In this article, US-based investment manager Direxion — which launched the Daily FTSE China Bear and Bull leveraged funds — breaks down which sectors are supporting growth in the Chinese equity market.

As the epicentre of the global COVID-19 pandemic and, therefore, the first to grapple with its devastation, China has spent the pandemic year slightly ahead of the curve when it comes to monitoring, containing and, ultimately, recovering from the effects of the virus.

The nation’s dramatic response to COVID-19, including the accommodative monetary policy adopted by the People’s Bank of China, helped it to maintain its track record of economic growth through a year when many nations, including the US, experienced some degree of GDP contraction.

However, given China’s slight head start on the pandemic timeline and its continued economic resilience, the nation’s central bank started 2021 by signalling its intention to normalise policy through the year and reduce some of the excess liquidity that has built up in its markets.

This is as a record number of foreign investors have funnelled into the country’s equity markets, surpassing the US for the first time in terms of international investments.

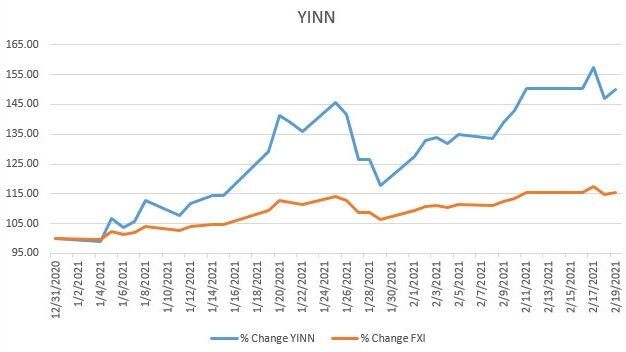

Despite these signals from the central bank, as well as some direct action already taken, Direxion’s stable of China leveraged funds have shown little sign of slowing from the pace they have so far set in the final weeks of 2020 and into 2021.

Liquidity boots prices, growth supports them

Already this year, the People’s Bank of China has withdrawn roughly $12bn from its open market operations in an attempt to reduce rising asset prices that have run up over the course of the more lenient borrowing environment.

That was in late January, and while Chinese markets took a slight dip as a result of the action (and in anticipation of future monetary tightening), core Chinese equity has resumed its upward trajectory into February.

The FTSE China 50 Index rose about 5% through the initial weeks of the month and about 10% year-to-date, which has put the triple leveraged Daily FTSE China Bull 3X Shares [YINN] up nearly 40% year to date.

Source: Bloomberg

Major components of the index in the financial space like The Industrial Bank [601166.SS] and Ping An Bank [000001.SZ] have obviously benefited from the lower liquidity and rising rates.

But continued resilience among the industrial and consumer segments from the likes of electrical component manufacturer Midea Group [000333.SZ] or Baoshan Iron & Steel [60019.SS], and even strong sales from liquor producers like Kweichow Moutai [600519.SS] and Wuliangye Yibin [000858.SZ], have supported this broad-based momentum within the Chinese equity space.

Although this strong equity performance bodes well for the overall strength of the Chinese economy, it also paves the way for the central bank’s planned monetary tightening. Add to that signs of rising price pressure among manufacturers and steady demand by consumers, and it may not be too long before the People’s Bank of China again looks to ease an inflationary economic environment.

Still, given the tenuous first steps the world seems to be taking from under COVID-19, the recovery may very well be given room to run. China ended 2020 with a record trade surplus, and it will be interesting to note whether that statistic was aided by constraints of the pandemic or if it only marks the beginning of further growth for the country.

Chinese tech and internet stocks continue to outperform

Of course, these core sectors only tell part of China’s growth story circa 2021.

While the nation’s financial and industrial concerns continue to support its international trade, China’s online corporate monoliths continue to expand in both size and scope.

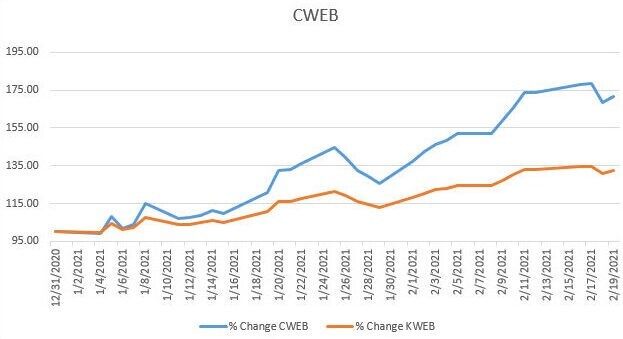

In the first few weeks of this year alone, The Direxion Daily CSI China Internet Index Bull 2X Shares [CWEB], which tracks the CSI Overseas China Internet Index, has surged by more than 65%. This is compared to the roughly 100% gains the ETF posted through all of 2020.

Source: Bloomberg

While the growth picture for China’s increasingly robust online landscape has always been fairly bullish, the recent performance among online staples like Baidu [BIDU] and Tencent Holdings [TCEHY] and e-commerce companies Meituan [MPNGF] and Pinduoduo [PDD] has put a renewed spotlight on the persistently high growth expectations for the sector. This is as the nation just announced it had reached almost 1 billion internet users by the end of 2020.

Of course, given China’s history with regulating and censoring the online landscape, as well as the more universal concern about how giant online companies threaten to become monopolistic, there are potential roadblocks to the rapid rate of growth the sector has seen in recent months.

With regard to the latter concern, the Chinese central government just finalised anti-trust regulations that aim to stave off some of the anti-competitive practices that other free-market countries have been more lax in implementing but which have roiled online giants like Alibaba Group Holdings [BABA] with myriad antitrust lawsuits.

While the success or failure of these regulations is yet to be seen in either encouraging competition or supporting growth, the fact that they are being implemented at all may, in fact, be another area in which China is getting the jump on Western nations that are still debating whether or not monopolies are even a bad thing.

What’s more, China’s regulations are, at the moment, fairly undefined, putting the onus of proof on regulators as the government gets a handle on how to effectively oversee the industry without hampering its growth.

Cautiously embracing rapid growth

With the worst of the pandemic seemingly in the rear-view, China seems to have entered a new growth phase in its history, adopting a firm and decisive grip on how it wants to grow in the coming years.

But while the future for Chinese markets remains tied up with the policy set forward by its central bank and ruling Chinese Communist Party, Chinese stocks will likely still find influence from global asset trends.

At the moment, equity markets around the world remain on a growth trajectory, and the measures so far taken by the People’s Bank of China have not slowed enthusiasm for the investment outlook within China.

This article was originally published in Direxion’s Spotlight newsletter on 22 February.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy