A limit order is an instruction to your broker to carry out a trade in the financial markets at a specified price that is more favourable than the current price. It is often used as an alternative to a market order in times of market instability or volatility, when a market order cannot guarantee you the optimal price on a trade. However, this is dependent on the asset reaching a specified price. If it doesn’t, it may lead to a missed trading opportunity.

Limit orders

Limit orders are a type of execution tool that trigger a buy or sell trade at a specified price that is above or below the current market price. This is often within a set time period. There are two main types of limit order: buy and sell limit orders, which execute trades at different prices.

Limit orders are effective at controlling the prices that you trade. These can be used alongside stop-loss orders in order to prevent losses as much as possible. Limit orders can be used on our online trading platform, Next Generation, where you can specify exactly how much you are willing to buy and sell an asset for. Although this price is guaranteed, the actual filling of the position is not, so read on to discover more about limit orders in trading.

What is a limit order?

How does an order limit work on our platform?

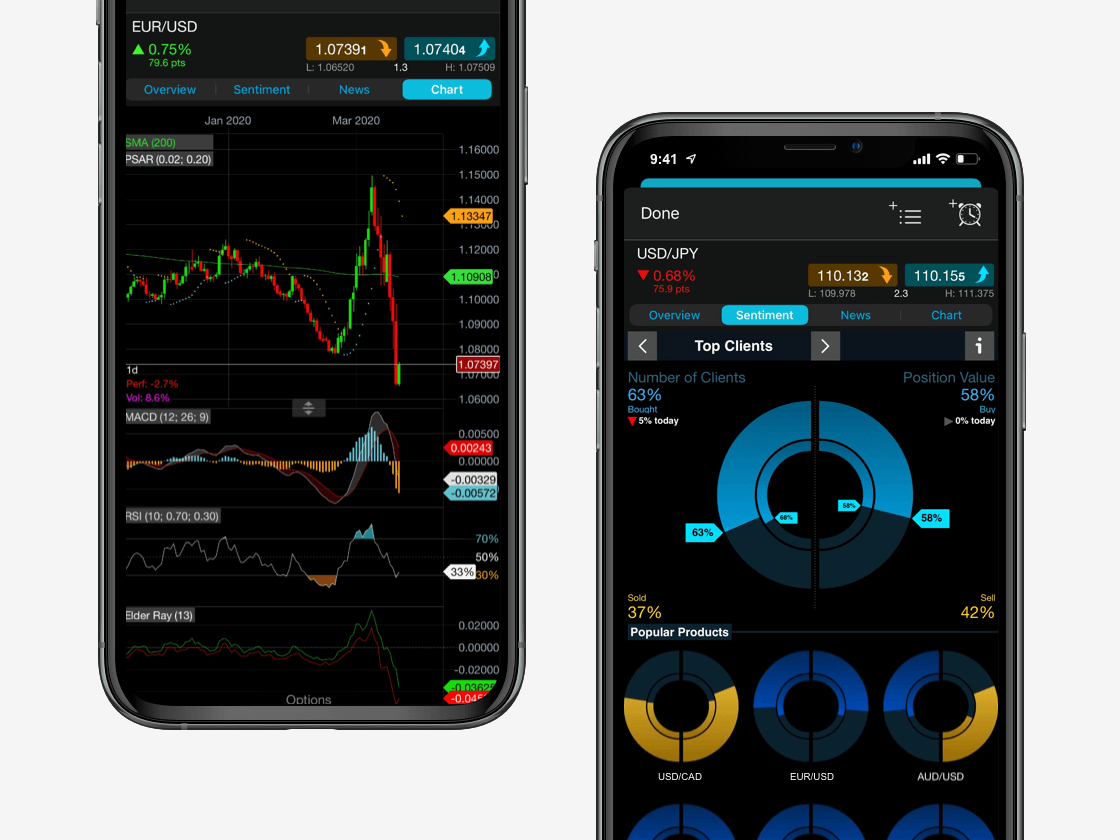

Watch the video below to find out how to place market, limit and stop-entry orders on our award-winning* trading platform. You can place a limit order anywhere on the platform by clicking on the buy or sell price, whether this be from a watchlist, trading chart or even open positions that you already have.

We offer spread bets and CFDs on a range of financial markets, including shares, indices, forex and commodities. When placing a limit order, you can specify how much per point (spread betting) or how many units (CFDs) you would like to buy or sell.

Please note that any examples used throughout this article reflect our derivative trading products and these do not require you to take direct ownership of the asset.

Buy limit order

A buy limit order can only be executed at or below the specified limit price. By using a buy limit order, you are guaranteed to pay the price that you specified or less. To set a buy limit order, simply open the trading chart for your chosen instrument and click on the blue ‘Buy’ button. Here, you are able to change the type of order, order duration and also add stop-loss and take-profit orders to your trades if needed.

One risk that comes with setting a buy limit order is that the filling of the position is dependant on the asset reaching the desired price that you enter. If the asset does not lower to the price that you specify before the date and time of expiry, then the trade will not be executed and you could miss out on potential success.

Sell limit order

A sell limit order can only be executed at or above the specified limit price. By using a sell limit order, you are guaranteed to receive the price that you specified or more. However, in the same way as a buy limit order, this all depends on whether the price rises to your specified amount. If it does not reach the desired price, then the trade will not be executed. To set a sell limit order, follow the same steps as above using the orange ‘Sell’ button.

Limit order examples

Buy limit order example

Let’s say that there has been a positive earnings report for the electric car company Tesla and you want to buy and hold Tesla shares, as you believe its value will go up in the long-term.

You plan to buy Tesla stock for £840 but the current market price is £850, so you could set a limit order on our Tesla price chart for the maximum price that you are willing to pay. If the share price reaches £840, your order would then be filled.

Sell limit order example

Let’s say that there is volatility within the oil market and you want to short sell Brent Crude Oil, as you believe its value will go down in the short-term.

You plan to sell Brent Crude Oil for £57 but the current market price is £50, so you could set a limit order on our Brent Crude Oil price chart for the minimum price that you are willing to sell for. If the price reaches £57, your order would then be filled.

How long is a limit order good for?

When you set limit orders on our platform, you can choose the order duration, which falls under two categories:

- Good ‘til cancelled (GTC) – the order will remain open until you cancel it manually or it has been filled at the specified price

- Good ‘til date (GTD) – you can choose a specific expiry date that the order will close by if it has not been filled

Of course, there is no guarantee that buy or sell limit orders will be filled, as your desired price may never be reached. In this case, your order will either remain open until the price matches or you may cancel the order early.

Market order vs limit order

The main difference between a market order and a limit order is the specification of price. A market order is an order to buy or sell a security immediately at any given price, whereas a limit order specifies the minimum and maximum prices that a trader is willing to buy or sell an asset for.

Therefore, limit orders aim to secure the position around your budget, while a market order is more focused on opening a position as quickly as possible.

Stop order vs limit order

The main difference between a stop order and a limit order is the guarantee that the order will be filled at the exact price specified. Whereas limit orders always aim to fill at the best available price, stop orders can be affected by market conditions such as gapping or slippage on a price chart between trading days. This can result in losses if trades are executed at a different price to the stop price.

In order to avoid executing trades at an unexpectedly lower or higher price, there is also the option to choose a guaranteed stop-loss. This works in the same way, except that for a premium fee, it guarantees to close the position at the exact price specified, regardless of market volatility or gapping.

What is a stop-entry order?

A stop-entry order is similar to a limit order in that it allows you to enter a transaction at a selected target price. A stop-entry order to buy is an order at a price above the prevailing market price, and a stop-entry order to sell is an order at a price below the prevailing market price.

However, stop-entry orders are mainly used when market value appears to be declining, and these can only be executed when the price becomes less favourable for your chosen asset. This is primarily to capture momentum at the start of a new trend. As always, there is the risk of executing a trade outside of your price specifications, which be managed using our advanced platform features.

- Do you want to practise setting up limit orders before committing to an actual trade? Open a demo account now to trade risk-free with virtual funds.

- Alternatively, open a live account if you are ready to spread bet or trade CFDs on the financial markets.

Explore our boundary trading tools for risk management

Our Next Generation trading platform contains boundary trading tools that help to control slippage in volatile markets by specifying a price range in the order ticket. If the price at execution is outside the specified range, then the order will be rejected. Boundary orders are available for all market and stop-entry orders, so learn more by watching the video below.

In order to monitor your positions for any changes within the market, you can also set up push notifications for desktop and mobile for all order types on our platform. Read about our trading alerts to find out more information on how to activate limit order and stop-entry notifications on your account.

Seamlessly open and close trades, track your progress and set up alerts

*No1 Web-Based Platform, ForexBrokers.com Awards 2020; Best Telephone & Best Email Customer Service, based on highest user satisfaction among spread betters, CFD & FX traders, Investment Trends 2020 UK Leverage Trading Report; Best Platform Features & Best Mobile/Tablet App, Investment Trends 2019 UK Leverage Trading Report.