Every day, we handpick the 5 Top Stories stock market investors need to know. In 5 minutes, you’ll learn the stocks, CEOs, and money managers moving markets.

Nintendo Switches Up Guidance

The Kyoto-based company [7974:T] has upped its Switch sales forecast from 15 million to 15.5 million for the fiscal year ending March after its quarterly operating profit of ¥184.5bn beat expectations. Nintendo also increased its revenue, operating profit and net income guidance. The firm’s stock hit an all-time high earlier this year, buoyed by the launch of The Legend of Zelda: Tears of the Kingdom. But according to a note from Goldman Sachs analyst Minami Munakata, “the share price looks overvalued”.

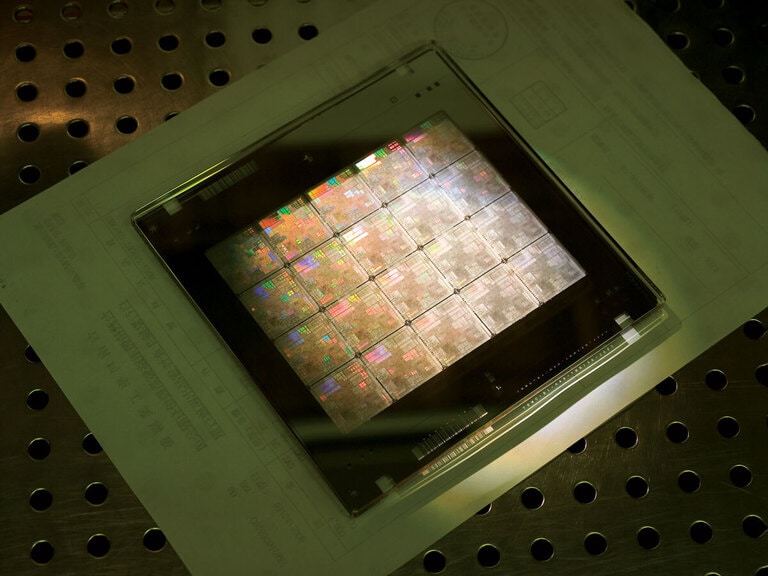

Dream Team: Nvidia and Cisco

Nvidia [NVDA] and Cisco Systems [CSCO] announced Tuesday they are to partner to help businesses build in-house artificial intelligence (AI) infrastructure; Cisco will offer its own networking equipment alongside Nvidia’s software, AI models and development tools. “Working closely with Cisco, we’re making it easier than ever for enterprises to obtain the infrastructure they need to benefit from AI, the most powerful technology force of our lifetime,” Nvidia CEO Jensen Huang said in a statement.

Novartis €2.7bn Acquisition

Pharma behemoth Novartis [NVS] has announced it is to buy German biotech MorphoSys [MOR] for €2.7bn. MorphoSys is working on a treatment for a rare bone-marrow cancer. Novartis will offer shareholders €68 per share and take the firm private; the MorphoSys share price jumped more than 40% on the news. Novartis’ M&A strategy currently involves focusing on fewer therapeutic areas.

Mixed Outlook for Palantir

Shares in the enterprise software company [PLTR] popped 13% in extended-hours trading after its Q4 earnings report on Monday. US commercial revenue during the quarter was up 70% year-over-year to $131m, while the firm’s customer base rose 55% to 221. Nevertheless, Palantir expects the coming quarter to be quieter, with sales of between $612m and $616m, less than analyst expectations of $617.4m.

VinFast EV Recall

The Vietnamese electric vehicle maker [VFS] announced Tuesday that it is recalling almost 6,000 of its VF 5 models manufactured between March and December last year. The issue is due to a faulty combination switch, although the firm was at pains to point out that the error had been registered on only one vehicle, with no incidents reported. VinFast made its Nasdaq debut last year.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy