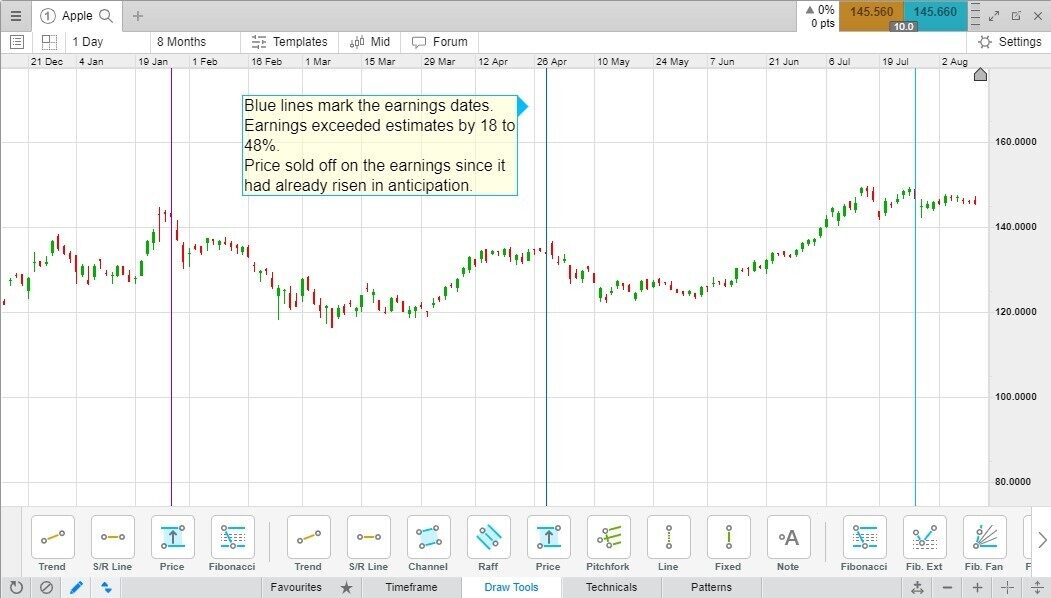

‘Buy the rumour, sell the news’ is a well-worn expression, and in the context of trading, it means that if good news is expected sometime in the future, the price will often move higher in anticipation of that date, but not necessarily after.

Market pricing tends to move in anticipation of something happening – the rumour. By the time the event happens, most people who want to own the stock or currency already do. This means that when the event occurs, there is no one left to buy and keep pushing the price up. This leads people to sell, trying to cash in their profit.

In the same way, if positive news comes out and a stock or other asset drops on the news, traders will say, “the information was already baked in”. What they are referring to is the fact that the price rise happened before the news, so the price of the asset already reflects the impact of that good news.