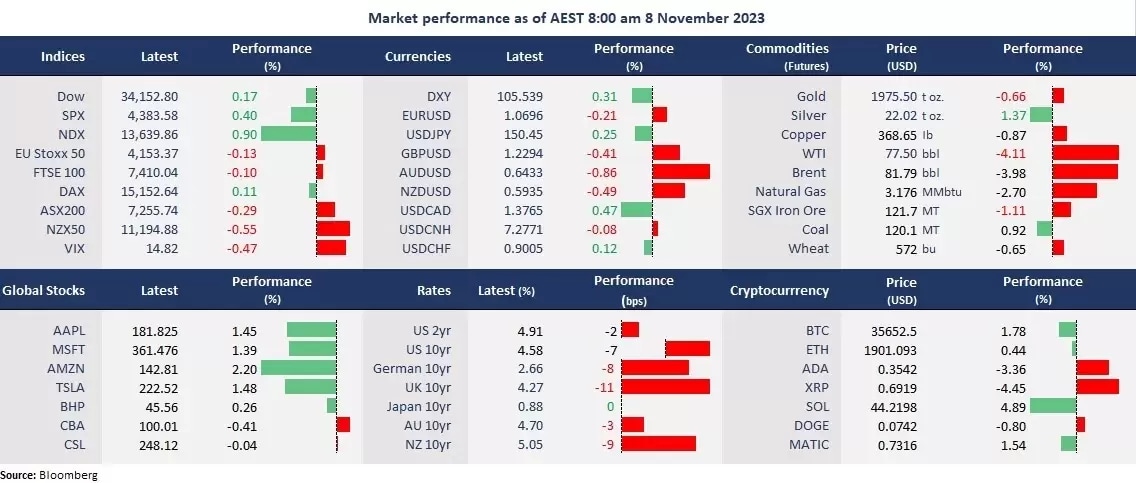

Here are today's main market standouts as China data sends oil lower, while US IT monitoring and analytics company Datadog's shares leapt higher.

- Global government bond yields slumped as peak rate bets are still in play.

- Tech powered Wall Street’s rally as the S&P 500 extended a seven-day winning streak. Amazon led gains.

- The US dollar strengthened as the BOE’s official hinted rate cuts in 2024, and the RBA did a dovish hike.

- Chinese data sank oil prices, with WTI and Brent futures hitting the lowest level since July.

- Gold retreated further due to a firmed USD, whilst risk-off abated.

- Asian stock markets are set to open slightly higher. ASX 200 futures were up 0.08%, and Hang Seng Index futures rose 0.18%.

Chart of the day

WTI, daily

Company news

- WeWork filed for Chapter 11 bankruptcy, which threatens office closures in the US and London.

- Datadog (NDX: DDOG) soared 28% as AI-powered cloud revenue beat estimates and raised full-year guidance. CEO Olivier Pomel said “AI native customers” contributed 2.5% of its annualized revenue.

- Uber (NYSE: UBER) rose 3.7% despite an earnings miss as gross bookings, trips and active consumers saw strength.

ASX corporate actions

- JHX to release Q2 FY24 earnings call. Consensus calls for EPS at a 9.7% average growth in the past three years.

- WDS is set to launch Investor Day

- RMD Dividend Ex. US$0.48. Pay Date: 12/14/23

Today’s agenda

- New Zealand Inflation Expectations

- Japan’s Leading Indicators

- ECB’s President Lagarde Speaks

- BOE’s Governor Bailey Speaks

- Fed Chair Powell Speaks

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.