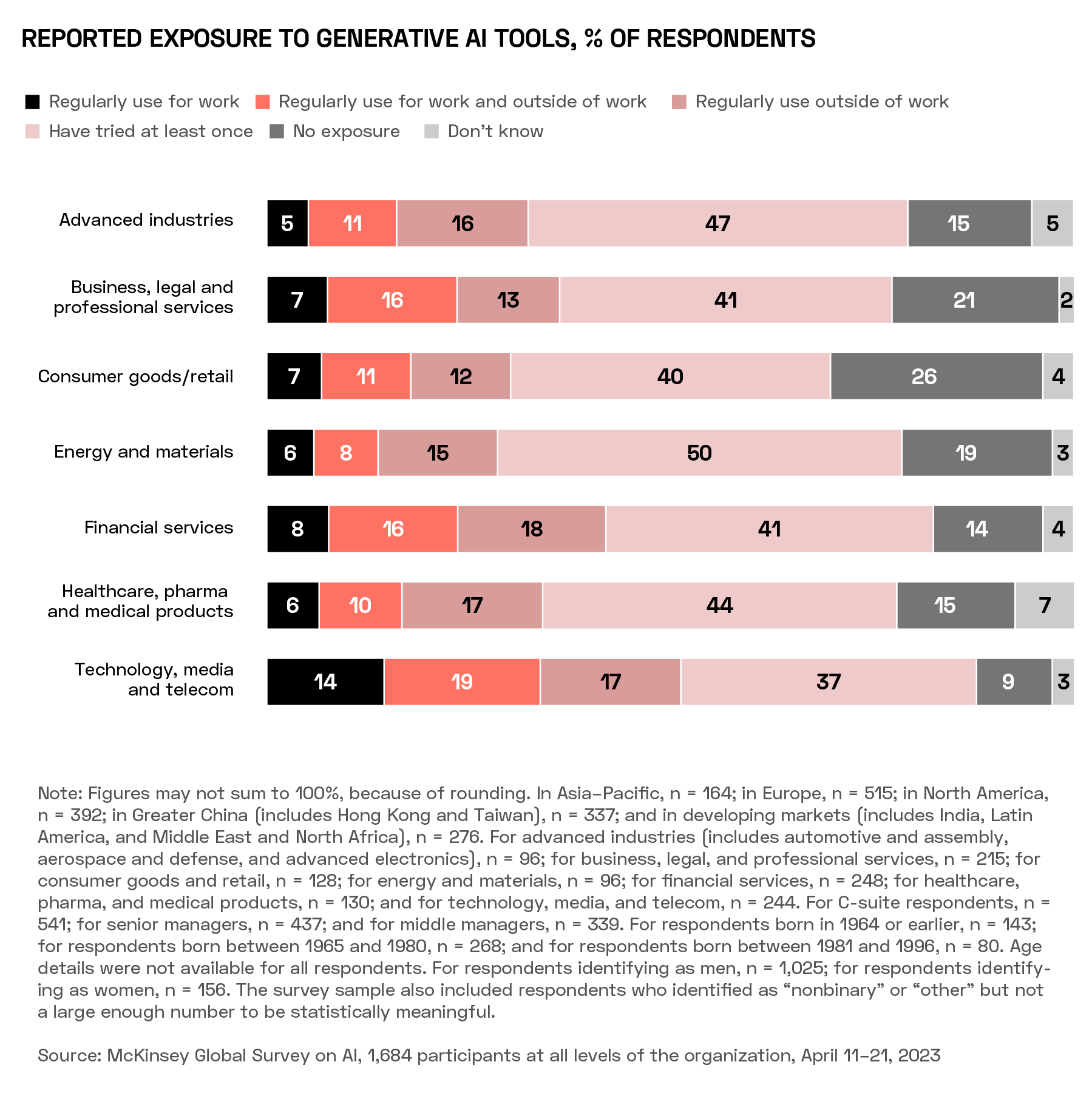

An April 2023 McKinsey survey suggested that a third of workers within technology organisations were already using generative AI regularly at work, with a further 17% using it outside of their work.

Marco Argenti, Chief Information Officer at Goldman Sachs, has said that AI technology is progressing at such a pace that a “hybrid AI ecosystem” enabling businesses to exploit its opportunities is already coming into existence.

In an interview for the Goldman Sachs Intelligence blog last month, Argenti shared his vision of a widespread hybrid AI model whereby businesses use larger, generalist third-party large language models (LLMs) as a “brain” that interprets prompts for smaller, private models that are more industry-specialised, and trained on proprietary data.

Given the pace of AI’s development over the past year, Argenti expects 2024 to be a year of adoption in which companies will be focused on the returns they can expect from investment in the technology. This will pose questions around issues such as how to ensure safety and accuracy while scaling use cases and could lead to the emergence of concepts including AI digital rights management.

Argenti believes that capital flows into AI will “follow the evolution of the corporate spending” in that it will be harder for companies to raise money to build foundational models. “It’s so capital intensive you can’t really have more than a handful,” he says. But if those models are thought of as operating systems, “there’s a great opportunity for capital to move towards the application layer, the toolset layer” — a shift he imagines could take place in 2024.

Generative AI for the Top Line

The range of possible applications for AI in businesses is likely to increase substantially in 2024.

In a November report, professional services firm Ernst & Young (EY) outlined its top ten opportunities within generative AI for technology companies in 2024.

Among EY’s findings were a high degree of intent among technology CEOs, with 65% of those surveyed revealing that they believed failure to act on AI now would hand their competitors an advantage. The report’s recommendations to businesses included that they experiment with AI in order to discover the most profitable use cases and shape corporate investment strategy around their AI roadmap. The latter instance could see more businesses acquiring smaller, AI-focused companies in order to access AI intellectual property and talent.

The pathway to profitability through businesses’ adoption of AI will be sector-dependent, but strategy consultancy BCG has outlined how generative AI can make B2B sales teams more effective. BCG identifies a disconnect between intention and implementation, with 75% of sales organisations having invested in AI and sales analytics but only 20% having fully implemented the technology.

BCG found that 66% of sales reps believe that generative AI can make them more productive. The report cites Salesforce’s [CRM] offerings through its conversational AI assistant Einstein Copilot as an example of how these are being implemented. Einstein generates call summaries and deal insights for sales reps following sales calls.

According to BCG, Microsoft [MSFT] is also building similar capabilities into its CRM products.

UiPath and Salesforce Expand Toolkits

Other companies continue to develop generative AI applications that purport to offer rapid efficiency gains to the businesses that adopt them.

UiPath [PATH], for example, released a suite of new business automation tools in November. According to a press release, these new tools can transform “millions of tasks and thousands of processes across the enterprise with AI”, significantly improving worker productivity by automating repetitive tasks.

Salesforce similarly delivered improvements to its AI offerings in December, adding the Data Cloud Vector Database and Einstein Copilot Search to its Einstein 1 Platform.

The former of these enriches users’ AI prompts with both structured and unstructured data from across a business — for example, by providing relevant knowledge articles to call centre representatives, enabling quick case identification and improved customer experience. Meanwhile, Einstein Copilot Search will be able to access data to provide more relevant responses to complex queries from users, such as by attaching relevant emails and phone transcripts to queries from customer support.

AI’s Big Strides in 2024

OpenAI, in which Microsoft has a 49% stake, could be on the verge of a groundbreaking development in AI technology.

While generative AI has helped the technology go mainstream, it isn’t commonly regarded as intelligent in the same way that humans are.

The next hypothetical level of AI is known as artificial general intelligence (AGI). Reuters reported in November that OpenAI researchers believed one of the company’s projects, named Q*, could represent a breakthrough on this front. Unlike generative AI programs such as ChatGPT, which can generate responses to open-ended prompts, Q* shows the ability to solve mathematical problems to which there is only one correct answer — a key milestone in AI development.

The ability of AI to solve problems like this has been described by Bloomberg columnist Parmy Olson as “alarming”. According to Olson, the programme suggests reasoning capabilities that may lead some to pre-emptively assign it undue responsibilities. OpenAI CEO Sam Altman called the Q* revelation an “unfortunate leak”.

With several nations (including the US and UK) holding major elections this year, concern over AI’s potential impact may be warranted. In December, the Financial Times reported that AI was already being used to create deepfakes to influence Bangladesh’s elections.

How to Invest in AI

Investment in the biggest names associated with AI drove mega-cap tech stocks to unprecedented highs during 2023. Microsoft’s share price gained 65.7% in the 12 months to 10 January, though it wasn’t the highest-performing member of the Magnificent Seven. Over the same period, Nvidia’s [NVDA] share price gained 234.2%.

Microsoft’s AI exposure takes various forms, most notably its stake in OpenAI. Unlike Nvidia — which is a ‘picks and shovels’ stock for the space, hence its outsized returns — Microsoft is also responsible for products that develop or incorporate LLMs (for example, OpenAI’s GPT-4, or its own Dynamics-365 CRM).

Investors looking for exposure to similar companies — builders of B2B AI software products — outside the Magnificent Seven can consider companies like Salesforce or UiPath. Salesforce shares gained 77.25% in the 12 months to 10 January, while UiPath gained 76.6%.

For diversified exposure to the theme, investors can select an ETF such as the Global X Artificial Intelligence & Technology ETF [AIQ], which holds Microsoft, Nvidia, Salesforce and UiPath as of 9 January. AIQ gained 41.9% in the 12 months to 10 January.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy