It is prime time for technological convergence, according to ARK Invest’s ‘Big Ideas 2024’ report: “Five major technology platforms — artificial intelligence (AI), public blockchains, multiomic sequencing, energy storage and robotics — are coalescing and should transform global economic activity.”

This convergence could see the growth rate of real global GDP, which has averaged approximately 3% for the last 125 years, accelerate to 7% over the remainder of the decade.

ARK believes that an investment strategy focused on the most transformative areas will generate the greatest returns. “The global equity market value associated with disruptive innovation could increase from 16% of the total to more than 60% by 2030” (ARK includes public blockchain value as part of all calculations and forecasts of “equity market value”).

Artificial Intelligence

AI is the key to this technological convergence.

“AI is catalysing the other technologies and accelerating them all,” Cathie Wood, Founder, CEO and Chief Investment Officer of ARK Invest, told OPTO Sessions in an interview.

The report observes that the technology is accelerating faster than anticipated by forecasters and is already making a significant impact on the productivity of knowledge workers. The ability of generative AI programs to compose text, generate images, pass exams and perform a variety of knowledge work is rapidly improving.

For example, generative AI copilots — such as the GitHub Copilot, introduced in 2023 — have already demonstrably improved the productivity of software developers. Coders using the copilot were 2.2x more productive than those not using it, according to Github data.

Similarly, consultants using generative AI worked 1.25x faster than those who didn’t. Generative AI led to a 1.17x improvement in the quality of work of the top 50th percentile of consultants, with the equivalent figure for the bottom 50th percentile being 1.43x — suggesting that generative AI has a greater impact on the productivity of underperforming workers than on top performers.

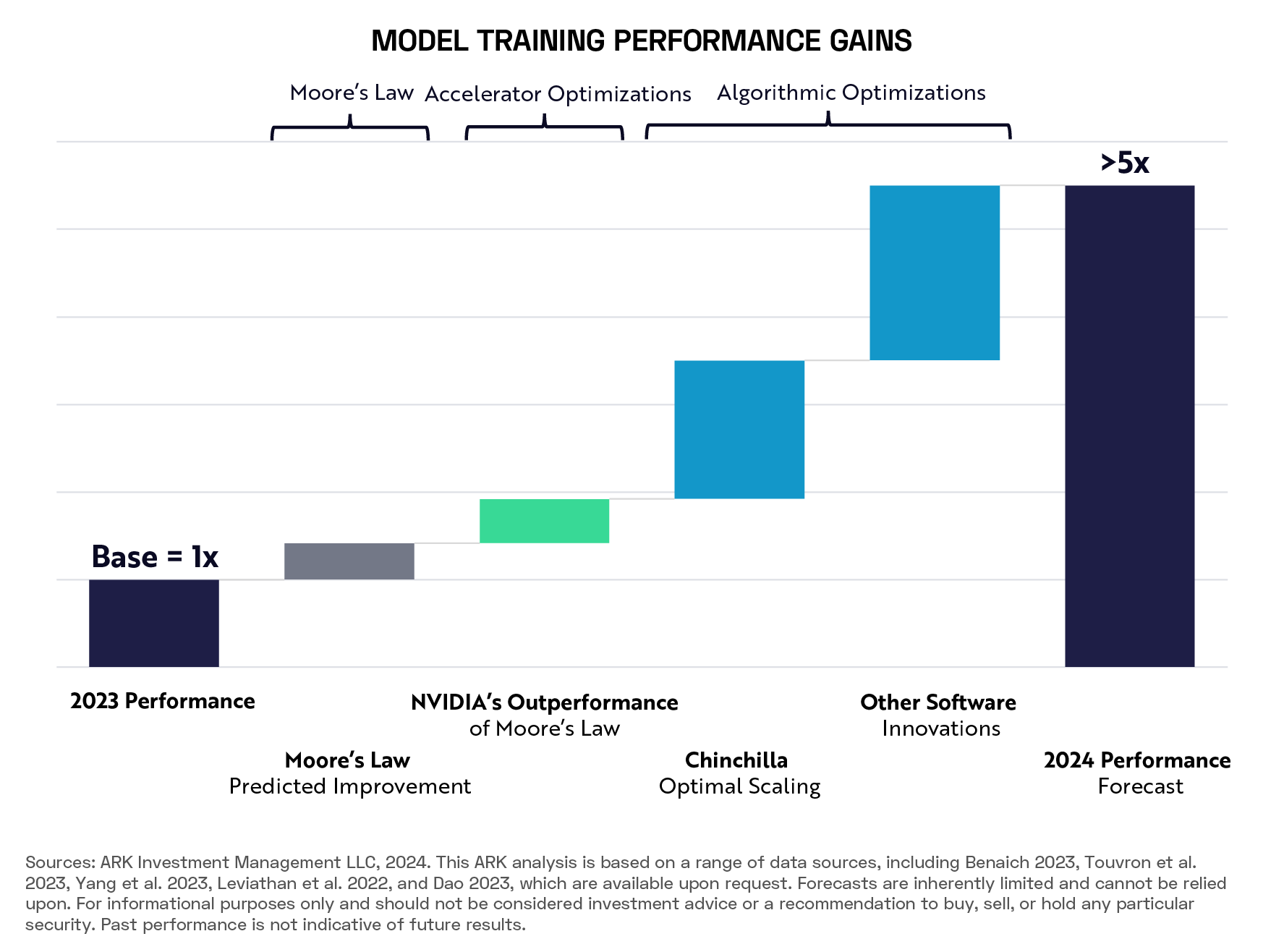

The pace of improvement of AI models is exceeding prior expectations.

ARK anticipates training performance will increase 5x in 2024, thanks to the effects of Moore’s Law (which states that the number of transistors on a microchip doubles about every two years), as well as the fact that Nvidia has previously outperformed the gains predicted by Moore’s Law, and algorithmic optimisations such as Chinchilla Optimal Scaling.

At the same time, the costs of training AI models are expected to fall by as much as 75% annually through 2030.

Public Blockchains

Cryptocurrencies

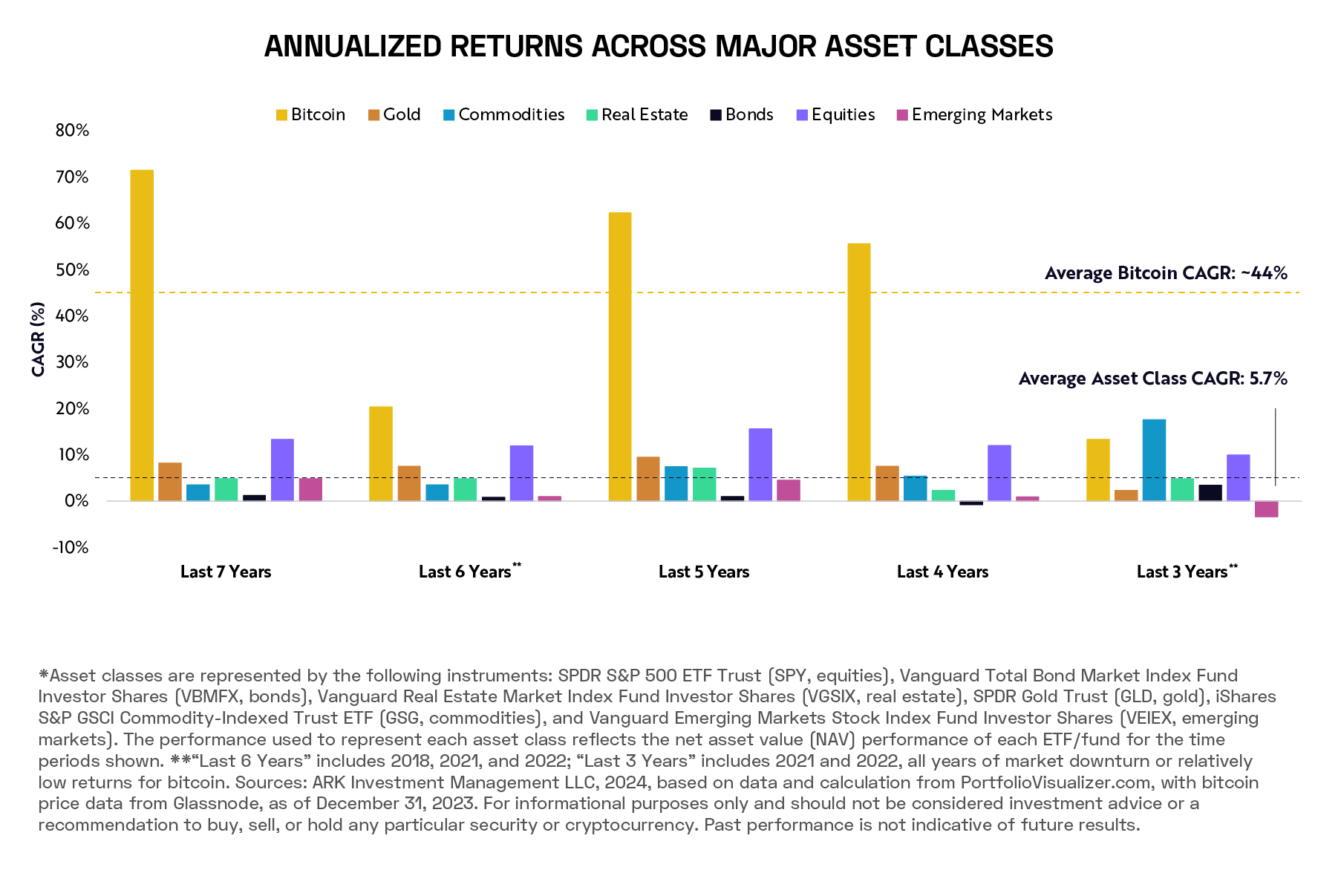

Cryptocurrency — specifically bitcoin — is a favourite asset class of ARK Invest. Bitcoin’s returns over the last seven years have outperformed all other asset classes, with an average of 44% CAGR compared to 5.7% across all asset classes.

One aspect of bitcoin’s investment case is its relatively low correlation to other asset classes.

For the 12 months to December 2023, this correlation was on average 0.27, on a scale of 0 to 1; only commodities and gold have a lower average correlation to other asset classes, of 0.21 and 0.25, respectively.

Bonds, real estate, equities and emerging markets, by contrast, have average correlations to other asset classes of 0.35, 0.53, 0.53 and 0.49, respectively.

This low degree of correlation could contribute to bitcoin’s increasing reputation as a safe haven asset.

According to some experts, it can act as a hedge against inflation. As ARK points out in the report, investors turned to bitcoin during the crisis that followed the collapse of Silicon Valley Bank.

That was “a big wake-up call for the financial world” in terms of bitcoin as an asset class, Wood told OPTO Sessions.

These use cases are helping transform bitcoin into a reliable risk-off asset, said Wood, having traditionally been regarded by investors as primarily a risk-on asset.

In January, Wood told CNBC that her base case for bitcoin sees it reaching a price of $600,000 by 2030, and that her bull scenario sees it reaching $1.5m.

Other Big Ideas in blockchain:

- “Smart contract networks could generate fees of $450bn in 2030”

- “Digital wallets could generate $23bn in vertical software revenue”

Multiomic Sequencing

Precision Therapies

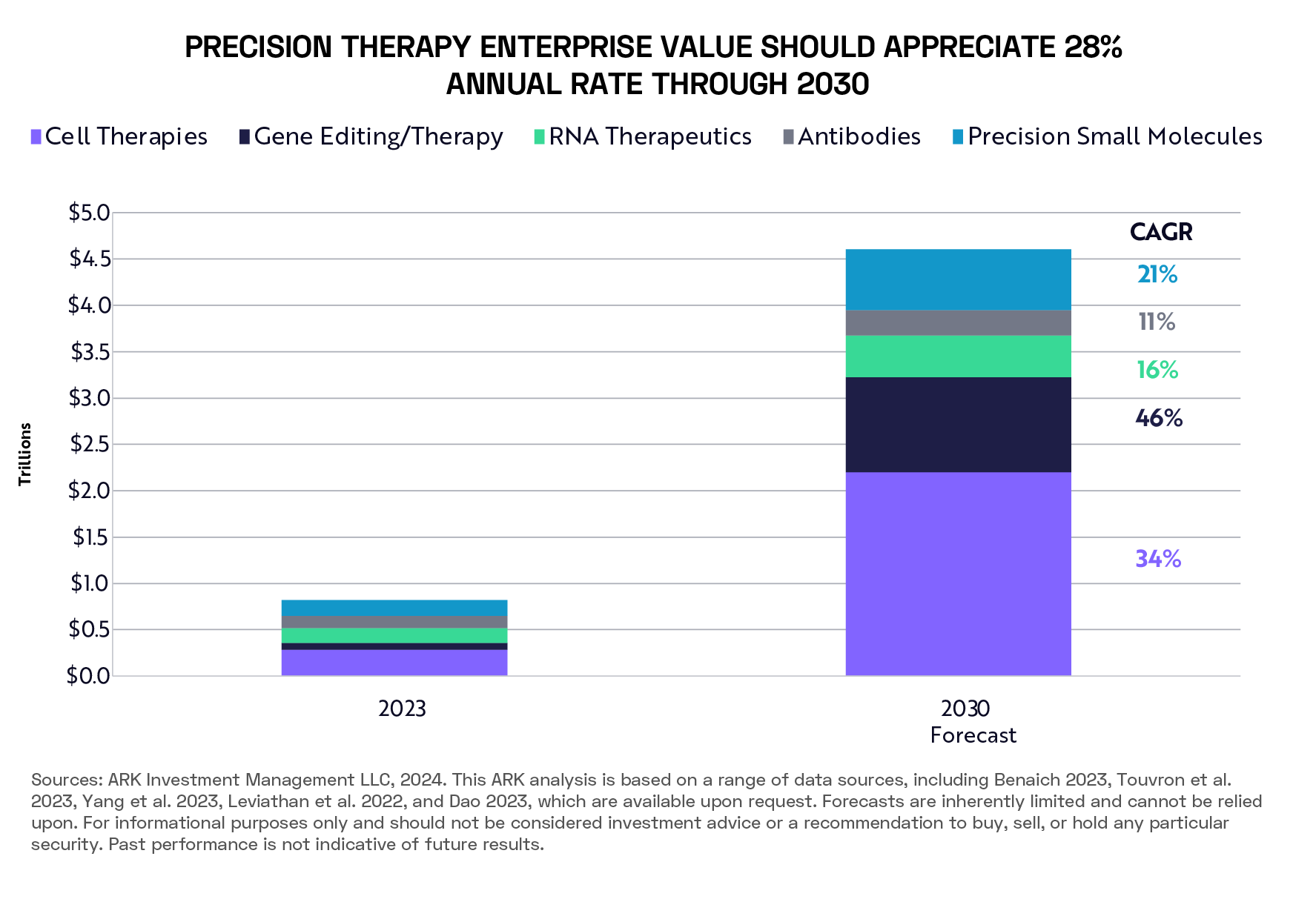

According to ARK, AI, CRISPR gene editing and new sequencing technologies have increased returns on research and development (R&D) for precision therapies while enabling therapies to target previously untreatable conditions.

ARK believes that novel therapeutic modalities and R&D methods could reverse a 25-year downtrend in returns on investment in new treatments.

Moreover, precision therapies offer the scope to treat conditions that were previously undruggable.

For example, gene editing medicines like CRISPR-Cas9 have the potential to cure rare genetic diseases such as Sickle Cell Disease (SCD). SCD has historically been managed through available therapeutics, but has had no definitive cure. However, in December, the US Food and Drug Administration approved the first gene editing-based treatment for the disease.

ARK estimates that if curative precision therapies could be developed for all genetic diseases, it could generate $15trn of value (through reduced spend on direct costs such as medicines and in- and out-patient disease management) over the next 50 years.

ARK’s research suggests that the enterprise value of companies focused on precision therapies could appreciate at an annual rate of 28% through the next seven years, from approximately $820bn in 2023 to approximately $4.5trn by 2030.

Other Big Ideas in multiomics:

- Multiomic tools could reduce R&D spend on each new drug by 25%.

- Convergence with AI and automation could further accelerate the discovery of new drugs.

Energy Storage

Electric Vehicles

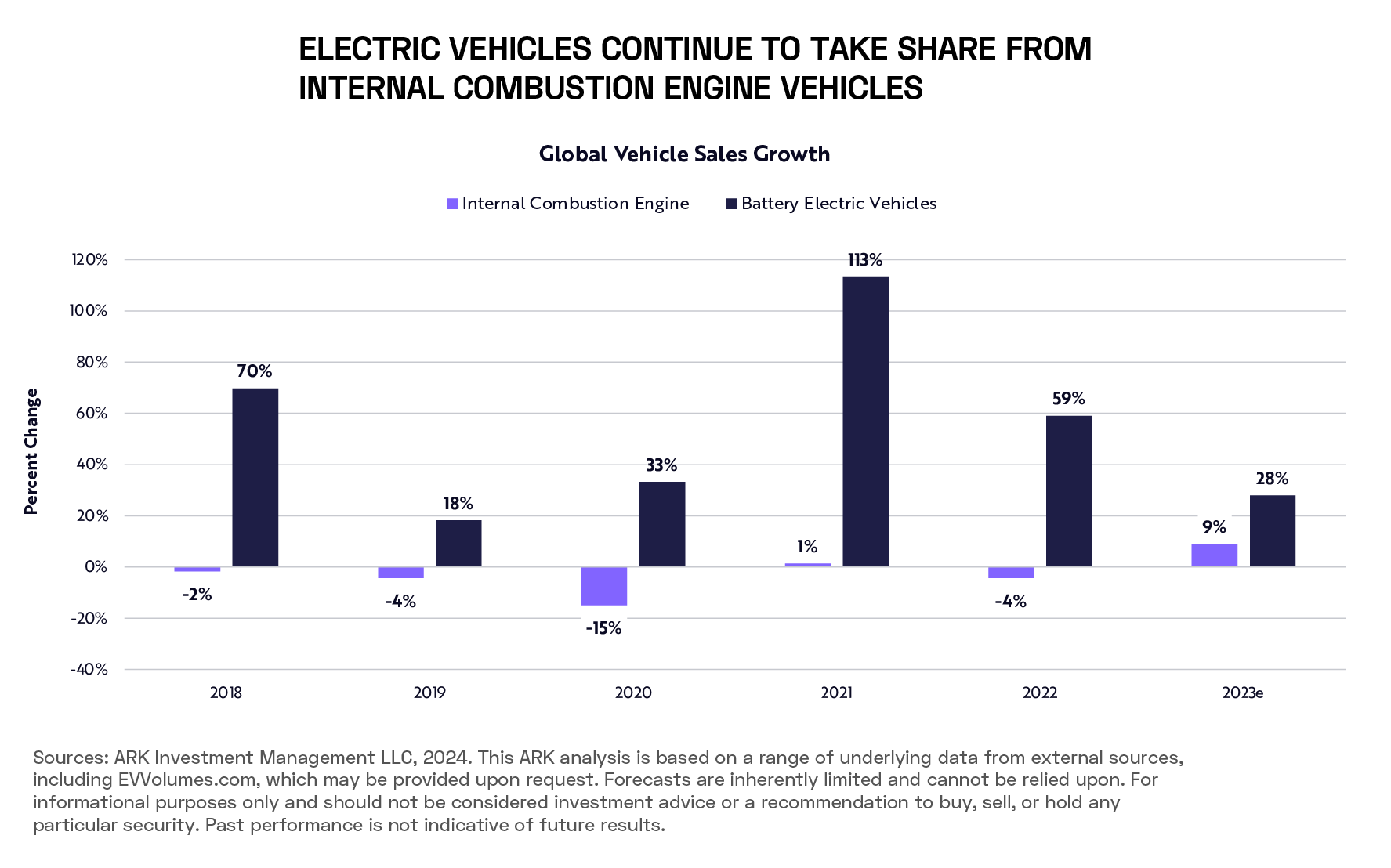

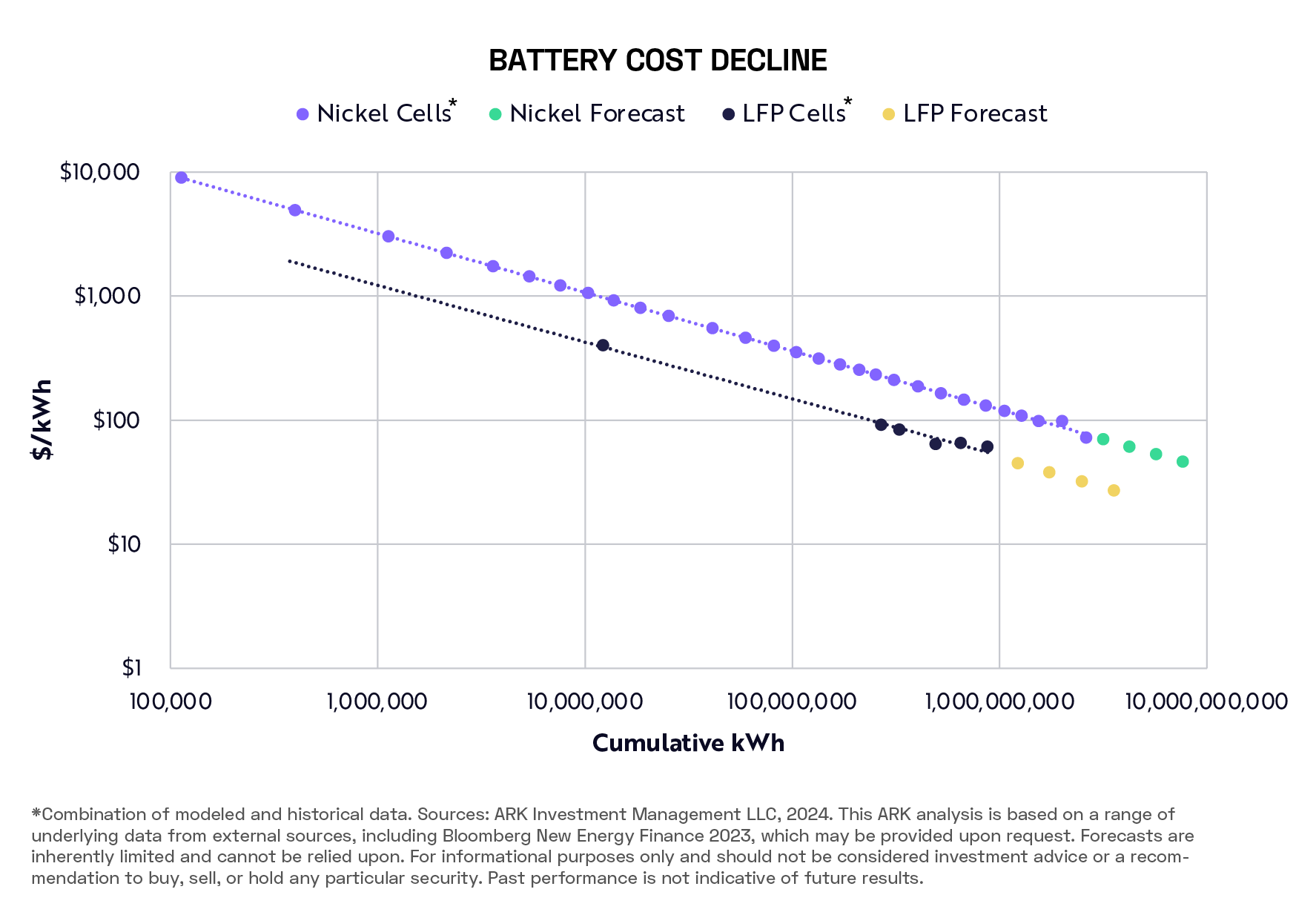

The cost of battery technology is falling, and this dynamic is powering increased electric vehicle (EV) adoption.

Demand for EVs is on the rise, scaling at 33% per year between 2023 and 2030 according to ARK’s estimates, suggesting sales could grow from 10 million to 74 million during that time. Furthermore, ARK anticipates that if robotaxi platforms flourish, EVs could account for 95–100% of all vehicle sales in 2030.

According to Wright’s Law, for every cumulative doubling in the number of kWh produced, battery costs will fall by 28%.

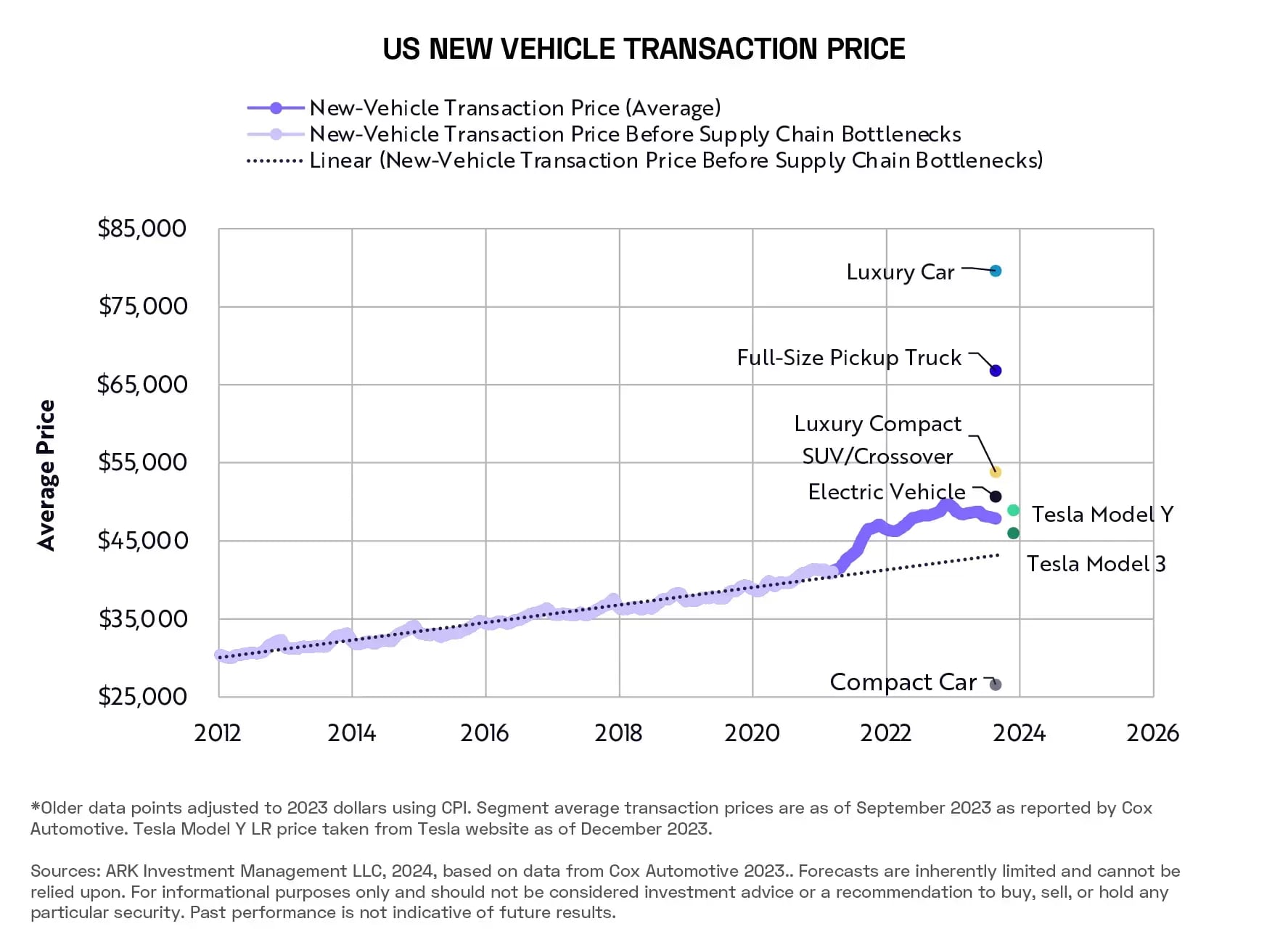

This has meant that EVs are now reaching price parity with comparable internal combustion engine (ICE) cars.

Wright’s Law also implies that EV charging speeds will increase over time; these have already witnessed an almost threefold increase over the past five years. ARK anticipates that this threefold improvement could play out again over the next five years, bringing the time required to charge for 200 miles of range down to four minutes by 2027.

This is currently a primary focus of EV makers, since charging times are one of the major barriers to consumer adoption; however, ARK anticipates that “as EV charging reaches acceptable rates, manufacturers are likely to optimise for other features, including autonomous driving, safety and entertainment”.

All told, these dynamics suggest that EVs will take market share from ICE cars for the remainder of the decade. This is squeezing traditional carmakers, whose business models have been slow to adapt to the decline of ICE cars.

Robotics

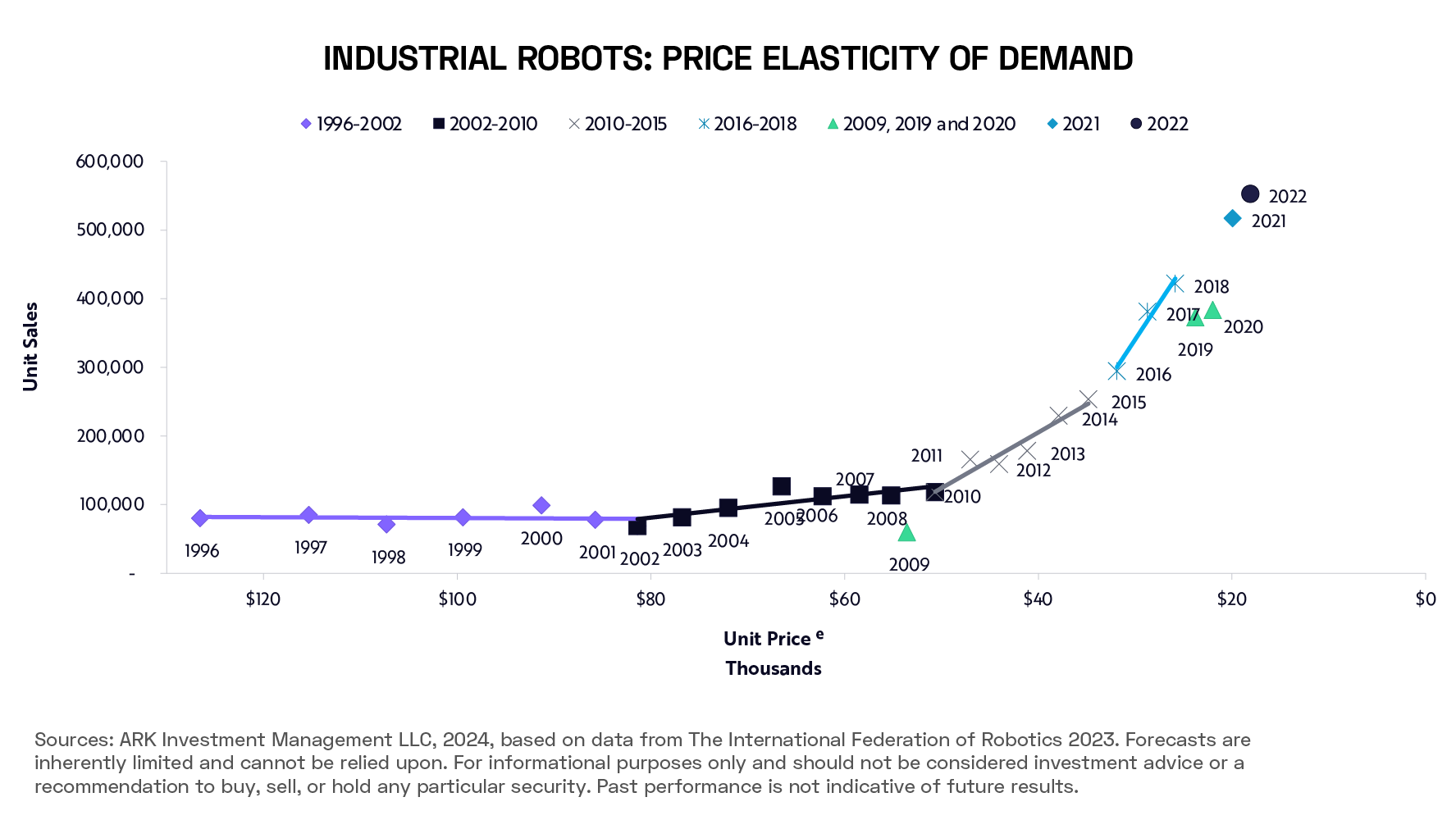

According to ARK, the convergence of AI and hardware should enable generalised robotics.

Again, the falling costs of the technology over time are fuelling an increase in demand. ARK estimates that costs of robots have fallen 50% over every period that unit sales have doubled.

Robots are also becoming more efficient. In 2022, according to ARK, the number of items that industrial robots could pick and place in an hour surpassed what humans can achieve; ARK states that it’s “unclear where the upper limit will be” in terms of the ultimate efficiency potential of industrial robots.

The increasing capability and falling costs of robots mean that companies are deploying them increasingly densely. Robots, more and more, are “freeing humans from tedious physical tasks”. The estimated number of robots deployed by Amazon [AMZN], for example, is catching up to the number of humans it employs, suggesting robots may soon surpass human employees at the e-commerce giant.

Between the productivity gains of industrial robots, and the potential value of the time that domestic robots could save individual users, ARK estimates that generalised robots could unlock over $24trn in revenue per year.

Other Big Ideas in robotics:

- Robotaxi platforms — the convergence point of EVs, AI and robotics — could generate $28trn in enterprise value over the next five to 10 years.

- Global autonomous delivery revenues could reach $900bn by 2030.

- Reusable rockets could help hypersonic flight become a $35bn market in 2030.

- 3D printing revenues could scale at an annual rate of approximately 40% during the next seven years, from $18bn to $180bn in 2030.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy