Simply put, a market order is a buy or sell order for a financial asset at its prevailing price. It is well suited to high volume trades in particular, as it is considered to be the fastest type of order. A trader will usually place a market order if they are happy to pay the immediate bid or ask price for their chosen security.

Market orders: how they work and when to use them

Market orders are a type of execution tool that allows traders to place a buy or sell order for a financial instrument. This will execute the trade immediately at the available market price. Market orders are the simplest order type, and as long as there are enough buyers and sellers at the time, the order is guaranteed to be filled. Read on to discover when to use market orders, how to place them and watch our video below to get started.

What is a market order?

When should I use a market order?

Traders often choose to use a market order when they are prioritising the speed of placing a trade over price. Traders that want to execute a trade immediately and who have more leeway for the executed price may prefer market orders over limit orders, which are more focused on executing the trade at a specific price but take time to execute as the market needs to reach that price.

Market orders could be used in the following situations:

- When the goal is to execute the trade immediately (for example, when trading on news or earning releases).

- When you’re trading a smaller spread bet stake size or number of CFD units.

- You’re trading in a highly liquid market and your asset has a narrow spread.

You may opt for a market order when short-term trading. For example, scalpers, high-frequency traders and day traders often use market orders as their aim is to enter and exit the market as quickly as possible, making a profit from small price fluctuations. If these types of traders were to instead place a limit order, they would not likely be able to fill as many transactions throughout the day, as the order price may never be met.

What does it mean when a market order is not filled?

When a market order is not filled, this is usually because the market is less liquid or there is a lesser volume of assets than normal. For a market order to be filled, there needs to be a willing buyer and seller on both ends.

For example, if you place a large market order for a particularly low-volume share, such as a penny stock, there may not be enough shares available at the current price. This means that your order won’t be filled, and you will have to wait until there is more liquidity within the share market to re-submit your order.

A market order may also not be filled due to volatile or unstable conditions of the market. For example, if there is a large jump or drop in an asset’s price, sometimes the market will halt. When this period of volatility is over and market conditions are more stable, you may then place a market order once again, as the previous would not have been filled.

How to place a market order

To place a market order on our Next Generation trading platform, simply follow the below steps:

- Register for an account. This will automatically grant you access to our free demo account, where you can trade without risks using virtual funds.

- Explore our product library. We offer spread bets and CFDs on over 10,000 financial instruments, including forex, shares and indices. Choose the asset that you want to trade.

- Open the trading chart for your chosen asset. Then, click on the buy and sell boxes in the right-hand corner of the screen. This will bring up an order ticket.

- Enter your stake size (if spread betting) or number of units (if trading CFDs). From the list of order types, select ‘Market’.

- Add risk-management controls to avoid losses. You can set regular, trailing or guaranteed stop-loss orders, as well as boundary levels, so that you don’t get caught out by slippage or gapping on price charts.

- Make sure you understand associated costs. The ticket automatically calculates estimated margin costs, as well as spreads and potential overnight fees. Read more about our trading costs.

Market order example

Let’s say that you want to spread bet on shares of the fictional company XYZ.

Buy price = $35

Sell price = $32

You decide to place a market order for 100 shares. If it is a high-volume stock, then all 100 should be filled at the ask price of $35 per share, meaning that you will pay $3,500 for the order. However, if it is a stock with a lower volume or liquidity level, then you aren’t guaranteed that all 100 will execute at this price. Perhaps the first 50 may execute at $35 but then the next best ask price is at $38 for the remaining 50, meaning that you will pay a slightly higher amount for the whole trade.

For this reason, some traders prefer to use limit orders instead, so that there is no slippage between the price specified on the chart and the price at which the trade is executed.

Market order vs limit order: what are the differences?

A limit order is a type of execution tool that allows traders to specify their price limits, rather than executing the trade at any available price. The main differences between these two order types revolve around the price of an asset and the timeline of the trade.

| Market order | Limit order |

|---|---|

| Trade is executed as quick as possible after placing the buy or sell order. | Trade will only be executed when the price limit is reached, otherwise it will remain unfilled. |

| Orders can rarely be cancelled as they are usually filled almost immediately; only if they have not yet been executed due to a lack of liquidity in the market. | Orders can be cancelled at any point before fill. |

| Stop-loss and take-profit orders can be added. | Stop-loss and take-profit orders can be added. |

| No limits on price, meaning that a trade may be executed at a slightly higher or lower price than expected if there is slippage on the chart. | Traders must specify a buy or sell price limit that the order cannot overstep, even in periods of volatility. |

| Trade is executed almost immediately at the date and time of placement. | Traders can specify an expiry date for the order to close by if it has not yet been filled, or they can close them manually. |

Read more about limit orders.

Do market orders get filled before limit orders?

Market orders usually get filled before limit orders, as long as there are enough buyers and sellers. This is because automated execution means that buy and sell orders get filled at the next available price, without the need to worry about price limits or boundaries.

What are the risks of market orders?

- Traders have less control of price.

- If the market is illiquid, this can lead to trades being executed at a higher or lower price than intended.

- Placing market orders for instruments with a wider bid-ask spread comes with a higher risk of loss.

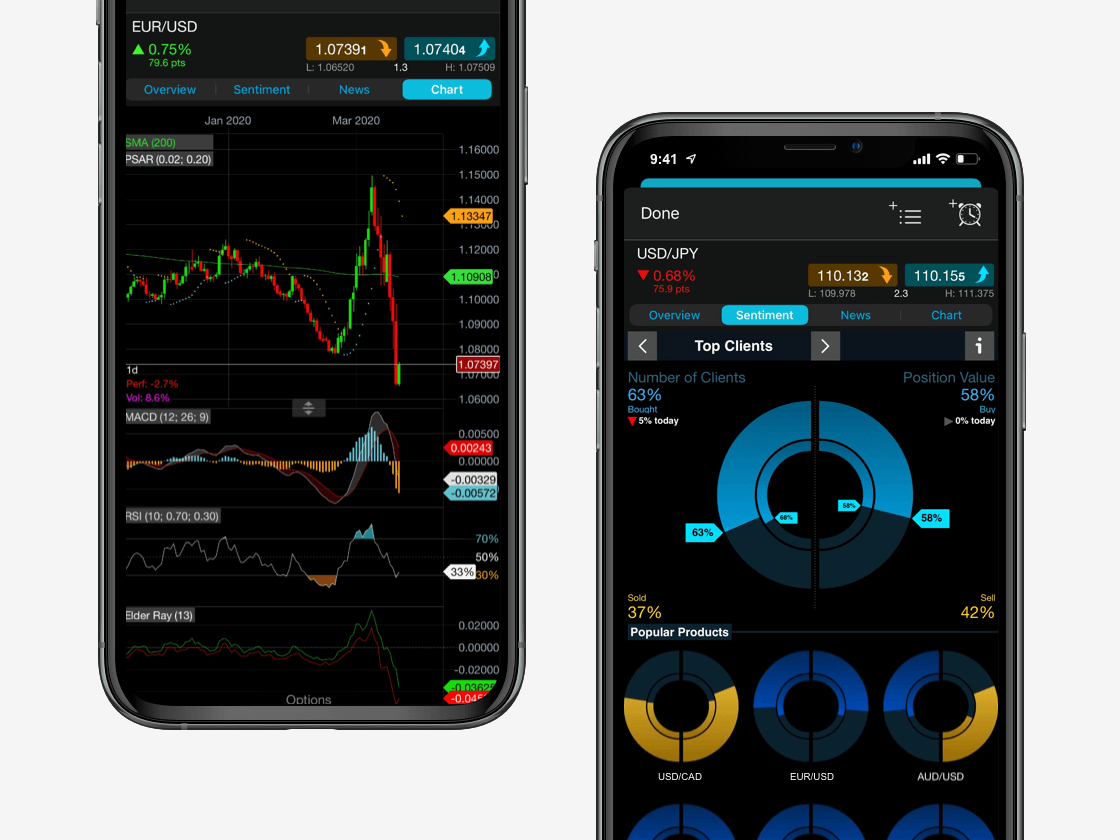

Seamlessly open and close trades, track your progress and set up alerts

Summary

In conclusion, market orders are an effective execution tool if you want to place a quick trade, regardless of price. However, you may wish to consider risk-management tools such as stop-loss orders when placing a buy or sell market order. Security prices such as stocks and currency pairs can be volatile and often jump or drop suddenly on a price chart, which could mean that your trade is executed at a very different price to what you originally thought.

FAQ

Can you add stop-losses to market orders?

You can add stop-loss orders to market orders, including regular, trailing and guaranteed stop-losses. Learn about the different types of stop-loss order that you can use to help prevent capital loss.

Are market orders better than limit orders?

Whether you should use a market or limit order for your trade depends on your overall strategy. Market orders are more effective for immediate trades, whereas limit orders are more effective at protecting your capital and only placing a buy or sell order at your specified price. Read more about limit orders.

How do I get notifications for market orders?

You can register for notifications on your mobile, tablet and desktop devices for when market orders and other execution types are triggered in your account. Discover how to set up our trading alerts platform feature.

Can I place market orders before the market opens?

You can technically place orders before certain markets open, in what is known as pre-market sessions. However, these will not be executed until your chosen financial market has opened and this may also come with delays, increasing the chance of gapping or slippage on price charts. You should therefore ensure that you add risk-management controls to your positions.