Most traded currency pairs

The most traded currencies in the world come from multiple continents and they belong to some of the strongest economies. These include major forex pairs, as well as "safe haven" currencies and those with historically stable trade links. This article is a guide to five of the most traded currency pairs on our platform.

The foreign exchange market is the largest and most liquid market in the world. It offers exchanges between any two nation’s currencies and includes major, minor and exotic currencies. The result is a market that offers hundreds of possible currency pairs to trade.

The forex market is open 24 hours a day, from Sunday evening until Friday night, which takes advantage of the international time zone differences of London, Tokyo and New York. This allows currency traders to open and close positions at any time throughout the day without the time restrictions that exist in other markets, therefore forex market hours are considered more flexible.

Forex trading is available through spread betting or CFD trading, both of which are leveraged products. This means that while there is a chance of maximising profits, there is an equal chance of losses, as traders are only required to place a percentage of the full trade value, known as a margin requirement. This article is a guide to some of the most popular forex pairs to trade right now.

What are currency pairs?

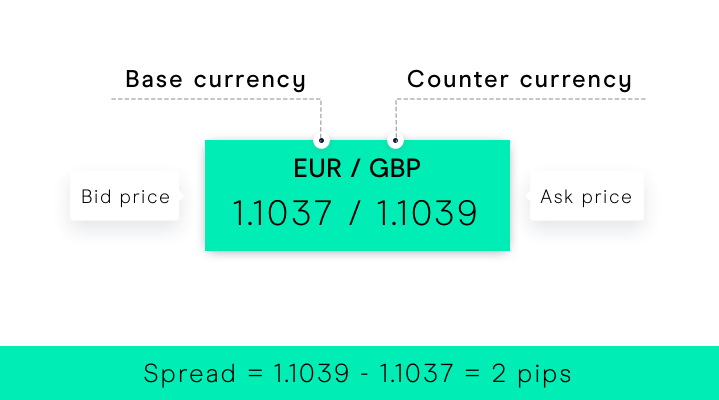

Currency pairs measure the value of one currency against another. They are split into a base currency and a secondary quote currency. An example is perhaps the most popularly traded currency pair in the world, the EUR/USD, where its price represents how much of the quote currency, the US dollar, is required to buy one unit of the base currency, the Euro.

Each currency pair has a bid and ask price. The bid price is defined as the maximum price a buyer is willing to pay for the currency, the ask price is defined as the minimum price a seller would be willing to accept the currency for, and the bid-ask spread represents the difference in pricing between the two currencies. In some cases, forex traders prefer to trade on currency pairs with a lower or tighter spread as it reduces the overall costs involved in the trade. However, some traders prefer to trade on volatile currency pairs with wider spreads and lower liquidity in an attempt to profit from the fluctuating gaps in price.

Most popular forex pairs for beginners

The United States dollar (USD) is the most commonly traded currency in the world, and therefore most major forex pairs include the USD as the base or quote currency. When combined with other currencies from some of the world’s biggest economies, including China, Japan and the United Kingdom, these are seen as major crosses.

Major forex pairs are particularly attractive to traders as they signify the most prosperous and stable economies across the globe, and traders are able to take advantage of their low spreads that accurately represent market value. Major forex pairs are often the most traded currencies amongst beginners.

Top currency pairs to trade

At CMC Markets, we offer both spread betting and CFD trading opportunities for over 300 forex pairs, including all major crosses. Please note that spread bets are only available for clients based in the UK and Ireland. Below is a list of five of the most traded currency pairs in the world, which is organised according to current economic data, spreads and margin rates from our platform.

Join a trading community committed to your success

USD/JPY

“The Gopher” is a combination of the US dollar and the Japanese yen. It is one of the most popular forex pairs in the world due to the prominence of the JPY throughout Asia and the USD worldwide. It boasts a high liquidity, meaning that traders can buy and sell the currency pair in large volumes without the price fluctuating too much in its exchange rate. It also has one of the tightest spreads in the forex market, reducing the overall costs of the trade.

- Minimum spread: 0.7 points

- Margin rate: 3.3%

EUR/USD

“The Fiber” is a combination of the Euro and the US dollar. This is generally considered the most traded currency pair as it stems from two of the world’s largest and most reputable economies. Similar to the USD/JPY, this currency pair is associated with very low spreads, high liquidity and the ability to place large volumes of trade. This combination can be seen as one of the best currency pairs for forex scalping, as the markets are mostly stable throughout the year, therefore, it is perhaps one of the most profitable currency pairs in terms of smaller and more frequent earnings.

- Minimum spread: 0.7 points

- Margin rate: 3.3%

GBP/USD

“The Cable” is a combination of the British pound sterling and the US dollar. This is seen as a particularly volatile currency pair, due to its frequent fluctuations in price, exchange rate and pip movements. This can result in large profits if the trader is successful, however, it can result in equally great losses when market volatility is at a high. The GBP/USD is particularly favoured by day traders, who aim to take advantage of price fluctuations by dipping in and out of the market at a quick and precise pace. For this reason, it is also one of the best forex pairs for swing trading, another short-term forex strategy. It is recommended that those who trade this volatile currency pair strengthen their knowledge of technical analysis of the market before opening any positions.

- Minimum spread: 0.9 points

- Margin rate: 3.3%

EUR/GBP

“The Chunnel” is a combination of the Euro and the British pound sterling, a play on words for the Channel Tunnel that connects both continents. This currency pair is typically seen as very strong, given the proximity of regions and their solid history of trade. Given the situation of Brexit on the economy, the forex pair has become more volatile in recent years, which can be very attractive for skilled traders. The exchange rate also relies on changes to interest rates which are announced by regional banks, therefore, one currency can suddenly strengthen against the other, making the pair much more volatile. This also applies to the other currency pairs on this list.

- Minimum spread: 1.1 points

- Margin rate: 3.3%

USD/CHF

“The Swissie” is a combination of the US dollar and the Swiss franc. For many years, the financial stability of Switzerland has been used as a ‘safe haven’ for investors of the forex market, who will rely on trading the CHF in times of market volatility. Therefore, this is a popular forex pair for traders when the economic or political situation of a region is uncertain. As the value of the CHF strengthens against the USD due to increasing investment, the price of this currency pair starts to drop. Although it is one of the most stable currency pairs to trade and therefore offers many benefits. However, when the markets are in a more stable position, the USD/CHF may be of less interest to traders who opt for other major currency pairs that are featured on this list.

- Minimum spread: 2.5 points

- Margin rate: 3.3%

To see a full list of currency pairs that we offer, along with their minimum spreads and margin rates, visit our page on forex trading.

Explore the most popular forex pairs with CMC Markets

- Open a live account to start trading straight away or practice first with virtual funds on our demo trading account.

- Choose which currency pair you would like to trade, either from our most traded currency pairs list or a more exotic pair.

- Keep up to date with our news and analysis section of the website, which can provide insight and predictions into future movements in the forex market.

- Remember that the forex market can be volatile and trading with leverage can greatly increase the chance of losses for traders. Therefore, we advise you to consult our risk management section and familiarise yourself with stop-loss measures as part of an effective trading strategy.

Summary

We offer the highest number of forex pairs to trade in the industry, with over 300 currency pairs available on our platform, so the forex market is full of opportunity for traders worldwide. Whether you are trading minor, exotic or the most traded currencies, there is a forex trading strategy to suit every personality and trading style in order to make the most of market liquidity.

Powerful trading on the go

Seamlessly open and close trades, track your progress and set up alerts