In this article, Frank Holmes, CEO of U.S. Global Investors and executive chairman of HIVE Blockchain Technologies, looks at the recent market changes to cryptocurrency prices, in part due to environmental concerns raised by Tesla’s Elon Musk. He also explores the role renewable energy plays in the way cryptocurrencies are mined.

And just like that, Elon Musk has turned on Bitcoin.

In a tweet on Wednesday (12 May), the self-proclaimed “Technoking of Tesla” said his company — which announced in February that it bought $1.5bn in Bitcoin [BTC-USD] — would be suspending vehicle purchases using the cryptocurrency. Musk cited crypto miners’ “increasing” use of fossil fuels, particularly coal, “which has the worst emissions of any fuel.”

"Tesla has suspended vehicle purchases using Bitcoin. We are concerned about rapidly increasing use of fossil fuels for Bitcoin mining, especially coal, which has the worst emissions of any fuel." - Elon Musk, via Twitter

The price of Bitcoin responded by dipping below $50,000, ending the day down more than 12%, its worst trading session since January [NB: Bitcoin went on to drop 13.3% on 19 May].

Musk’s tweet comes a week after a new bill in New York was introduced that proposes to halt operations at all cryptocurrency mining facilities in the state for up to three years while an environmental impact study is conducted.

According to the legislation, individual crypto mining centres would be permitted to return to normal operations only if they’re found not to interfere with the state’s decarbonisation goals.

I don’t question Elon Musk’s or the New York legislature’s good intentions, but I respectfully disagree with the underlying insinuation that crypto miners in particular are a threat to the climate.

Don’t get me wrong: The computer processing power needed to mine Bitcoin, Ethereum [ETH-USD] and other digital tokens is not insignificant. The University of Cambridge’s Bitcoin Electricity Consumption Index (CBEI) estimates that the global Bitcoin network, running at full capacity, uses about 147.8 terawatt hours (TWh) on an annualised basis, or almost as much as Sweden consumes every year.

147.8TWh

Global Bitcoin network's annual energy consumption

That’s a big number, but it doesn’t take into account the percentage of Bitcoin mining that uses renewable energy. In a December 2019 report, CoinShares believed it to be 73%. Last month, Ark Invest’s Yassine Elmandjra said it was closer to 76%.

If those figures are accurate, then there really shouldn’t be any concern about crypto mining as it relates to greenhouses gas emissions. I believe New York lawmakers will find that to be the case, should the bill become law.

Square: Crypto is key to a clean energy future

In fact, I expect the industry to convert entirely to renewable energy much more rapidly than other industries precisely because it uses so much energy. Solar and onshore wind are now cheaper than coal and even gas, so it only makes sense from a cost perspective.

Take HIVE Blockchain Technologies [HIVE]. We use nothing but cheap renewable energy in Sweden, Iceland and elsewhere to mine Bitcoin and Ethereum. This is one of the reasons why HIVE is among the most profitable crypto miners right now.

Crypto mining may even help accelerate the deployment of renewable energy, which should please Musk. That’s according to a special report published last month by Square [SQ] and Ark Invest. The digital payments company says that, because crypto miners are “unique” energy buyers, they’re an ideal complement to wind and solar as well as better storage technology. Returns on investment could be improved, for one thing, which would incentivise the deployment of new renewable and storage projects.

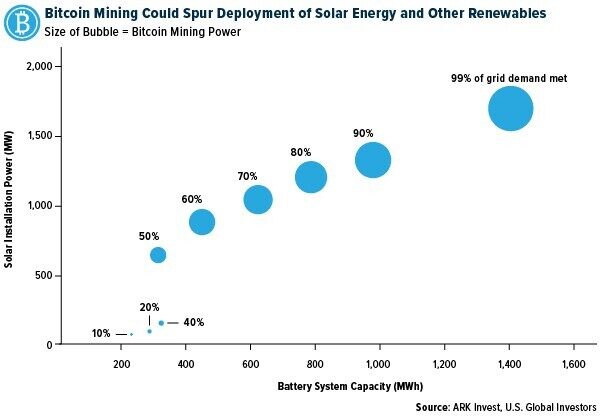

The chart below illustrates the impact that Bitcoin mining could have on solar in particular. The size of the blue bubbles is proportionate to the size of the Bitcoin network in the US. As the size of the network increases, the greater amount of solar power (y-axis) and battery storage (x-axis) is available to the energy grid.

“Increasing Bitcoin mining capacity could allow the energy provider to ‘overbuild’ solar without wasting energy,” the report says.

I believe this model could be a win-win for not just crypto miners, which would get access to cheap energy, but also states such as New York that have aggressive decarbonisation goals. Everyone’s needs would be met.

Mike Colyer, CEO of New York-based crypto services firm Foundry, agrees. Locating renewable energy projects near crypto mining operations “allows for a faster payback on those solar projects or wind projects,” he told Markets Insider in March. More renewables “can be built faster in regions where before it was not attractive because they would produce too much energy for the grid in that area.”

Total Crypto ecosystem at $2trn market cap, Ether at $500bn

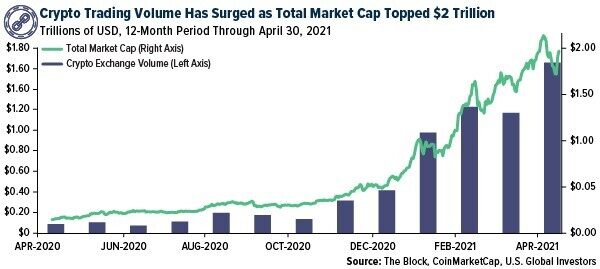

Despite Musk’s flip-flop, demand for cryptos continues to boom, with trading on major crypto exchanges reaching an incredible $1.7trn in April. Early that month, the size of all cryptocurrencies surpassed $2trn for the first time, more than double where it was at the beginning of the year.

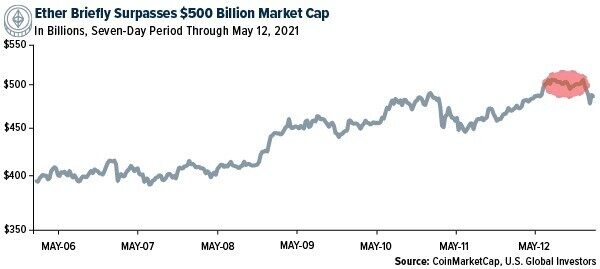

Early on Wednesday (12 May), the market cap for Ether, the number two digital coin, briefly surpassed $500bn as its price touched a new all-time high of over $4,300 before declining on Musk’s tweet. To put that in perspective, $500bn is greater than the market cap for JPMorgan [JPM] and Visa [V].

Ether, of course, powers the Ethereum network, which is the basis for decentralised finance (DeFi). With Ethereum, anyone with an internet connection can have access to financial services — from banking to investing to borrowing and lending — that in the past have been opaque, tightly-controlled and inequitable. When there are no overhead costs associated with running a traditional bank or insurance firm, prices can come way, way down. And since everything is built on smart contracts, human error can be eliminated.

The growing demand for Ether tells me investors are becoming more and more aware of DeFi’s potential in making financial services cheaper, faster, more reliable and more equitable. It’s also a big reason why we made the decision to mine Ether at HIVE on top of Bitcoin. Bitcoin is clearly digital gold, which I believe will remain hugely in demand, but Ether is the fuel that powers the whole system.

This article was originally published on Frank Talk, a blog by Frank Holmes, CEO of U.S. Global Investors and executive chairman of HIVE Blockchain Technologies.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy