7 strategies for financial hedging

Financial hedging is an advanced strategy that helps to minimise and offset risks within your trading portfolio. Learn about some of the most effective hedging strategies that can be used when spread betting or trading CFDs within the financial markets.

What is hedging?

Hedging is the practice of opening multiple positions at the same time in order to protect your portfolio from volatility or uncertainty within the financial markets. This involves offsetting losses on one position with gains from the other.

Typically, the aim of financial hedging is to take a position on two different financial instruments that have an opposing correlation with each other. This means that if one instrument declines in value, the other is likely to increase, which can help to offset any risk from the declining position with a profit. These investment decisions should not be rushed and require a lot of thought and analysis beforehand.

Financial hedging is perhaps more common amongst short-term and medium-term traders, as market volatility tends to last for limited periods of time and these traders aim to take advantage of rapid price fluctuations. Long-term position traders are less likely to take into account recent changes within the market and instead, they more often open positions based on their predictions for the long-term future.

Who uses a hedging strategy?

Hedging strategies are commonly used by retail traders that have a good knowledge of the financial markets and are able to forecast upcoming changes within the economy. However, anyone can use a hedging strategy, especially if there is a large sum of money or portfolio involved. For this reason, professional traders and institutional investors also tend to apply this strategy.

Hedging can be seen as a risk-management strategy that helps to protect your trading portfolio. Trading in volatile markets can present consequent risks for an investor: changes to interest rates and currency exchange rates, political, social and economic instability, geographical changes, and commodity shortages, to name a few. These are all factors that a trader could consider as part of their fundamental analysis before opening positions. This way, they are able to plan their hedging strategies in advance of the markets in order to minimise losses.

Why do traders hedge and in which markets?

- To offset liquidity risk in the share market. Traders may be worried that a stock cannot be traded back and forth quickly enough in the market without impacting its price if there is a lack of buyers.

- In case of poor weather conditions, natural disasters or lack of resources that can have a negative impact on commodity positions and create commodity risk.

- To avoid currency risk on forex positions. Lending and interest rates fluctuate often, as well as exchange rates for currency pairs. Interest rates can also affect the treasury market.

Practise hedging with virtual cash

Trade risk-free with £10,000 virtual funds

Types of hedging strategies

Hedging strategies come in many forms, depending on the financial market and instrument that you are looking to trade. Here are some of the most common approaches that traders tend to use:

- Use of derivatives: futures, options and forward contracts

- Pairs trading: taking two positions on assets with a positive correlation

- Trading safe haven assets: gold, government bonds and currencies such as the USD and CHF

- Asset allocation: diversifying your trading portfolio with various asset classes

Continue reading as we explore the above strategies in more detail.

Hedging with derivatives

Forward contracts

Hedgers may decide to use a forward contract when price movements are particularly volatile within their chosen market, as they are an agreement to exchange a financial asset at a specified price on a future date. This allows you to close out your position before the delivery date in return for cash. Hedgers tend to trade forwards in order to avoid the volatility of an asset’s price, as the terms of agreement are set at the beginning of the contract. Any price fluctuations, therefore, will not influence the price at the end of the forward contract.

For example, a commodity trader could use a forward contract if they are concerned about weather conditions or natural disasters that may have an effect on supply and demand for an asset, such as corn, wheat or sugar. By locking in the price at the start, the trader will hedge against possible risk factors that could lead to losses.

Learn more about forward contracts.

Futures and options

Another type of derivative trading involves futures and options contracts. While these are not offered at CMC Markets, they work in a similar way to forwards to guarantee the future price of an asset. If your intent is to make a purchase in the future, then you could go long, whereas if you intend to sell the asset, you could go short. By having future prices agreed upon, this can help to reduce any uncertainty on market conditions. Futures and options tend to be more regulated than forward contracts and you would be obligated to carry out the full duration of the contract.

Pairs trading

Pairs trading is perhaps the most commonly utilised method of hedging. The best way to describe pairs trading is essentially as a long-short hedge strategy, meaning that it’s market-neutral. It doesn’t matter if the two securities involved belong within the same asset class, as long as there is a positive correlation between them.

In order to carry out a pairs trading strategy, the trader should identify when one asset is overvalued and one is undervalued, where their deviating values are calculated using the standard deviation. They can then choose to open a buy position to go long on the asset that is undervalued, and short sell the overvalued position. In order to make a profit, the assets should reverse back to their original positive correlation.

Learn more about pairs trading.

Trading on safe haven assets

Gold

Belonging to the family of precious metals, gold has often been considered a ‘safe haven’ for many investors, due to its rarity, reliability and stability within the commodities market. The value of gold remains constant after many years, and in times of political, social and economic uncertainty, traders may choose to invest in gold as a way to hedge their positions in other suffering markets.

It also helps to protect traders against market inflations and is commonly seen as a hedge against inflation and currency devaluations. The price of gold also tends to increase when the stock market crashes, so stock traders may focus on this commodity in times of increasing downside volatility.

Read our full guide to gold trading.

Government bonds

Debt securities such as treasuries (T-bonds) and government bonds (gilts) are generally considered to be safe investments all year round. They provide a fixed rate of return until their expiry date, and when they mature, the government pays the bondholder the face value of the bond. This means that any principal invested is then repaid to you. Although government bonds tend to attract less risk-tolerant investors, they can still be affected by interest rates, inflation and currency strength for a particular economy, just not as strongly as other financial markets such as the stock market. In times of market uncertainty, government bonds are typically seen as a safe haven.

Currency pairs

Currencies such as the US dollar (USD), Swiss franc (CHF) and Japanese yen (JPY) are generally considered to be safe havens within the forex market. This is because their economies are particularly strong (the US has the largest economy in the world, for example) with stable interest and exchange currency rates. The USD is the world’s global reserve currency, meaning that it’s used for many business deals and often won’t be dented by domestic or international uncertainties. Switzerland also has a low-volatility capital market, stable government, tax-friendly policies for the wealthy and minimal unemployment, which traders can take advantage of in times of market uncertainty.

Asset allocation

Asset allocation is another strategy that aims to offset risk while also diversifying your trading portfolio. For example, some traders choose to dedicate a certain percentage of their portfolio to separate asset classes, such as 40% equities and 60% bonds. This allocation depends on many factors and characteristics of the trader, such as age, investment goals and risk appetite, so we would never recommend the same strategy for every trader.

An effective way to spread out your asset allocation could be to add indices, share baskets or ETFs to your portfolio, which contain multiple stocks using one single position. This ensures that your risk is spread across a number of assets that have the potential to rise or fall equally, rather than placing your entire capital on one potentially risky asset.

Browse a number of different asset allocation strategies.

NEW

Share baskets

Get exposure to the world's fastest-growing, trending industries, from Driveless cars to Streaming Media

How to hedge

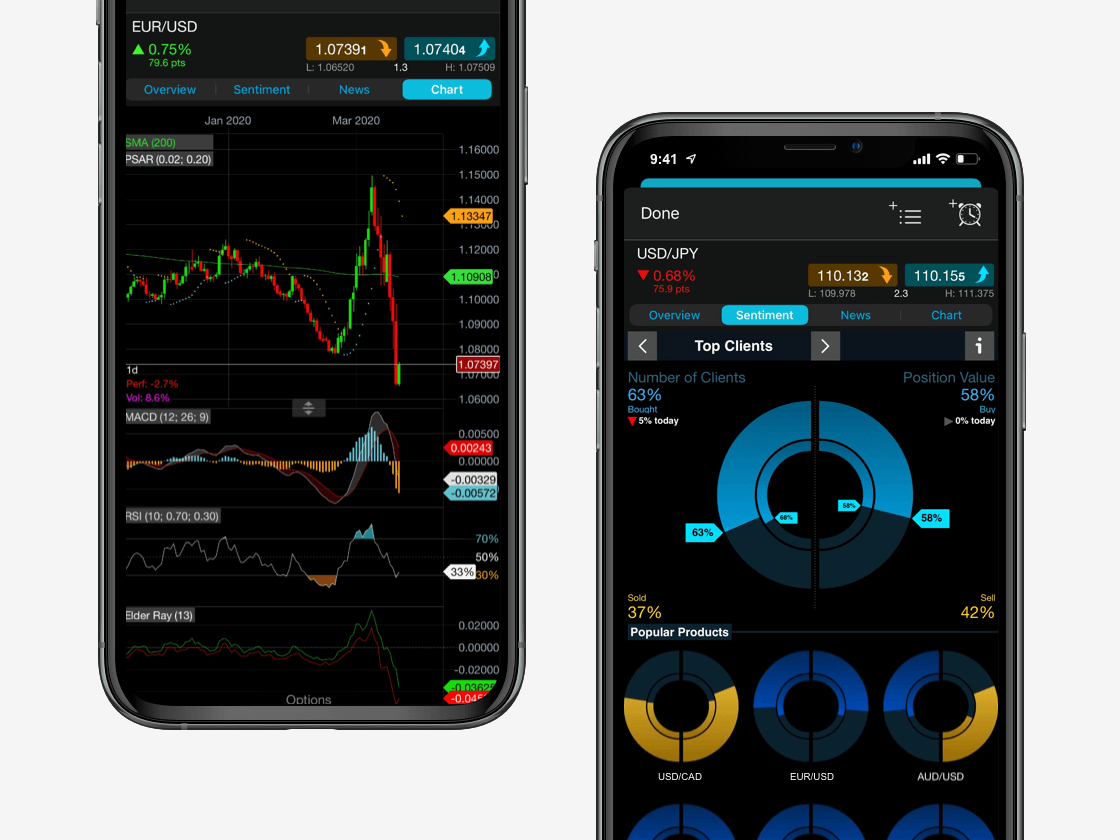

- Open an account. You will have access to 12,000 financial instruments in our product library.

- Choose whether you want to hedge via spread bets or CFDs. When you spread bet with us in the UK or Ireland, it is a tax-free method*, whereas CFDs come with extra costs but are available globally.

- Consider how much capital you have available. Placing multiple positions will come with extra costs, especially if holding positions overnight or applying order types. See an overview of our trading costs.

- Pick a strategy. Decide whether to trade forward contracts, use a pairs trading strategy or open positions on safe haven assets, as these will work differently for every trader.

- Don’t assume that hedging is an alternative to risk-management. You could still apply stop-losses on positions where you think the market is particularly volatile, for example.

Hedging example: testing a CFD hedging strategy

Let’s explore how to utilise financial hedging in the stock market as part of a CFD trading strategy for a shareholder that already owns company stock from elsewhere. Please note that we don’t currently offer shareholding services to our clients in the UK.

Investor responses to potential volatility depends on their individual circumstances and approach. For active investors, the risk-averse, and those with concentrated holdings in a single stock, hedging may be a viable option.

How to hedge a short stock position

An investor that owns 10,000 XYZ shares and is concerned about a share price drop after an announcement, such as an earnings report, may establish an account with CMC Markets. In the lead up to the company report, the investor opens a position to short sell 10,000 units. The price at which the CFD trade is executed is “locked in”.

If the value of XYZ stock falls, losses on the shareholding could be offset by gains on the sold CFD position. It’s important to note that this also means that the shareholder will not benefit from any post-result XYZ rally. Any gains on the rise in XYZ shares may be neutralised by losses on the sold CFD position.

This type of hedging strategy reduces the market risk of holding a share (to zero when executed properly), but there are other risks and costs that investors must consider.

Costs of hedging with CFDs

Naturally, there are costs involved in establishing the CFD position.

Margin required: establishing a long or short position in CFDs requires an initial margin. This is usually in the range of 5% to 20%, depending on the size and liquidity of the stock, making CFDs a more capital efficient form of hedge.

Holding costs: holding a position overnight will result in overnight fees, although if the CFD position is open for just a few days, these are likely minimal. (Please note that forward contracts don’t have any overnight holding fees).

Tax consideration: these are dependent on individual circumstances but CFDs usually require you to pay capital gains tax, although they are exempt from stamp duty*.

Before carrying out a hedging strategy, you should try to calculate whether the risk-reward ratio is worth it; in other words, whether the amount you pay to open multiple positions will supersede the losses saved on a particular trade.

Hedging strategies can also be practised with a spread betting account, which is tax-free but, similar to CFDs, also comes with spread costs and overnight fees, as well as others. Read an overview of our trading costs for each product.

What are the advantages of hedging?

- Hedging helps to limit losses and lock in profit.

- The strategy can be used to survive difficult market periods.

- It gives you protection against changes such as inflation, interest rates, currency exchange rates and more.

- It can be an effective way to diversify your trading portfolio with numerous asset classes.

- Helps to increase liquidity within the financial markets.

What are the disadvantages of hedging?

- No trading strategy is completely risk-free; therefore, you should still take appropriate action for managing risk within your trades, such as applying stop-loss orders and other controls.

- As hedging rarely helps a trader to profit, it can only mitigate losses at best.

Browse an overview of our execution tools and order types.

FAQ

What are hedging strategies for the currency market?

Some strategies used for forex hedging include the use of options and forwards, as well as carry trades and cross currency swaps. You can use long or short positions on forex CFDs to hedge your currency exposure from other international assets you might own. Learn more about hedging in the forex market.

What is the best hedging strategy?

There is no ‘best’ hedging strategy that works for every trader as each individual will have a different overall objective, amount of capital to spend and risk appetite. Therefore, you should research the different types of strategies before deciding on one that suits your goals and opening an account.

What’s the difference between hedging and speculation?

While traders usually speculate on an asset’s price movements with the aim of making a profit from drops and rises, hedging aims to offset risk and prevent losses, while not focusing entirely on profit. Hedging is rather seen as more of a risk-management strategy.

How can I start financial hedging?

To start hedging within the financial markets, open a trading account. Decide whether you want to spread bet or trade CFDs, and you can practise first risk-free on a demo account with £10,000 worth of virtual funds.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.