Contango and backwardation futures curve

The terms “contango” and “backwardation” apply to the futures market and can indicate whether the delivery price of a particular asset is higher or lower than its current spot price. This helps traders and institutions to assess whether they would rather buy a financial instrument at spot price or use contracts for future delivery.

While the futures or forward markets were originally designed for commodity merchants to sell their product at a future date and lock in the current price, not everyone who trades the futures and commodities markets wants to take ownership of the product that they are trading. For example, a retail trader may buy a crude oil futures contract without taking delivery of 1,000 barrels of oil. Instead, they can trade for the profit potential, which is the difference between the price at the start of the contract and the closing price.

Understanding contango and backwardation can help traders make better trading decisions because they will understand how spot prices relate to future prices, called the futures curve. At CMC Markets, our forward CFD and spread bet contracts are based on the underlying price of a futures contract and are the equivalent product for trading future prices. Learn more about forward trading here.

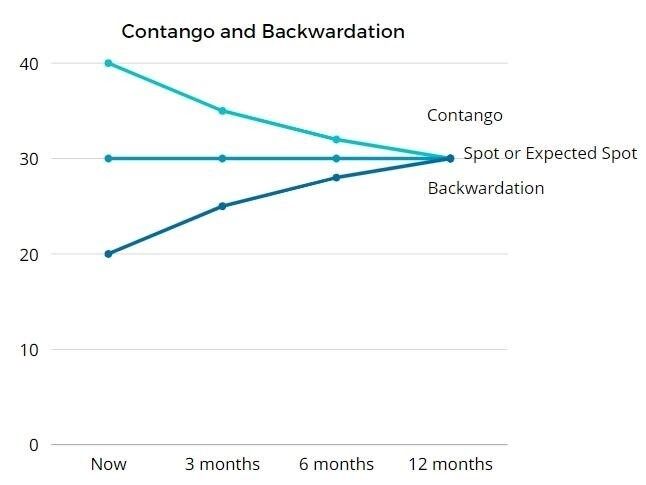

Contango and backwardation futures curve

Contango refers to when a commodity futures price is above the spot price. For example, let’s say that the spot price of Brent Crude Oil today is $70 per barrel. If you buy a futures contract that expires in two months, if the holder of that contract receives their oil and has to pay $75, this means that the market is in contango. This is because the cost of the forward contract is higher than the spot price or the expected future price.

Over time, as that contract nears expiration, it will move closer to the spot price. Therefore, unless the price rises above the price paid, the value of the contango contract will drop to meet the spot price at expiry. If the spot price stays the same, the contract that was bought for $75 will be worth $70 when the contract expires. This is called the futures curve.

Contango is the result of anything that causes prices to be higher in the future relative to now, such as supply and demand. This could be a belief by market traders that the spot price will increase in the future, thus making it worthwhile to lock in a price now, even if it is above the current spot price.

Contango can also be caused by the “cost of carry”. You may pay a higher price for a product now that will not be delivered for several months, because it is not possible to store the product. Instead, you are essentially paying the person who sold you the contract to store those goods for you. That incurs a cost of carry in the form of a higher-than-spot price.

When spread betting or trading CFDs with us, you do not need to worry about taking ownership or storing your physical asset, as our derivative products allow you to speculate on the price movements of the underlying forward contract. This means that you can open a position based on whether you think the price of the asset will rise or fall, leading to profits or losses, depending on if the market moves in your favour.

Crude oil, whether Brent or West Texas, is usually in contango due to the cost of carry of oil. It requires storage until used. The below chart shows the cash price for Brent Crude Oil. The black line is the price of crude for a contract that expires in three months. The forward contract is consistently above the cash price, representing contango. At this time, the cash price was 40.414 and the forward price was 40.82.

Another example of contango is demonstrated on the following silver chart. This shows the cash price as well as the price of the forward contract two months into the future, with hourly closing prices. During this period, the futures contract trades at a higher price than the spot price, meaning that the market is in contango.

Backwardation refers to when the future or forward price is below the spot or expected spot price. For example, let’s say that the spot price of crude oil today is $90 per barrel. If you buy an oil forward contract that expires in two months, if the holder of that contract receives their oil and has to pay $85, this means that the market is in backwardation. This is because the price for its future delivery is lower than the current spot price.

Over time, as that contract nears expiration, it will move closer to the spot price. Therefore, the $85 will move up to $90, assuming that the spot price stays the same.

Gasoline is in backwardation when the prices of the futures contracts are lower than the cash spot price. The following chart and price levels show how this can occur. The cash price is 1.1226 and the price a month later, on a forward contract, is 1.1201. The prices continue to decline the further out they go. Looking at the chart, the extent of the backwardation was more severe in the past. The cash price and November price have converged at the far right of the chart.

Backwardation in the natural gas market is not very common. However, there are times when certain contracts are less in contango than others, which could result in backwardation.

Let’s say that the current spot price for natural gas is 2.85. A month later, it is 3.02, then 3.25, 3.37, but then a month later the price drops to 3.29, which is cheaper than the prior month. This is followed by 3.21. These later contracts are potentially heading into backwardation, as the price is decreasing consistently. This market is not in backwardation currently, because the forward contracts still value higher than the spot price, but, if in January, the spot price is 3.37 and February and March contracts are priced below that, backwardation would be present.

In a similar way to silver and natural gas, gold is not often in backwardation. This is because gold trading is often used as a safe haven for traders in times of political or economic instability, and investors pour their money into physical gold and gold stocks and ETFs, increasing its overall value. However, gold trading is linked with the US dollar, meaning that the fluctuation of interest rates for the currency can push gold into contango or backwardation easily.

Learn more about how to trade commodities.

Whereas contango sees futures prices drop towards the spot price over time, backwardation sees the futures prices rise toward the spot price over time. Contracts in contango have an inherent downward bias, while contracts in backwardation have an inherent upward bias. Either way, both spot and future prices converge when the contract expires.

With both situations, these biases affect the contracts themselves, and may not necessarily have anything to do with the price direction of the commodity as a whole. If a forward contract is in contango, this does not mean that the price of a commodity will drop, but rather, it means that a specific contract may fall to meet the spot price, or the spot could also rise.

Contango and backwardation are conditions of the market that can change. The market can flip from contango to backwardation, or vice versa. Building a trading strategy based on a specific condition could become unprofitable if the conditions flip rapidly.

Contango futures are a common way of trading the condition, along with backwardation. Futures and forwards are very similar products. A forward contract is an agreement between two parties, such as a trader and financial broker, while a futures contract trades on an exchange and the buyer and seller are matched by the exchange. Given that CMC Markets is a financial broker that offers traders access to thousands of instruments, we provide forward contracts to trade on contango and backwardation through spread bets and CFDs. See our dedicated page for FX forward contracts rates.

Although traders often prefer to trade contango, you can also find ways to profit from backwardation. In backwardation, the futures price is above the spot or cash price. Here, a trader could buy a futures contract in the hope that it moves higher to meet the spot price. This can be profitable if the price of the commodity is trending higher.

If futures prices are below the expected price, though, this could also mean that traders are anticipating less demand for the commodity. If the price chart confirms this by showing a downtrend, the trader may actually wish to sell the commodity or futures contract, expecting lower prices in the future.

Profiting from backwardation is not as simple as it sounds and it does not solely depend on whether you should or buy or sell the asset. Other things to consider include the outlook and trend of the commodity, plus the amount of backwardation present.

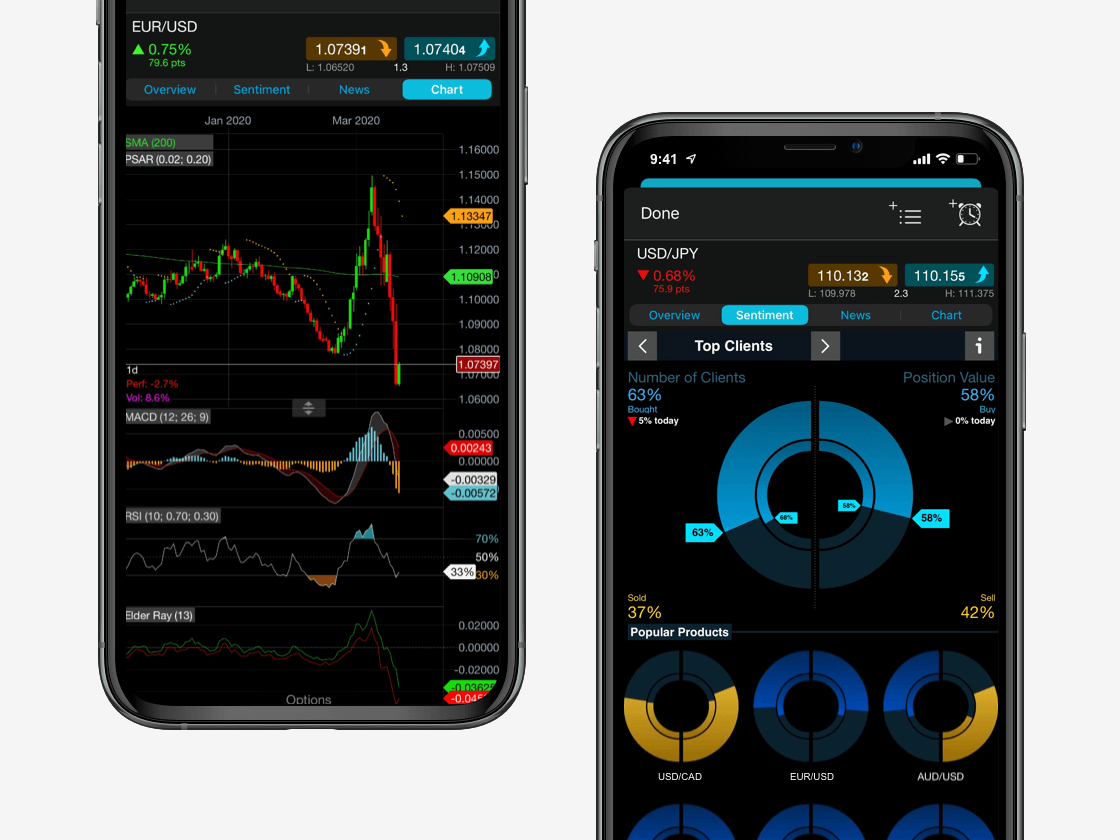

Seamlessly open and close trades, track your progress and set up alerts