Financial substack Doomberg joins Opto Sessions to discuss three key geopolitical risks: China’s supply chain dominance and potential conflict with Taiwan; Saudi Arabia’s oil price influence; and Australia’s vulnerability to refinery dependencies.

LISTEN TO THE INTERVIEW:

One of the greatest geopolitical risks from a purely economic perspective is, according to Doomberg, the danger of war breaking out between China and Taiwan.

“That would be a catastrophe that would ripple around the world,” says Doomberg.

Taiwan, Doomberg points out, is home to some of the world’s most important factories, given its centrality to the global semiconductor industry.

“That would be a catastrophe that would ripple around the world.”

“The art of making semiconductors is indeed an art,” says Doomberg. “It’s not something that can just be copied and pasted. The technologists who work at such factories are amongst the most important humans on the planet, given the susceptibility of our way of living to such tiny pieces of technology.”

For this reason, Doomberg takes the view that any kind of kinetic conflict between China and either Taiwan or the US is something that every effort should be made to avoid.

China has achieved a dominant position in global supply chains for a wide range of goods. The nation has a dominant position in solar panel markets because it took a “monopolistic” hold of key elements in the polysilicon supply chain, says Doomberg. The same thing now appears to be taking place with electric vehicles (EVs).

“They leverage local access to cheap thermal coal and what we would consider slave labour. They give massive policy support to their state-owned enterprises and other domestic champions. Then they flood the world with artificially cheap supply and put everybody else out of business.”

Saudi Oil Dominance

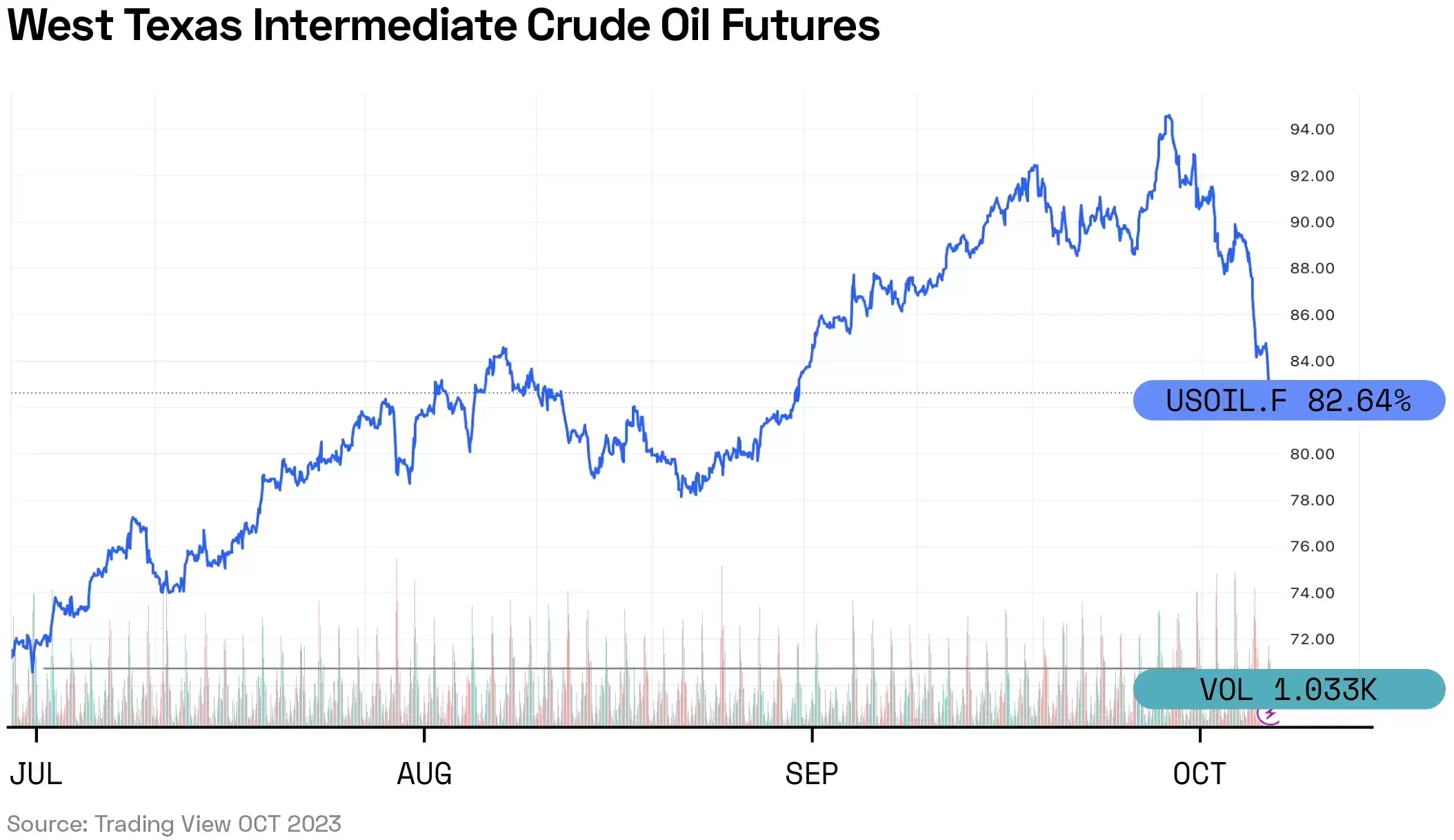

In July, Saudi Arabia began voluntarily cutting one million barrels of oil per day from its production, confirming at the start of September that these cuts would run until the end of the year.

In the three months to 5 October, crude oil futures rose 14.6%, though this period includes a slump in early October, driven, according to Reuters, by weak macroeconomic data.

Doomberg feels that this is a perfect demonstration of the price elasticity of demand for oil.

“The Saudis are basically running an experiment that we should all observe the outcome of,” says Doomberg. “How could it be that cutting one or two million barrels a day of production, when the global production is 100 million barrels, causes a 25% spike in the price?”

This price elasticity is, in Doomberg’s view, a powerful argument against environmentalists calling for an end to fossil fuel investment. “If this one individual, Mohammed bin Salman, has that much power, what does that tell you about how tight things are and how opposition to investing in fossil fuels is going to end?”

The hikes in oil prices implied by ending fossil fuel investment will, in Doomberg’s view, dissuade voters from electing governments seeking to enact such policies. Ultimately, they hope that bin Salman’s decisions will provoke more grounded conversations about the trade-offs involved in energy policy within developed economies.

“The Saudis are basically running an experiment that we should all observe the outcome of.”

Regarding the prospect of individual nations achieving energy independence, Doomberg says, “With enough money and ingenuity, anything is possible”. Nevertheless, bin Salman’s approach is “proof of the fallacy of our belief that we can stop investing in fossil fuels today and maintain any semblance of our lifestyles”.

Australia’s Achilles Heel

“Australia is a true energy superpower,” says Doomberg. “It’s a coal superpower, a natural gas superpower. It doesn’t have much in the way of oil, but it is an enormous mining superpower.”

However, Doomberg argues that Australia has an “Achilles heel” in that all of those industries require diesel to operate. “You can't operate a coal mine without giant diesel trucks. You can't mine for lithium in the way that the Australians mine for it without all manner of diesel-powered machinery.”

“Australia is a true energy superpower.”

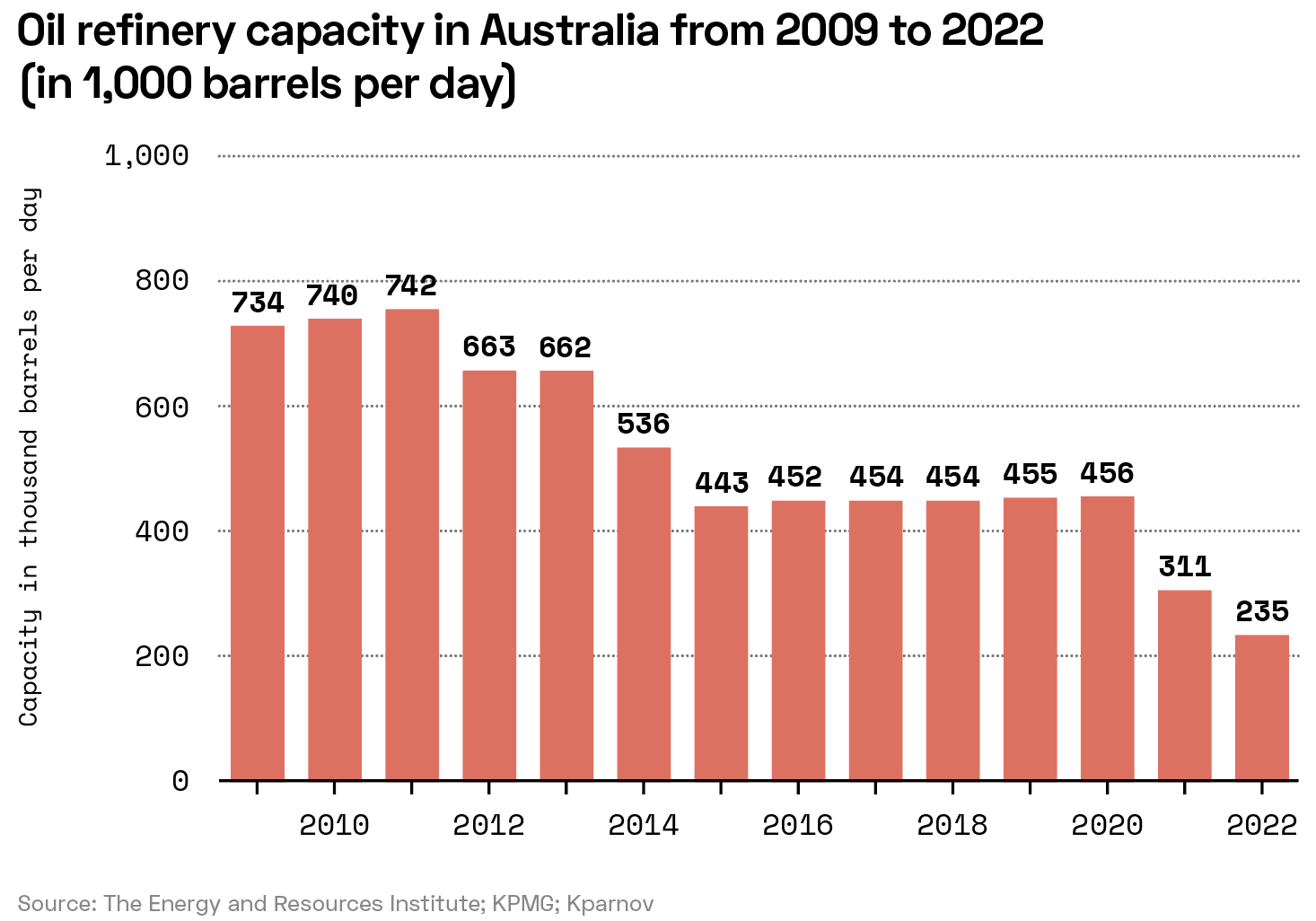

According to Statista, Australia’s oil refining capacity fell by nearly two-thirds in ten years, from 663,000 barrels per day in 2012 to 235,000 in 2022.

“ On a per capita basis, Australia has 84% less domestic refining capacity than the US, which itself hasn’t built a major new refinery in more than 40 years,” says Doomberg. The upshot of this is that Australia is reliant on its neighbours for access to the refined diesel required to meet its domestic needs.

These neighbours are thousands of nautical miles from Australia, says Doomberg. Furthermore, the country has little in the way of stored diesel reserves. Any disruption to the supply chains feeding diesel to Australia could therefore be incredibly disruptive, not just to Australia itself, but to the world, given the increasing global reliance on commodities, like lithium, in which Australia is abundant.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy