AI has the potential to transform the healthcare industry for investors, according to Vinay Thapar of Alliance Bernstein. While health tech companies have lagged markets over the past five years, research indicates that the sector is set to see rapid growth over the next five to 10-year period, driven by groundbreaking developments in cellular technology.

- Alliance Bernstein and Bessemer Venture Partners believe that AI will catalyse future growth in healthcare and health tech stocks.

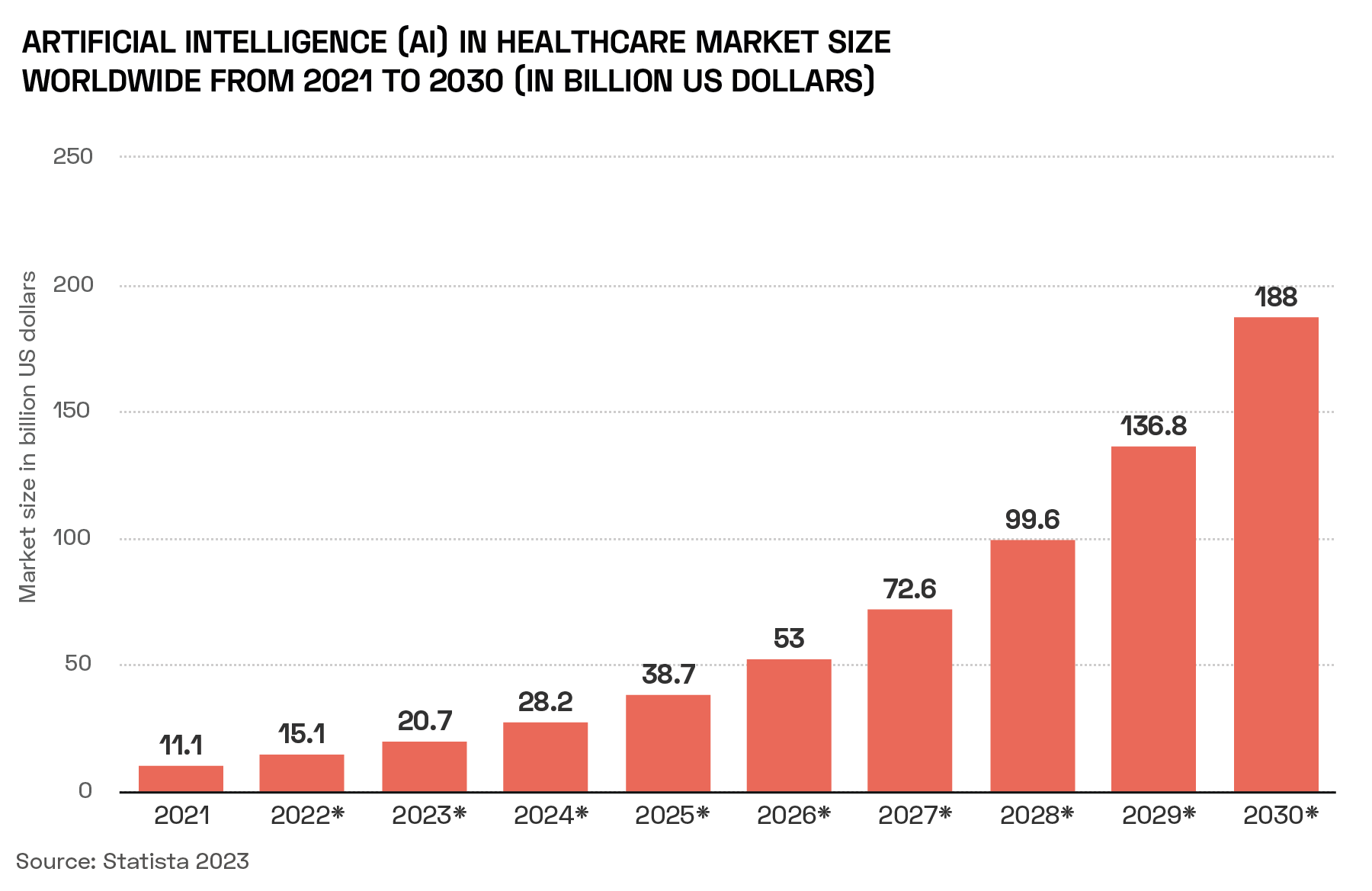

- GlobalData and Statista forecast CAGR of 35% for the AI in healthcare market over five to 10 years.

- Goldman Sachs Future Health Care Equity ETF is down 4% year-to-date.

Artificial intelligence (AI) could play a transformational role in the healthcare industry, according to Vinay Thapar, Co-Chief Investment Officer and Senior Research Analyst at Alliance Bernstein.

In a June report titled ‘Will AI Transform the Healthcare Industry for Investors?’, Thapar writes that there are four areas in which AI could improve healthcare companies’ operations: research and development, clinical trials, commercial development and diagnostic ability on the part of physicians.

“In all these areas, we believe AI’s success will be measured by its ability to produce better healthcare outcomes,” writes Thapar. He cites Veeva Systems [VEEV] and ICON [ICLR] as two examples of companies that have implemented AI into commercial tools, and refers to Northwestern Medicine’s partnership with Alphabet’s [GOOGL] Google to develop an AI model that can detect certain cancers earlier than currently available tools allow.

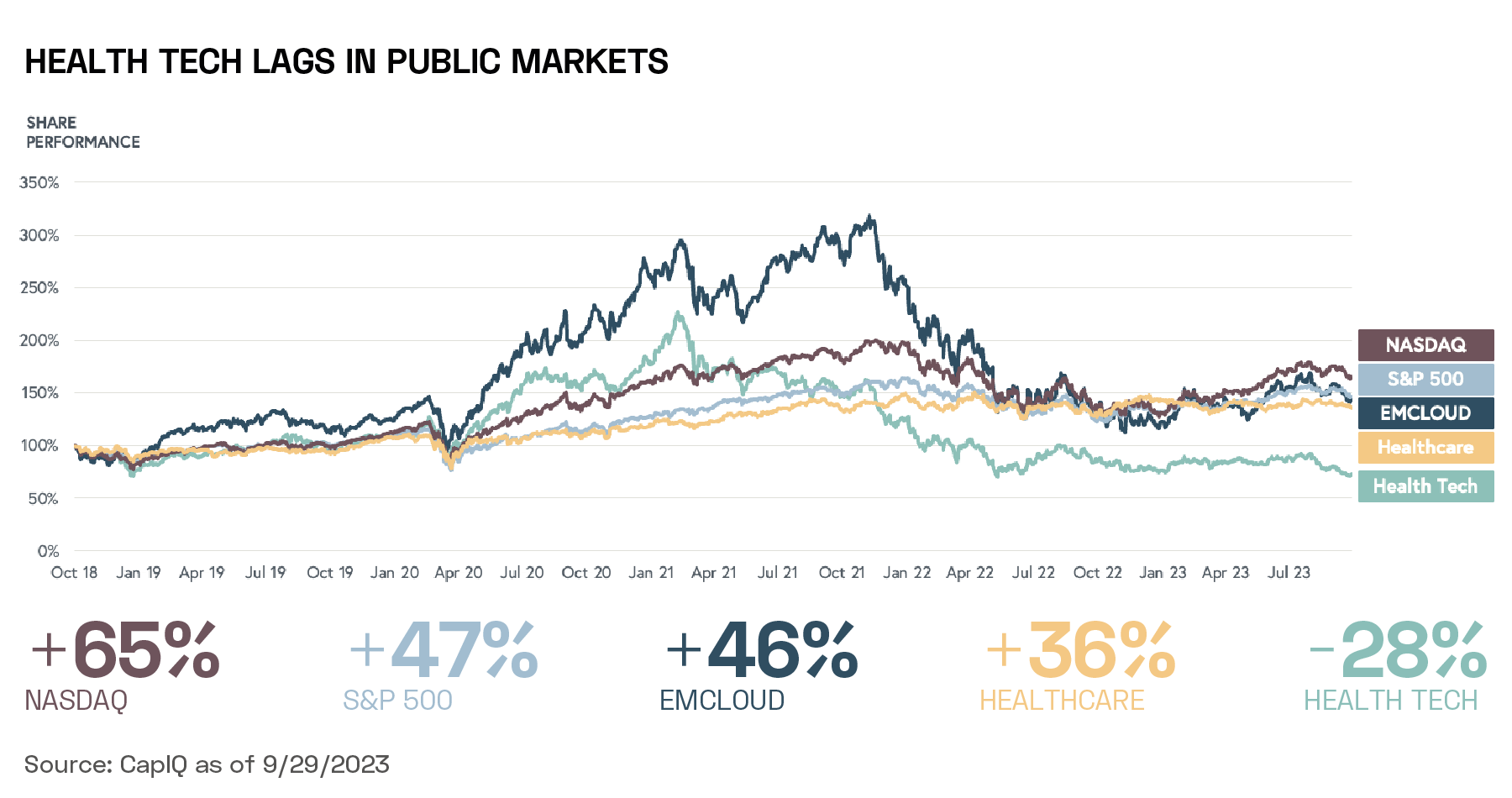

According to Bessemer Venture Partners (BVP), health technology is in need of good news. The venture capital (VC) firm’s ‘State of Health Tech 2023’ report released in September observes that public health tech companies have lagged broader markets over the last five years, while VC funding is projected to fall to $10bn in 2023, 65% below its 2021 peak of $29bn.

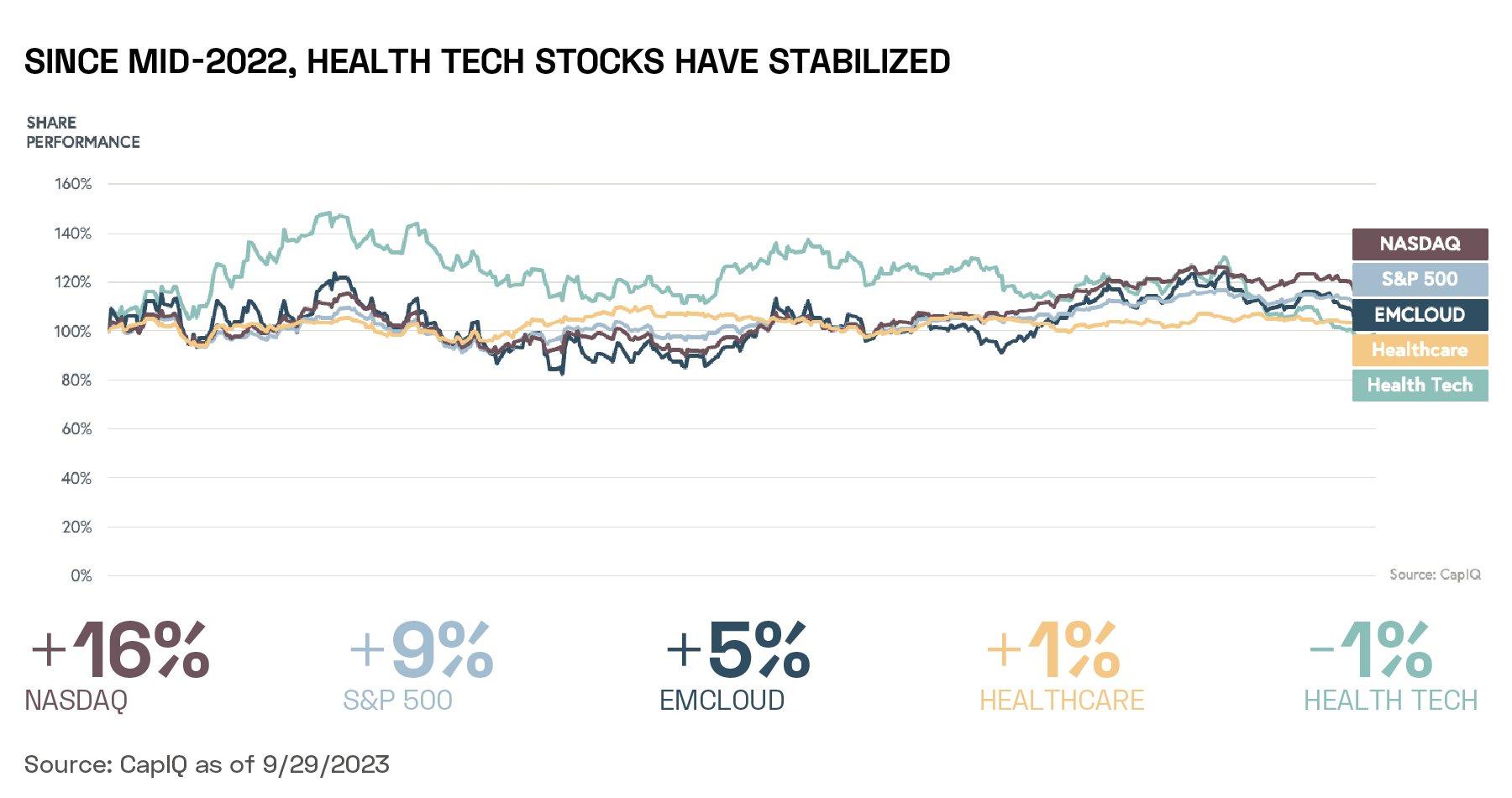

However, BVP argues that health tech is suffering from a “hype cycle”. Having surged during the onset of the Covid pandemic, health tech companies witnessed a correction beginning in February 2021.

“From the peak in 2021 to the trough starting in May 2022, on average, health tech stocks lost 60% of value,” notes BVP. Since May 2022, health tech stocks have stabilised; on average, health tech companies fell approximately 1% during this period. This still trails broader markets, but far less dramatically than over the five-year period.

Additionally, the sector has created $90bn of market cap over the past five years, largely thanks to new listings. Looking forward, BVP expects that AI will be a powerful growth driver for the theme.

The Value-Add

Healthcare’s various subsectors are all set to benefit to varying degrees from the tailwinds offered by AI.

Market insights firm GlobalData’s July report into AI in healthcare suggests that every subsector is expected to grow in the period from 2022 to 2030, with an overall CAGR above 35%. AI within medical devices is forecast to grow at a 29 1% CAGR from $336m in 2023 to $1.2bn in 2027. Meanwhile, Research and Markets expects the AI-based clinical trial solution providers market to grow beyond $1.5bn in 2023.

Strategy consultancy firm McKinsey believes that generative AI’s impact on the pharmaceutical and medical product industries could be substantial, amounting to 2.6–4.5% of annual revenues (or $60–$110bn per year) across both industries. McKinsey cites automated preliminary screening of new treatments as one potential productivity boost, alongside enhanced identification and prioritisation of new indications (i.e., symptoms or circumstances that suggest a certain treatment is appropriate).

Statista forecasts that the AI in healthcare market will grow from $11.1bn in 2021 to nearly $188bn in 2030, implying a CAGR of approximately 37% during the period.

Statista’s report into the space found that one of the key benefits of AI in healthcare is saving physicians’ time. Physicians currently spend approximately half of their working time treating patients and the other half on administrative tasks; by automating much of the latter, AI could enable medical professionals to spend 20% more time treating patients.

A UK Health Hub?

The UK government is aiming to capitalise on the potential of AI to improve healthcare outcomes, having announced a £100m fund at the end of October devoted to accelerating its uptake.

British companies and researchers are already making notable progress.

As detailed in the journal Nature Medicine, researchers at Imperial College London have developed an AI tool in partnership with Kheiron Medical Technologies that can detect 13% more breast cancers than humans in screenings. The tool, dubbed Mia, proved effective at flagging false negative readings by human radiologists in the mammograms of 25,065 women across four screening sites in Hungary between April 2021 and January 2023.

“Typically, non-traditional healthcare companies have realised their capabilities to analyse radiology, utilising technology and AI to pinpoint abnormalities in scans that might otherwise go undetected,” Arelis Agosto, Senior Healthcare Analyst at Global X ETFs, told OPTO Sessions in August.

This month, Anglo-Swedish pharmaceutical giant AstraZeneca [AZN] announced it is launching a new health tech business called Evinova. The unit will offer a drug development suite, which will employ AI and machine learning to develop experimental protocols.

“We believe Evinova’s combination of scientific expertise and track record in developing AI-enabled digital technologies at scale, provides a real opportunity to fundamentally improve patient care, drive healthcare transformation and reduce carbon emissions,” said Pascal Soriot, CEO of Astrazeneca.

Could AI Win a Nobel?

AI and machine learning continue to shape the future of medicine, enabling breakthroughs at the cellular and molecular level. In September, the research team behind Google DeepMind’s AlphaFold, an AI program that can predict the 3D shapes of proteins based on amino acid sequences, won the prestigious Lasker prize.

According to the Guardian, recipients of this award often go on to win the Nobel prize; AlphaFold’s recognition therefore raises the possibility of the first-ever Nobel awarded for AI research.

AlphaFold is far from the only advance occurring in the space, however. Researchers at Canada’s University of Waterloo have recently developed a program called GraphNovo, a machine learning program that offers an accurate understanding of sequences of peptides in cells. Like proteins, peptides are formed of chains of amino acids. Being able to understand their shape and function could have radical implications for immunology, as well as the diagnosis and treatment of cancer.

How to Invest in AI in Healthcare

Veeva’s share price has gained 7.4% year-to-date, while ICON’s gained 37.4% and Alphabet’s gained 53%. Over the same period, AstraZeneca’s has dropped 3.4%.

Given the breadth of healthcare innovation, investors may opt for an ETF to gain diversified exposure. One option is the Goldman Sachs Future Health Care Equity ETF [GDOC], an actively managed, all-cap ETF that focuses on companies creating groundbreaking solutions in the fields of genomics, precision medicine, tech-enabled procedures and digital healthcare.

As of 29 November, 95.5% of the fund’s holdings are in the healthcare sector, while 2% are in real estate and 1.5% are in information technology. AstraZeneca is the fund’s third-largest holding, with a weighting of 5.1%. Veeva has a smaller weighting of 1.2%. The fund is down 4% year-to-date.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy