As Jens Nordvig, co-founder and CEO of MarketReader, recently told OPTO Sessions: “The key destination for emerging markets flow is now India”. Here is a collection of stocks to watch in India’s booming tech sector.

- Angel One has surpassed the 20-million customer mark — the brokerage is popular with young people looking to secure their financial future.

- Zomato has received approval to operate as an ‘online payments aggregator’, making it easier for customers to pay for their online food orders.

- Happiest Minds has established a separate business unit focused on generative AI.

MakeMyTrip

The Strong Earnings Stock

MakeMyTrip [MMYT] hailed Q3 2024 as a “seasonally strong quarter” with gross bookings up 21.7% year-over-year, revenue up 25.6% and net profit more than doubling from $15.9m to $38.9m. “We are excited about the opportunities that lie ahead of us, as the travel and tourism sector is a focus area for the Indian government and is expected to benefit from increased investments in travel infrastructure,” commented MakeMyTrip CEO Rajesh Magow in the 23 January press release.

Angel One

The Client Base Milestone Stock

Angel One [ANGELONE:NS] announced on 25 January that its client base has surpassed the 20-million mark. The brokerage has become hugely popular with young people looking to secure their financial future. “We remain steadfast in our commitment to reaching our north star — empowering one billion lives, with our cutting-edge wealth-creation solutions,” said Chief Growth Officer Prabhakar Tiwari in a press release. The Angel One share price is up 153.2% over the past 12 months.

Zomato

The Online Payments Stock

Zomato [ZOMATO:NS] announced in a regulatory filing on 24 January that it had received approval from the Reserve Bank of India to operate as an ‘online payment aggregator’. The food delivery firm launched its own payments business, Zomato Pay, in 2021 and last year announced a partnership with ICICI Bank [ICICIBANK:NS] to launch an instant payment system, meaning customers can pay for food orders directly through the app.

Nazara Technologies

The Social Media Influencer Stock

Nazara Technologies [NAZARA:NS] announced last week that it’s to acquire a 10.8% stake in Kofluence, India’s leading social media influencer marketing company, to develop “an influencer-driven game discovery platform”: “Our goal is to create an environment where gaming collaborates with the creativity of influencers, enriching the gaming experience for a global audience,” commented Nazara CEO Nitish Mittersain in a press release. The Nazara share price hit a 52-week high in mid-January.

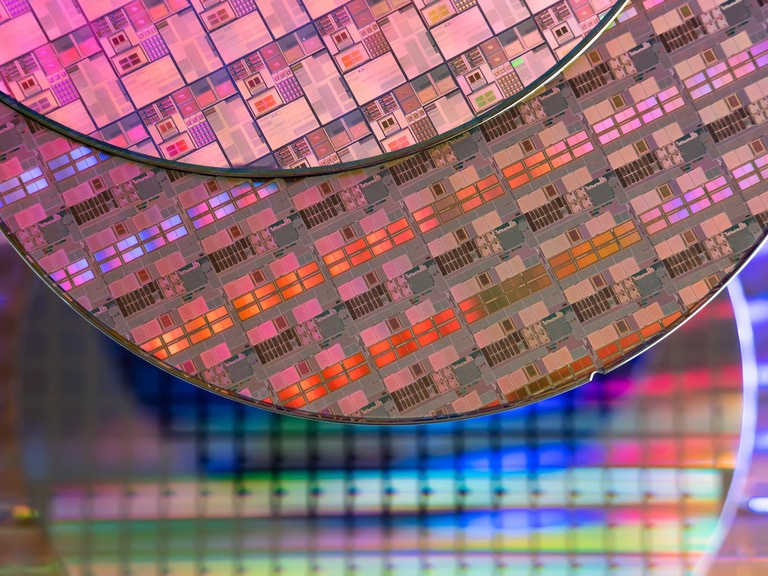

Happiest Minds

The Generative AI Stock

Happiest Minds [HAPPSTMNDS:NS], which describes itself as “the mindful IT company”, established a new business unit focused on generative AI in October last year. According to a press release, the company plans to equip all of its 5,000-plus employees with coding knowledge and train them to be competent in using the technology. “We foresee that generative AI can be a significant revenue source for us in the years ahead and help us reach our vision of becoming a billion-dollar enterprise by 2031,” said Happiest Minds executive board member Rajiv Shah.

Another Way to Invest in India Tech

The India Internet & E-commerce ETF [INQQ] holds all five stocks as of 25 January. As of 30 September, 30.2% of the portfolio is allocated to fintech, while e-commerce and food delivery have allocations of 15.4% and 13.7% respectively. Travel services and communications software have weightings of 12.5% and 11.6%; SaaS and gaming account for 9.1% and 1.4%. The fund is up 36% in the past year and up 9.4% in the past six months.

The VanEck Digital India ETF [DGIN] holds MakeMyTrip and Zomato as of 26 January. As of 31 December, information services accounts for 50.6% of fund exposure, while communication services and consumer discretionary have allocations of 13.1% and 8.8%. The fund is up 34.3% in the past year and up 19.2% in the past six months.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy