Netflix shares have bounced following an encouraging Q4 earnings report, which highlighted the positive effects of its password-sharing crackdown and new ad-supported tier. These moves might see Netflix edging ahead of its competitors in the streaming wars, though Apple’s new headset could shake things up.

- Netflix shares surge after earnings and $5bn WWE deal.

- Traditional entertainment businesses have struggled to compete in streaming.

- Disney faces a boardroom showdown with activist investor.

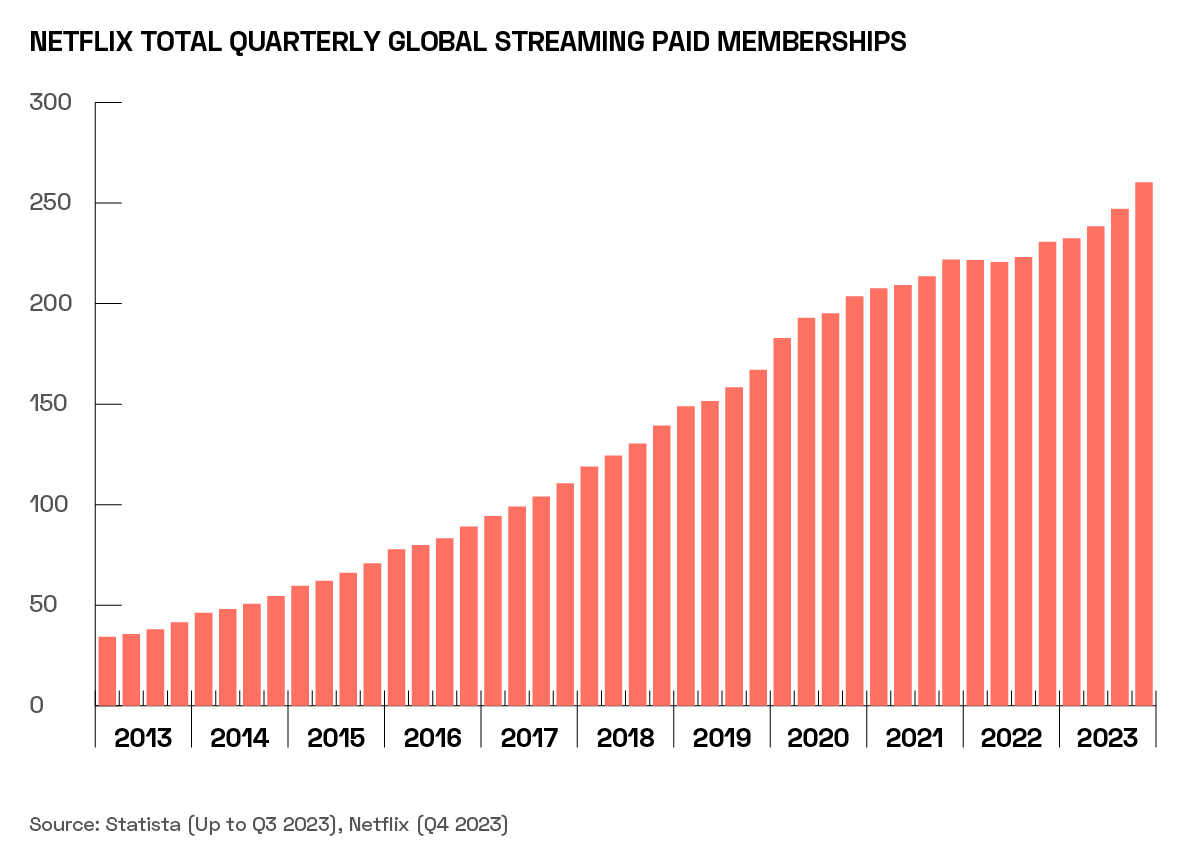

Netflix [NFLX] total subscriber growth exceeded Wall Street expectations in Q4, rising by 13% to 260 million, and allaying analyst fears that a crackdown on password-sharing would lose viewers.

Revenue increased 12% year-over-year. This was driven in part by the restrictions on password sharing, but also by the success of Netflix’s new ad-supported tier. “The ads plan now accounts for 40% of all Netflix sign-ups in our ads markets”, the company said in a letter to shareholders.

Additionally, Co-CEO Gregory Peters indicated in the earnings call on 23 January that the default conversion of T-Mobile’s [TMUS] Netflix On Us customers to the ads tier would double the number of US subscribers on it.

CEO Denies Pivot Towards Sport

One of the most eye-catching announcements accompanying the report was that Netflix will livestream World Wrestling Entertainment’s Raw, starting in January 2025.

Worth $5bn, the deal prompted speculation that Netflix is moving into the arena of live sports streaming, as Amazon [AMZN] has done.

Sports streaming is on the rise, according to PwC, with the number of US viewers streaming at least one event per month set to increase from 57 million in 2021 to over 90 million by 2025.

Spend on live sports media rights in the US is estimated at $28bn for 2024, and the expiration of the NBA’s broadcast contract after the 2024–25 season is expected to spark “fierce competition from traditional TV incumbents and streaming giants”.

However, Co-CEO, President and Director Theodore Sarandos downplayed these suggestions during the earnings call, indicated that wrestling, as sports entertainment, is especially close to Netflix’s core proposition. “I would not look at this as a signal of any other change or any change to our sports strategy,” he said.

Big Spender

The sheer cost of Netflix’s WWE deal is another blow to its competitors.

Efforts to build rival streaming services cost established entertainment companies Disney [DIS], Warner Bros Discover [WBD], Paramount [PARA] and Comcast [CMCSA] a combined $5bn in 2023, according to the Financial Times.

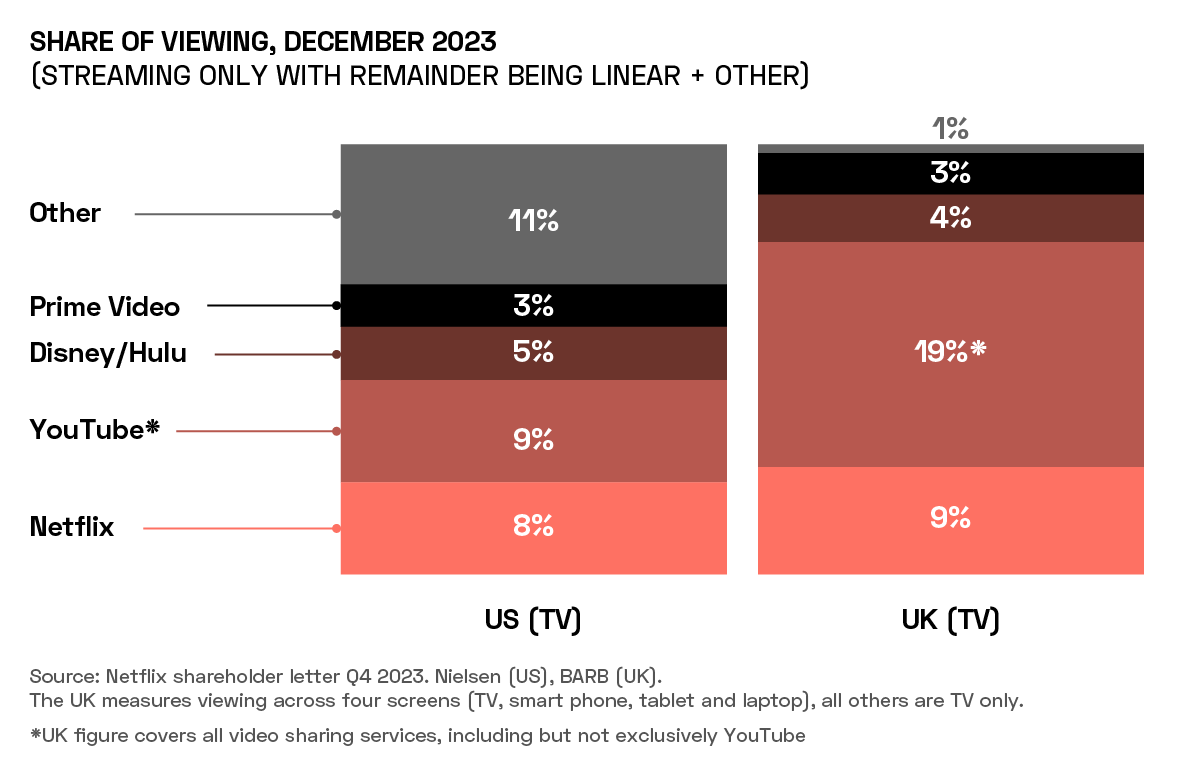

Despite these efforts, Netflix remains the most popular streaming platform besides YouTube in the majority of markets, with 8% of the viewing share in the US in December.

Disney and Amazon’s Prime Video are also competitive in most markets, taking third and fourth spot respectively in the US. Prime Video led the way in offering an ad-supported tier as well as in live streaming sports, with ads to begin appearing by default on Amazon’s streaming service in the US from 29 January.

According to Business of Apps, Prime Video had 190 million users in 2022. Disney+ users fell 8.5% year-over-year to 150.2 million in Q4 2023.

Getting Board of Disney

Declining numbers are just one ingredient in a cocktail of challenges for Disney.

The entertainment giant made a series of box office blunders in 2023, and was forced to cut 7,000 jobs in order to make savings of $7.5bn; in addition, its content has been the subject of political controversy in recent years.

While some would credit Disney’s struggle at the box office to the popularity of streaming, the blockbuster success of films like Barbie and Oppenheimer show there may be something else at play.

Activist investor Nelson Peltz has vowed to take on Disney’s CEO Bob Iger over many of the issues plaguing the company. Peltz’s firm, Trian Partners, nominated Peltz and former Disney CEO James Rasulo to the Disney board in December. The Guardian reports that Trian’s proposal is likely to be put to Disney investors in the spring.

Apple’s Immersive Heads Up

The next front in the streaming wars may well be an immersive one. Apple’s [AAPL] Apple TV+ has unveiled details of the first immersive shows that will be launched for its mixed reality headset Apple Vision Pro.

Viewers will find themselves in the middle of the action in Prehistoric Planet Immersive, a short film based on Apple’s Prehistoric Planet series, and Adventure, a series following professional athletes in some of the world’s remotest places.

Netflix, however, has confirmed that it won’t have a dedicated app on the headset when it launches.

“Our members will be able to enjoy Netflix on the web browser on the Vision Pro, similar to how our members can enjoy Netflix on Macs,” a Netflix spokesperson told The Verge. Disney+, however, will feature a range of 3D movies on the service.

How to Invest in Streaming Platforms

In the 12 months to 30 January, Netflix’s share price gained 63.1%, and 18.5% since Q4 earnings were announced on 23 January. The streaming giant’s stock hit a 52-week high on Monday.

Over the last year, with the exception of Comcast, which has gained 20.8%, the established entertainment companies have struggled. Disney has fallen 9.1%, Warner Bros 27.1% and Paramount 37.8%.

However, the big tech companies encroaching on the streaming industry have outperformed. Amazon has gained 60.4% while Apple has gained 34.8%.

Instead of individual stocks, any of which risk being eventual losers of the streaming wars, investors can select an ETF for diversified exposure across the streaming industry. As of 26 January, the First Trust S-Network Streaming & Gaming ETF [BNGE] holds Netflix, Disney and Warner Bros. The fund has gained 22.4% over the past 12 months.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy