In this article, Frédérique Carrier, head of investment strategy at RBC Wealth Management, explores the four main drivers that underpin the technology helping with the shift towards renewable energy.

The world is in the midst of a transformative shift toward renewable energy. This transition will be more rapid and potentially more profound than the adoption of oil in the 1850s.

In that instance, it took a century from the time commercial oil wells were first drilled for oil to account for a quarter of the energy used worldwide. Today’s goal is to achieve the bulk of this energy transition by 2050, or over just three decades, in line with the Paris Agreement’s aim to keep global warming to well below two degrees Celsius compared to pre-industrial levels.

A considerable share of the energy currently produced from fossil fuels will need to be replaced by energy from renewable sources, remembering that demand for electricity will go on rising from current levels as the world population grows and many activities, such as transport, become increasingly electrified.

In short, the energy transition requires that within a few decades, the way energy is produced, stored, transmitted, and consumed will need to change.

According to IRENA, the International Renewable Energy Agency — an intergovernmental organisation that supports countries in their transition to greater reliance on sustainable energy — $110trn will need to be invested over the next 30 years to realise the global energy transformation.

Cumulative investments needed for energy transition

The donut chart depicts the breakdown of the estimated $110trn in cumulative investments needed for the energy transition, according to the International Renewable Energy Agency: Electrification and infrastructure, $26trn (23%); Renewables, $27trn (24%); Energy efficiency, $37trn (35%); Fossil fuels and other, $20trn (18%).

Renewables: $27T (24%)

Note: Fossil fuels = mostly oil, natural gas, coal

Source - IRENA

Importantly, this transformative investment is being driven by a government policy roadmap that is synchronised for the first time, with 2020 marking a turning point:

- The European Green Deal refocused the EU’s COVID-19 stimulus package onto renewables — charging infrastructure, power generation, and green hydrogen projects, allocating up to $600bn to green projects.

- China’s 14th Five-Year Plan called for electric vehicles (EVs) to constitute 20% of overall new car sales in China by 2025 from just 5% now and to reduce its dependence on coal (spending up to 10 trillion yuan, or $1.5trn).

- Joe Biden won the US presidential election, with a sweeping infrastructure programme (up to $2trn) one of his key initiatives.

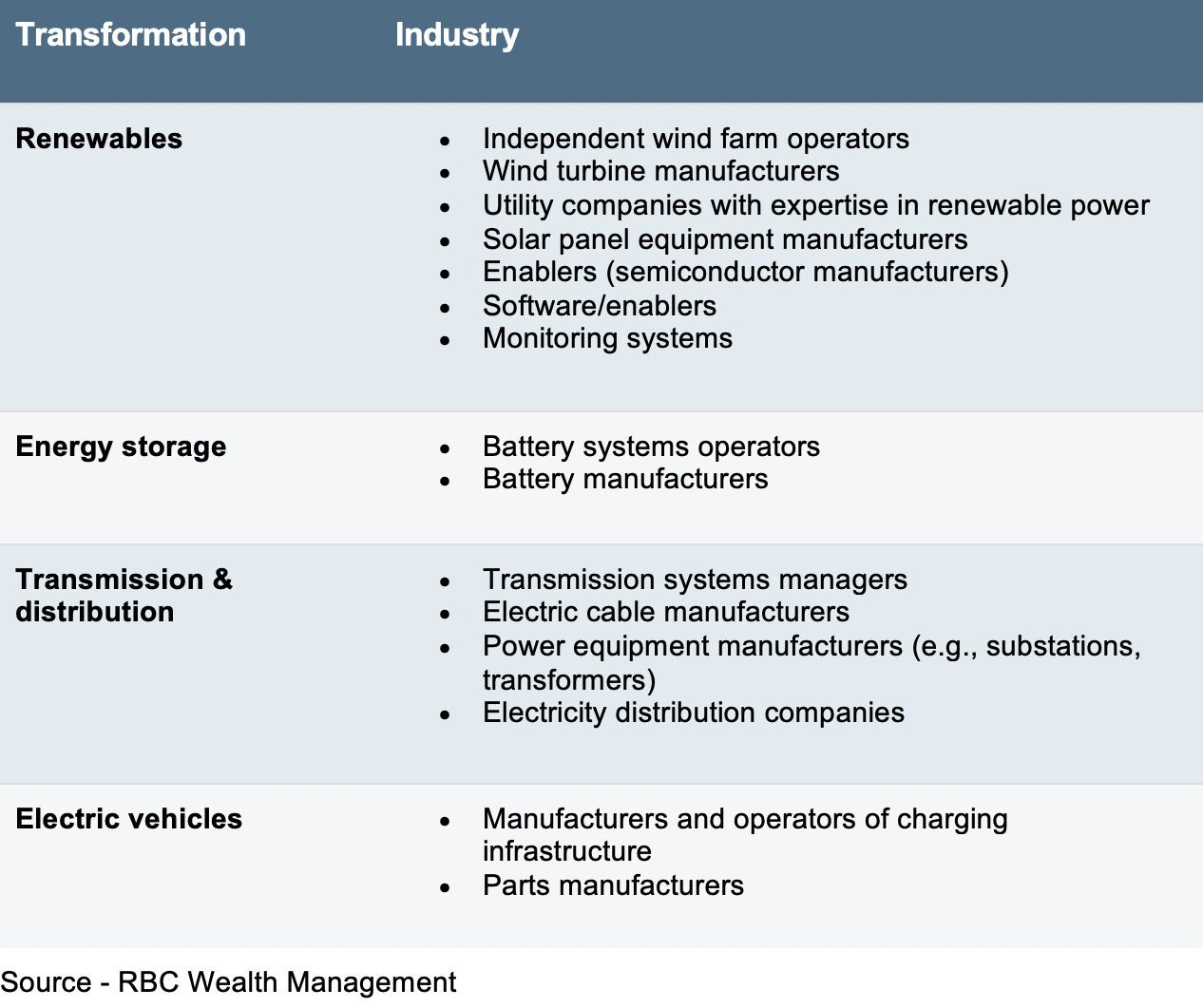

Some industries set to benefit from the energy transition

Source - RBC Wealth Management

Transformation #1: The way energy is produced

As we noted in our climate change report in March, energy used in industry, transport, and buildings is responsible for some three-quarters of all greenhouse gas emissions.

At the moment, fossil fuels (mostly oil, natural gas, and coal) are burned to produce electricity, creating carbon emissions in the process. One way to reduce emissions is to shift to electricity generated by wind turbines, solar panels, and other renewables.

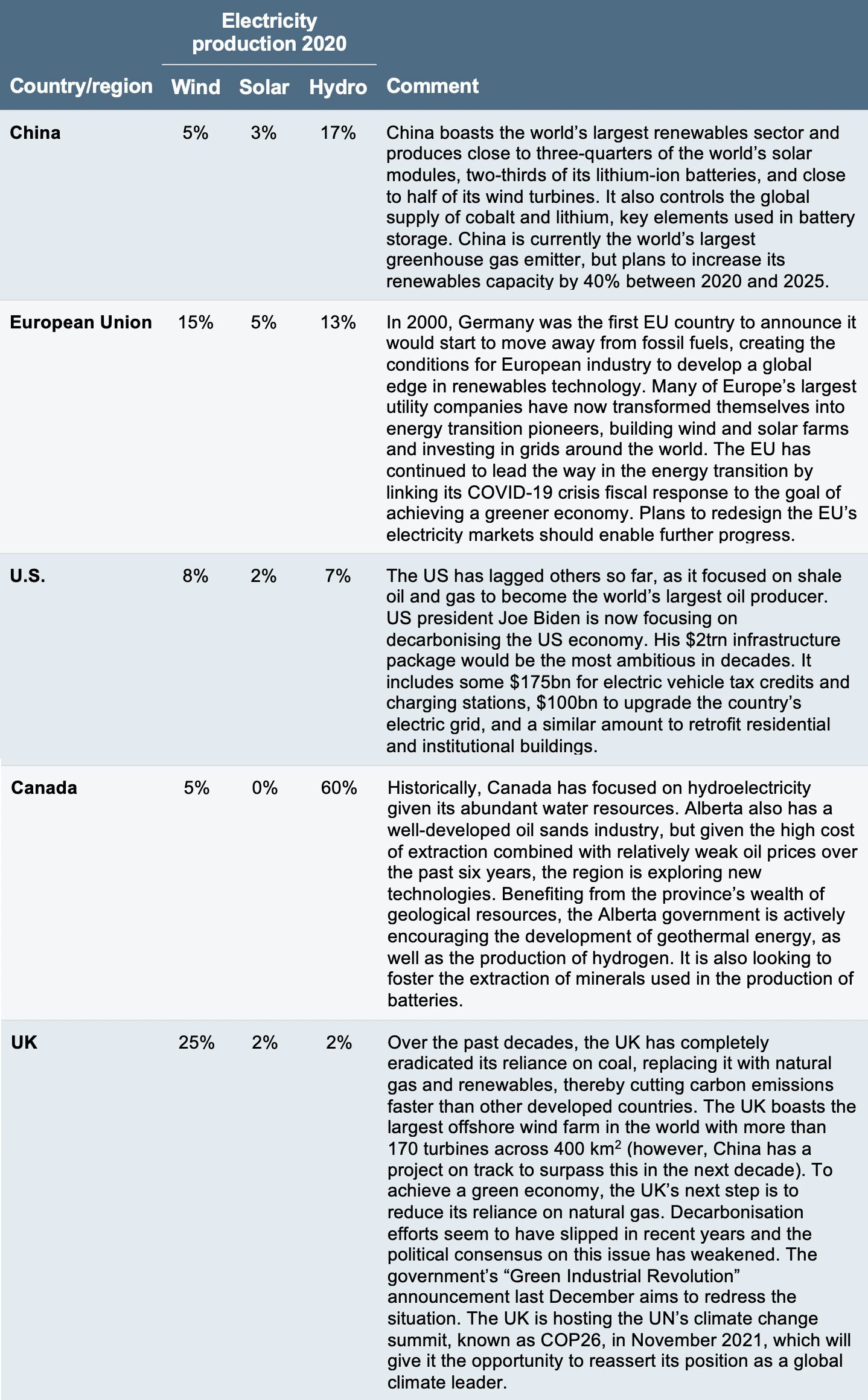

Various countries’ renewable energy situation

They are all making an effort

Source - Energy Information Administration, Natural Resources Canada, Ember and Agora Energiewende, China Electricity Council; UK Department for Business, Energy & Industrial Strategy

Hydropower is already being used as much as it likely can: not all countries have the water resources necessary, and those that do have already developed them as much as possible over the past 100 years.

The International Energy Agency (IEA) projects that renewables will account for 95% of the net increase in global power capacity through 2025. It points out that solar and onshore wind, for which costs have fallen dramatically over the past two decades, are already the cheapest ways of adding new electricity-generating capacity in most countries.

The IEA expects solar alone to account for 60% of all renewable capacity additions through 2025, with wind providing another 30%. Within the latter, offshore wind is expected to see the most growth, driven by further cost declines and a move beyond Europe/UK, where it is already a major factor, to new markets such as China and the US, where ample potential remains.

While wind and solar will likely play the largest role in the low-carbon economy, other technologies will also feature:

- Nuclear produces no greenhouse gas emissions, though the manufacturing of the equipment and the construction of the station most probably do.

- Carbon capture removes carbon dioxide from the atmosphere or directly from industrial processes and injects it into deep underground geological formations (known as “sequestration”).

- Hydrogen as a way to store solar and wind energy to be used when needed and as a direct substitute for fossil fuels including coking coal.

- Geoexchange takes advantage of the fairly constant temperatures a few metres below the earth’s surface to heat homes and buildings in the winter and cool them in the summer using heat pumps.

- Waste heat recovery captures the waste heat from buildings and industrial processes and converts it into electricity via thermoelectric generators.

The energy transition has forced oil and gas companies to invest in renewables. European majors are leading the way. Royal Dutch Shell [RDSA] even links executive pay to the progress it makes in reducing emissions. US big oil has been more reticent, though these companies are starting to take some steps. The global energy majors can be part of the solution, reinvesting part of their substantial free cash flow to help fund their transition aims. The risk, in our view, is that they overpay for renewables projects.

Transformation #2: The way energy is stored

One major challenge for renewables is the disconnect between the continuous nature of electricity demand and the intermittency of solar and wind power. The sun doesn’t always shine and the wind doesn’t always blow. Worse, storms can make a wind farm inoperable.

This can be dealt with by adding an energy source that runs only when needed —though these usually produce some harmful emissions and are costly to run if only used part-time.

Battery energy storage systems, which can store energy during periods of excess and discharge it during shortages, are another solution. These can be stationary or modular, industrial-size batteries installed at various points of the electric grid to support grid management. They are a critical component in an increasingly renewable-reliant grid.

Storage costs are coming down thanks to innovation and economies of scale. According to Shelby Tucker, RBC Capital Markets, LLC Utilities Analyst, storage system unit costs are expected to decline by 45% by 2030 and by 59% by 2050, while the next-generation battery technologies, some offering more than double the energy capacity of standard lithium-ion batteries, may drive down costs even further. Tucker believes the global market for batteries has the potential to grow 100 times by 2050.

Battery technology can also be key to the uptake of EVs. Reducing the battery cost is important in making EVs more price competitive as batteries represent as much as 30% of the cost of an EV. Already down by more than 85% over the past decade, it needs to fall further.

The average cost of a lithium-ion battery pack is currently just under $140 per kilowatt-hour (kWh). According to BloombergNEF, EVs become cost competitive compared to traditional cars at $100 per kWh, which appears to be achievable by 2023, with some producers reporting costs below $100 for the first time.

Importantly, battery range, efficiency, and speed of recharging should also improve thanks to innovation and investment. Volkswagen [VOWG] recently committed to reducing battery costs by up to half and producing long-range and fast-charging batteries from 2024.

Hydroelectric power can act as a very large-scale battery. In Canada, Quebec recently green-lighted a large wind power project made feasible by the ability to use the province’s massive hydro capacity as a back-up when wind power falters.

Likewise, Alberta’s extensive wind and solar potential could be much more fully developed if backed-up by neighbouring British Columbia’s extensive hydroelectric resources. What’s missing is a more integrated grid system along their 1,800 km border.

Transformation #3: The way energy is transported

Because solar panels and wind turbines are installed where the sun shines and the wind is blustery, and not necessarily near cities, the current transmission model based on power plants sending electricity to nearby cities is not viable.

To transport solar- and wind-generated electricity, high-voltage transmission is needed over large distances. In the US, as in many other places, this is an issue because the transmission system is highly fragmented and doesn’t easily send electricity from one end of the country to the other.

High-voltage transmission systems are under development, but this is a complex undertaking with several stakeholders, including landowners and state and local governments. One example is the TransWest Express, a high-voltage electric grid designed to move three gigawatts (GW) of wind power generated in windy Wyoming to California. Construction is finally about to start, 17 long years after planning began.

China has been building out its ultra-high-voltage transmission network since 2009 to accommodate surging electricity consumption and various power resources. By the end of 2020, it had constructed 30 networks to transmit electricity from its interior to the populated coastal regions in Eastern and Southern China.

Power distribution systems, which connect power lines to homes, will also need to be upgraded to accommodate higher electricity demand as reliance on fossil fuels in the home decreases while electricity consumption increases. For instance, according to the US Federal Highway Administration, an EV uses 4,000 kWh of electricity per year to operate, assuming 13,500 miles driven — admittedly, a long distance by European standards. By comparison, the average US household consumes 11,000 kWh per year, so having an EV would increase consumption by one-third in the US.

Transformation #4: The way energy is used

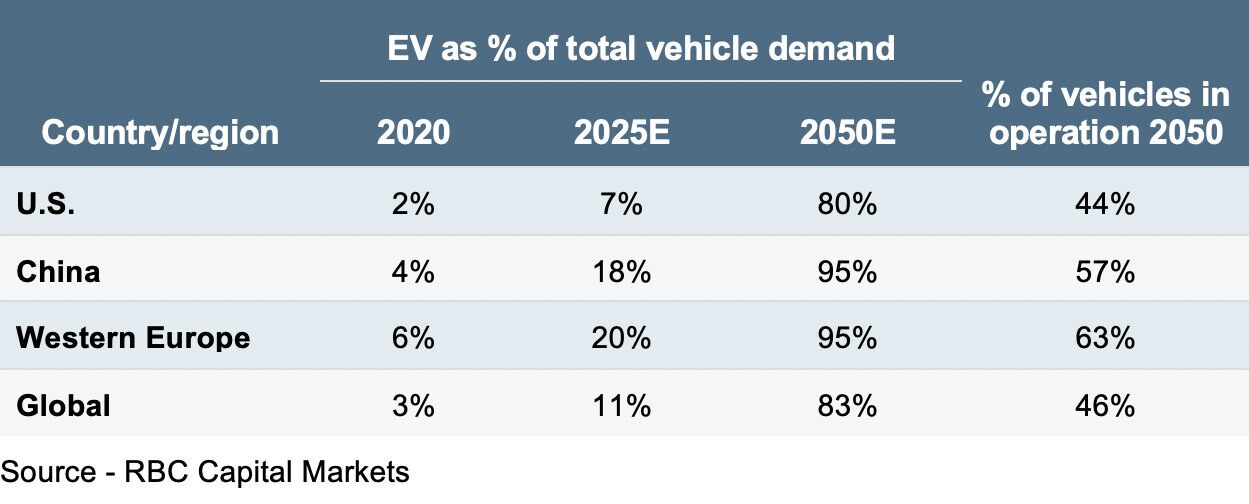

Despite buzz for years about EVs, such cars were a mere 3% of global demand in 2020, though with stark regional differences. Still-prohibitive prices, inadequate battery ranges, and a lack of public and home charging infrastructure have all stunted the uptake.

Global electric vehicle demand forecast

Western Europe leads, China is catching up

Source - RBC Capital Markets

But this appears about to change. Auto Analyst Joseph Spak, auto analyst at RBC Capital Markets, LLC US, forecasts EVs will represent 11% of demand for new cars by 2025, with growth rates of some 40% per year, supported by regulations to phase out internal combustion engine vehicles. To date, at least 24 countries have proposed some form of zero-emission vehicle targets. For instance, the UK will ban the sale of new petrol and diesel cars from 2030.

Meanwhile, Biden’s infrastructure plan proposes allocating some $175bn to EVs in the form of tax credits to consumers and incentives to build 500,000 public charging stations.

Manufacturers are in the early stages of a heavy investment and capital expenditure cycle to dramatically boost the production of EVs and develop the related software. Many are planning to ramp up EV capacity, and to offer a wider range of price points and models.

General Motors [GM] is accelerating its EV plans by spending $27bn over the next five years on electric and autonomous vehicles. It aims to deliver more than one million EVs by 2025 and to stop making gasoline-powered cars by 2035.

Ford’s [F] legacy internal combustion engine vehicles should also transition to EVs, though at a slower pace than at GM. Chinese car manufacturers are also ramping up EV production. Zhejiang Geely Holding [0175], one of China’s biggest automakers and owner of Volvo Cars [VOLV-B], launched a luxury EV brand called Zeekr. A growing number of startups also are eyeing the country’s booming EV market. Li Auto [LI] is aiming to be the number one smart EV maker in China, and is targeting 20% market share in China by 2025.

The transition from internal combustion engines to EVs has been compared to that from horses to cars. It may not be an exaggeration. The change goes much beyond altering assembly lines. EVs are increasingly becoming more like smartphones, with wireless transmission of software updates.

Getting this digitalisation right is key, as software opens up new opportunities for recurring and post-sale revenues via digital upgrades and increased customer connectivity. Volkswagen is spending €27bn over the next five years on software, artificial intelligence, and autonomous vehicles, aiming to increase the share of its own software used in its cars from currently 10% to 60%. Like others, it is opting to keep new technologies in-house to learn how to optimise technology and costs.

Spak points out that investors have generally cheered this step-up in investment as it improves companies’ future prospects. But they will likely want to see proof of better returns on these investments and of EVs as a platform with more recurring revenue opportunities, a larger addressable market, and less cyclicality.

For traditional automakers undergoing this metamorphosis, investor enthusiasm should be tempered by the possibility of write-downs of legacy manufacturing footprints, restructurings, labour concerns, and culture change.

Parts suppliers will also need to navigate a swift transition. Spak believes those that can show a path to stronger earnings power in an EV world should see their valuations re-rate higher—or at least sustain their recent increases in valuation. Should current levels of profitability be merely maintained or even decrease, a higher valuation would be harder to justify, in his view.

A pause that has refreshed?

Green technology stocks have lost some ground so far this year, as the market has rotated into stocks that will likely benefit from the economic reopening. A useful gauge is the MSCI Global Alternative Energy Index, which tracks companies that derive 50% or more of revenues from operations that contribute to a more environmentally sustainable economy.

The index lost close to 30% of its value between early January and early March this year. To be sure, this followed a 220% gain from the trough of March 2020 to the index’s January peak (versus the MSCI World Index’s gain of 71% over the same period).

After the recent correction, the index’s relative price-to-earnings ratio is the lowest it has been in four years. Despite the strong gains last year, the recent volatility represents a good opportunity, in our view, to build exposure to these long-term, secular themes.

This article was written by RBC Wealth Management and originally published on the firm’s research and insights page, here.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy