Jens Nordvig, Co-Founder and CEO of MarketReader, returns to OPTO Sessions to discuss AI, the potential of a bubble in the space, and its impact on the equity market. He also discusses policymakers’ responses to inflation.

LINKS TO THE INTERVIEW:

Jens Nordvig is Co-Founder and CEO of MarketReader, a platform that uses artificial intelligence (AI) to empower investors to understand why the market is moving, by correlating economic shifts to geopolitical events. He is also the Founder and CEO of Exante data, which develops proprietary data and analytical solutions for investors.

Prior to this, Nordvig was the Head of Fixed Income Research at Nomura, and Senior Investment Associate at Bridgewater Associates. He holds a master’s degree in economics from Aarhus University and a PhD in economics from the University of Southern Denmark.

“I don’t think that there’s any doubt that the AI market overall is going to continue to grow tremendously,” Nordvig says. MarketReader uses AI in “a very practical way. We’ve generated a system where we can explain why markets are moving in real time. We get that type of insight in front of users in a way that has not been seen before.

“We couldn’t do that without AI. Even just the presentation aspect of using language rather than math to convey insights is very, very powerful.”

Overvalued or a Good Bet?

“Nvidia [NVDA] is the company that has put AI on the radar of everyone involved in the stock market,” Nordvig says. Despite being so large, Nvidia continues to exhibit explosive growth. Key to the company’s future is whether that growth proves sustainable, as well as whether there is the potential for competition to emerge.

“I think it’s very hard to say that the clear market leader in this space is an overvalued stock.”

Referring to the removal and reinstatement of OpenAI CEO Sam Altman, Nordvig says that “the whole debacle we saw in OpenAI in the last weeks is, I think, related to competition”: “Some of the leadership in OpenAI — I’m not going to name names — had ideas about producing chips on their own. Because the real bottleneck now in terms of training systems, using these incredibly large data sets, has to do with sheer processing power.” Because there is a shortage of such chips, Nvidia can charge them what they like.

While the sector may be at an “inflection point where lots of players will try to come in and grab market share”, it is difficult to quickly enter the market due to the challenges of chip production at scale.

“I think it’s very hard to say that the clear market leader in this space is an overvalued stock,” he says. “But we can have a discussion about whether the valuation is extreme, and how long the growth will continue. If they continue to grow for a couple of years at this pace, this is not an expensive stock. It’s just a matter of how long you think they can maintain that leadership position.”

Key investment focus

“All kinds of large corporations that we speak to have AI as a key investment focus,” he says. “But it’s going to be a multi-year process; it’s not something that is over in the next couple of quarters. People are experimenting, ramping up. And when they find a fit in the area, they’re going to say, ‘Okay, now we’re going to be aggressive.’”

While large corporations like Alphabet [GOOGL], OpenAI, Microsoft [MSFT] and Amazon [AMZN] heavily invest in AI training, many others are still in the experimentation phase. “The big investments are going to come once the initial results of the experimentation have come through.”

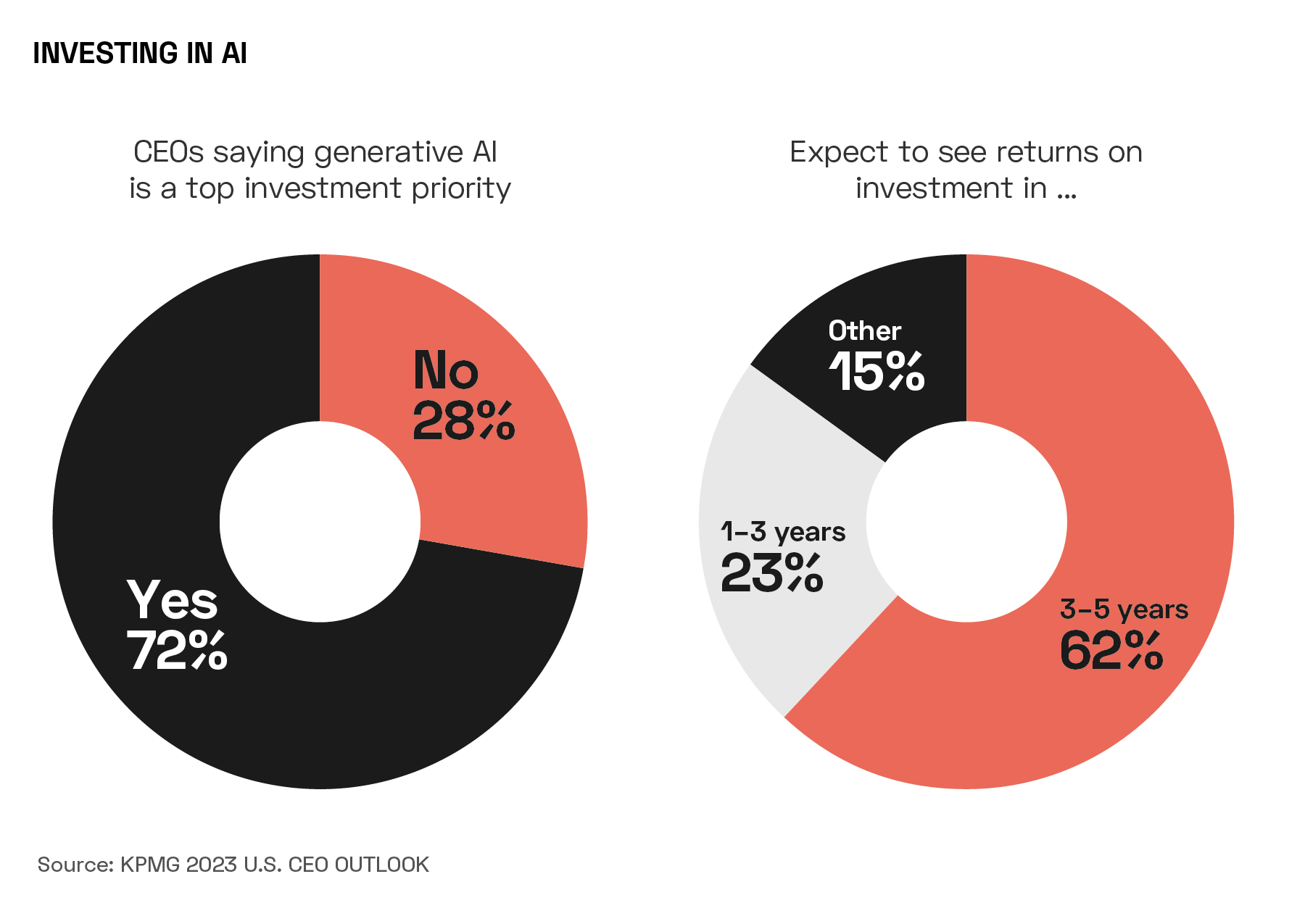

Underscoring the expectations for AI, 62% of CEOs surveyed in KPMG’s ‘2023 US CEO Outlook’ expect a return on investment in AI over the next three to five years.

However, to date, AI’s impact on the performance of equity markets has been concentrated in large corporations, as they have access to huge amounts of data and can outcompete companies without such capacity or datasets.

“There is a sort of economies of scale playing out,” says Nordvig. “The insights that we can generate with these AI systems really come from processing an incredible amount of data. Smaller businesses will not be able to do that on their own. There will be some smaller businesses that apply AI in a certain way that is unique, and can maybe boost productivity…but that’s just applying AI as opposed to developing stuff on their own.”

While such use cases are likely to have an impact on profit and productivity, large companies are likely to maintain a competitive edge, creating a potential diversification opportunity for investors. From a portfolio perspective, AI-related stocks could act as a hedge against potential damage in other sectors, given the transformative impact of AI on various industries.

“It’s always tricky to look at stocks that have had a big run-up and say, ‘OK, now they’ve come too far.’ But on this occasion, there is a very good reason why this is something that’s going to have a profound impact on how we manage businesses. Barriers to entry, especially access to vast amounts of free data, give these companies a protective edge that traditional industries lack, making it challenging for competitors to catch up.

Another factor impacting concentration is high interest rates, with mega caps relatively unaffected, but others reliant on borrowing facing significant challenges. Cash cushions and income generation from tech companies further contribute to their advantage, with the presence of high-yield bonds with high-interest rates for other market players further driving market bifurcation.

Wider Macro-economic Factors at Play

Nordvig doesn’t expect AI to be the dominant factor affecting economic growth. Factors such as the effects of the Covid-19 pandemic, China’s “severe structural challenge”, and interest rates will also play a role.

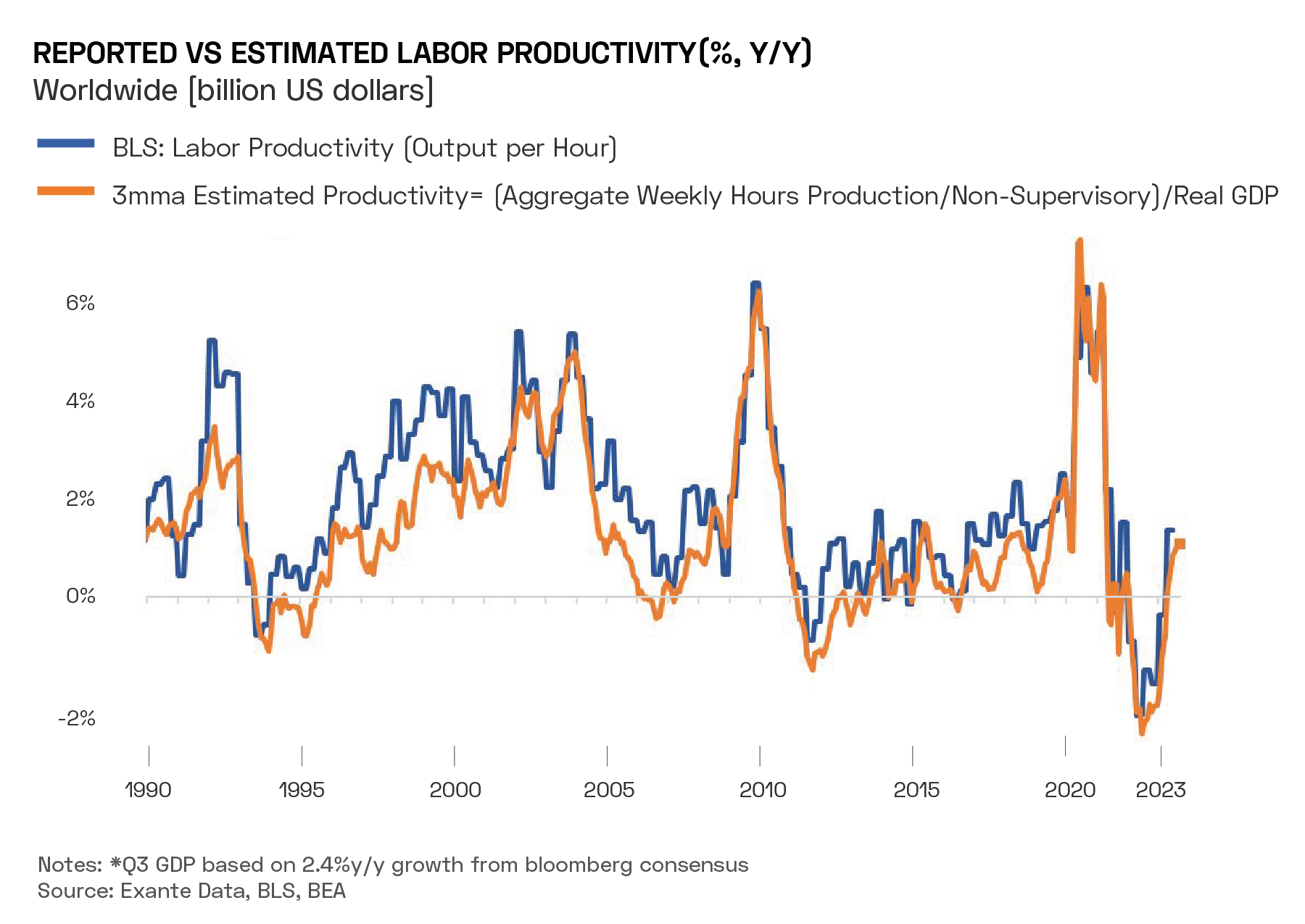

While AI is expected to boost productivity in the coming years, be believes it is unlikely to reach levels seen in the mid-1990s, potentially settling at 1.5%, up from 1% today. “The cyclical forces can dominate in the short term even if there’s a structural shift that goes in the other direction.”

There has been a change in central banks’ approaches in recent years, with policymakers acting with increased humility due to the unpredictability of inflation cycles that have challenged traditional forecasting models. Central banks, as shown by the US Federal Reserve and the Bank of England, have demonstrated pragmatism by emphasising real-time data over long-term inflation forecasts.

Emphasising inflation as the anchor and mandate for central banks, Nordvig suggests that the key variable to watch for potential rate cuts is whether inflation, especially in services, approaches the target on a sustained basis over the next three to six months. If this trend occurs, central banks may not need to maintain the current high-interest rates, potentially allowing for a significant cut of up to 200 basis points.

“That means that stocks that are sensitive to interest rates can definitely move, and we’ve already seen a prelude to that.”

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy