Illumina Inc. [ILMN] is facing a proxy fight with activist investor Carl Icahn as he seeks board representation and pushes for operational changes at the world’s biggest genome sequencing company. Shareholders took it well, with shares rising more than 20% on 13 March. Meanwhile, biotech shares were flying high, with Provention Bio stock surging nearly 260% on its acquisition by industry heavyweight Sanofi, and Moderna shares jumping 7% on an analyst upgrade by investment bank TD Cowen, who expect it to be a market leader for RSV vaccines. Will the biotech stocks rally last?

- Carl Icahn launched a proxy battle with Illumina over its acquisition of cancer-screening company Grail, blaming it for the $50bn drop in market value since 2021.

- Provention Bio shares surged almost 260% on 13 March on being acquired by Sanofi for nearly $2.9bn.

- Moderna shares were up nearly 7% on 13 March after TD Cowen upgraded the stock from market ‘perform’ to ‘outperform.’

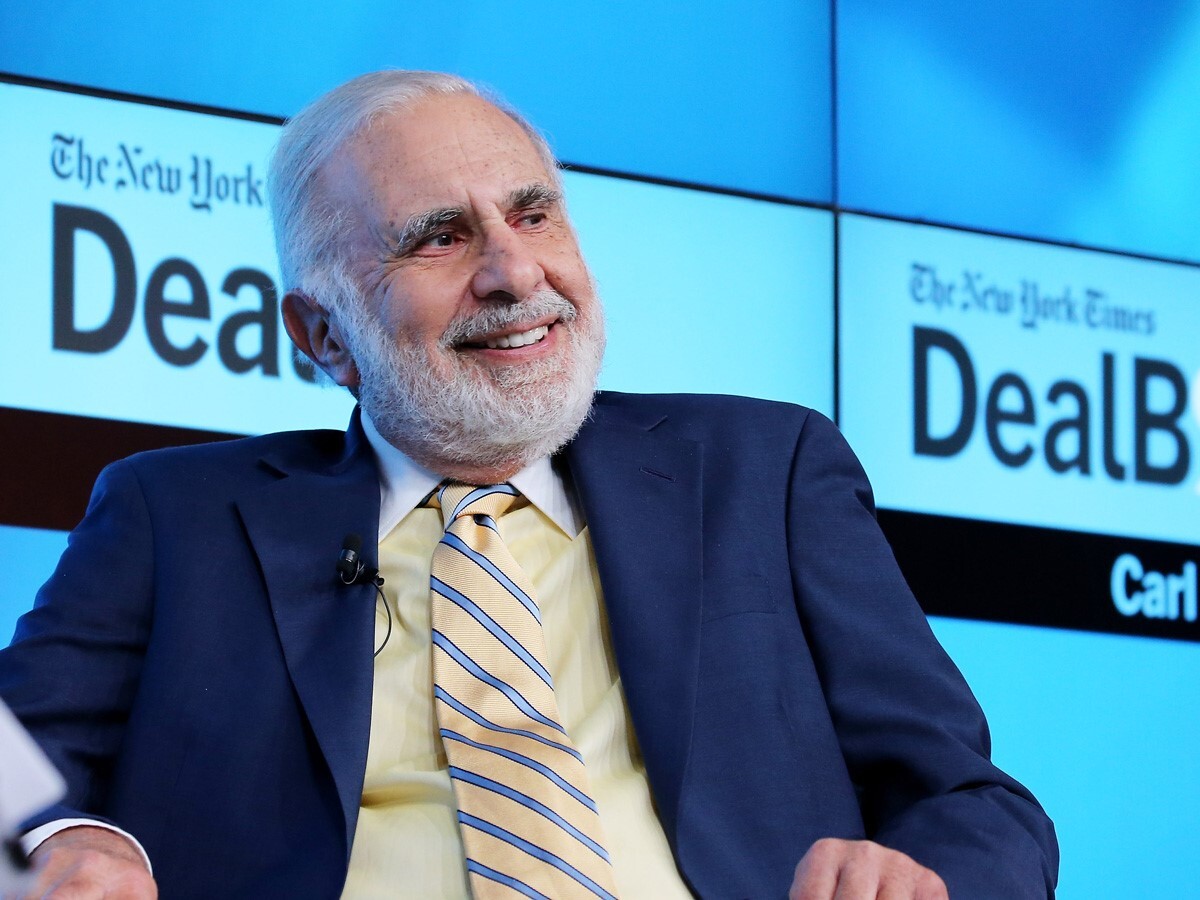

Icahn takes on Illumina

Carl Icahn launched a proxy battle with Illumina [ILMN], the world’s largest genome sequencing company, alleging that its management and board of directors had cut the company’s value by about $50bn through its risky acquisition of cancer-screening company Grail for $8bn in 2021, despite antitrust regulator opposition by the US Federal Trade Commission (FTC) and European Union (EU).

Illumina was worth around $75bn in August 2021, but its market value has now tumbled to about $30bn. Meanwhile, the Grail acquisition remains on hold, as the FTC has since approved the deal, but the EU moved to block it, FT reported.

Illumina’s shares surged over 20% on 13 March following Icahn’s move.

The activist investor is trying to strike a deal with Illumina and intends to nominate three people to the genetic testing company’s board, according to a letter viewed by The Wall Street Journal.

“We are convinced that at least three shareholder representatives are needed on Illumina’s board to attempt to put an end to this insanity now before the reckless decision-making escalates into a no-return situation,” Icahn said in the letter.

Illumina urged its shareholders to vote against Icahn’s nominees for the board in a statement on 13 March. “Mr Icahn was explicit and unyielding in his demand that any resolution should give him outsized influence and control. The board has determined Icahn’s nominees lack relevant skills and experience, and that it is not in the best interests of shareholders to appoint”, the press release stated.

Provention Bio soars on Sanofi deal

Meanwhile, some biotech stocks are experiencing a boost.

Provention Bio [PRVB] shares surged almost 260% on 13 March on being acquired by French biopharmaceutical company Sanofi [SNY] for nearly $2.9bn.

Sanofi’s $119bn market capitalisation makes it the world’s tenth largest drugmaker.

Sanofi’s acquisition would give it full ownership of Provention’s Tzield drug, a US-approved therapy for delaying the onset of third-stage type 1 diabetes in adults and children aged eight years and older at second stage.

The transaction also bolsters Sanofi’s drug pipeline, which investors had criticised as being weak despite growth in sales of its flagship product, asthma, and eczema drug Dupixent.

The deal builds on an existing partnership between the two parties and is expected to complete in Q2 2023.

Sanofi also said on 16 March it would slash the price of its insulin drugs Lantus by 78% and Apidra by 70%, following announcement for sweeping price cuts by other pharmaceutical giants, including Eli Lilly [LLY] and Novo Nordisk [NVO]. The three companies hold over 90% of the global market for insulin.

Moderna shares spike on upgrade

Moderna [MRNA] shares were up nearly 7% on 13 March after TD Cowen upgraded the stock from market perform to outperform, predicting the pharmaceutical company will be a market “leader” for RSV vaccines, CNBC reported. “Moderna’s near-to-mid-term valuation is becoming less reliant on the emergence of new COVID variant epidemic waves, and more so on PCV, RSV, and flu,” the Cowen analysts said.

According to Cowen analysts, key opinion leaders think that Moderna, Pfizer [PFE], and GSK [GSK] will compete in a "three-player vaccine market" for the RSV vaccine. The respiratory syncytial virus, which affects the lungs and respiratory system and typically results in mild, cold-like symptoms, is the subject of a competition between the three businesses to get the first vaccine against it approved by the FDA.

Clinical trials showed Moderna's RSV vaccine was effective, and patients tolerated it well.

Funds in focus

The ARK Genomic Revolution ETF [ARKG] provides exposure to companies involved in the biotech and genomics industry. The ETF is up 2.17% in the last year. As of 20 March, Exact Sciences [EXAS], Moderna, and Pfizer make up 11.50%, 1.18%, and 1.03% of the ETF's portfolio, respectively. The fund's focus on innovative biotech companies positions it well to benefit from the growing demand for genetic sequencing technology and personalised medicine.

The SPDR S&P Biotech ETF [XBI] also provides exposure to biotech companies and includes Illumina, Moderna, and Exact Sciences. Amgen [AMGN] is the fund’s largest holding, with an 11.97% weighting. Illumina is among the fund’s top ten holdings, with a weighting of 4.89%.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy