Dave Mazza, Chief Strategy Officer at Roundhill Investments, discusses what drove Meta’s record market cap gains following its Q4 results. He praises the results of the company’s ‘year of efficiency’, and highlights why AI is a key consideration for all the ‘magnificent seven’ companies.

On 2 February, Meta Platforms [META] posted the largest single-session market value addition in stock market history, gaining 20.3% and adding $197bn to its market cap, the day after it posted Q4 earnings that surpassed market expectations on all fronts.

Breaking down the factors behind the surge, Mazza explained to OPTO Sessions that “the company saw an increase on everything, from daily active users (DAUs) to monthly users (MAUs), translating into pretty robust revenue, and then stronger targets — even as they’re spending a significant amount of money”.

In December, Facebook’s DAUs increased 6% year-over-year, while its MAUs increased 3% year-over-year. Across Meta’s ‘Family of Apps’, daily active people increased 8% year-over-year, while monthly active people increased 6% year-over-year.

Meta’s quarterly revenue increased 25% year-over-year, driven by a 21% increase in ad impressions and a 2% rise in average cost per ad. Meanwhile, its quarterly costs fell 8%. Quarterly income from operations rose by 156% year-over-year and lifted its operating margin from 20% to 41%.

Efficiency Pays Dividends

Meta’s annual revenue increased 16% year-over-year, and its full-year operating margin rose from 25% to 35%. This, in particular, impressed Mazza.

“Their margin growth was incredible,” says Mazza. “It’s now at 35%, after being relatively modest.”

Mazza attributes this to Meta’s ‘year of efficiency’ beginning to pay off. Since Q3 2022, Meta has cut approximately 21,000 jobs in an effort to flatten its structure and make its delivery teams leaner, enabling it to redeploy resources towards the development of artificial intelligence (AI) products.

This strategy, despite attracting criticism, is now paying dividends — literally, with Meta having announced its first-ever pay-out of $0.50 per share following its bumper earnings report.

Meta’s projections for the next quarter offered yet more encouragement for investors. Bloomberg reports that a consensus of estimates had analysts hoping for $33.6bn; Meta’s guidance of $34.5–$37bn comfortably tops this at the low end.

AI is Now

Having cut costs in order to invest in AI, it follows that the success of this investment is important to both Meta’s management and its investors.

“ There are themes that are going to happen 10 years in the future, but it’s worth buying it now,” says Mazza. By contrast, he says, “AI is here now.

“It’s being used by consumers. It’s being used at the enterprise level. And the reason is because it helps with efficiency.”

AI, he continues, is viewed by businesses investing in it, such as Meta, as the next driver of new growth. “The integration of — particularly generative — AI into products and services is exciting,” he says.

As such, all the magnificent seven stocks are seeking to adopt AI technology in order to safeguard their future growth.

“Even Apple [AAPL] teased out what they're building,” said Mazza, referencing CEO Tim Cook’s comments, following Apple’s earnings for the quarter ended 30 December, that the company may release generative AI features for its software later this year.

He views this foray into the AI scene as an interesting divergence from Apple’s previous trajectory. Until now, “they’ve been kind of left out, they haven’t spoken much about AI”.

MAGS Leaders

Roundhill’s Magnificent Seven ETF [MAGS] is dedicated to the magnificent seven stocks. The fund is approximately equal-weighted and rebalances every quarter: this, Mazza previously told OPTO, effectively forces investors to “sell high and buy low”.

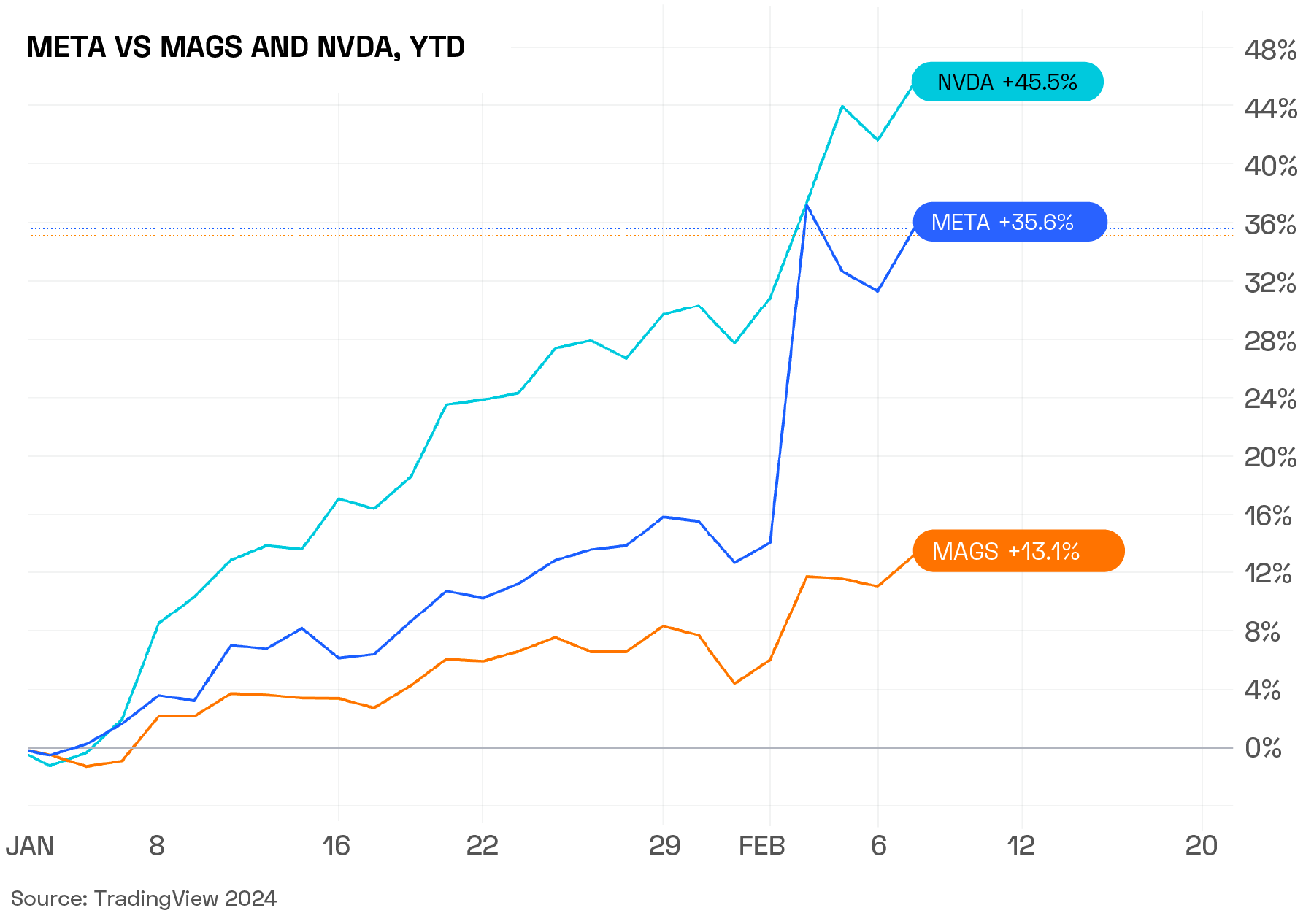

Meta’s share price gains since the last rebalancing make it the fund’s second-largest holding as of 7 February, with a 17.1% weighting. This underscores the fact that, despite accruing the largest single-day market cap gain in stock market history, Meta’s stock has trailed that of MAGS’ top-holding Nvidia [NVDA]. The chipmaker has rallied 45.5% year-to-date, while Meta has gained 35.6%. Over the same period, MAGS has gained 13.1%.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy