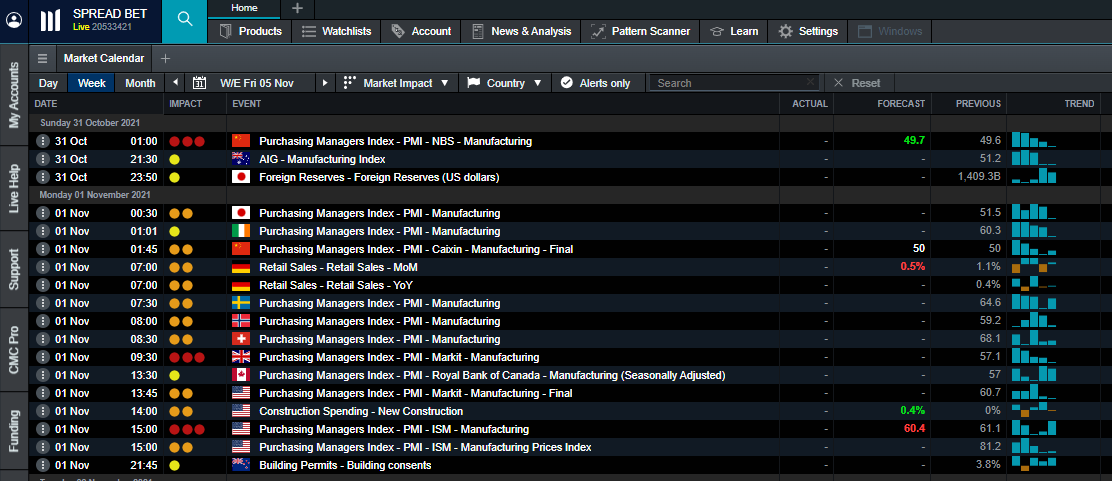

The forex economic calendar covers close to 4,000 macroeconomic events, also incorporating central bank meetings and important speeches, to offer a complete picture of the world’s important economic announcements. These include the closely-watched US non-farm payrolls release, CPI and PPI data, plus manufacturing figures from major economies including the US, UK, eurozone, China and Japan. You can also obtain at-a-glance information on major announcements for economies such as India and New Zealand.

The customisable nature of the calendar allows you to sort events by date, country, timeframe, category or its likely impact on the market. Each event is categorised into high, medium and low impact levels, based on five years’ worth of back-testing and historical price data. These distinctions help you to determine which announcements are likely to have the most impact on the financial markets.

You are also able to drill down into a specific country and access charts for data such as interest rates and GDP, and compare these with the same data from other countries.

Ultimately, you can set up the calendar to suit your preferences and trading strategy – you could choose to view only the events that are relevant to a specific instrument (EUR/USD or UK 100), or by the particular asset class (forex, indices, shares, commodities or treasuries) that you wish to trade.