With industrial production as its driving force, the German economy is one of the largest economies in Europe, as well as worldwide. It is one of the highest exporters across the globe, mainly focusing on products such as machinery and electronics. The country is also one of the biggest producers of wind turbines and by the year 2030, it expects to reach its aim of generating 65% of its energy from renewables. Timber, nickel, and copper are some key natural resources within its reserves that are popular products to trade within the commodities sector.

The German stock market

Germany is viewed by many as an important and influential country, as it is home to several of the world’s largest businesses and represents one of the world’s strongest economies. With a stock index that is comprised of many industry-leading companies, the German stock market is important to traders for many reasons. This article explores how Germany has influenced the world’s financial markets over the years and we provide an insight into the trading opportunities that exist on our Next Generation trading platform. If you are looking to get involved in the German stock market, read on to discover the numerous products and asset classes that we offer with spread betting and CFD trading.

The German economy

German stock exchanges

In total, Germany offers a choice of eight stock exchanges for traders. These include the Berlin Stock Exchange, Stuttgart Stock Exchange and the Munich Stock Exchange. However, Germany’s largest stock exchange is the Frankfurt Stock Exchange.

The Frankfurt Stock Exchange

Known in Germany as FWB Frankfurter Wertpapierbörse, the Frankfurt Stock Exchange is operated by its owner, Deutsche Börse Group. It is the principal stock exchange in Germany, where 90% of all trades are executed through its own trading system, Xetra. The prices presented on this system help to calculate Germany's main stock index, the DAX.

Its origins date back to the 11th century and Frankfurt gained recognition as a major financial centre in the 19th century. It was in the mid-20th century that the Frankfurt Stock Exchange was established as the largest and most prominent stock exchange in Germany. This consequently led to further investment, both nationally and internationally.

The Frankfurt Stock Exchange is valued at approximately $1.9 trillion and has longer trading hours than most, operating between 8am-8pm local trading time. However, German stocks can also be traded on through our online platform with spread bets and CFDs, and these trading hours are displayed on the individual instrument pages for your chosen asset. Learn more about stock market hours.

German stocks

There are a wide range of industries represented in the German stock market. These include chemical, retail and financial services industries. Below are some examples of top German stocks by market capitalisation, according to their industry. Open an account today to start trading on German stocks.

- Technology: SAP, Deutsche Telekom, Wirecard

- Automotive: BMW, Volkswagen, Daimler

- Pharmaceuticals and Chemicals: Bayer, BASF, Merck.

- Consumer Goods: Adidas, Henkel

- Finance: Allianz, Munich Re, Deutsche Bank

German stock index

Rather than trading on one singular stock or multiple individual stocks, traders can diversify their portfolio and trade on share prices through a stock index. The DAX stock index is one of the most popular indices to trade in the world. It was established in 1988 and it is comprised of the largest and most actively traded companies, based on market capitalisation. The DAX includes several industry-leading brands, such as those mentioned above, including Adidas, BMW and Siemens.

Companies gain admission as members of the DAX index based on a variety of conditions and factors, which include financial reports, audits, and capital requirements. In order for members to be listed on the index, they need to consistently pass a strict set of criteria each quarter.

Following an announcement from Deutsche Börse in November 2020, the DAX expanded to consist of 40 companies, which took place in the third quarter of 2021.

How to trade on German stocks

At CMC Markets, traders have been trading with us for over 30 years. Our award winning Next Generation platform* offers financial derivative products as an alternative to investing in physical shares from an array of markets around the world, including the German stock market. Furthermore, members of our platform can also spread bet or trade CFDs on other German asset classes, such as treasuries and commodities and indices.

Spread betting is a tax-efficient** way of speculating on the price movement of the underlying assets. This means that traders do not actually own the asset, and when possible, traders can go long or short on the position. The benefit of spread betting is that if the price of an asset is predicted to fall, then traders have the option to sell. Users of our platform can spread bet on indices, forex, commodities, global shares and treasuries. CFDs work in a similar way and allow traders to buy or sell a number of units for an instrument, depending on whether they think that the price will rise or fall, and the difference in price will be exchanged at the end of the contract. Trading CFDs can be beneficial to traders, as they can gain access to an asset at a lower cost than purchasing it outright, and can also choose to go long or short.

However, both are derivative products and require trading with leverage which comes with various risks and can result in the loss of capital. Another risk to note is that of market volatility and rapid changes in price, which may arise outside of normal business hours if a trader is spread betting or trading CFDs on international markets. This can cause the account balance to change quickly, which can then run the risk of an account close-out. Therefore highlighting the importance of monitoring the account on a regular basis.

On our trading platform we offer a derivative version of the index to trade called the Germany 40. You can view our Germany 40 live price chart, along with additional details and trading hours. You can spread bet and trade CFDs on the following asset classes by opening an account with us. Please note that indices are available with a demo account for practising with virtual funds, but you will need to open a live account in order to trade on shares and ETFs, with which demo users have access for a month.

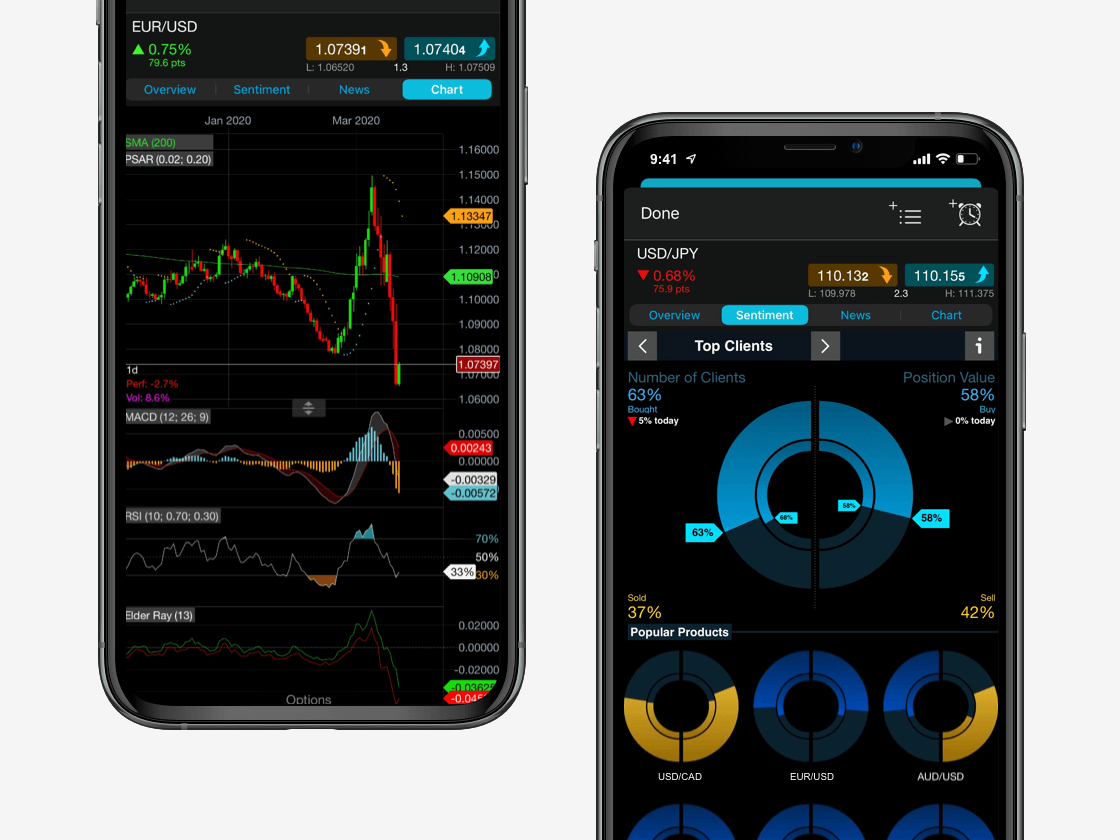

Seamlessly open and close trades, track your progress and set up alerts

German stock ETFs

Exchange-traded funds (ETFs) are investment funds that consist of a compilation of assets, such as shares and bonds. In particular, ETFs commonly track stock indices, such as the Germany 40, which can be traded like any other stock. Our Next Generation platform offers a number of ETFs that track the performance of the underlying Germany 40 index that you can trade on, including the following:

Trade the German stock market with CMC Markets

In summary, many traders view the German stock market as highly influential, due to its strong reputation and numerous industry-leading companies. Using our platform, traders can spread bet and trade CFDs on German assets within the share and index markets, as well as commodities and treasuries. Register now for a demo account or live account. Please note that all asset classes can be traded using virtual funds with a demo account, aside from ETFs and shares which Demo have access for a month.

Our Next Generation platform also consists of a variety of useful features for share trading, such as the news and analysis section, which contains fundamental analysis stock reports from Morningstar and news updates from Reuters. Explore more of our platform features through our library of platform video guides.

*No1 Web-Based Platform, ForexBrokers.com Awards 2020; Best Telephone & Best Email Customer Service, based on highest user satisfaction among spread betters, CFD & FX traders, Investment Trends 2020 UK Leverage Trading Report; Best Platform Features & Best Mobile/Tablet App, Investment Trends 2019 UK Leverage Trading Report.

**Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

FAQ

What is the main stock exchange in Germany?

Germany is one of the largest economies in Europe, and their main stock exchange is the Frankfurt Stock Exchange. Also known as the FWB Frankfurter Wertpapierbörse, the Frankfurt Stock Exchange is operated by its owner, Deutsche Börse Group. The prices presented on this system help to calculate Germany's main stock index, the DAX.

What are some examples of German stocks?

Examples of German stocks include industry leading brands, such as Adidas, BMW, and Volkswagen. Other examples of German stocks traded on the Germany 40 index, includes global financial companies, like Allianz and Deutsche Bank. Search more instruments that you can trade.

How can I invest in German stocks?

You can invest in German stocks with our Next Generation trading platform, where you can spread bet and trade CFDs by opening an account with us. Indices are available with a demo account for practising with virtual funds, but you will need to open a live account in order to trade on shares and ETFs.