Demand for processors that can power generative AI applications is rising, while there are signs that a supply glut is easing. Here is a collection of stocks to capitalise on opportunities in the semiconductor industry.

- AMD expects its AI processor MI300 to be the fastest of its products to achieve $1bn in sales, according to its CFO.

- Qualcomm is seeing signs that the smartphone chip supply glut is easing, but is still expecting near-term shipment growth to decline.

- Broadcom is confident its $61bn takeover of VMware will get the green light.

AMD

The AI Accelerator Stock

Advanced Micro Devices (AMD) [AMD] will start shipping its AI accelerator, the MI300 processor, in coming weeks, as it announced on its third-quarter (Q3) 2023 earnings call on 31 October. The MI300, which will rival Nvidia’s [NVDA] H100, should boost AMD’s cloud computing division. It is expected to be “the fastest product to achieve $1bn in sales” in the company’s history, said President and CEO Lisa Su on the call. This could help data centre revenue reach approximately $400m in Q4 and exceed $2bn in 2024. The AMD share price has surged 16.7% in the past week and 73.3% year-to-date.

Qualcomm

The Smartphone Demand Stock

Qualcomm [QCOM] is optimistic that the chip glut which has been hampering the smartphone market is easing. “We’ve seen a stabilisation in the market,” commented Chief Financial Officer Akash Palkhiwala on the Q4 2023 earnings call on 1 November However, he added that the outlook is for near-term handset shipments to decline in the mid-to-high single digits, compared with 2022’s shipments. The company is expecting revenue for the current quarter, Q4 2024, to be in a range of $9.1–9.9bn, above Wall Street estimates of $9.32bn, according to Zacks data.

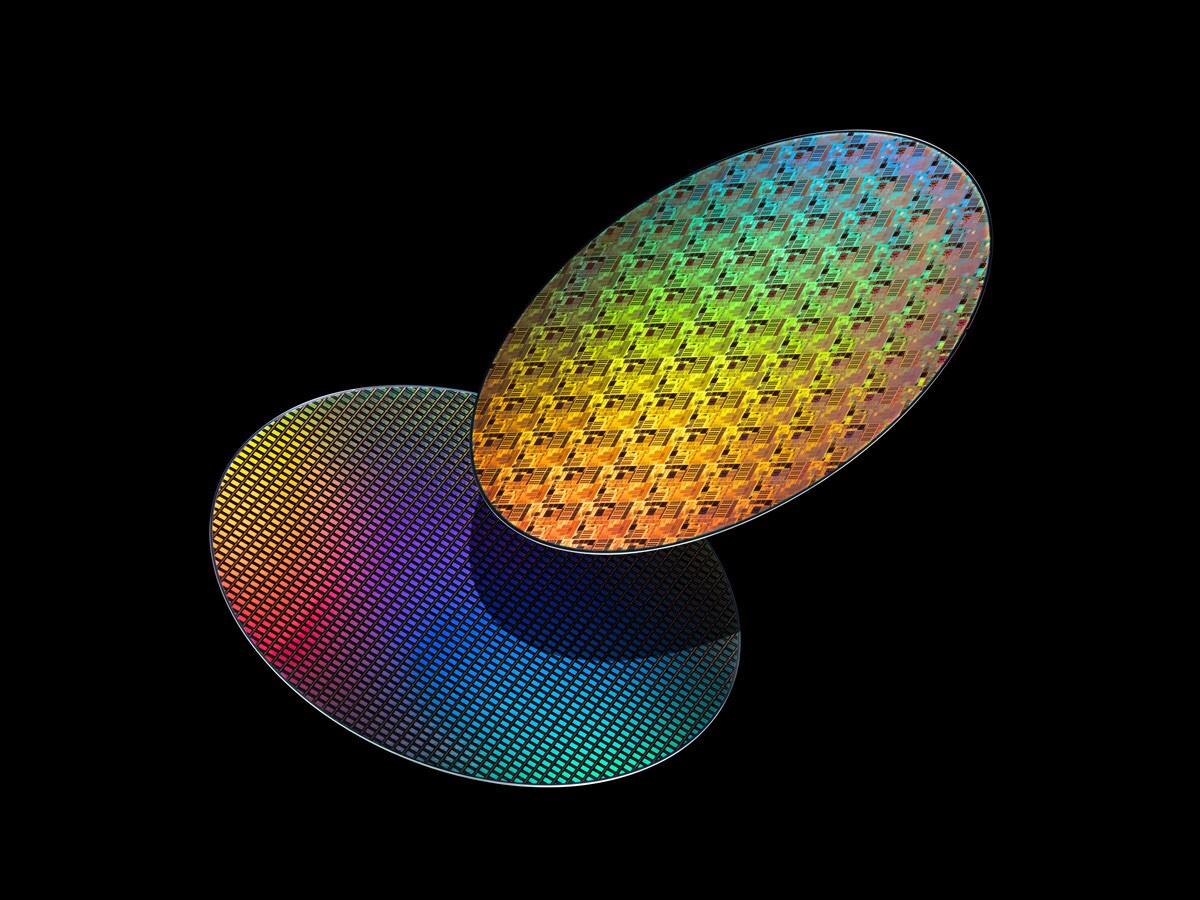

Texas Instruments

The Wafer Fabrication Stock

Texas Instruments [TXN] broke ground on its $11bn chip fabrication plant in Utah last week. In tandem with an existing facility in the state, the new plant, which is expected to receive subsidy support through the CHIPS and Science Act, will produce “tens of millions of analogue and embedded processing chips every day at full production,” according to a press release. The chipmaker had announced its investment in Utah back in February, citing cost advantages and greater control of supply.

Broadcom

The Acquisition Stock

Broadcom [AVGO] is confident that its $61bn merger with cloud computing and virtualisation software provider VMware [VMW], first announced in May 2022, will get the green light. The deal has already been approved by several countries, including the UK, Canada and Australia, but is currently being held up by Chinese regulators, as detailed in an October report by the Financial Times. The agreement between the two companies expires on 26 November, according to a statement issued by the pair last week, reported Bloomberg.

Micron Technology

The China Exposure Stock

Micron Technology [MU] President and CEO Sanjay Mehrotra met with China’s Minister of Commerce Wang Wentao last week. Just months after the chipmaker’s products failed the country’s security review, Wentao announced: “We welcome Micron Technology to continue to take root in the Chinese market and achieve better development under the premise of complying with Chinese laws and regulations.” Mehrotra suggested on the Q4 2023 earnings call in September that the China ban had impacted sales to data centre customers in the country — total revenue for the fiscal year slumped 49.5%.

Another Way to Invest in Semiconductors

The iShares Semiconductor ETF

The iSHares Semiconductor ETF [SOXX] has all five stocks in its top-10 holdings. As of 3 November, semiconductors account for 79.7% of the portfolio, while semiconductor equipment has a 20.1% allocation. The fund is up 37.6% year-to-date.

The VanEck Semiconductor ETF [SMH], which also holds all five stocks, is a pure-play on the semiconductor investment theme, focusing on companies that derive at least half of their revenue from semiconductor-related activities. The fund is up 47.3% year-to-date.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy