Arbitrage involves profiting from the price difference between identical or related financial instruments, though this usually doesn’t involve large percentage profits. The bigger the mispricing of market inefficiency, the bigger the profit, and the quicker traders will jump in to exploit it. This will reduce the profit potential and bring the asset back into alignment with other market prices or information.

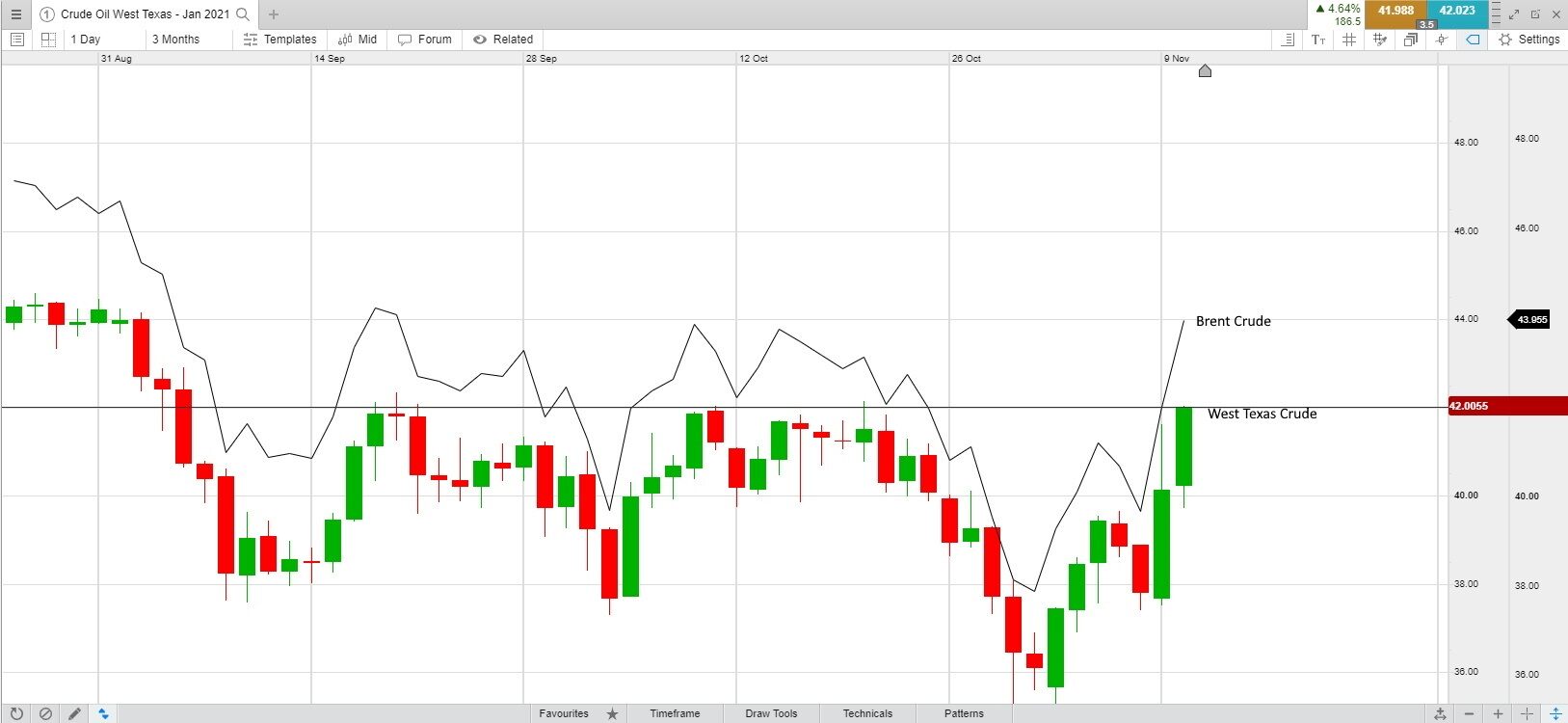

An arbitrage opportunity often becomes apparent through comparing assets. If two currency pairs often move in the same fashion, but then start to diverge, this may present arbitrage in forex trading, under the assumption the two pairs will eventually start moving together again. If two very similar assets are priced differently without justification, this may also present an arbitrage opportunity.

This means that large inefficiencies or mispricing won’t last long, but small inefficiencies may last a long time, since there is less incentive to capitalise on them.