LINKS TO THIS EPISODE:

AI took centre stage in 2023, dominating headlines after the launch of ChatGPT and other large language models. Investors gearing up for the next wave must grasp the technology’s transformative potential, impact on costs and employment, and market dynamics.

Artificial intelligence (AI) dominated headlines in 2023, with public interest surging on the launch of ChatGPT and other large language models. Next year, investors looking to harness the potential of the technology need to understand the extent to which it will change daily life, as various OPTO Sessions guests have detailed.

Race to Zero

People and governments are underestimating the rate of AI development, and the scale of its impact on employment and the economy, according to Jeff Booth, technology leader and author of The Price of Tomorrow: Why Deflation is Key to an Abundant Future.

In Booth’s view, human intelligence is just error correction. “Human intelligence is being moved into computers at a very fast rate and at some point is going to merge”, he told OPTO Sessions. “You can see some of the productivity gains applied to work today in the digital realm. It’s behind the scenes in most things you do, removing labour at a crazy rate.” He believes that AI technology has reached a point where it can correct errors better and faster than humans can.

Those who are able to fully leverage AI will see the most gains.

“The people who use AI are gaining most of the value, whether you’re a business or super user, from prices falling. Other people who aren’t using it are going to zero because they’re not on the leading edge. In the short term, everyone should learn these tools as fast as they can — you’ll win more of the economic energy by doing so.”

Established Market Leaders

The potential for future expansion in AI is considerable, Jens Nordvig, Co-Founder and CEO of MarketReader, told OPTO Sessions earlier this year. “I don’t think there is any doubt that the AI market is going to continue to grow tremendously.”

Current market leaders have a considerable moat. “Nvidia [NVDA] is the company that has put AI on the radar of everyone involved in the stock market,” Nordvig said. Despite being so large, Nvidia continues to exhibit explosive growth. Key to the company’s future is whether that trend proves sustainable, as well as whether there is the potential for competition to emerge.

Referring to the removal and reinstatement of OpenAI CEO Sam Altman, Nordvig said that “the whole debacle we saw in OpenAI is, I think, related to competition… Some of the leadership within OpenAI had ideas about producing chips on their own. Because the real bottleneck now in terms of training systems, using these incredibly large data sets, has to do with sheer processing power.” Given there is a shortage of such chips, Nvidia can charge whatever they like for them.

While the sector may be at an “inflection point where lots of players will try to come in and grab market share”, it is difficult to quickly enter the market due to the challenges of chip production at scale.

“I think it’s very hard to say that the clear market leader in this space is an overvalued stock,” he said. “But we can have a discussion about whether the valuation is extreme, and how long the growth will continue. If they continue to grow for a couple of years at this pace, this is not an expensive stock. It’s just a matter of how long you think they can maintain that leadership position.”

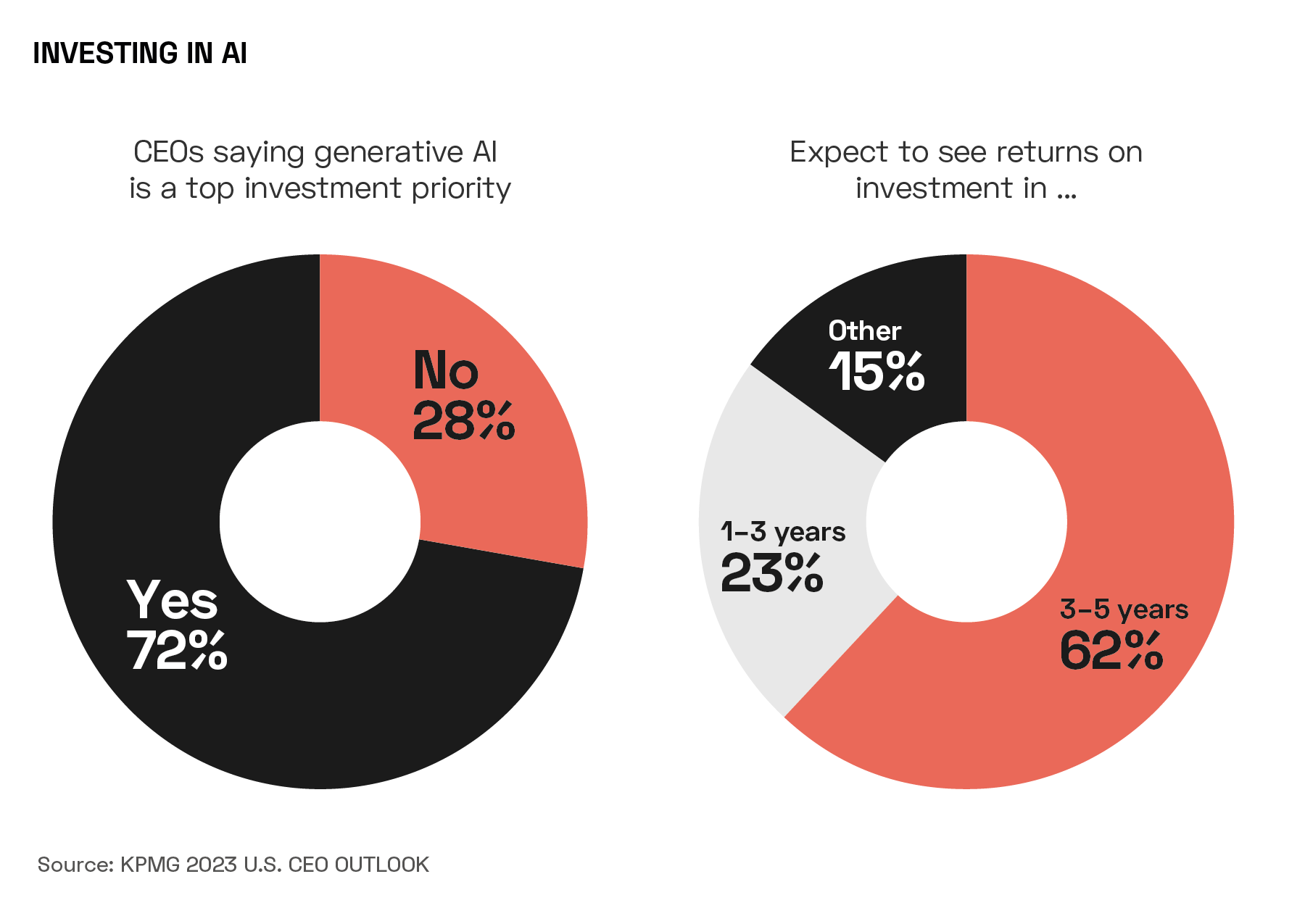

Key Investment Focus

“All kinds of large corporations that we speak to have AI as a key investment focus,” according to Nordvig. “But it’s going to be a multi-year process; it’s not something that is over in the next couple of quarters. A lot of people are experimenting, ramping up. And when they find a fit in the area, they’re going to say, ‘Okay, now we’re going to be aggressive.’”

While large corporations like Alphabet [GOOGL], OpenAI, Microsoft [MSFT] and Amazon [AMZN] invest heavily in AI training, many others are still in the experimentation phase. “The big investments are going to come once the initial results of the experimentation have come through.”

However, AI’s impact has been concentrated in large corporations, as they have access to huge amounts of data and can outcompete companies without such capacity or datasets.

“The barrier to entry that the leaders in the AI space have is this access to incredible amounts of data that other people would have to buy. They have it for free. That means the profits these companies can generate have a kind of protection that an industrial company, a chemical company, a car manufacturer in the traditional sense will not have. It’s hard to say that the leadership that they have now is going to evaporate when they get more competition. It is actually harder to compete with them as opposed to traditional companies in traditional industries.”

Wider Macro-economic Factors at Play

Nordvig doesn’t expect AI to be the dominant force affecting economic growth. Factors such as the effects of the Covid-19 pandemic, China’s “severe structural challenge” and interest rates will also play a role.

While AI is expected to boost productivity in the coming years, he believes it is unlikely to reach levels tech stocks saw in the mid-1990s, potentially settling at 1.5%, up from 1% today. “The cyclical forces can dominate in the short term even if there’s a structural shift that goes in the other direction.”

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy