In this article, Michael Gayed, a portfolio manager at Toroso Investments and author of the Lead-Lag Report, compiles 10 takeaways from the GameStop drama at the beginning of the month. He considers what it means for markets and the lessons he covers may be particularly valuable as the second chapter of the saga has begun this week.

With GameStop [GME] stock down 86% [at time of writing] from its recent high of $483, it’s looking like the mania inspired by the “Reddit army” of retail traders is fizzling out. While it feels like it’s been going on forever, it’s almost hard to believe that it’s been only less than two weeks [at time of writing] since GameStop initially moved into the triple digits on its way to an unbelievable peak near $500 per share.

What started out as fervour frm a small group of retail traders looking to execute a short squeeze on a beaten down retail stock turned into a madness where all sense of investment strategy went out the window as the war against big hedge funds became intensely personal.

As I began commenting about what I was seeing on Twitter [TWTR], you can imagine the responses I got. Middle fingers. All sorts of “NSFW” name calling. Phrases, such as “revolution”, “elitist”, “garbage” and “shill” were used, along with my personal favourite (which showed up many times) “burn it to the ground”. Others claimed it didn’t matter whether they lost 100% of their investment. It was all about sending a message to the hedge funds.

Well, I hope they meant it. What happened will no doubt be litigated for months (you can get ready for the Netflix [NFLX] movie in the meantime), but it’s not too early to look at what investors should take away from this experience. You’ve probably heard any number of people offer their hot takes on whether or not the markets will be fundamentally changed going forward, but I want to take a look instead at what we’ve (hopefully) learned having gone through a truly one-of-a-kind market environment.

Here are 10 big ideas that investors should be aware of in a post-GameStop world.

The Fed is responsible for this

There’s a lot of blame being thrown around as far as who’s responsible for this whole saga. Retail traders believe that hedge funds have been making millions of dollars for years betting on the failure of businesses and manipulating asset prices in their favour.

Many pundits think that the Reddit board warriors are guilty of colluding to pump up the price of a stock resulting in millions of dollars of losses for people who got in just before the inevitable crash. But let’s point the finger of blame squarely where it belongs — the US Federal Reserve.

The central bank has been blowing this thing up to the point where the wealth disparity that’s been created has reached an inflection point. Things have been tilted in the favour of big corporations and wealthy investors who have been able to take advantage of tax cuts and record low interest rates in order to assume more debt to grow their balance sheets.

What the Fed has been doing is widening the gap between the wealthy and the middle class so far that some of the small retail investors decided they’d had enough and finally decided to do something about it. The narrative that’s been playing out in the media has been the little guy vs. the hedge funds, but it’s really the Fed that piled up the kindling and lit this thing on fire.

The game may not be fair, but be prepared to play it

In general, if you’re going to get involved in the financial markets, you should be prepared that things aren’t always going to go the way you plan. Many of the Reddit traders were probably quite happy with the way things were progressing early on.

That was until Robinhood stepped in and changed the rules mid-game.

In response to the trading frenzy, Robinhood raised margin requirements significantly on many of the affected stocks and limited buying to as little as one share on GameStop.

At different points, Robinhood and Interactive Brokers didn’t allow new positions to be established at all and, in some cases, went ahead and closed positions if the account was at risk of not having the necessary collateral.

Investors, of course, cried foul, but speaking strictly from a legal standpoint, Robinhood has a lot of leeway to do what it wants to protect itself. If they feel their financial health is at risk based on market conditions, they can mostly put on restrictions as they see fit.

For Robinhood traders, it was a problem they probably didn’t see coming, but unexpected things like this can happen and, in some cases, there’s not much you can do about it.

Hedge funds will be just fine

We can say there was some degree of success for the WallStreetBets group in that its GameStop pump resulted in losses of more than 50% for Melvin Capital, who had one of the biggest short positions in the stock. How much does Melvin Capital now manage after that huge loss? $8bn.

In other words, the fund is going to be just fine. In fact, most hedge funds, even the ones impacted by GameStop, are still in great shape and in position to net millions in management fees. There are dozens of hedge funds managing more than $10bn and the top 100 account for more than $1.2trn in assets. The GameStop fiasco will be a mere footnote for most of them.

Everybody is guilty of price manipulation

There are going to be a lot of questions as to whether what Reddit traders did was a true stock pump. You could make the argument that what happened was simply a group of like-minded investors discussing an investment idea and deciding to buy at the same time, kind of what happens when friends get together over drinks, but on a much larger scale.

There’s no question, however, that the end result was price manipulation that pushed GameStop well above any reasonable valuation for the company. And there’s that little issue where they said they did it specifically to harm the hedge funds.

This kind of thing has been happening for years. The fact that GameStop was able to have a short interest of 120% suggests the possibility of a broader disconnect in the markets, but the huge short positions, many taken by hedge funds, have been taken in order to help drive down the price of the stock in question.

Let’s not let the Fed off the hook here either. What they’re doing is effectively engaging in constant market manipulation. What’s happened over the past year is an extreme example, but the central bank is constantly adjusting interest rates, adding and taking away liquidity in order to achieve a balance between growth, inflation and employment. The idea of a free and fair market is largely a myth.

The K-shaped recovery is at the core of this

This sort of piggybacks on the first takeaway that the fuel for the GameStop story is rooted in the wealth inequality between the haves and the have-nots. We’ve seen throughout this recession that the wealthy have been disproportionately less negatively impacted by the economic slowdown than the lower and middle class.

We’ve seen that in overall wealth levels, where the upper class has taken advantage of the remarkable rebound in the stock market. We’ve seen that in the jobs market, where higher-income individuals are more likely to be able to work remotely, whereas lower-income folks that work at grocery stores, Walmart [WMT], etc. have largely been forced to go into work.

Higher unemployment levels are also more common in the lower-income category. It’s easy to see how the lower and middle class get angry at seeing this, especially how the rich have mostly recovered in full from the initial economic downturn.

Some hedge funds made a lot of money

The narrative over the past two weeks has been how the small retail investors squeezed out the big hedge funds, but that wasn’t the case across the board. In fact, several big money managers were long on GameStop well before any of this happened, viewing the company as an intriguing value/turnaround play.

One such company was Senvest Management, which started acquiring GameStop shares back in September around $10 a share. When the mania hit an apex, this was the headline.

There are other stories like it. South Korea-based MUST Asset Management might have made as much as $1bn on its GameStop position, which as of the first half of last year was around 5% of all shares outstanding. Even mega-managers, including BlackRock and Fidelity, made money on the bubble.

Many investors assume that all hedge funds do is short stocks. While they do often engage in short selling, that’s far from the only investment they make. Reddit traders went into this trying to screw the hedge funds. They actually made some of them much wealthier.

Diversification is still important

Diversification is always important in long-term portfolio construction, but it was interesting to see how the broader market responded to the action in GameStop. The stock and the S&P 500 actually became inversely correlated during that week or two.

As GameStop rose, the market sold off, seemingly anticipating that risks were rising as the bubble was inflating. The opposite occurred as well when a falling stock price led to investors moving back into large-caps.

This is sort of a unique example, but it is proof that a portfolio, which includes variously correlated assets, such as stocks, bonds, commodities, real estate, etc, helps manage risk, especially downside risk.

Which is a nice segue into the next point...

If you want to kill it in the market, you can’t get killed

Everything I do is about identifying conditions to help limit downside risk. As I’ve said many times before, you don’t have to always capture 100% or more of a market’s rally. If you can avoid capturing less of a market correction and produce a net capture ratio of greater than 100%, you can still beat the market overall and take much less risk in the process.

One of the really unfortunate parts of watching the GameStop traders was their mindset when buying shares. A lot of them were willing to buy at any price. Most had no exit strategy.

They were willing to hold indefinitely because the message board rhetoric said they have to if they want to support the cause. This is a prime example of completely ignoring downside risk. The risk of losing money on a gamble like this was always high. Having no strategy at all when things go south only exacerbates loss potential.

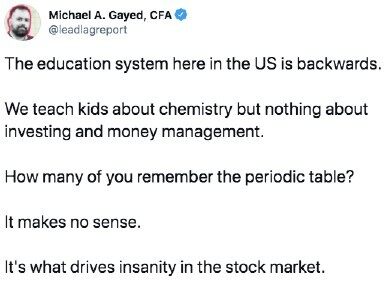

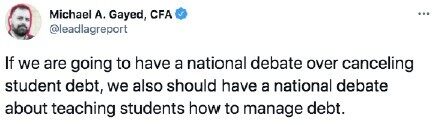

The education system is backwards

I’ll simply copy a couple of thoughts I posted on Twitter.

Far too few schools teach personal finance as part of their curriculum. Even fewer make it a requirement. Different subjects are important in developing a well-rounded education, but how are so many schools missing out on teaching something that every person will have to deal with throughout their life?

Could any of this have been avoided if traders had a better understanding of managing risk and developing a financial plan? Perhaps, but we’ll never really know.

This was going to end badly for retail traders

Bubbles like this happen occasionally, but history has shown that they always come crashing back to earth. I’ll return to one of Farrell’s rules of investing to sum it up best: “Excesses in one direction will lead to an opposite excess in the other direction.”

Few, if any, of the Reddit traders viewed the GameStop saga as a financial transaction. They just got swept up in a frenzy that became entirely about settling a personal grievance. Money was simply the tool for making it happen. Maybe they believed that this time would be different, but it rarely is. This bubble was always going to burst and the prices of these stocks were always going to come crashing back to earth.

It’s just a shame that so few people saw this coming.

This article was originally published on Michael Gayed’s critically acclaimed Lead-Lag Report on 5 February 2021. The report offers in-depth insights into long-term investment strategies as well as access to model portfolios, regular updates, a chat room and more.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy