Trading tips to help transform your strategy

Even the best of traders do not make a profit with every trade, so it is important to remember that loss-making trades are inevitable, irrespective of how well you know the markets. The following tips will help you navigate the financial markets, enabling you to devise a sensible and stable trading strategy.

Seek high value trades

As a trader, your objective is to make profits, and not place lots and lots of trades, which would normally just result in your broker getting rich. A fairly obvious but often forgotten rule is to know what sort of set ups are right for your strategy. Spend some time trying to identify your trading goals and resist the urge to buy or sell on a whim just because you feel you should be doing something.

Follow market trends

Don’t forget that you are not an investor. If a trade goes wrong, don’t kid yourself that you are going to hang onto it for a bit longer as 'the market will come back' or on the hopes that 'the market is wrong'. We are constantly told that discipline is a big part of trading. Don’t let one big loss ruin lots of perfectly good trades.

Know when to take profits

It can be easy to get carried away when a trade starts going in your favour, with many traders feeling that this is the one that is really going to go to the moon. In the same way that you have a stop loss in mind when you enter a trade, it helps to have an idea of at least where you want to take profits. Don’t let a solid profitable trade turn into a loser.

Identify maximum loss limits

Just because you are trying to identify smaller moves does not mean you should relax your approach to risk management. Know where you are going to get out before you get in, and place a stop-loss order, whenever possible. Learn how to manage your risk with GSLOs on our Next Generation trading platform, which guarantee to close you out of a trade at the price you specify, regardless of market volatility or gapping.

Be aware of your risk-versus-reward ratio

This one ties in with knowing where your stop loss and targets are. You are probably not going to be as correct as you think you are, so make sure that your potential profits are a realistic multiple of what you are risking. That way, if you are right even slightly less than half the time, you could still make money overall.

Follow economic announcements

Know what major economic announcements are due out and research how these could affect the markets you are watching. For instance, you may have spotted the most reliable chart pattern in the world, but if the US non-farm payrolls are due out in 90 seconds, chances are that the market could act somewhat erratically. Most brokers provide economic calendars these days so there is no excuse for not knowing what is happening in the financial world.

Be ready for technical glitches

In our constantly-connected world, we can often take for granted that stuff just works. But what are you going to do if you have trades open and your internet connection goes down or your PC decides to self-destruct? Have a phone number ready for your broker at the very least, and potentially the option to connect via alternative means, such as a mobile app.

Spend some time away from the screen

It can be too easy to be sucked into the hypnotic world of flashing numbers and moving charts. This is a cliché but can mean that you end up not seeing the wood for the trees. Take regular breaks, walk away and come back to the markets with a fresh pair of eyes.

Relax and have fun

Trading can be stressful enough without putting added mental pressure on yourself. The right trades should not need to be forced and should not involve squinting for hours at a time at a price chart.

The 'going with the flow' approach will be hard to achieve if you are scared, intimidated or constantly on edge with every change in price. It is important that you have confidence in your system, and enjoy the challenge of where next for markets. Watch our video from stock market trader Tom Hougaard below on his top tips for a trader's mindset.

Trading guidance: what to do with big wins

Anyone who trades for long enough will probably encounter big wins from time to time. It's important to know how to handle these wins in a way that won't negatively affect your trading strategy and future trades.

So much of the success or failure of trading stems from what goes on in traders' heads, not on their computer screens, and it is how these big wins affect their thinking that can cause real problems for future trades.

First of all, a large winning trade may make a trader feel invincible – like they have finally cracked 'this trading business' and can rightfully claim their place as a master of the universe. This is a dangerous mindset to have. It is of course important to have a positive outlook and to have faith in their ability to analyse the markets and make good trading decisions. But, a feeling that they can do no wrong may well lead to a more relaxed approach to choosing the next trading opportunities and placing trades that they normally wouldn't.

The other danger is the temptation to drastically increase trade sizes. This is again linked to overconfidence and a possible feeling that the trader has solved the puzzle of the markets. Trading a lot bigger than they have done previously can lead to traders giving back the large profits they've made, and more.

The right approach to dealing with big wins

Firstly, it’s important to recognise that it’s part of the process. Most traders will probably experience big wins from time to time, or trades that deliver profits much quicker than expected. These are always welcome but probably don’t mean they have some clairvoyant ability to be right all the time. Be grateful for the profits, but at this time it's more important than ever to stick to a trading plan and look for the right criteria when placing a trade. Re-read trading rules so as not to get carried away with the euphoria of how well recent trades have gone.

It's tempting to think about increasing trade sizes and there is nothing wrong with that. As a trader's account grows they will want to take on bigger trades, but they should make sure they do so in line with what is hopefully a conservative approach to risk management, rather than assuming the big wins are going to continue. Most professional traders only risk a small portion of their account on any one trading idea, so if increasing trade sizes, be sure to stick to the risk parameters in your trading plan.

Big wins really shouldn’t be a problem, as long as we don't get carried away in the moment. We should remember that occasional losses are inevitable for all traders – the key is to limit the size of those losses with careful risk management while maximising profitable trades.

Trading tips from successful traders

A book that gets mentioned time and again as a trading classic is “Market Wizards: Interviews with Top Traders” by Jack Schwager. First published in 1989, it’s a collection of conversations with some of America's legendary traders, who made millions from the financial markets. It’s well worth having on your bookshelf.

Here are tips from some of the world’s best traders featured in a book that really stands the test of time:

Find your trading methodology

Traders have different approaches, timescales and can trade across various markets. All successful traders have a methodology to analyse the markets that works for them – from short-term changes in price during the day (day trading) to looking to catch major trends over months and sometimes even years. It is important to find an approach that fits your own “trading personality”. If you do not feel comfortable with a strategy then chances are that it will not be successful for you.

Use risk management strategies

All the traders mentioned the importance of risk control. There are a couple of elements to this. It is important to trade at a size that does not have a material effect on your account if you are wrong. It is also good practice to have a level in mind (or a stop loss placed on your trade). If this level is hit or stop loss triggered, you admit you are wrong and take the loss. Once again, it's that familiar trait, or discipline, that played a major part in their success over the years.

Accept your trading losses

Linked to the risk control aspect is the acceptance of losses. Experienced traders know that taking manageable losses is part of the business of trading, but it is something that many of us struggle with in the beginning. A series of winning trades can easily be wiped out by one loss if you let it go on for too long. The traders interviewed had confidence in their approach of winning over the long term, so did not have a problem with admitting they were wrong and taking losses along the way.

Spend time analysing and understanding the markets

The traders took their market analysis and time devoted to executing and managing trades very seriously, often devoting large chunks of their waking hours to their work on the markets. They weren’t just having a punt now and again or trading on a hunch. There are no shortcuts when it comes to trading success, but the effort they put in was clear from their results.

Waiting for the right trade

Many of the traders interviewed said that patience played a big part – waiting for the right opportunity to come along. This ties in with a quote from another classic trading book: “Reminiscences of a Stock Operator”, written about a legendary trader called Jesse Livermore who was active in the 1920s. He said that it wasn’t his doing that made money, but his sitting on his hands. This applies to waiting for the right opportunity, and then holding the trade to maximise profits. Nearly 100 years later, it’s an approach still used by successful traders and one echoed by the many interviewees in Schwager’s book.

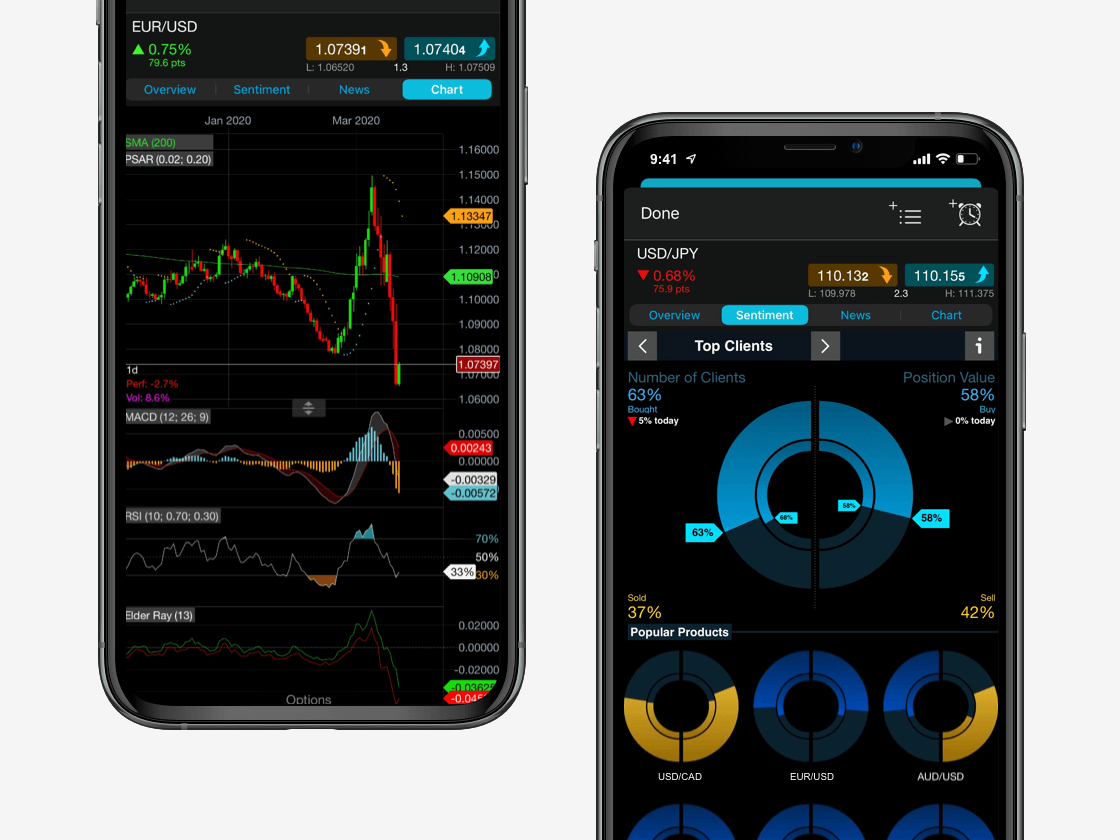

Seamlessly open and close trades, track your progress and set up alerts

How to avoid common mistakes in trading

Watch our video guide to find out which are the most common mistakes and how can you avoid making them.

Create a balance between risk and reward

Studies show that the number one mistake that losing traders make is not getting the balance right between risk and reward. Many let a losing trade continue in the hope that the market will reverse and turn that loss into a profit. The reverse approach is applied to profits too. A lot of traders are only too eager to quickly take a profit as they are worried it will otherwise disappear.

This is of course completely opposite to that well-worn market advice 'let your profits run and take losses quickly.' The maths here is simple enough: if you are, for example, losing £100 on trades that go wrong, and only making £50 on trades that go well, your trading account is probably only going to head in one direction: down.

Before you place a trade you should weigh up the potential profit versus the risk you are willing to take (risk/reward ratio). As a general rule of thumb, you would factor in double the potential profit amount (if not more) you expect to make versus the amount you stand to lose if the price moves in an unexpected direction.

If the trade does not fit those requirements, then the sensible approach is to pass on the trade and wait for a better opportunity to come up where the balance is more in your favour. This takes discipline of course – sadly, another trait that many traders just don’t have.

Practise patience

Patience is another useful trait in trading, but one that many of us will not have in the beginning. With constant access to markets and breaking news and changing prices, there can be a feeling that you need to act at the speed of light. But how many times have you opened a trade and then been disappointed that the market has not immediately taken off in the direction you were expecting?

The reality is that just because you have decided the market needs to move in a certain direction, it rarely means it will start going that way as soon as you place your trade. The market has not been waiting patiently for you to click buy or sell before going on its merry way!

Trades need time to develop, so if you have seen what you think is a good opportunity in the market then place your trade and give the market a chance to prove you right. Stop losses are very important in trading, to help protect against trades that don’t go your way, but don’t place them so close to where you entered that you will be taken out of the trade on just a normal fluctuation in price.

Avoid risking too much capital in a single trade

The third most common mistake is in relation to the financial amount at risk. The sad truth is that most people risk too much on any one trading idea.

If you have, for example, £1000 in an account, then risking £200 on whether the euro is going to bounce is a foolhardy approach by most professional traders' standards. If losing on one trade means a serious percentage of your account will disappear, chances are that the account will not last long.

As conservative as it sounds, most professional traders would advocate only risking around 1-3% of the financial value of your account on any one trading idea. In other words, start conservatively, even though this might be going somewhat against the nature of many aspiring traders.

Build a trading diary

Building a trading diary is easier than ever before. Chances are that you are probably placing your trades on a desktop machine, tablet or smart phone, all of which offer a way for you to make quick notes about why you decided to buy or sell that particular market. Taking a quick screenshot of the trading chart when you placed your trade takes just a couple of clicks. All of this information will be very useful when you finally sit down to review what you have done and will help you see if there is any way of improving your future strategies.

Evaluate winning as well as losing trades

Assuming you are doing this as you go along, you need to commit to making some time to sit down and go back through your trades. Ideally this should be done away from the excitement and gyrations of the market, so weekends can be a good idea. Make notes about winning as well as losing trades. If you were faced with the same market today, what, if anything, would you do differently? Is there a common mistake that is cropping up time and again that you need to focus on to avoid this in the future?

Study your trading charts

There are some mistakes that many of us repeatedly tend to make when we first start trading – and you may be able to spot these in some of your own trades. A common mistake, and temptation, is to go against major trends. It is human nature to try and pick tops and bottoms in the markets, but this is not a consistently profitable approach. Printing out charts when you place trades can make this tendency easy to spot when you go and do your review. It lets you know what you should be aware of in your future trading. Forewarned is fore armed!

Think about where you are placing your stop-loss orders

Setting very tight stop losses is a popular mistake for many. No one likes losing money but sometimes, placing a stop loss too close to your entry point is self-defeating as you are not giving the market enough time to prove you right. Would the trade have worked better if it had a bit more breathing room? Regular reviews will help you pick up on small tweaks like this that could be made to your strategy and could end up making all the difference between whether you win or lose trades.