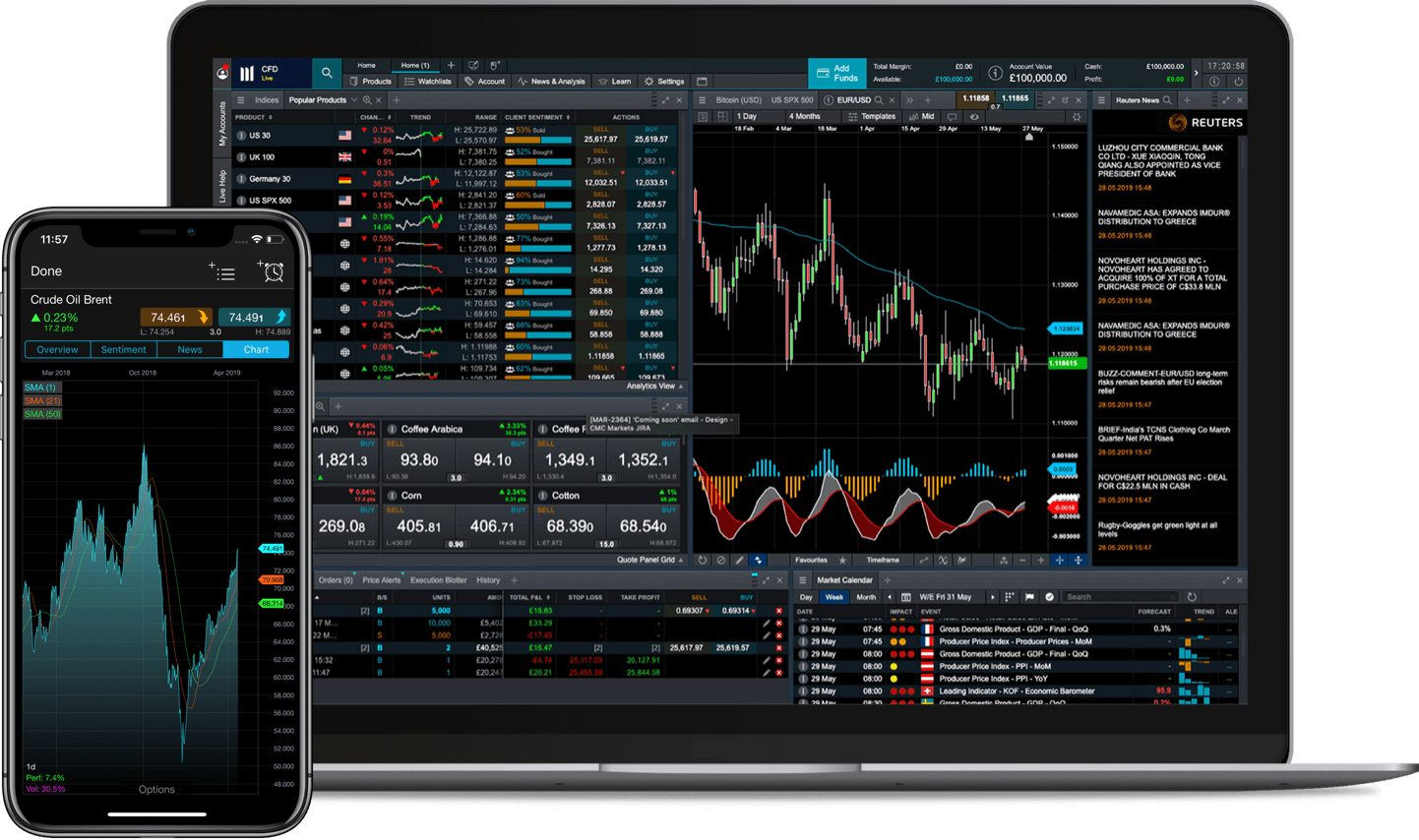

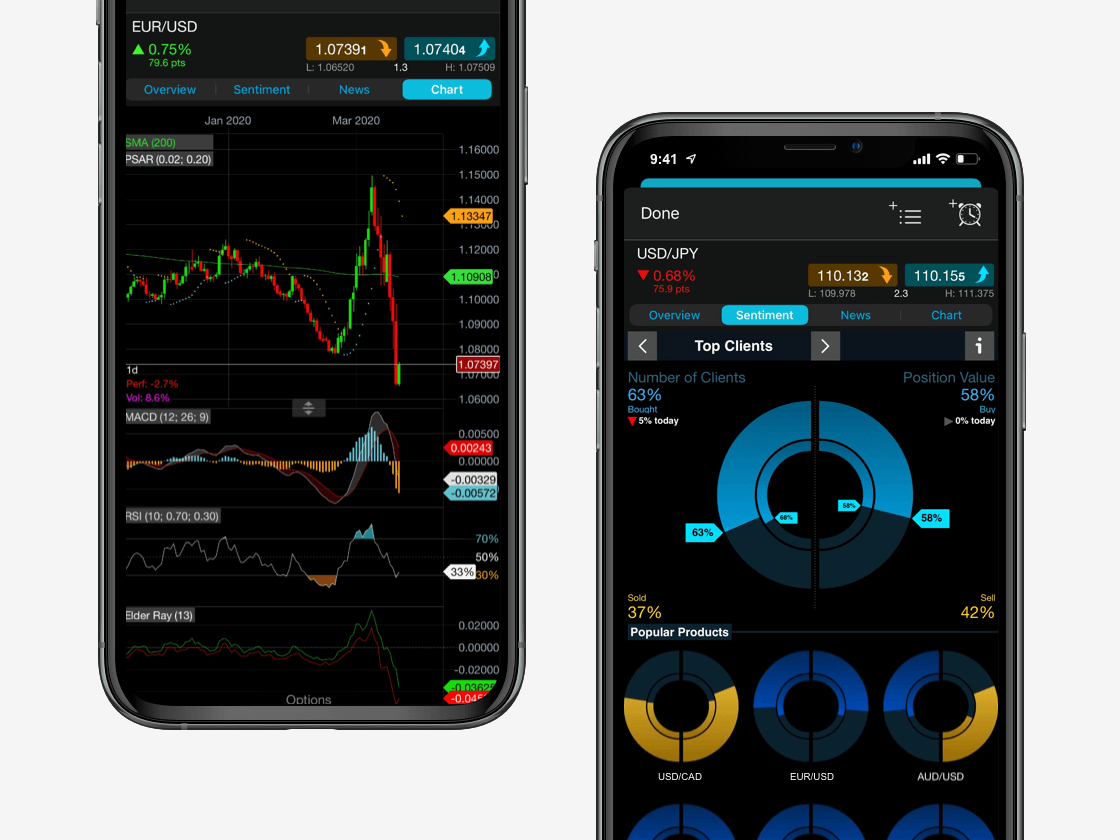

Paper trading provides new and experienced traders a way to learn about new markets, test out strategies, or familiarise themselves with a trading platform without risking real money. The paper trading account is funded with a balance of virtual money, such as £10,000, but it’s traded like real money. Profits and losses are calculated as if this was real money, so you can track your progress while learning how everything works.

Paper trading gets its name from when people used to write down trades to practice instead of actually trading them. Software today allows traders to place trades without risking (or making) any money.