Artificial intelligence and other disruptive technologies are driving an increase in demand for data centres. This rise could see global data centre capacity almost triple in the next six years. While big tech stocks such as Amazon offer exposure to the theme, more focused exposure can be gained through data centre real estate stocks such as Digital Realty Trust.

- Global X touts data centre real estate as an inflation-resistant investment with several tailwinds.

- Research suggests that hyperscale data centre capacity could almost triple within six years.

- Amazon, the world’s largest cloud service provider, is investing in the US Midwest; shares are up 28.3% in the twelve months leading to 30 October.

Data Centre Real Estate

Cloud providers are likely to be among the winners from the artificial intelligence (AI) revolution, according to Rachel Aguirre, Head of US iShares Product at BlackRock. With AI hardware stocks such as Nvidia [NVDA] leading gains on the Nasdaq this year, Software as a Service (SaaS) stocks, and those of companies running the data centres that power the cloud, could be in the ascendant.

Pedro Palandrani, Director of Research at Global X Funds, wrote in May that AI was among a number of technologies that are driving increased demand for data centres. Other key segments include 5G infrastructure, autonomous vehicles, virtual reality and blockchain.

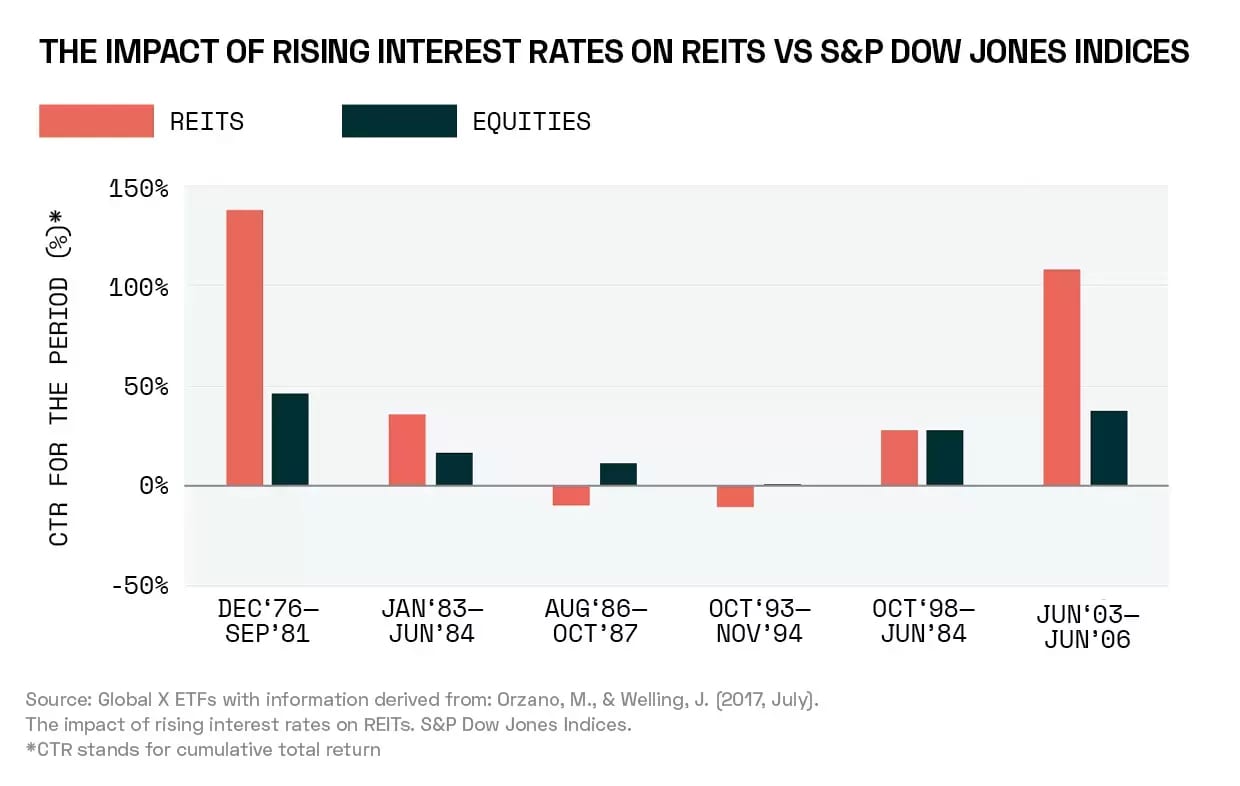

The real estate firms operating data centres represent an interesting opportunity: “In the current inflationary environment, real estate can be an attractive investment because the sector is generally better at passing price increases onto consumers compared to other non-cyclical sectors,” Palandrani noted. Tax benefits are further potential advantage, since real estate investment trusts (REITs) are able to pass 90% of taxable profit onto shareholders.

The growth in demand for digital infrastructure means that data centre REITs outperformed the S&P 500 in five of the seven years up to 2022. “Couple the economy’s digital shift with inflation, and we believe that data centre and cellular tower REITs have positive momentum,” said Palandrani.

However, he warned of an upcoming supply-demand imbalance in data centre capacity, exacerbated by the increased costs of the material and labour needed to construct them. But this could, in fact, prove another tailwind for the industry as a whole, as the supply gap could serve to boost the value of existing data centres.

Hyperscaling Data Centre Capacity

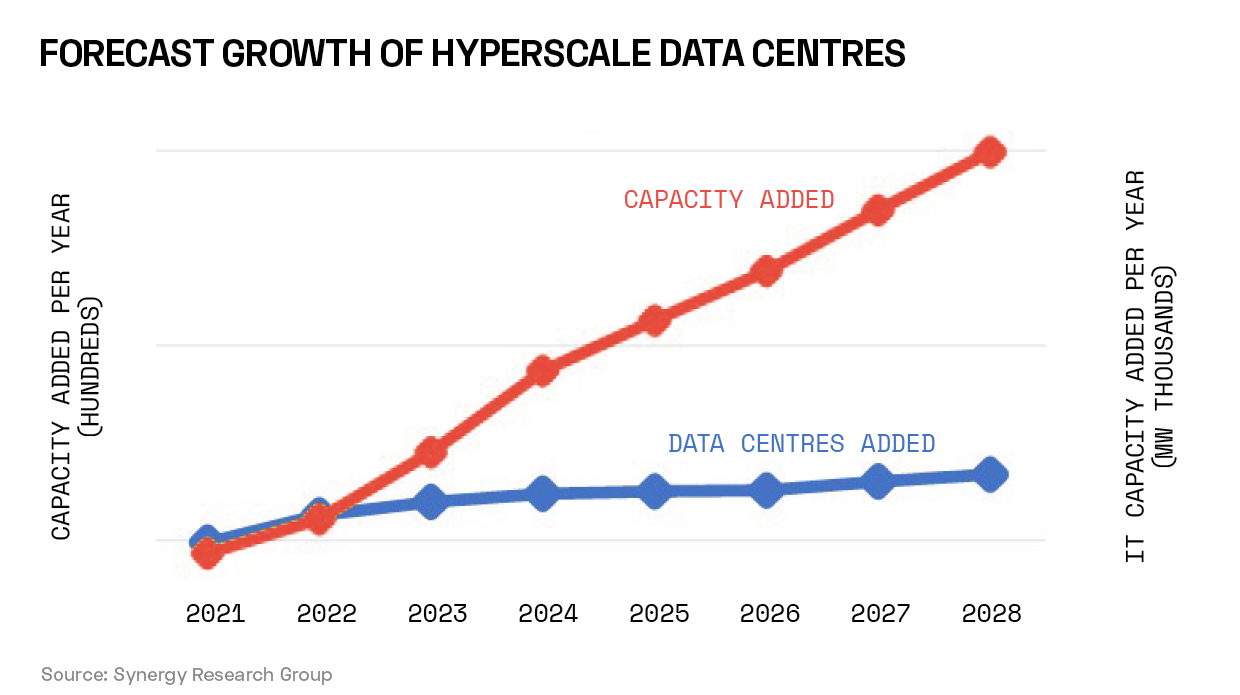

Cloud industry intelligence firm Synergy Research Group believes that hyperscale data centre capacity is set to balloon.

Synergy’s report, ‘Hyperscale Data Centre Capacity to Almost Triple in Next Six Years, Driven by AI’, suggests that increases in the average capacity of data centres under production, the retrofitting of existing data centres, and growth in the overall number of hyperscale data centres will lead total capacity to almost triple through 2028. The report cites the proliferation of generative AI technology and services as a key driver of demand for the rise in data centre capacity.

The report also notes that the total number of data centres globally has doubled over the past five years.

“Some seem to think that the big hyperscale operators were caught off guard by the impact of AI,” John Dinsdale, Chief Analyst and Research Director at Synergy Research Group, told Opto. However, he points out that the major players such as Amazon [AMZN], Microsoft [MSFT], Alphabet [GOOGL] and Meta [META] already had a strong pipeline of new capacity in the works. “I would not say that they were caught out by AI demands, but I think there may have been some level of underestimating the power density required in AI-oriented facilities,” said Dinsdale.

This increased power demand is principally attributable to the sheer quantity of graphics processing units — such as those produced by Nvidia — required by data centres to power AI applications. According to Synergy, these increased energy demands are “causing hyperscale operators to rethink some of their data centre architecture and deployment plans”.

AWS Market Share Slips

Amazon Web Services (AWS), the world’s largest cloud service provider, announced on 25 October that it will launch a sovereign cloud for the European market. The cloud will store data on servers located in Europe, and will be managed only by employees resident in the EU. Amazon’s sovereign cloud aims to provide governments and businesses in highly regulated industries with greater assurance that its cloud provision meets the bloc’s data privacy standards. Competitors Microsoft and Oracle [ORCL] have already established their own sovereign European clouds, according to Reuters.

Amazon and Microsoft both announced earnings in the week commencing 23 October. AWS grew at a slower pace than its peers, Microsoft’s Azure and Alphabet’s Google Cloud, expanding by 12% year-over-year compared to Azure’s 29% and Google Cloud’s 22%.

A Moveable Feast

The data centre market is shifting geographically. “Many AI workloads are not as latency sensitive as other workloads,” according to Dinsdale. This means that data centres can be placed in more distant, less expensive locations.

“We were already seeing hyperscale data centre growth in the US Midwest outpacing that in other regions such as Northern Virginia and Silicon Valley,” said Dinsdale. “We fully expect that trend to continue.”

For example, in June Amazon announced its intention to invest $7.8bn into Ohio data centres by 2030. These investments come on top of $6.3bn invested into the state since 2015, which includes 18 solar and wind farms with an annual capacity of 6.6 million MWh.

How to Invest in Data Centres

One way to tap into the potential tailwinds of the data centre industry is by buying into key SaaS stocks and cloud providers such as Microsoft, Amazon, Alphabet and Oracle. These four stocks gained 44.4%, 28.3%, 30.2% and 33.4% respectively, in the year to 30 October.

However, these are diversified plays, with cloud services a significant but not necessarily principal revenue stream. More focused exposure can be gained through specialised data centre real estate stocks.

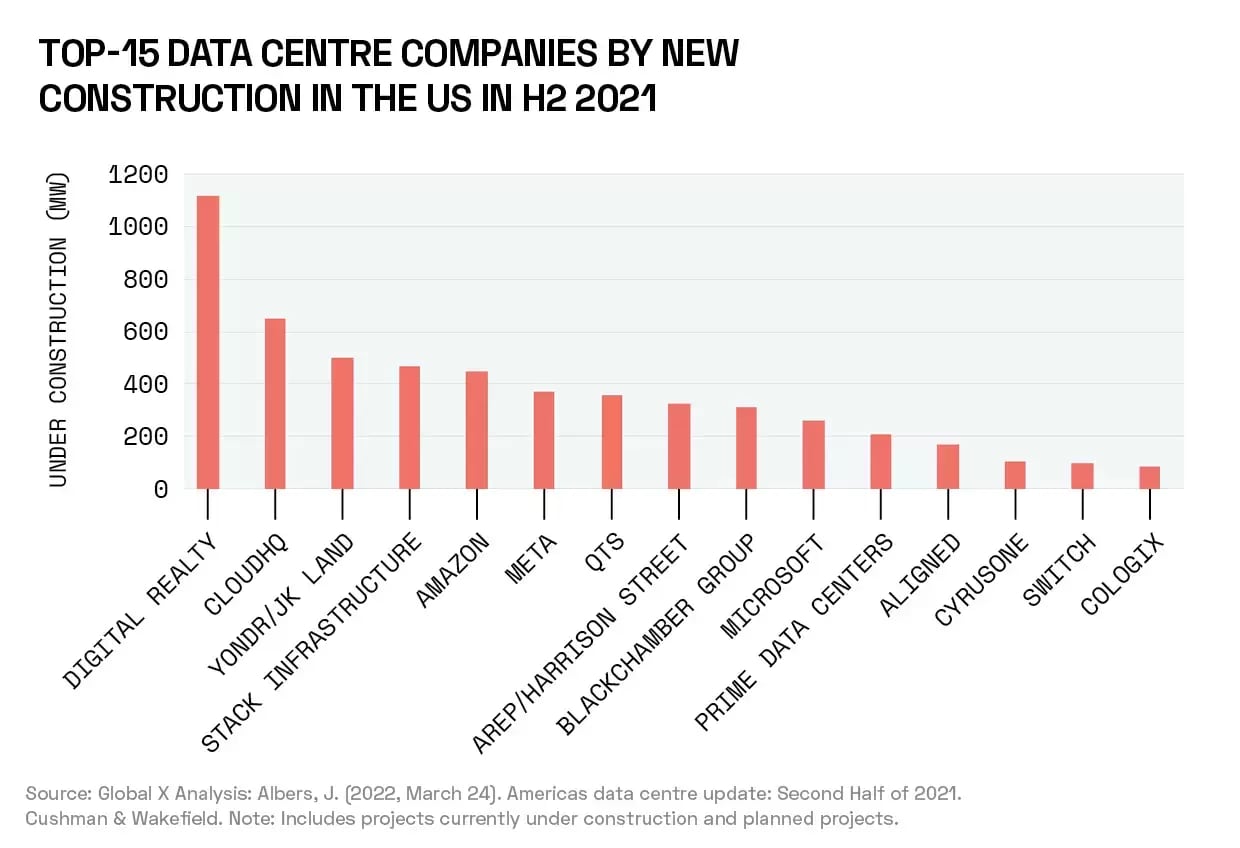

According to Global X’s research, Digital Realty Trust [DLR] topped the list of data centre companies by new construction in the US during the second half of 2021. Digital Realty’s shares gained 25.8% in the year to 30 October.

Global X offers an ETF dedicated to providers of data centre and cellular tower infrastructure: the Data Centre REITs & Digital Infrastructure ETF [VPN]. VPN tracks an index comprised of companies with at least half their revenue derived from owning, operating or developing data centres or cellular towers, or from manufacturing the hardware that powers them.

VPN was up 6.1% in the year to 30 October.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy