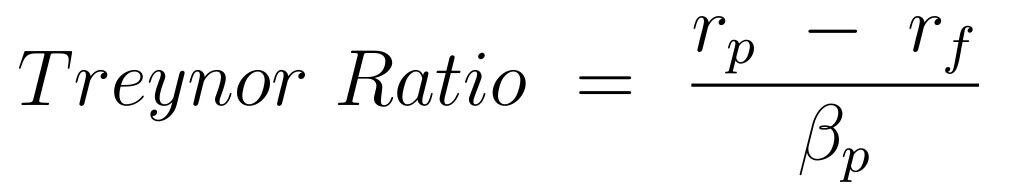

The Treynor ratio, also referred to as the Treynor index, measures the excess return for each unit of risk in a portfolio or investment. This is also called the risk-adjusted return.

Excess return is the return made over and above the risk-free rate of return. The risk-free rate is often considered to be the rate offered on US Treasury Bills, or, you could also think of it as the amount you get in a savings account. In both cases, there is very little chance that your money will be lost. If an investment yields 9% in a year, and the risk-free rate for one year is 1%, the excess return is 8%.

The Treynor ratio also factors in risk using beta, which is part of fundamental analysis. Beta measures how a stock moves relative to a major market index. The market index represents market risk, also known as systematic risk. This is the risk inherent in investing in a certain product, such as stocks.