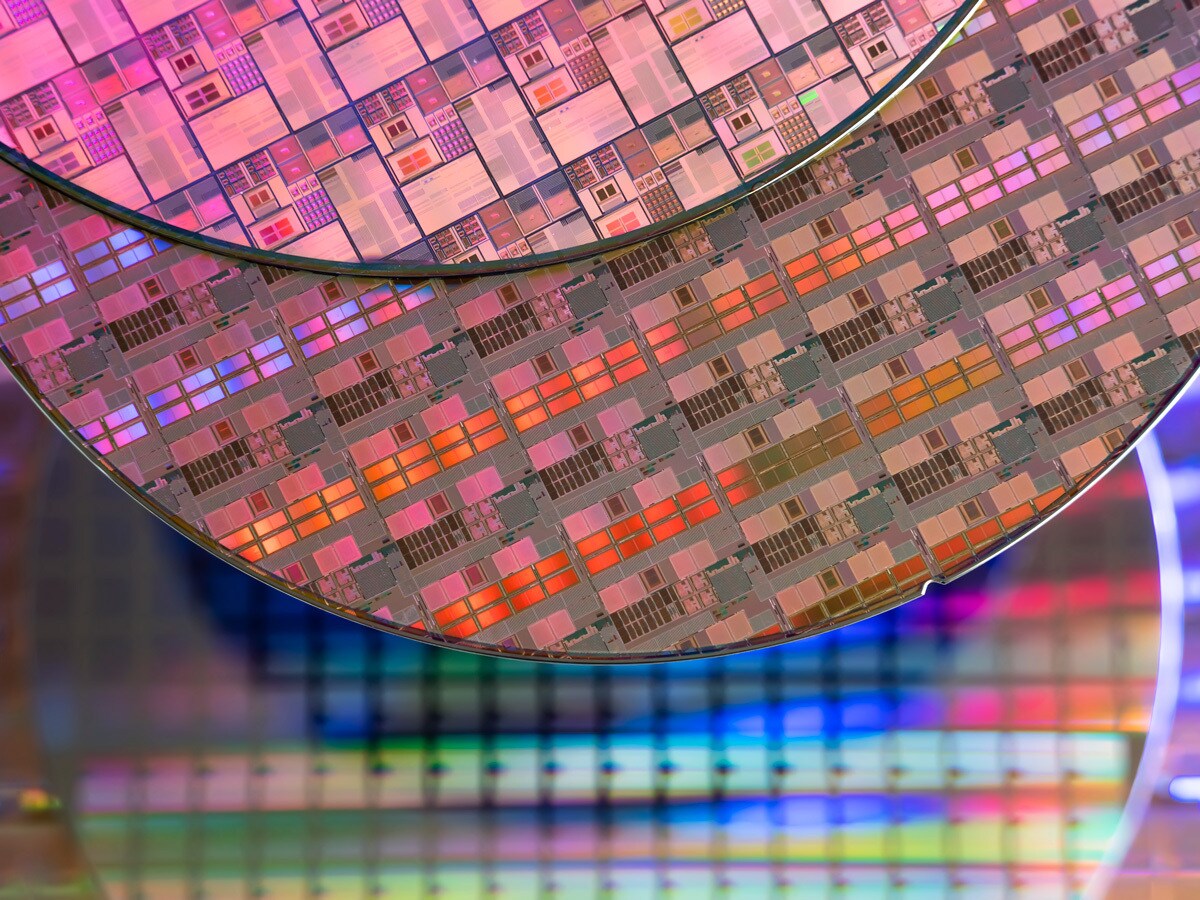

The chip sector slumped mid-pandemic, but 2024 will be a “bounce-back year”, according to Gartner. Nvidia, the largest holding in the VanEck Semiconductor ETF, is benefitting from artificial intelligence (AI) demand and still has room to grow, say analysts.

- VanEck Semiconductor ETF grows 8% so far this year.

- Top holding Nvidia soars 23% year-to-date.

- Gartner says chip sector to recover after a slow 2023, up 17% in 2024 to $624bn

The VanEck Semiconductor ETF [SMH] crept up 0.6% in the week to 29 January, but has grown 58.3% in the past 12 months, as top holding Nvidia [NVDA] continues to rally and the semiconductor theme gears up for a stronger 2024.

While 2023 marked a difficult time for the semiconductor industry, a rebound is anticipated for the sector in 2024, with businesses’ artificial intelligence (AI) ambitions driving chip demand.

The latter is impacting the share price of US chipmaker Nvidia, which has rocketed 199.8% in the past year, and increased 2.6% in the week to 29 January.

Last week, Nvidia’s market cap reached a record $1.5trn.

Meanwhile, the SMH fund’s second-largest holding, Broadcom [AVGO], drifted down 0.5% last week, but has gained 108.5% over the past year.

The VanEck Semiconductor ETF is a pure-play fund offering exposure to 25 US-listed companies that derive at least half their income from semiconductor-related business.

Nvidia: Strength to Strength

Nvidia is the largest holding in SMH as of 26 January, with a 11.1% weighting in the fund’s portfolio.

At its Q3 earnings in November, Nvidia reported revenues of $18.1bn, a 206% leap year-over-year. GAAP earnings per diluted share rose to $3.71, increasing 1,274% from

$0.27 for the year-ago quarter. Earlier this month, Nvidia became the fourth most valuable stock in the S&P 500.

Despite some concerns that Nvidia stock is becoming overvalued, analysts anticipate the US chipmaker will extend its bull run in 2024. Earlier in January, Stacy Rasgon of Bernstein told CNBC he believed Nvidia stock will continue to rise. New products as well as AI demand could shore up further growth.

Rasgon said Nvidia was “one of the cheapest ways to play the AI theme”, with rival stocks such as Advanced Micro Devices [AMD] still more expensive.

The second-biggest holding in the VanEck Semiconductor ETF is Broadcom, with a weighting of 11%. The California-based tech company focused on semiconductor solutions and infrastructure software last reported earnings in early December, with revenue of $9.3bn, a rise of 4.1% year-over-year.

Chip Sector Expects Boost

The semiconductor industry has grappled challenges including a slump in demand and supply chain disruptions in recent years. The VanEck Semiconductor ETF plummeted in 2022, though it recovered in value through 2023.

However, in December Gartner forecast that the size of the global semiconductor sector will expand 17% this year, to reach a value of $624bn, in what it terms a “bounce-back year”, with demand growing for all chip types. In particular, it predicts the memory market will grow by 66.3%, following a steep decline of 38.8% during 2023.

The VanEck Semiconductor ETF could benefit if predictions of a stronger semiconductor market are borne out.

At TipRanks, a consensus of 26 analysts deems the fund a ‘strong buy’. A 12-month average price target of $201.22 would be a 6.9% rise from its last close.

NVDA stock is a ‘strong ‘buy’, according to a consensus of 38 analysts at TipRanks. A 12-month average price target of $675.40 would be a 10.7% rise from the last close. For AVGO, a consensus of 20 analysts offers the same rating, though the average price target of $1,191.18 represents 1.1% downside from the recent close.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy