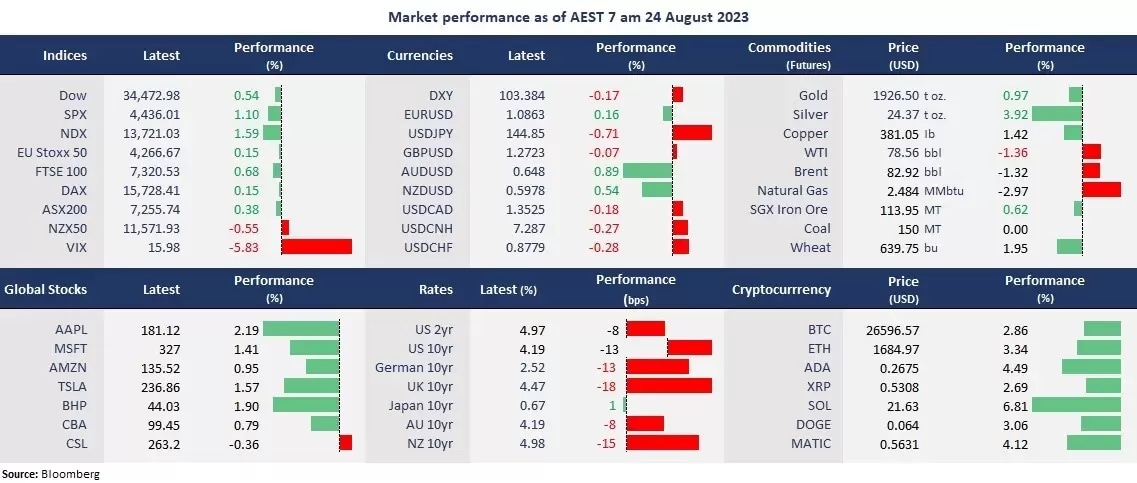

The US stock markets gained on a broad-based rally as dip-buys in tech continued to ride the risk-on momentum ahead of Fed Chair Powell’s speech at the Jackson Hole symposium. Nvidia becomes a new Wall Street legend with a jaw-dropping earnings beat. The AI chipmaker’s shares soared nearly 10% before pulling back in after-hours trading, further boosting broad sentiment in extended futures markets.

Traders seem to double down on a bond-bottoming market ahead of the Jackson Hole event, when central banks will provide clues for their future policy path, pressuring the USD. Precious metal prices, such as gold and silver, jumped 1% and 4%, respectively.

The economic front also paved the way for a potential softening tone of the Fed and ECB. The US flash Composite PMI index fell to 50.4 in August, the sharpest month-on-month decline since November 2022, suggesting deteriorating business activities. The euro zone’s flash composite PMI fell to 47.0, the lowest since November 2020, suggesting business activities stalled.

In Asia, Chinese stock markets rebounded, with the Hang Seng Index bouncing off a 9-month low following positive Baidu’s earnings and the BRICS meeting. The ASX 200 also finished higher, led by consumer stocks, such as Woolworths, amid a profit jump in its full-year earnings result. Futures point to a higher open across The Nikkei 225 futures were up 0.66%, the ASX 200 futures rose 0.42%, and the Hang Seng Index futures climbed 0.70%.

Price movers:

- 10 out of 11 sectors finished higher in the S&P 500, with Technology and Communication Services, leading gains, up 1.92% and 1.9%, respectively. Real Estate also benefited from a drop in rates, finishing 1.46% higher. Energy was the only sector that ended in the red, down 0.3% due to a decline in oil prices.

- Nivida blew away earnings expectations with an 101% year-on-year revenue growth. The chipmaker’s earnings per share came to US$2.7 on revenue of US$13.51 billion, beating estimates of US$2.09 and US$11.22 billion, respectively. The company’s guidance for the current quarter is US$16 billion, or 170% annually, well above the consensus of US12.61 billion. Its gross margin may increase to 71.2% due to the lucrative AI chip business for the data center. Nvidia announced a $25 billion share buyback program.

- Snowflakes’ shares jumped 4% in after-hours trading on an earnings beat in the second-quarter. The cloud data analytics company topped earnings estimates due to a surge in generative AI demands. Its earnings per share were US$0.22 on revenue of US$640.2 million, topping expectations of US$0.1 and US623 million, respectively. Its revenue grew 37% year on year.

- Foot Locker’s shares plunged 28% following a disappointing earnings report due to weak demands in China, dragging on Nike’s stocks, which posted a 10-day losing streak, suggesting high inflation and China’s slowdown started biting on the retailer’s profit.

- WTI futures fell below US $80 per barrel again on economic concerns following weak global manufacturing PMIs. Crude oil’s price may continue to decline toward the 50-day moving average of 76.50 from a technical perspective.

ASX and NZX announcements/news:

- Auckland Airport (ASX/NZX: AIA)’s 2023 full-year revenue grew 108% to NZ4625.9 million, but the net profit fell 77% to NZ$397.1 million due to the flood. Its earnings per share fell 78% to NZ 2.9 cents. The New Zealand’s largest airport will pay a dividend of NZ cents per share.

- Whitehaven Coal (ASX: WHC) reported a record operating income of A$4.0 billion on a net profit of A$2.7 billion in FY23, up 37% from a year ago. The final dividend is A$0.42 fully franked, and announced a A$948.9 million share buy-back program.

- Air New Zealand (ASX/NZX: Air)’s full-year earnings before one-off items as NZ$585 million on revenue of NZ$6.3 billion. The New Zealand flag carrier will pay a dividend of NZ 6 cents per share, the first time payout since the pandemic.

Today’s agenda:

- US unemployment claims

- US durable goods orders for July

Maximize your potential gains! Take immediate action and seize the investment opportunities that await you. Login to the platform now!

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.